The Invest Voyager app allows investors to trade and invest in crypto currencies. It is located in New Jersey, and is regulated under the FinCEN (Financial Crimes Enforcement Network). The company plans expand its services to Canada as well as the UK and Europe.

The majority of the company's revenue comes from its merchant service business. It also offers a staking/lending program that contributes approximately $15,000,000 to quarterly run-rate revenue.

According to Invest Voyager, the company is expected to earn $415 million by 2021. This is an increase over $81 million the year before. The company's annual growth seems quite impressive.

You can use the app to trade cryptocurrency and get rewards for your holdings. The referral program pays $25 to you and your friends for each referral who signs up and trades at least $100.

You can deposit Bitcoin, Bitcoin Cash, Dash, Litecoin, Ethereum, Tether, True USD, Basic Attention Token or Voyager Token into a wallet you create in the app. Automate your investment with recurring buys. This allows you to automatically invest in a coin at the frequency that suits you best.

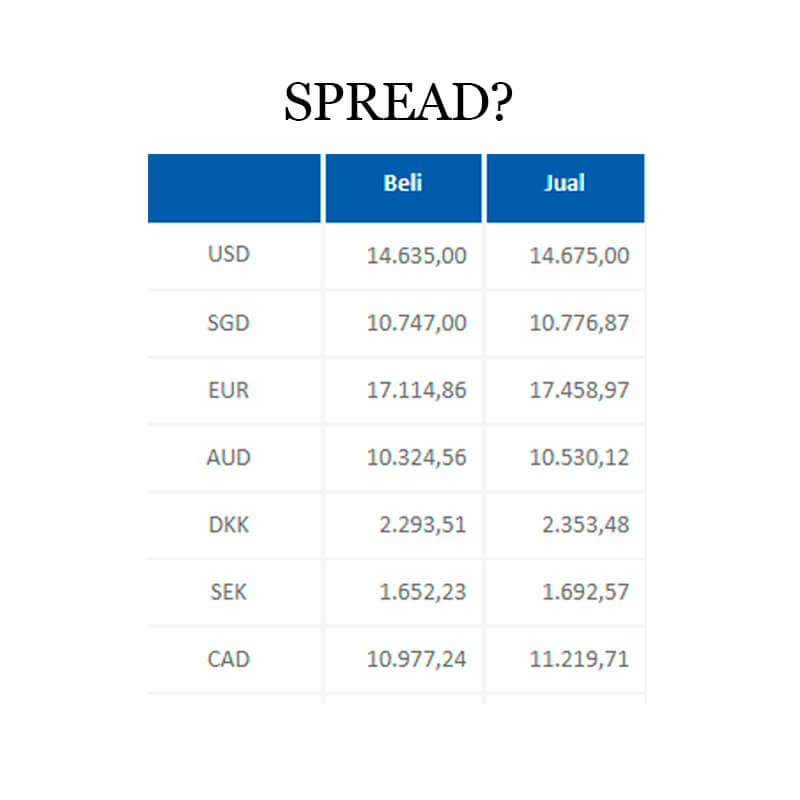

The platform offers advanced charts that traders can use to monitor their positions and make informed decisions. To place trades they can set market orders and limit orders. It's important to note that the app does not display the bid x ask, so it can be tricky to determine the spread when placing a limit order.

Some traders complain the app's limited order categories make it difficult to execute trades efficiently. The high fees for withdrawals are also an issue.

Voyager lists many coins that don't have significant support. The company is working to fix this problem by adding more tokens.

Another concern is the recent bankruptcy filing of the company, which was made public in July. Although the company claims it has around 100,000 creditors, many aren't sure how to get their money back. They also worry about how they will navigate the claim process.

Voyager’s Unsecured Creditors Committee wants to negotiate an arrangement that will allow crypto holders to have access to their funds. Some customers are worried that their interests might not be considered in the negotiation process.

The company has not paid many of its largest lenders, including Three Arrows Capital (3AC), which is a major problem. Although it tried to settle with 3AC, it is not certain that it will succeed.

Voyager customers who have lost their funds may be forced to wait. People who have large amounts crypto in their accounts may find this a problem.

Research is key before making an investment. Before you make a decision on where to invest, compare the costs of different cryptocurrency exchanges. It's also important to understand the risks involved before you decide to invest in a specific cryptocurrency.

FAQ

Which is more secure, forex or crypto?

Two types of high-risk investments, cryptocurrency trading and forex trading, are highly risky and can bring you great rewards but also huge risks.

Crypto, short for cryptocurrency, is a digital currency created from a piece of code through blockchain technology. It can be traded as any other type of money on exchanges, and has been the subject for speculative investments because of its dramatic price swings.

Forex, or foreign exchange currency trading, involves highly leveraged investments in which participants speculate on the value of one currency in relation to another. Forex can be a volatile investment and could cause significant losses if it's not managed correctly.

Both Crypto and Forex have their advantages and disadvantages but, overall, crypto tends to carry a greater level of risk compared to Forex. Cryptocurrency prices are fairly unpredictable due to the limited number of units available along with existing regulations surrounding cryptocurrencies around the world while forex markets tend to move more steadily so investors have more control over their investments. When deciding which option between Cryptocurrency and Forex is safer, it will depend on your risk appetite and experience with each investment option.

Which is more difficult forex or crypto currency?

Each currency and crypto are different in their difficulty and complexity. The new blockchain technology makes crypto a little more complicated in terms of fundamental understanding. Forex is a well-established currency with a stable trading infrastructure.

Cryptocurrency trading is more risky than forex. This can be due to the fact that cryptocurrency markets are unpredictable and move rapidly. It is important to research historical trends and learn from your peers if you wish to be successful at crypto trading.

Forex traders need a good understanding of the dynamics between foreign currencies pairs. For instance, they must be able to see how prices respond to news. It also requires an acute understanding of technical indicators that can indicate buy or sell signals. Leverage is another factor that must be taken into account, as traders risk not only their capital but also additional borrowed funds when trading currency pairs with significant volatility.

Both forex and crypto both require attention, solid research skills and a clear strategy in order to consistently make profitable trades.

Which trading site is best for beginners?

It all depends upon your comfort level in online trading. It's a good idea to begin with an experienced broker who has expert advisors if you are completely new to online trading.

These brokers remove the guesswork from choosing companies and offer solid recommendations to help you build your portfolio. Many brokers offer interactive tools that allow you to see how trades work, without having to risk any real money.

You can also trade independently if your knowledge is good enough. They offer customized trading platforms, live feeds of data, and research tools such as real-time analyses to help you make well-informed choices.

No matter what route you choose to take, it is important that you read reviews from customers before making any commitments. They will provide insight into how each site treats customers and give you an idea of the overall experience.

Can forex traders make any money?

Yes, forex traders can make money. While it is possible to achieve success in the short-term, long-term profits typically come from dedication and a willingness to learn. Traders who understand market fundamentals and technical analysis are more likely to be successful than those who rely solely on luck or guessing.

Forex trading isn’t easy, but it is possible to earn consistent profits over time with the right strategies. Before you risk real capital, it is important to find a mentor who is knowledgeable about risk management.

Many traders fail because of lack of a systematic plan or approach. However with discipline, one can increase their chances of making profit in the foreign currency (forex) markets.

Experienced forex traders create trading strategies that they follow when trading to minimize their risk exposure and still find profitable opportunities. The key to risk management is being able to see the big picture. New traders often chase short-term gains and lose sight of a long-term strategy.

Forex traders can increase their chances of making long-term profits by keeping records, understanding currency trading platforms, and studying past trades, payments, and by keeping accurate records.

Forex trading is all about discipline. Developing rules, such as what you are willing to lose on each trade, helps reduce losses and ensure success. Strategies like leveraging entry signals can help increase profits beyond those that could be achieved without the guidance of an experienced mentor.

However, regardless of whether you are investing your own capital or managing funds on behalf of someone else, persistence and learning from successful day traders are essential to being a profitable trader in forex markets.

Where can i invest and earn daily?

Although investing can be a great investment, it's important that you know your options. There are other ways to make money than investing in the stock market.

One option is investing in real estate. You can earn steady returns while also enjoying long-term appreciation and tax advantages by investing in real estate. Consider diversifying your portfolio by investing in bonds, ETFs or mutual funds. You might also want to consider specialty fields such as cryptocurrency.

You could also look into investing in dividend-paying stocks or peer-to-peer lending sites that allow you to lend money and receive interest payments from borrowers. Trading online with day trading strategies is also possible, if you are comfortable with taking on the risks.

It doesn't matter what your investment goals are, it is important to research each type of investment before you dive in headfirst. Each asset has its own set of risk factors. Make sure you closely monitor any investments and recognize when to buy and sell accordingly so you can maximize your earnings and work towards achieving your financial goals!

Frequently Asked Question

What are the 4 types?

Investing is a way for you to grow your money and possibly make more long-term. There are four major types of investment: stocks, bonds mutual funds, cash equivalents, and stock.

Stocks can be broken down into common stock or preferred stock. A common stock gives an individual ownership right of a company, including voting rights at shareholders' meetings and the potential to earn dividends. The preferred stock gives you ownership rights, but no voting privileges. Investors also have the option to receive fixed dividend payments.

Bonds are loans by investors that are made to governments or businesses in exchange for interest payments. While bonds have a greater stability and less risk than stocks stocks, their returns are often lower than stocks.

Mutual funds involve pooling investor money together in order to spread investment risk and diversify investments over many different types of securities including stocks, bonds, and commodities. Professional managers manage mutual funds. They use their experience to choose profitable investments based on pre-determined criteria, such as risk level or expected return rate.

You can find cash equivalents in products like Treasury bills or money market deposits or certificates of deposit (CDs), which usually mature in one or two years. They are also less likely to be defaulted or lose value. This type of investing is best for conservative investors who aren't willing to take high-risk but still want a higher return than depositing money in low-interest bank accounts.

Statistics

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

External Links

How To

What are the best options for storing my investment assets online?

While money can be confusing, the decision to where it should be stored can be just as complex. There are many options to protect your valuable assets.

You can easily access your investment assets online from any device. It also makes it easy to keep track of them quickly and easily. But, you should be aware that electronic breaches can happen when you use digital options.

A physical form of money like cash or gold can be safer, but it's more difficult to track and requires higher levels of protection and storage.

Another option is to keep your investments in traditional banking and investing accounts. You also have the option of self-storage facilities, which allow you to store valuables such as gold, silver or other precious metals safely outside your home.

You may also want to consider specialized investment firms offering secure custody services that are specifically designed to protect large asset portfolios.

You make the final decision.