Futures on gold are financial derivatives that offer investors leveraged exposure to the current price of gold. You have many options to purchase or sell gold futures. You can trade futures contracts which expire on a certain date. The contract allows for you to trade futures contracts that allow you to buy and sell a given amount of precious metals at a given price. It is important to keep in mind that you must have a minimum capital to open a position.

A broker is required to help you trade gold futures. A broker is necessary to help you understand the market and decide when it's best to exit or enter a trade. There are a few different options available, such as Interactive Brokers, Charles Schwab and TD Ameritrade. You can also choose between ETFs or mini-gold futures.

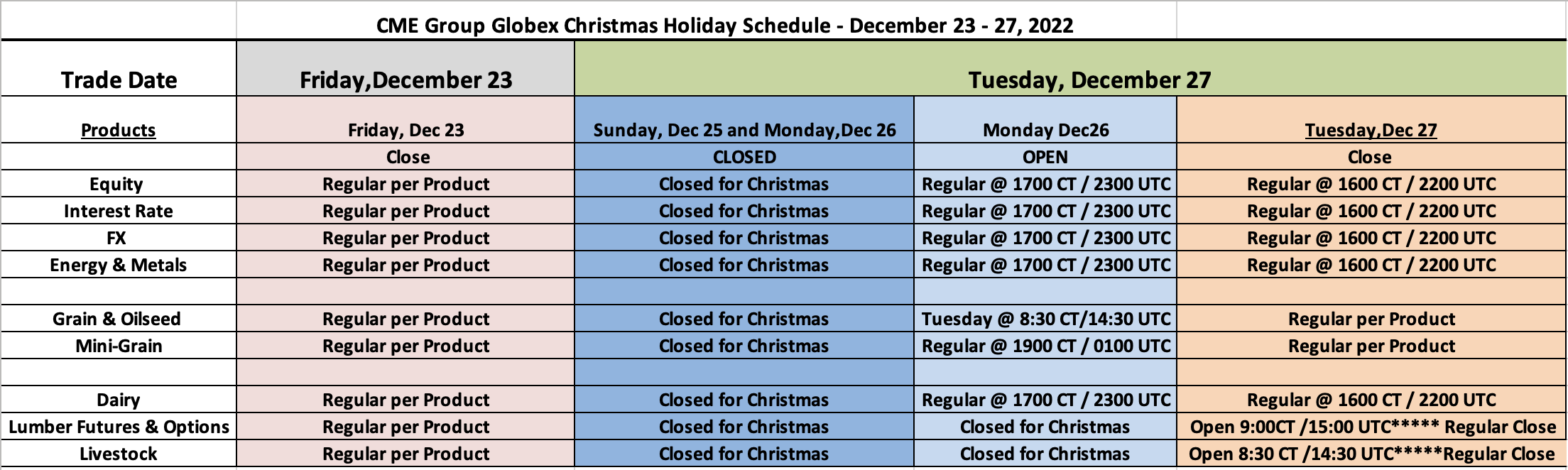

Gold futures listed on the Chicago Mercantile Exchange are traded seven days a weeks, 24 hours a night. E-mini, and micro-gold futures can also be traded. They offer liquidity and a more flexible trading platform.

A brokerage account is required to trade gold futures. To open a position in gold options, there is an upfront fee. Depending on the size of the order, commissions can be negotiated. Thinkorswim is a web-based trading platform that allows traders to access the markets. This platform allows for custom charting and screeners as well as economic indicators. It is also accessible on iOS and Android apps.

Speculators can have a significant impact on the gold market's short-term prices. They are usually bearish on gold markets. So be ready for some slow trading and poor performance. Gold is particularly weak in the summer months. These periods range from July to august.

A good hedge against inflation is gold. The global demand and supply for gold determine the price of the metal. Forex inflation must be monitored by traders to ensure an informed decision.

The process of buying and selling futures gold is very simple. It is easy to learn the rules. You should be ready for catastrophic losses. If you lose, you could lose all of your capital.

A $100 point movement in gold prices can result in a loss of capital. This means that you will need a large amount of capital to make a profit. You'll also have to be aware of volatility in the futures gold. If you want to hedge your investment against possible losses, then investing in futures market is the best option.

Gold futures trading can be a profitable way of managing volatile financial environments. However, you must be prepared for the risk of defaulting. Because speculators have such an influence on the price of gold in the short term, it is likely that you will need trades to maximize your profit. Also, gold is not an easy commodity to hold long-term.

Whether you are trading gold futures or a related commodity, it is important to monitor market trends and sentiment. A sharp spike in the price of gold can trigger a new long buying rush. A sharp drop in gold's price can cause traders to leave the markets.

FAQ

Where can i invest and earn daily?

Investing can be a great way to make some money, but it's important to know what your options are. You don't have to put your entire savings into the stock market - there are plenty of other options.

One option is to buy real estate. You can earn steady returns while also enjoying long-term appreciation and tax advantages by investing in real estate. You may also consider diversifying your portfolio with bonds, ETFs, mutual funds, or specialty fields like cryptocurrency.

If you are looking for short-term income or daily profits, you might consider investing in dividend-paying stocks. You may also want to look into peer-to–peer lending platforms that allow you borrow money from other borrowers and receive interest payments on a daily basis. You can even trade online using day trading strategies if you feel comfortable with the risks involved.

No matter your investment goals, it is important that you do thorough research on each type and investment before making any major decisions. Every asset comes with its own risks. To maximize your earnings and help you reach your financial goals, make sure to closely track any investments.

Can you make it big trading Forex or Cryptocurrencies?

Trading forex and crypto can be lucrative if you are strategic. You must stay on top of trends to know the best times to buy or sell in order to make any money in these markets.

Also, you will need to be able to spot patterns in prices. This can help you determine where the market is heading. Additionally, it's important to keep your risk as low as possible by trading only with money that you can afford to lose.

You will need to have experience, knowledge and skills as well as discipline to create a long-term profitable strategy.

The volatility of cryptocurrency prices is a problem. It is important to ensure that your entry position matches your risk appetite and exit strategy. This means that you should take profit or limit losses if you have the opportunity.

It is crucial to do your research on cryptocurrency exchanges before you sign up for any wallet.

Furthermore, forex trading involves predicting fluctuations of currency exchange rates through technical/fundamental analysis global economic data. This type trading requires specialized knowledge. Understanding the different currency conditions is crucial.

It all comes down to taking calculated risks, learning continuously, and finding the most effective strategy for you. With enough dedication combined with this knowledge - you could potentially get very rich trading cryptos or forex if done correctly with proper education & research behind it!

Which is better forex trading or crypto trading.

Both forex and cryptocurrency trading have their potential profits. But it all depends upon your investment goals.

Forex trading allows you to invest in different currencies. It is a great option for beginners. This requires a smaller initial capital, and forex markets can be accessed 24/7 around the world.

However, crypto trading can offer a very immediate return due to the volatility of prices. The liquidity of crypto trading means that you can quickly cash out your tokens.

In both instances, it is crucial to do your research prior to making any investments. With any type or trading, it is important to manage your risk with proper diversification.

It is important to be familiar with the various types of trading strategies that are available for each type. To maximize their profits, crypto traders can use arbitrage or margin trades to maximize their gains. Forex traders may use either technical analysis or fundamental analysis to assist them in making decisions. Some traders might also opt for automated trading systems, or bots, to manage their investments. Before investing, it is important that you understand the risks as well as the rewards.

Is Cryptocurrency an Investment Worth It?

It's complicated. It's complicated. Although cryptocurrency has gained popularity over the last few years, it depends on many factors as to whether it will prove to be a profitable investment. On one hand, the cryptocurrency market is highly volatile and unpredictable so there's always a risk involved when investing in them.

On the other hand, if you're willing to take that risk and do your research, there are potential gains to be made based on events like Initial Coin Offerings (ICOs) and shifts in the marketplace.

Because cryptocurrency assets are not subject to traditional stock market movements, they can be used as a portfolio diversification tool.

It comes down to each person's individual tolerance for risk and knowledge in relation to the crypto markets. If you're able to make informed decisions and are open to taking risks, then investing is definitely something worth considering.

Which trading site is best suited for beginners?

It all depends on how comfortable you are with online trading. You can start by going through an experienced broker with advisors if this is your first time.

These brokers can take the guesswork and help you build your portfolio by making solid recommendations. Plus, most offer interactive tools to demonstrate how trades work without risking real money.

There are many sites that let you trade on your own if you have some knowledge and want to take more control of your investments. They provide customizable trading platforms and live data feeds. You can also access research resources such as real-time statistics to help you make informed decisions.

You can find customer reviews on any route, no matter what. These will give insight into the experience and level of service at each site before you commit.

Which is better, safe crypto or Forex?

Forex trading and cryptocurrency are both highly risky investments with varying rewards and risks.

Crypto, shorthand for cryptocurrency is a digital currency made from code using blockchain technology. It can be traded on exchanges like any other form of money and has been the subject of speculative investments due to its dramatic price swings over time.

Forex, or foreign exchange currency trading, involves highly leveraged investments in which participants speculate on the value of one currency in relation to another. Forex is a high-risk investment that can lead to large losses if it is not managed properly.

Both Forex and Crypto have advantages and disadvantages, but crypto generally carries more risk than Forex. Because of the limited supply and regulations around cryptocurrencies, prices can fluctuate. But forex markets move more consistently so investors have more control. Therefore when determining which between Crypto and Forex is safer it would depend on one's own risk appetite as well as their experience with each investment option before making a final decision.

Statistics

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

External Links

How To

How do I protect my online investment account from unauthorized access?

Safety is a must when it comes to online investment accounts. It is vital to secure your assets and data against any unwelcome intrusions.

First, make sure that your platform is secure. Make sure to look out for encryption technology and two-factor authentication. These security measures will give you maximum protection from hackers and malicious actors. It is also important to have a policy that details how any personal data you share with them will regulated and monitored.

It is important to use strong passwords and limit your access to public networks. Avoid clicking on suspicious links and downloading unknown software. These can result in malicious downloads that could compromise your funds. Finally, review your account activities periodically so that you are aware of any changes or irregularities in order to detect potential threats quickly and take immediate action if necessary.

It is important to be familiar with the terms and conditions of any online investment platform. You need to be aware of all fees associated with investing as well as restrictions and limitations regarding how you can use the account.

Fourth, be sure to research the company where you plan on investing. Check out user reviews and ratings to get an idea of how the platform works and what other users have experienced. You should also be aware of the tax implications when investing online.

Follow these steps to ensure your online account is protected from potential threats.