Day trading is an investment where traders trade securities within one day, such as stocks, options and forex. It is a highly active and competitive industry, with thousands of professional day traders. They use a variety strategies to trade the markets and make small profits from price fluctuations.

A brokerage that has low commissions, low margin rates and a broad selection of asset types is the best for day trading. These include customizable charting and technical analysis indicators, which allow traders to trade in realtime.

Brokerage Fees

A broker that offers online day trading can charge fees which can have a significant impact on how much a trader makes. Day trading commissions can be thousands of dollars for a single trading session. So it is important you select a broker with reasonable fees.

Trading platforms

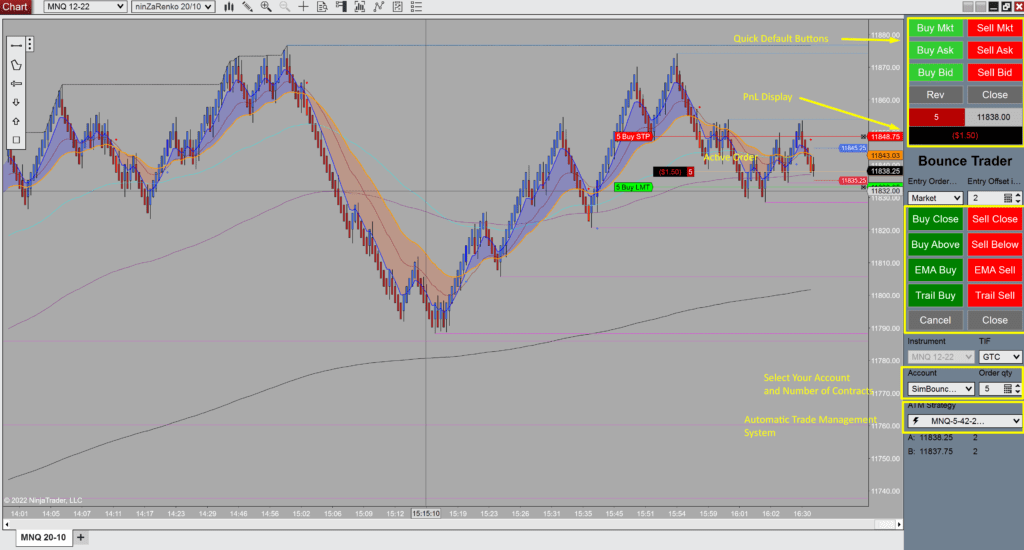

A trading platform's quality can determine whether or not a day trader is able to execute orders efficiently and accurately. A top-quality platform will have accurate price quotes and flawless data feeds. This will enable you to execute trades according to your trading plan.

An accurate trading platform must also be able to provide historical data about stock price movements. This data will allow you to better predict the market's future direction.

There are many platforms that you can choose from. It is important to carefully consider the features and tools you require from your day trading brokerage before you make a choice. You should open a paper trading account to learn the basics of trading before you risk real money.

Interactive Brokers continues to be our number one choice for the best day trader due to its wide asset range, low costs and outstanding technical tools. Interactive Brokers' trading platform has a large variety of charts, technical indicators and tools that enable investors to analyze stocks, ETFs, and other options.

IBKR's charting platform, TWS Light, provides $0.00 commissions on equities/ETFs and low costs scaled based on volume for active traders who need advanced functionality. You can also get a free trial of the TWS Pro account. This allows you to access advanced charting features and order routing.

Thinkorswim is a powerful trading platform from TD Ameritrade that includes a range of charting options. These tools allow you to create your own investment strategy and monitor the market. The platform offers multiple charting tools such as trend lines or moving averages as well as news feeds and technical analysis tools.

In addition to its downloadable and web-based trading platform, TD Ameritrade offers an excellent mobile app for Android and iPhone devices. It offers a wide range of features including real-time streaming and quotes as well as an extensive educational section.

Webull is a relatively new online broker that launched in 2017. It offers an online platform for US equities. ETFs and options. No commissions or fees are charged to trade these assets.

FAQ

Is Cryptocurrency a Good Investing Option?

It's complicated. The popularity of cryptocurrency has increased over the years. However, whether or not it is a good investment depends on many factors. On one hand, the cryptocurrency market is highly volatile and unpredictable so there's always a risk involved when investing in them.

You can also make a profit if your risk is taken and you do your research.

The potential for portfolio diversification is also possible through cryptocurrency investments, as these assets can move independently from traditional stock exchanges.

In the end, it really comes down to an individual's personal tolerance for risk and knowledge related to the crypto market. It is definitely worth investing in cryptos if you have the knowledge and ability to make informed decisions regarding this asset class.

How can I invest bitcoin?

It can be difficult to invest in Bitcoin. But it isn't as hard as you think. You just need the right knowledge, tools, and resources to get started.

There are many options for investing. You have the option to buy Bitcoin direct, trade on an exchange, or gain exposure using a financial instrument called a derivatives contract.

You will also have to decide where to store your bitcoin. There are many options such as exchanges, wallets, custodians and cold storage. Depending on your risk appetite and goals, some options might be more suitable than others.

Next, find any additional information that may be necessary to make confident investment decisions. Before you start investing in cryptocurrencies, it is important to learn the basics and understand how they work. To stay on top of crypto trends, keep an eye out for market developments and news.

Last but not least, develop a plan that will allow you to invest in Bitcoin according to your experience and have reasonable expectations of returns. This will help you be more successful long-term.

What is the best trading platform for you?

Many traders find it difficult to choose the right trading platform. It can be overwhelming to pick the right platform for you when there are so many options.

The best trading platforms should provide the features you want, including advanced chart analysis tools, real time market data, and advanced order execution capabilities. It should also offer an intuitive and user-friendly interface.

It should offer a variety account types and affordable fees. They should also be able to provide reliable customer services and educational resources. Try out demo accounts or free trials to see if you like the idea of using virtual money.

You should consider your type of investor or trader when looking for a trading platform. For example, are you active or passive? How often do you plan to trade? What asset class mix would you like? This will help you narrow your search for the right trading platform.

After you have found the right platform for you, you should look at additional features like stock screening tools and backtesting capabilities. Alert systems are also available. Make sure you have the appropriate security protocols in place for your data to prevent theft or breaches.

MetaTrader 4/5 (MT4/MT5) and cTrader are some of the most well-known trading platforms.

What are the advantages and drawbacks to online investing?

Online investing has one major advantage: convenience. You can access your investments online from any location with an internet connection. Online trading allows you to access market data in real time and trades from anywhere. Many online brokerages charge lower fees than traditional ones, which makes it easier to start investing with less money.

However, online investing does have its downsides. Online investing is not without its challenges. For instance, you may find it difficult to obtain personalized advice or guidance online as there are no financial advisors or brokers to help you make your decisions. Online trading platforms may not offer the same level or security as traditional brokerages. Investors must be aware that there are risks. Finally, online trading can be more complex than conventional investing, so it's essential to understand the markets and develop a sound strategy before getting started.

Online investing is a complicated process. It is important to be familiar with the various types of investments that are available. Stocks, bonds, mutual funds, and cash equivalents are all options for investors. Each investment has its risks and rewards. Before you decide which type of investment is best for you, it is important that your research is thorough. Some investments may also require a minimum investment or other restrictions.

Forex traders can make money

Yes, forex traders can make money. It's possible to make short-term gains, but the long-term benefits of forex trading are often based on dedication and a willingness for learning. More traders who are able to understand the market and can analyze technical issues will be successful than those who rely on luck or guesswork.

Forex trading isn’t easy, but it is possible to earn consistent profits over time with the right strategies. Before you risk real capital, it is important to find a mentor who is knowledgeable about risk management.

Many traders lose their money because they don't have a well-planned strategy or plan. But with discipline, you can maximize your chances of making a profit in foreign exchange markets.

Forex traders who are experienced create trading plans to help them reduce their risk exposure while still finding lucrative opportunities. This is crucial because many traders who are new to forex trading can be too aggressive and chase quick wins instead of following a consistent, long-term strategy.

Forex traders can increase their long-term profitability by keeping detailed records, studying past trades as well as payments and understanding platforms that facilitate currency trading.

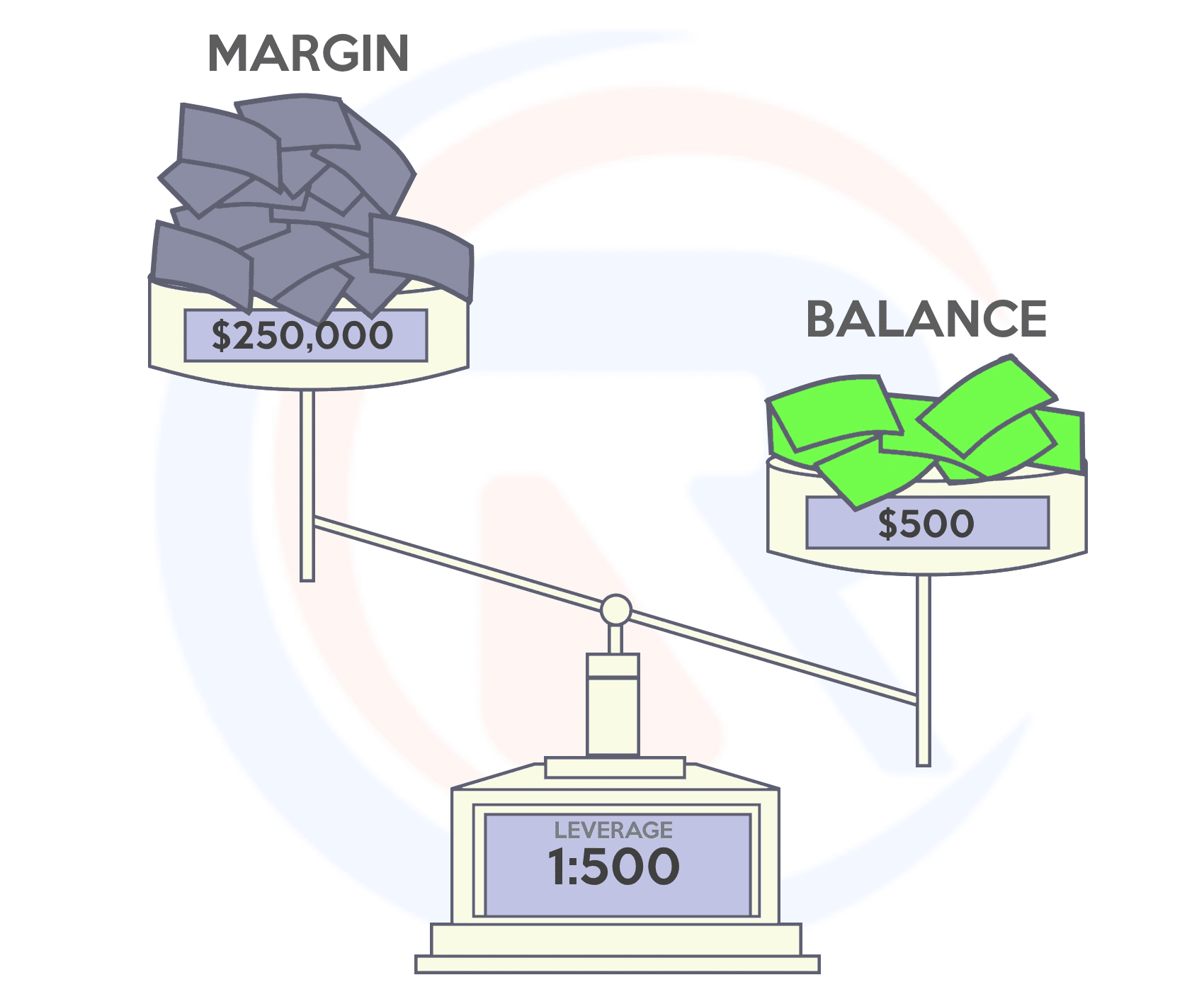

Forex trading is a disciplined business. Setting rules for how much money you're willing and able to lose per trade can reduce losses and help ensure success. Furthermore, strategies such as leverage entry signals can help increase profits that are not possible without the guidance of an experienced mentor.

Be persistent, learn from successful day trader and be persistent. Profitability in the forex market trading markets is dependent on whether you're managing funds for yourself or someone else.

Frequently Asked questions

Which are the 4 types that you should invest in?

Investing allows you to increase your financial resources and potentially earn money in the long-term. There are four major categories: stocks (bonds), mutual funds (mutual funds), and cash equivalents.

Stocks can be divided into two groups: common stock and preferred stock. A common stock is an individual's ownership of a company. This includes voting rights at shareholder meetings as well as the ability to receive dividends. Preferred stock also gives ownership rights but with no voting privileges, as well as fixed dividend payments that offer investors a reliable income stream.

Bonds can be loans made by investors to governments or companies for interest payments. Bonds provide more stability and less risk than stocks, but the returns are typically lower than those of stocks.

Mutual funds involve pooling investor money together in order to spread investment risk and diversify investments over many different types of securities including stocks, bonds, and commodities. Mutual funds are managed by professional managers who use their expertise to select profitable investments in accordance with pre-set criteria such as level of risk or desired gain rate.

Cash equivalents include products such as Treasury bills, money market deposits, certificates of deposit (CDs), and commercial paper which often mature within one year or less during which time they carry minimal risks of default or downturns in their value. This type of investing is mostly suitable for conservative investors who don't want to take high risks but still seek a little bit more return than depositing money at traditionally low-interest bank accounts.

Statistics

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

External Links

How To

How can I verify that an investment opportunity is legitimate?

Online investing requires research. Make sure you research the company behind the opportunity. Also, ensure they are registered with the relevant financial authorities. Additionally, look out for any industry regulations or restrictions that could apply to your investments.

Review past performance data, if possible. To get an idea of the customer experience with the investment opportunity, look online for reviews. Be skeptical of promises of substantial future returns or future results.

Learn about the investment's risk profile and review the terms and condition. Before you open an account, check what fees and commissions might be taxed. Do your due diligence and make sure you get what you pay for. You should also have a clear exit plan in place in case things don't go as planned. This can help to reduce your losses in the long-term.