A Crypto IRA can be a great way to diversify your retirement funds. However, you should do your research before you open an account. There are several key considerations, including choosing a custodian and choosing a cryptocurrency that's suitable for your overall investment goals.

To open a cryptocurrency IRA, the first step is to select a provider. First, you need to determine if the provider is licensed to offer these accounts. If the provider is, you'll be able to choose from the hundreds of cryptocurrencies available, and the company will provide you with a secure storage facility to hold your assets. You may also be able to access specialized retirement experts and trading advice from some providers.

Consider the cost of setting up and monthly fees before you make a decision on a platform. These can vary from a few hundred dollars up to a few thousand depending on which provider you choose. The initial purchase fee you pay for a cryptocurrency can also be applied.

Like all investments, you should always do your research before making a decision. Talk to your financial advisor, tax professional or tax attorney about any potential disadvantages. Your best bet is to choose a provider with a solid reputation for customer service and low fees.

It is important to select an IRA that is well-respected in the crypto space. Investing in a cryptocurrency IRA will help you avoid capital gains tax. This is because cryptocurrencies are property to the Internal Revenue Service, so you will be able take advantage of tax advantages.

A crypto IRA may offer you tax deferred advantages, allowing for tax-free growth on your investments. Additionally, a crypto IRA allows you to add digital assets to your traditional savings accounts, bonds, and stocks to diversify your investment portfolio.

If you are a risk-taker, a crypto IRA will help you make the most out of your retirement investments. It is also a smart strategy to diversify investments and increase your overall retirement return.

A traditional IRA is the best option for a tax-advantaged savings strategy, but a crypto IRA may offer additional benefits. These include the possibility to fund the account using funds from your savings. To set up a cryptocurrency IRA you need to choose a custodian or exchange as well as a trading platform.

Coinbase is a great option for opening an IRA. It offers both traditional IRAs and Roth IRAs. Multi-encryption protects your assets. They also offer end-to–end insurance coverage to guard against account abuses. They offer a variety of tools from account management to trading, making it easy to use their offerings.

Another option is to create an IRA with iTrustCapital. Coinbase Custody, along with a third party storage provider, is what this platform uses to securely store your digital assets. iTrustCapital offers a way to diversify an IRA portfolio. You can buy and trade gold bullion and Silver bullion.

FAQ

Which is safe crypto or forex?

Cryptocurrency and Forex trading are two types of highly risky investments that vary greatly in terms of rewards and risks.

Crypto, which is shorthand for cryptocurrency, refers to a digital currency that was created using code and blockchain technology. It can trade on exchanges just like any money, and has been the subject speculative investment because of its drastic price swings.

Forex, also known as foreign exchange currency trade, is high-leveraged investment that involves participants speculating on the value and relative strength of one currency. Forex can pose a risky investment, and can result in significant losses if they are not managed properly.

While both Forex and Crypto have their strengths and weaknesses, Crypto tends to be more risky than Forex. Prices for cryptocurrencies are unpredictable because of the limited availability of units as well as existing regulations. On the other hand, forex markets tends to move more steadily and investors have more control. Therefore when determining which between Crypto and Forex is safer it would depend on one's own risk appetite as well as their experience with each investment option before making a final decision.

Which trading site is best suited for beginners?

All depends on your comfort level with online trades. It is a great idea to start with an established broker that has experienced advisors, if you are new to online trading.

These brokers take the guesswork out of choosing companies and give solid recommendations that can help you build a portfolio steadily over time. Many brokers provide interactive tools to show you how trades function without risking any money.

If you are more confident and have some knowledge, you can trade your investments independently on many websites. They provide customizable trading platforms and live data feeds. You can also access research resources such as real-time statistics to help you make informed decisions.

No matter which route you choose, be sure to read customer reviews before you make a decision. This will give you an insight into the service and experience of each site.

Which is more difficult forex or crypto currency?

Different levels of difficulty and complexity exist for forex and crypto. Because crypto is new and closely related to blockchain technology, it may prove more difficult for beginners. Forex has been around since the beginning and has a solid trading infrastructure.

In terms of cryptocurrency trading, there are more risks when compared to forex, due to the fact that crypto markets tend to move in unpredictable ways within short periods of time. If you want to succeed in crypto trading, researching the historical trends in the markets where it trades can give you an edge over your competition.

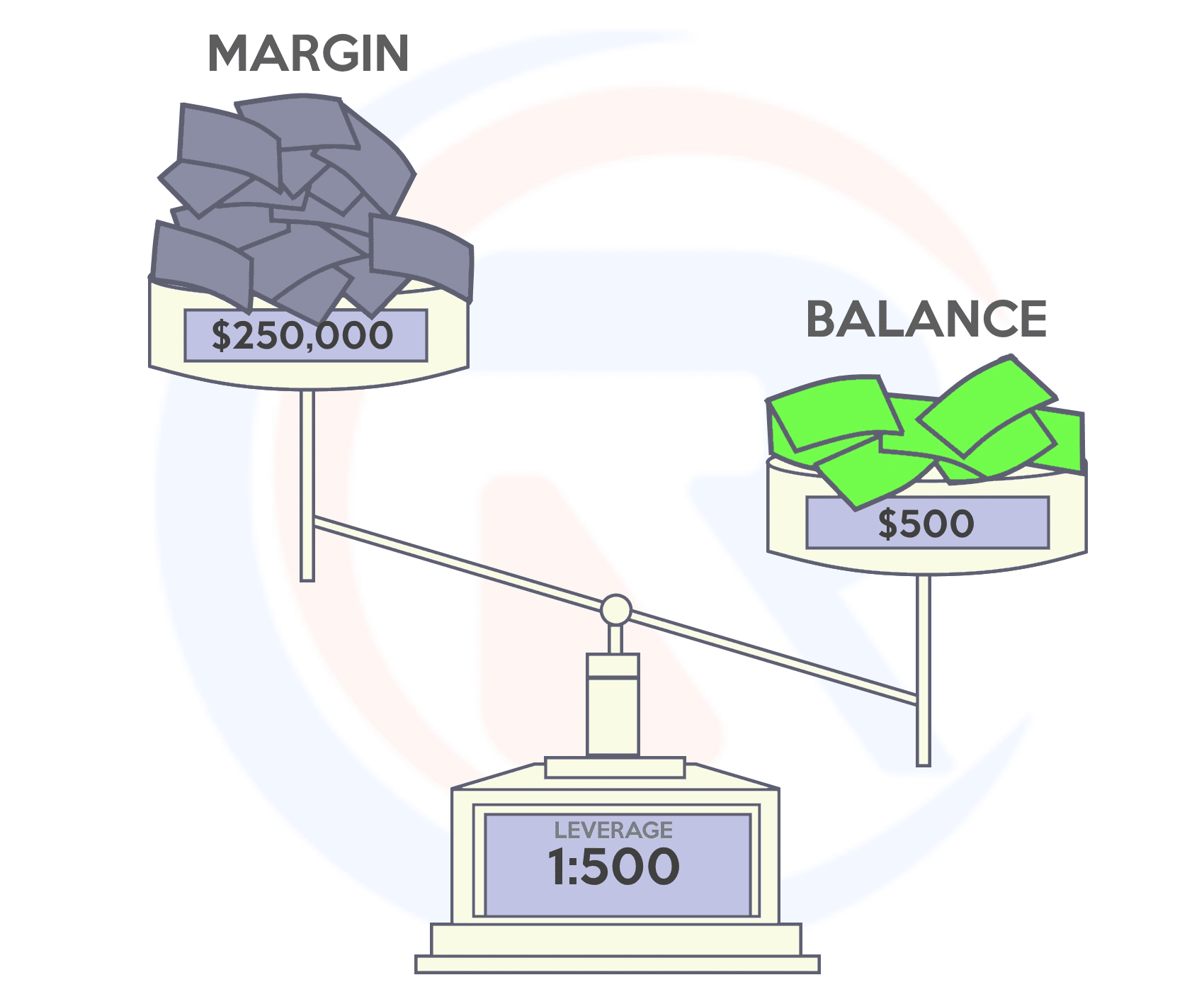

Forex traders should be able understand the dynamics among foreign exchange pairs. They need to know how prices shift based upon news and macroeconomic events. A good understanding of technical indicators is essential to identify buy and sell signals. The leverage factor is another important consideration. Forex traders who trade currency pairs with high volatility are at risk of losing their capital and may have to borrow additional funds.

To be successful in forex and crypto trading, you need to be attentive, have solid research skills, and have a clear strategy.

Where can i invest and earn daily?

Although investing can be a great investment, it's important that you know your options. You don't have to put your entire savings into the stock market - there are plenty of other options.

You can also invest in real estate. Investing in property can provide steady returns with long-term appreciation and tax benefits. Diversifying your portfolio might be a good idea.

If you are looking for daily income and short-term profits, then you should consider investing in stocks that pay dividends. Trading online with day trading strategies is also possible, if you are comfortable with taking on the risks.

Whatever your investment goals may, it's important that you research all types of investments before investing. Every asset has its own risks. To maximize your earnings and help you reach your financial goals, make sure to closely track any investments.

Which forex trading platform or crypto trading platform is the best?

Both forex and crypto trading offer potential profits. However, it all depends on your investment goals.

Forex trading is an investment in currencies. This option is accessible to beginners. This requires a smaller initial capital, and forex markets can be accessed 24/7 around the world.

The upside is that crypto trading provides a quick return, as prices can change very rapidly due to volatility. Also, crypto trades can be cashed out quickly due to their liquidity.

In both instances, it is crucial to do your research prior to making any investments. You can reduce your risk by diversifying assets. This will help you to be successful in any type of trading.

Understanding the various trading strategies for different types of trading is important. For instance, forex traders may use technical or fundamental analysis to make their decisions. Crypto traders might use arbitrage, margin trading, or both to maximize profits. Automated trading platforms or bots are also available to assist traders in managing their investments. Before you invest, it is important to fully understand the risks and benefits of each strategy.

How do I invest in Bitcoin

Although it may seem difficult to invest in Bitcoin, it is not as complicated as you might think. You just need the right knowledge, tools, and resources to get started.

You need to be aware that there are many investment options. To gain exposure to Bitcoin you can either purchase it directly or use an exchange to trade.

You also need to decide where to store Bitcoin. There are many choices, such as cold storage, exchanges or custodians. Depending on your risk appetite, goals, and other factors, certain options might be more appropriate than others.

Next, research any additional information you may need to feel confident about your investment decisions. It is crucial to know the basics about cryptocurrencies and how they work before investing. With that said, make sure you keep track of market news and developments so you can stay up-to-date with crypto trends.

Finally, create a plan for investing in Bitcoin based on your level of experience and set reasonable expectations for returns - this will give you a better chance at success long-term too!

Statistics

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How can you protect your financial and personal information while investing online?

Online investments require security. Online investments are a risky way to protect your financial and personal information.

Be mindful of whom you are dealing with when using any investment app. You want to work with a company that has positive customer reviews and ratings. Before you transfer funds to them or give out personal information, do your research.

Use strong passwords and two-factor authentication on all accounts and check for viruses regularly. Disable auto-login settings on your devices, ensuring no one can access your accounts without your knowledge or consent. Never click on any links in email from unknown senders. Don't download attachments unless it is clear to you. Always double-check a website security certificate before entering personal information into a website form.

To ensure only trustworthy individuals have access to your finances, delete all bank applications from outdated devices. Also, change passwords every few months. Keep track of account changes that might alert identity thieves such as account closure notices or unexpected emails asking to verify information. A variety of passwords is a smart idea for each account. This will prevent any breaches in the other accounts. Last but not least, make sure to use VPNs when investing online. They're often free and easy!