You have many options when it comes to trading silver. There are many options available for buying silver bullion, futures contracts and options. While silver prices fluctuate, they are often stable investments that can be made in industrial applications.

The best way to invest in this commodity is through a silver futures contract. These contracts are traded in dollars and cents an ounce. The size of the contract depends on many factors. A full silver futures contract is a commitment to buy or sell 5,000 troy ounces of the metal at a fixed price in advance of its delivery date.

Stocks of silver can be bought, which is popular for those who are curious about the price. The company that produces silver must also increase its profits if silver prices rise. The company can then increase its production and make more money as a result.

It is important to keep in mind that silver prices are sensitively affected by market sentiment. Periods of market volatility could cause large swings in silver's value. It is important that traders avoid reacting to fluctuations of the price silver and instead develop a solid trading strategy.

Technical analysis is key to trading silver. There are several tools you can use to analyze the price. These include Bollinger Bands, Moving Average Convergence Devigence (MACD), Relative Strength Index and (RSI).

Trend trading, another method to trade silver is to analyze the market trends and place orders accordingly. This strategy is especially useful when prices are stable and the silver market is consolidating.

Day trading is another option for silver, and it works much like scalping in that it focuses on short positions. A silver day trader may choose to scalp the price of silver for a few minutes, or they can hold the position for hours and take a long-term view.

The range-bound strategy, which focuses only on the upper and lowest ends of the silver price spectrum, is another type in silver trading strategies. This strategy can be used when silver is in consolidation and traders wish to place a buy or sell order at the top or the bottom of the range.

Investor optimism and pessimism are two of the most important factors that determine silver prices, and they are often reflected in the movements of other commodities. Silver prices can rise when markets are turbulent and investors are optimistic about the future.

You can make some money trading silver, regardless of whether you're a novice or an expert trader. Always consult a professional before trading.

FAQ

What are the disadvantages and advantages of online investing?

Online investing has one major advantage: convenience. You can manage your investments online, from anywhere you have an internet connection. Access real-time market data, and make trades online without leaving your office or home. Online brokerages typically charge less than traditional brokerages. This makes investing easier, especially if you have a smaller amount of money.

Online investing is not without its challenges. Online trading can make it difficult to receive personalized guidance and advice, since you don't have access to a financial advisor or broker to assist you with your decisions. Online trading platforms can offer less security than traditional brokerages. Investors should be aware of these risks. Online trading can be more complicated that traditional investing. Therefore, it is essential to fully understand the markets before developing a strategy.

You should also be aware of the different investment options available to you when investing online. Stocks, bonds, mutual funds, and cash equivalents are all options for investors. Each investment comes with its own risks. You should research all options before you decide on the right one. Some investments may also require a minimum investment or other restrictions.

What is the best forex trading system or crypto trading system?

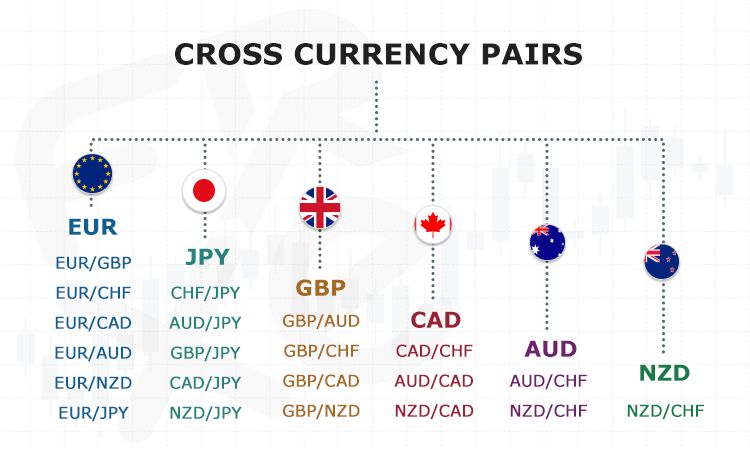

Both forex and crypto trading offer potential profits. However, it all depends on your investment goals.

Forex trading allows you to invest in different currencies. It is a great option for beginners. This requires a smaller initial capital, and forex markets can be accessed 24/7 around the world.

On the other hand, crypto trading offers an almost immediate return as prices can fluctuate quite rapidly due to their volatility. Also, crypto trades can be cashed out quickly due to their liquidity.

In both cases it's crucial to do your research before making any investment. With any type or trading, it is important to manage your risk with proper diversification.

Understanding the various trading strategies for different types of trading is important. For instance, forex traders may use technical or fundamental analysis to make their decisions. Crypto traders might use arbitrage, margin trading, or both to maximize profits. Additionally, some traders may opt for automated trading systems or bots to help them manage their investments. Before investing, it is important that you understand the risks as well as the rewards.

Can one get rich trading Cryptocurrencies or forex?

You can make a fortune trading forex and crypto if you take a strategic approach. You need to be aware of the market trends so you can make the most of them.

You will also need to know how to identify patterns in prices, which can help you decide where the market is going. Additionally, it's important to keep your risk as low as possible by trading only with money that you can afford to lose.

It also requires a combination of experience, knowledge, risk-management skills, and discipline in order to be able to develop a profitable strategy for long-term success.

The volatility of cryptocurrency prices is a problem. It is important to ensure that your entry position matches your risk appetite and exit strategy. This means that you should take profit or limit losses if you have the opportunity.

The cryptocurrency market is largely unregulated and presents substantial risks. Before you sign up for any type of wallet or platform, make sure to research the coins and exchanges.

Furthermore, forex trading involves predicting fluctuations of currency exchange rates through technical/fundamental analysis global economic data. This type trading requires specialized knowledge. Knowing the current conditions that affect different currencies' currency exchange rates is vital.

It's about taking calculated risks and being open to learning. The most important thing is to find the best strategy for you. With enough dedication, knowledge, and proper education, trading forex or cryptocurrency can be very lucrative.

How Can I Invest in Bitcoin?

Although it may seem difficult to invest in Bitcoin, it is not as complicated as you might think. You only need the right information and tools to get started.

The first thing to understand is that there are different ways of investing. To gain exposure, you can either buy Bitcoin directly or trade it on an exchange.

You must also decide where you will store Bitcoin. There is a wide range of options available, including exchanges, custodians, cold storage, wallets and exchanges. Depending on your risk appetite, goals, and other factors, certain options might be more appropriate than others.

Next, research any additional information you may need to feel confident about your investment decisions. Learning the basics of cryptocurrencies and how they work before diving in is important. To stay on top of crypto trends, keep an eye out for market developments and news.

Finally, you should create a plan to invest Bitcoin based in your level of expertise and set reasonable expectations about returns. This will ensure that you have a greater chance of long-term success.

Where can I find ways to earn daily, and invest?

However, investing can be an excellent way to make money. It's important to know all of your options. There are many other investment options available.

One option is investing in real estate. Investing in property can provide steady returns with long-term appreciation and tax benefits. It is possible to diversify your portfolio with ETFs mutual funds, bonds, and specialty fields like cryptocurrency.

If you are looking for short-term income or daily profits, you might consider investing in dividend-paying stocks. You may also want to look into peer-to–peer lending platforms that allow you borrow money from other borrowers and receive interest payments on a daily basis. Online trading is possible if you're comfortable with the risks.

Whatever your investment goals may, it's important that you research all types of investments before investing. Every asset has its own risks. To maximize your earnings and help you reach your financial goals, make sure to closely track any investments.

What is the best trading platform for you?

Many traders may find it challenging to choose the best trading platform. It can be overwhelming to pick the right platform for you when there are so many options.

The best trading platform must offer all of the features that you need such as chart analysis tools and real-time market data. It should also have sophisticated order execution capabilities. It must also be easy to use and intuitive.

You should have access to a range of account types, competitive fees, reliable customer service, and educational resources. Demo accounts and free trials are a great way to test virtual money before investing any real money.

Think about what kind of trader you are, whether you're active or passive, how frequently you intend to trade, and what asset class you want. Understanding these factors will help narrow down your search for the best trading platform for your needs.

Once you've found the right platform, be sure to check out additional features, such as stock screening tools or backtesting, alert systems, etc. Make sure you have the appropriate security protocols in place for your data to prevent theft or breaches.

Some of the most popular trading platforms include MetaTrader 4/5 (MT4/MT5), cTrader, eToro TradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade FXCM ThinkOrSwim App Store just to name a few!

Statistics

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

What are the best ways to avoid investing online scams?

Protection begins with you. To avoid being conned, learn how to recognize scams and understand how fraudsters operate.

Avoid high-pressure sales tactics, promises of guaranteed returns and offers that sound too good to be true. Do not answer unsolicited emails and phone calls. Fraudsters often use fake names, so never trust someone just based on their name alone. You should thoroughly investigate investment opportunities and do your research on the person offering them.

Never invest your money in cash, on the spot or by wire transfer. If an offer to pay with these methods of payment is made, you should immediately be suspicious. Don't forget to remember that "Scammers will attempt anything to get personal information." Be aware of the different online phishing schemes, suspicious links in emails and online ads that could lead to identity theft.

Secure online investment platforms are also essential. Look for sites with a good reputation and that have been regulated by Financial Conduct Authority. Secure Socket Layer or SSL encryption is an option that protects your data as it travels via the internet. Before you invest, make sure to read the terms and conditions for any app or site you use. Also, be aware of any fees or charges.