Forex traders are people who trade currencies. Forex traders are able to choose currency pairs according to economic volatility and economic developments. The best time to trade forex is when the major stock-markets are active. To learn more about the upcoming major events, visit the calendar.

Forex trading isn't for everyone. If you don't understand what you are doing, it's easy for you to lose your money. It is impossible to be complacent, even for the most skilled traders. Here are some tips for avoiding these pitfalls

Learn more about the forex market. Foreign exchange market is a non-centralized market. This allows for tighter spreads, and eliminates the potential for price manipulation. This does not mean the market is transparent. There may be difficulties spotting fraud transactions or getting the best price.

It is essential to select the right broker. Traders should consider a regulated broker. Regulated broker are responsible for safekeeping client funds, execution orders, and making sure that clients are treated fairly. They should also be able and willing to process withdrawals within 24 hour.

To open an account, first fill out the online form. A minimum amount must be deposited in order to prove your identity. Some brokers let you use your debit card or credit card to make payments. Others accept ewallets like Neteller and Skrill.

The forex market's liquidity is one of its most striking features. The majority of forex trading is done on technical indicators. Trading is very competitive when the market's active. There are many traders trying to grab the same opportunity. This is what makes the market a little volatile.

Forex Markets are open 24 hours a days, five days a săptămână. Traders can take advantage of the market's liquidity to minimize risk and maximize profits. There are many currency pairs available. The major currency pairs are the dollar, yen and euro. But which one is the best?

Identify your goals. Knowing your goals will help guide you in choosing the right forex platform and course. Beginners should start small. Start small with a deposit, and then gradually increase your investment.

Pick a forex broker based on their reputation. Traders should ensure that a broker is licensed by one of these organizations. The Financial Services Commission of Australia (FSCA), Cyprus Securities and Exchange Commissions(CySEC), and Australian Securities and Investments Commissions are these organizations.

Learn from the experts. Get to know all about the forex and financial market topics. Spending the time to understand the financial markets will save you time and prevent you from having to deal with headaches.

Use a money management strategy to help you deal with emotions and prevent unnecessary risk. Having a plan can also help you to maximize your gains.

FAQ

Which is more secure, forex or crypto?

Two types of high-risk investments, cryptocurrency trading and forex trading, are highly risky and can bring you great rewards but also huge risks.

The shorthand crypto, or cryptocurrency, is a digital money that has been created using code from blockchain technology. It can be traded on exchanges like any other form of money and has been the subject of speculative investments due to its dramatic price swings over time.

Forex or foreign currency trading involves high-leveraged investments that allow participants to speculate on the relative value of one currency. Forex is a high-risk investment that can lead to large losses if it is not managed properly.

While both Forex and Crypto have their strengths and weaknesses, Crypto tends to be more risky than Forex. Cryptocurrency prices are fairly unpredictable due to the limited number of units available along with existing regulations surrounding cryptocurrencies around the world while forex markets tend to move more steadily so investors have more control over their investments. The decision about which of Cryptocurrency or Forex is more secure will be based on the individual's risk appetite and their previous experience with each investment option.

Which is better forex trading or crypto trading.

Both crypto trading and forex have potential for profit, but which one is right for you depends on your investment goals.

Forex trading is an investment in currencies. This option is accessible to beginners. Forex trading requires less capital upfront and the forex markets are open 24 hours a day.

Crypto trading, on the other hand, offers a fast return because prices can fluctuate very quickly due to their volatility. You can cash out your tokens quickly because crypto trades are highly liquid.

It is important to research both sides of the coin before you make any investment. Any type of trading can be managed by diversifying your assets.

Understanding the various trading strategies for different types of trading is important. Forex traders might use fundamental or technical analysis to make decisions. Crypto traders, on the other hand, may use arbitrage and margin trading to maximize their profits. Some traders might also opt for automated trading systems, or bots, to manage their investments. Before investing, it is important that you understand the risks as well as the rewards.

How can I invest Bitcoin?

While it can seem daunting to invest bitcoin, it is really not that difficult. All you need is the right knowledge and tools to get started.

First, you need to know that there are many ways to invest. To gain exposure, you can either buy Bitcoin directly or trade it on an exchange.

You must also decide where you will store Bitcoin. There is a wide range of options available, including exchanges, custodians, cold storage, wallets and exchanges. There are many options available, but some might be more appropriate than others, depending on what your goals and risk appetite are.

The next step is to research additional information you might need in order to be confident about your investment decisions. Learning the basics of cryptocurrencies and how they work before diving in is important. Keep an eye on market developments and news to stay current with crypto trends.

Final, make a plan to invest in Bitcoin. This will be based on your experience level and allow you to set reasonable expectations for return. You'll have a better chance of success over the long-term.

Frequently Asked Question

What are the four types of investing?

Investing can be a great way to build your finances and earn long-term income. There are four major categories: stocks (bonds), mutual funds (mutual funds), and cash equivalents.

There are two kinds of stock: common stock and preferred stocks. A common stock allows an individual to have a share of the company. It includes voting rights at shareholder's meetings and the ability to earn dividends. The preferred stock gives you ownership rights, but no voting privileges. Investors also have the option to receive fixed dividend payments.

Bonds are loans that investors make to governments or companies in return for interest payments. They expire at the maturity date and can be repaid with interest payments. While bonds offer more stability and lower risk than stocks, the returns are usually lower than those of stocks.

Mutual funds can be described as pooling investors money together to spread investment risks and diversify investments over a wide range of securities. This includes stocks, bonds, and other commodities. Mutual funds are managed by professional managers who use their expertise to select profitable investments in accordance with pre-set criteria such as level of risk or desired gain rate.

You can find cash equivalents in products like Treasury bills or money market deposits or certificates of deposit (CDs), which usually mature in one or two years. They are also less likely to be defaulted or lose value. This type investment is best suited for conservative investors who don’t want to take too many risks, but still want a bit more return than depositing in traditional low-interest bank funds.

Which platform is the best for trading?

For many traders, choosing the best platform to trade on can be difficult. There are so many platforms available, it can be difficult to decide which one is best for you.

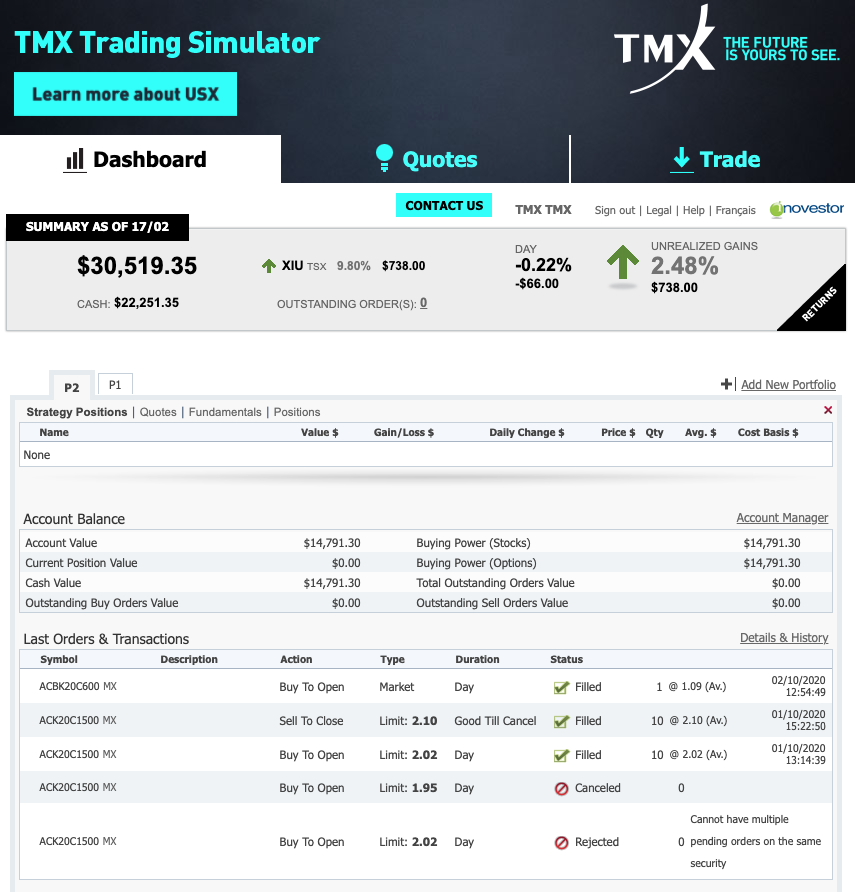

The best trading platform should offer the features you need, like advanced chart analysis tools, real-time market data, and sophisticated order execution capabilities. The interface should be intuitive and user-friendly.

You will need to have access to multiple account types, low fees, reliable customer support, and educational resources. You should look for demo accounts and free trials that allow you to practice with virtual money without risking your real cash.

Consider your trading style when searching for a platform. This includes whether you are active or passive, how often you trade and what asset classes you prefer. These factors will help you narrow down the search for the right platform.

Once you have chosen the platform that is right for you make sure you look at other features such stock screening tools, backtesting capability, alert systems and many more. Also, make sure that the platform you choose has appropriate security protocols in order to protect your data from theft and breaches.

MetaTrader 4/5, cTrader, eToro, ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader InteractiveBrokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM ThinkOrSwim, to name a few.

Is Cryptocurrency an Investment Worth It?

It's complicated. It is complicated. On one hand, the cryptocurrency market is highly volatile and unpredictable so there's always a risk involved when investing in them.

However, if you are willing to take that risk, and do your research, then there may be potential benefits based on events such as Initial Coin Offerings (ICOs), and shifts in market.

Because cryptocurrency assets move independently from traditional stock markets, portfolio diversification can also be possible with cryptocurrency investments.

It all comes down ultimately to an individual's risk tolerance and knowledge of the crypto market. If you can make an educated decision on this asset class and are comfortable taking risks, then investing in cryptocurrency is worth your consideration.

Statistics

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

External Links

How To

How can you protect your financial and personal information while investing online?

When investing online, security is crucial. Online investments can be dangerous. You need to know the risks and how to mitigate them.

Begin by paying attention to who you are dealing on investment platforms and apps. Reputable companies have good customer ratings and reviews. Before you transfer funds or provide any personal information, it is important to check the background of each company or individual that you are considering.

Secure passwords and two-factor authentication should be used on all accounts. Also, make sure to regularly check for viruses. Disable auto-login settings on your devices, ensuring no one can access your accounts without your knowledge or consent. Never click on any links in email from unknown senders. Don't download attachments unless it is clear to you. Always double-check a website security certificate before entering personal information into a website form.

It is important to ensure that only trustworthy people have financial access to your accounts. Make sure you delete old bank apps from all devices, and change passwords every few weeks if necessary. Notify identity thieves of any account modifications, such account closure notifications or emails asking for additional information. You should also use different passwords to protect each account from being compromised. The last thing is to make use of VPNs for investing online when possible. These are often free and easy to setup!