It can be frustrating and complicated to buy and sell NFTs. NFT market is not well-regulated. This makes it vulnerable to manipulation and fraud. Some popular crypto wallets and exchanges do not require users to verify their identities, making it easy to buy and sell without oversight. This has led to a boom in scams, and some NFTMs reward users based on trading volumes.

Wash trading, which is also known as the "zero-sum" game, allows you to trade the same NFT multiple times. This makes the NFT seem more valuable than it really is. The purpose of this is to create the appearance of a demand for the asset. While there is no hard data to support this claim, it is likely that this activity is a major contributor to the artificially high volume of NFT trades on the open market.

Das et al. recently examined the NFT market's best and most dangerous security risks. OpenSea. Etherdelta. This has created a wealth of opportunities for financial criminals.

One of the most common scams is known as pump and dump, or PD. A typical PD scam will promise big profits, if not a significant increase in price, to entice potential investors. But, this hype can often be misleading. These schemes are just a way for scammers to get funds from unsuspecting investors.

Wax trading is another, in which the same entity or person sells and purchases the asset multiple times. The objective is to create the illusion there is a demand and to increase the volume transactions by an artificially large amount. This is not a new phenomenon, but it does require a bit of creativity. It's possible with technology.

There are other lesser known security risks in the NFT market. MetaMask was the victim of a phishing attack that stole $1.7million in NFTs. This was actually a small operation. This would make it difficult to prosecute and track down if it happened in real life.

In addition to these concerns, you also need to consider how best to safeguard yourself against fraud. Despite the fact that manipulation of stock trading is forbidden in most US states, there may still be some dangerous projects. These projects are often created by the same con artists. It is best to avoid them.

The CDF is another option. The CDF (cryptocurrencydata framework) contains a complete database that includes information about the whole market, unlike other crypto markets. When considering whether to invest, it is important to consider the CDF. This includes information about the market's volume, exchanges, and transactions.

It can be overwhelming to choose the best cryptocurrency to invest, especially when considering the numerous NFTs. An easy way to ensure that your money stays safe is to invest on a reputable exchange like Coinbase.

FAQ

What are the disadvantages and advantages of online investing?

Online investing has the main advantage of being convenient. With online investing, you can manage your investments from anywhere in the world with an internet connection. Online trading allows you to access market data in real time and trades from anywhere. Many online brokerages charge lower fees than traditional ones, which makes it easier to start investing with less money.

However, online investing does have its downsides. Online trading can make it difficult to receive personalized guidance and advice, since you don't have access to a financial advisor or broker to assist you with your decisions. Online trading platforms might not provide the same level security as traditional brokerages. Investors need to be aware about the potential risks. Online trading can be more complex and difficult than conventional investing. Before you begin, make sure to thoroughly understand the markets.

Online investing is a complicated process. It is important to be familiar with the various types of investments that are available. Stocks, bonds, mutual funds, and cash equivalents are all options for investors. Each investment comes with its own risks. You should research all options before you decide on the right one. There may be restrictions on investments such as minimum deposits or other requirements.

Which trading site is best suited for beginners?

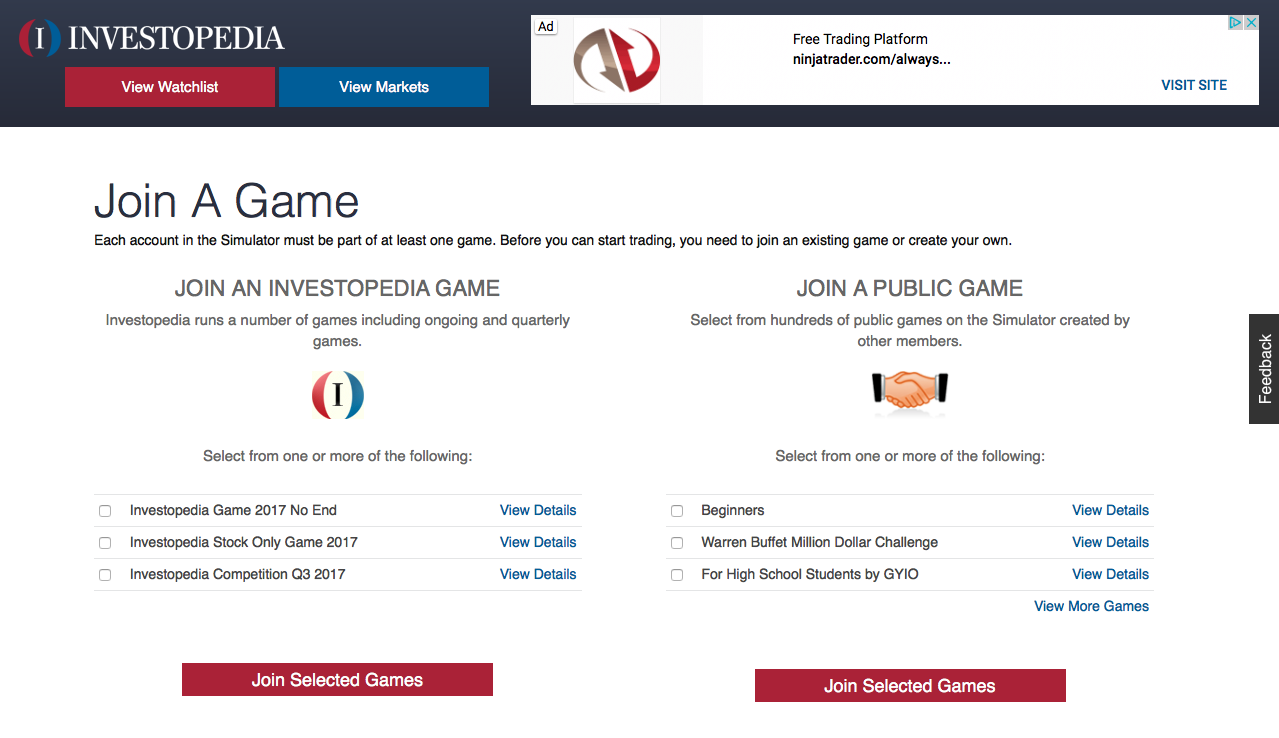

Your level of experience with online trading will determine your ability to trade. If you're completely new to the online trading process, it would be a great idea for you to go through an established broker with experienced advisors.

These brokers take the guesswork out of choosing companies and give solid recommendations that can help you build a portfolio steadily over time. Most brokers also offer interactive tools to show how trades work and help you avoid losing real money.

Many sites allow you to trade alone if you have some knowledge or want more control over your investments. You can create your own trading platform, access live data feeds and use research tools like real-time analysis to make informed decisions.

No matter what route you choose to take, it is important that you read reviews from customers before making any commitments. They will provide insight into how each site treats customers and give you an idea of the overall experience.

Which is better forex trading or crypto trading.

Forex and crypto trading both have their opportunities for profits, but which one is best for you really depends on your investment goals.

Forex trading is an investment in currencies. This option is accessible to beginners. You will need to invest a lower amount upfront. Additionally, forex markets are worldwide and available 24/7.

However, crypto trading can offer a very immediate return due to the volatility of prices. Also, crypto trades can be cashed out quickly due to their liquidity.

Both cases require that you do extensive research before investing. You can reduce your risk by diversifying assets. This will help you to be successful in any type of trading.

Understanding the various trading strategies for different types of trading is important. For example, forex traders could use technical analysis or foundation analysis to help make decisions. Crypto traders may choose arbitrage or margin trading to maximise their profits. Automated trading systems and bots may also be used by some traders to help them manage investments. Before investing, it's important to understand both the risks and the benefits.

Which is more difficult, forex or crypto?

Forex and crypto both have unique levels of complexity. In terms of basic understanding, crypto may be slightly more difficult because it is new and related to blockchain technology. Forex, however, has been around for quite some time and has a reliable trade infrastructure.

In terms of cryptocurrency trading, there are more risks when compared to forex, due to the fact that crypto markets tend to move in unpredictable ways within short periods of time. You can gain an advantage over your competitors by researching historical trends in the markets in which it trades.

Forex traders need to be able to comprehend the dynamics between foreign currency pairs. For example, how prices react to news. You also need to be able to read and understand technical indicators, which can signal buy or sell signals. Another important aspect to consider is leverage. Traders are exposed to additional risk when trading currency pairs with high volatility.

Forex and crypto both require keen research skills and attention to ensure successful trades.

How Can I Invest in Bitcoin?

Although it may seem difficult to invest in Bitcoin, it is not as complicated as you might think. To get started, you only need to have the right knowledge and tools.

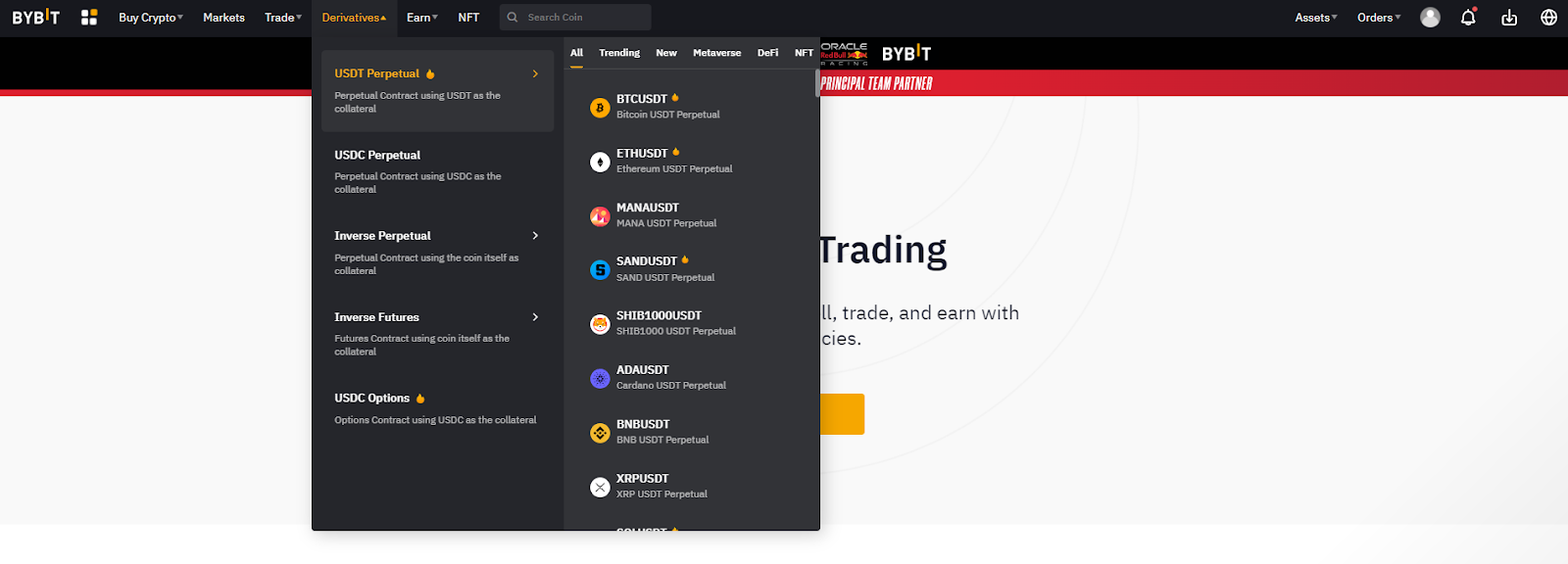

You need to be aware that there are many investment options. You have the option to buy Bitcoin direct, trade on an exchange, or gain exposure using a financial instrument called a derivatives contract.

You'll also need to decide where you will store your Bitcoin - there are many options available such as wallets, exchanges, custodians, and cold storage. Depending on your risk appetite, goals, and other factors, certain options might be more appropriate than others.

Next, gather any additional information to help you feel confident about your investment decision. It is crucial to know the basics about cryptocurrencies and how they work before investing. You should also keep up to date with market news and developments in order to stay abreast of the latest crypto trends.

Finally, create a plan for investing in Bitcoin based on your level of experience and set reasonable expectations for returns - this will give you a better chance at success long-term too!

Frequently Asked questions

What are the four types of investing?

Investing can help you grow your wealth and make money long-term. There are four major types of investment: stocks, bonds mutual funds, cash equivalents, and stock.

Stocks can be divided into preferred and common stock. A common stock gives an individual ownership right of a company, including voting rights at shareholders' meetings and the potential to earn dividends. Although preferred stock grants ownership rights, there are no voting privileges. Fixed dividend payments offer investors an income stream and provide a reliable source of income.

Bonds are loans from investors made to governments or companies in exchange for interest payments until the bond expires on its maturity date. Although bonds are more stable and less risky than stocks they offer a higher return than stocks.

Mutual funds allow investors to pool their money together to spread investment risk, diversify their investments, and diversify across a variety of securities such as stocks, bonds, or commodities. Professional managers manage mutual fund investments. They use their knowledge to choose profitable investments that meet pre-set criteria.

These cash equivalents are products like Treasury bills, money-market deposits, certificates or deposit (CDs), as well as commercial paper. They usually mature in one year or less and have minimal risk of losing their value or going bankrupt. This type investment is best suited for conservative investors who don’t want to take too many risks, but still want a bit more return than depositing in traditional low-interest bank funds.

Statistics

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

Is it safe to store my investment assets online, or should I consider other options?

Money can be complex but so can the decisions about how to store it. You have many options for protecting your valuable assets.

Online storage of your investment assets allows you to access them from anywhere and can be accessed quickly and easily. But, you should be aware that electronic breaches can happen when you use digital options.

You could also choose to store your money in physical currency like gold or cash. This is less secure but more manageable and requires more storage and protection.

Other options include keeping your investments in traditional banking or investing accounts as well as self-storage facilities that allow you to safely store gold, silver, or other valuables outside of your home.

You might also consider looking into specialist investment firms that provide secure custody services, specifically tailored to protect large asset portfolios.

It is ultimately your decision. What will work best for you, and provide the security and safety that you require to protect your investments.