Coursera allows you to watch lectures from top universities online and take part in online courses. Users can earn full degrees and technical certifications. Coursera has seen a rapid growth in its user base over the past few years. The company is a leader in the field of online education.

Coursera's business has several streams of revenue. There is a consumer segment that offers online classes as well as a degree section. Coursera earned $66.5 million in revenue during the third quarter. The largest portion of its revenue was generated by the consumer division.

Coursera holds a lot of cash. Coursera had $800 millions in cash left over at the end third quarter. This gives Coursera plenty of room to expand its offerings. Coursera may find it more difficult to raise capital due to rising interest rates. Coursera may have to cut back on its growth.

Coursera's value is high. The stock trades at over 11 times its trailing twelve-month revenue. There is little margin for error in this quarter. Coursera is still profitable but hasn’t yet been able show operating leverage as a result of higher sales.

Coursera's revenue falls into three groups: the consumer division and the degree segment. The enterprise segment is the third. Coursera's degrees segment earns fees from university partners based on each student's tuition payments. Subscriptions to Coursera’s original video content are a major source of revenue. Users grow on average by 20-25 percent per year.

Coursera's recent growth has slowed. However, the company expects to continue growing in the coming years. In addition, Coursera has taken a number of steps to improve its conversion rate. To attract more learners, Coursera is using social media performance marketing.

The company's valuation makes it a potentially attractive buy-and-hold investment. As the company approaches its peak market, there is a possibility that the stock price could drop due to a decrease in consumer interest. Coursera's growth will be difficult if there is no interest from consumers in its products.

Coursera is valued based on a number of factors. These factors include: investors, earnings, and sales. Choosing the right benchmark for Coursera is vital to educated investing decisions. Investors need to understand the concept risk-adjusted returns, which are calculated using beta and alpha measures.

Coursera's valuation is comparable to that of other companies. Coursera's gross margin is lower than other SaaS/Software businesses. Its margins are 60% instead of 80%.

Coursera releases its financial statements every quarter. The company maintains a healthy balance sheet and has raised more than $460 million in Venture Capital funding.

Coursera has a large user base which is its main revenue source. However, Coursera's conversion rates have not been as impressive as expected. This could make it possible for the stock to rebound by optimizing its platform.

Coursera is the first major edtech IPO of the year. Its stock has had a poor first year since its IPO. Despite a dismal third quarter, the company is still trading near its IPO price. Still, Coursera's potential to become a great stock is high, and the company's financials are sound.

FAQ

Which trading platform is best?

Many traders may find it challenging to choose the best trading platform. It can be overwhelming to pick the right platform for you when there are so many options.

A trading platform that is the best should have all the features you require, such as advanced chart analysis tools, market data and order execution capabilities. The interface should be intuitive and user-friendly.

It should offer multiple account types and low fees. You also need reliable customer service and educational materials. For those who want to try virtual money before you invest your real money, look out for free demo accounts.

Think about what kind of trader you are, whether you're active or passive, how frequently you intend to trade, and what asset class you want. These factors will help you narrow down your search to find the right trading platform.

Once you've found the right platform, be sure to check out additional features, such as stock screening tools or backtesting, alert systems, etc. Make sure you have the appropriate security protocols in place for your data to prevent theft or breaches.

MetaTrader 4/5, cTrader, eToro, ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader InteractiveBrokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM ThinkOrSwim, to name a few.

Can one get rich trading Cryptocurrencies or forex?

If you have a strategy, it is possible to make a lot of money trading forex and crypto. It is essential to be able to spot trends and determine the best time for you to buy and/or sell.

You will also need to know how to identify patterns in prices, which can help you decide where the market is going. It is important to trade only with money you can afford to lose.

It takes a combination of knowledge, experience, risk-management skills, discipline, and patience to build a profitable strategy that will lead to long-term success.

Prices for cryptocurrencies are volatile. The key is to ensure your entry position meets your risk appetite.

Researching potential cryptocurrency exchanges and coins before signing up is vital, as they are not well-regulated and can pose significant risks.

Because forex trading involves the prediction of fluctuations in currency rates via technical analysis/fundamental economic analysis, this type of trading requires special knowledge that has been acquired over time. A solid knowledge of the conditions that affect different currencies is essential.

It all comes down to taking calculated risks, learning continuously, and finding the most effective strategy for you. With enough dedication, knowledge, and proper education, trading forex or cryptocurrency can be very lucrative.

Which is more secure, forex or crypto?

Cryptocurrency and Forex trading are two types of highly risky investments that vary greatly in terms of rewards and risks.

Crypto, short for cryptocurrency or digital currency, is a digital coin that was created by a piece code using blockchain technology. Because of its volatility, it can be traded on an exchange like any other money.

Forex, also known as foreign exchange currency trade, is high-leveraged investment that involves participants speculating on the value and relative strength of one currency. Forex can be a volatile investment and could cause significant losses if it's not managed correctly.

Both Forex and Crypto both have their benefits and drawbacks. However, Crypto has a higher risk of losing money than Forex. The limited supply of cryptocurrencies and the regulations that surround them around the globe make their prices unpredictable. However, forex markets are more steady so investors can have more control over what they invest. When deciding which option between Cryptocurrency and Forex is safer, it will depend on your risk appetite and experience with each investment option.

What are the advantages and disadvantages of online investing?

The main advantage of online investing is convenience. You can access your investments online from any location with an internet connection. Online trading allows you to access market data in real time and trades from anywhere. Online brokerages typically charge less than traditional brokerages. This makes investing easier, especially if you have a smaller amount of money.

Online investing comes with its own set of disadvantages. Online investing can lead to difficulties in getting personalized advice and guidance. You don't have the support of a financial advisor, broker, or physical broker. Online trading platforms might not provide the same level security as traditional brokerages. Investors need to be aware about the potential risks. Online trading can be more complex and difficult than conventional investing. Before you begin, make sure to thoroughly understand the markets.

It is also important to understand the different types of investments available when considering online investing. Stocks, bonds, mutual funds, and cash equivalents are all options for investors. Each investment type has its own risks, rewards, and it is important to fully research each option before making a decision. Some investments may also require a minimum investment or other restrictions.

Which is more difficult forex or crypto currency?

Crypto and forex have their own unique levels of difficulty and complexity. Crypto may require a greater level of understanding due to its newness and connection with blockchain technology. On the other hand, forex has been around for a long time and has a reliable trading infrastructure supporting it.

In terms of cryptocurrency trading, there are more risks when compared to forex, due to the fact that crypto markets tend to move in unpredictable ways within short periods of time. You can gain an advantage over your competitors by researching historical trends in the markets in which it trades.

Forex traders must understand the dynamics of foreign exchange pairs. This includes how prices change based on news events. It also requires an acute understanding of technical indicators that can indicate buy or sell signals. Leverage is also an important factor to be considered, since traders can risk their capital as well as additional borrowed funds when trading currency pairs of high volatility.

For both crypto and forex, it is important to be alert, do your research well, and have a strategy for making consistent trades.

Most Frequently Asked Questions

What are the 4 types?

Investing can be a great way to build your finances and earn long-term income. There are four major categories of investing - stocks, bonds, mutual funds, and cash equivalents.

Stocks can be divided into preferred and common stock. A common stock gives an individual ownership right of a company, including voting rights at shareholders' meetings and the potential to earn dividends. While preferred stock does not grant voting rights, it gives owners ownership rights and fixed dividend payments. This provides investors with an income stream that is reliable.

Bonds are loans that investors make to governments or companies in return for interest payments. They expire at the maturity date and can be repaid with interest payments. Although bonds are more stable and less risky than stocks they offer a higher return than stocks.

Mutual funds are a way to pool investor money in order spread risk and diversify investments across many types of securities, including stocks, bonds and commodities. Mutual funds are managed by professional managers who use their expertise to select profitable investments in accordance with pre-set criteria such as level of risk or desired gain rate.

You can find cash equivalents in products like Treasury bills or money market deposits or certificates of deposit (CDs), which usually mature in one or two years. They are also less likely to be defaulted or lose value. This type of investing is best for conservative investors who aren't willing to take high-risk but still want a higher return than depositing money in low-interest bank accounts.

Statistics

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

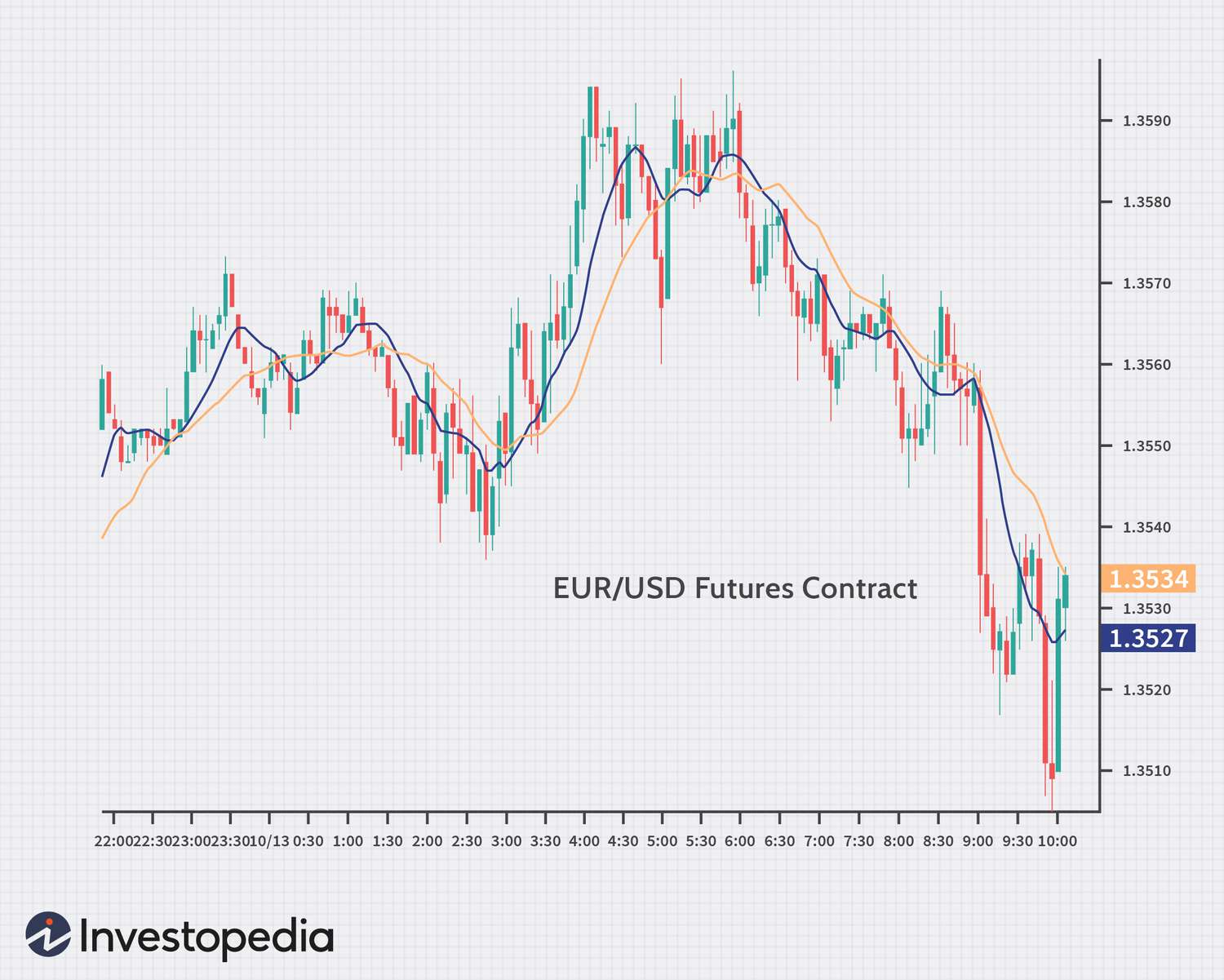

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

External Links

How To

What precautions should I take to avoid online investment scams?

Protecting yourself starts with you. Protect yourself by knowing how to spot fraudsters' tricks and learning how they work.

Don't fall for any offers that appear too good to pass up, high-pressure sales tactics or promises of guaranteed return. Don't respond to unsolicited calls or emails. Fake names are often used by fraudsters. Never trust anyone based solely on their name. Investigate investment opportunities thoroughly and independently, including researching the individual offering them before making any commitments.

Never invest money on the spot, in cash, or by wire transfer - if an offer insists upon these methods for payment, it should raise a huge red flag. Keep in mind that fraudsters will try everything to get your personal details. You can protect yourself against identity theft by paying attention to suspicious links and phishing emails, as well as the many types of online phishing schemes.

It is also important that you use secure online investment platforms. Look out for sites that are regulated and respected by the Financial Conduct Authority. Secure Socket Layer, which protects your data while it travels over the Internet, is a good encryption technology to look for. Before you invest, make sure to read the terms and conditions for any app or site you use. Also, be aware of any fees or charges.