Futures trading in agricultural commodities is a form of risk management and provides farmers with an opportunity to sell their produce at a specified price in the future. These markets provide liquidity and traders can trade 24 hours per day. This market can be used by farmers to increase their earnings.

The Indian only exchange for commodity derivatives trading is the National Commodity and Derivatives Exchange Limited. It has offices around the country and is run by an independent board. As of March 2018, the exchange traded 27 commodity contracts, including 25 agri-futures contracts.

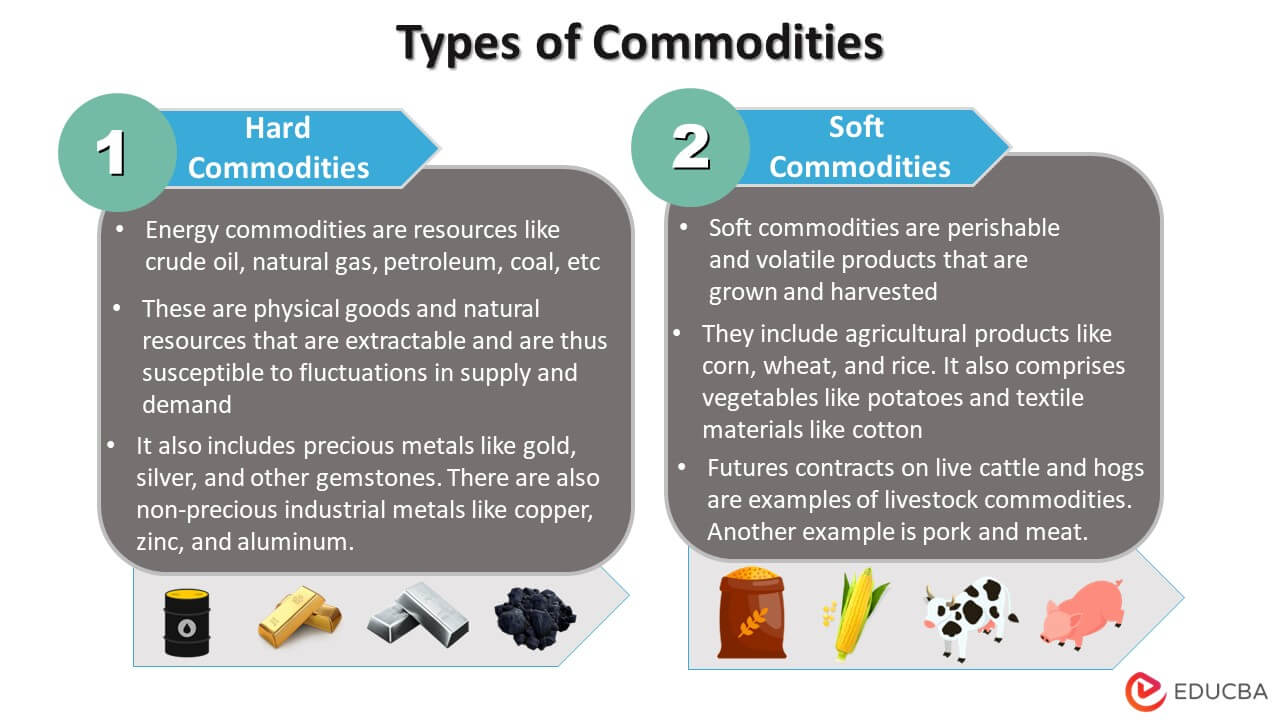

Agricultural commodities are primary livestock and produce that are vital to our daily lives. These include grains, milk products, and lean pork. Many of these products have an annual demand and supply cycle. In addition, there are also a number of byproducts that are used in everyday life. The most widely used agri commodities are wheat, crude palm oil, soya oil, and crude palm oil.

Agri-futures are also important to improve the overall marketing performance of farmers. Agri-futures can also be used to reduce harvest season risk. A futures contract can be sold by farmers to hedge their risk before harvest. They can then sell their produce at a reasonable price. They can also adjust their cropping plans based on futures market prices.

Futures trading in agricultural commodities is a profitable business, especially to farmers. But it also has its fair share of risks. These risks should be known by traders. Although there are many strategies available, it is best that you do your research before investing in any type of agrifutures. Traders can look at historical charts of the commodities they are interested in.

Having an online trading account is a quick and simple process. You can trade once you are ready. Since these contracts are standardized, they don't have to be settled by delivery. However, you may want to hedge against an existing long position or offset a short position.

Futures trading in agricultural commodities has another advantage: it frees middlemen from their grip. This is especially true for small farmers. These individuals are dependent on traditional marketing channels that charge high commissions. Trading in futures can help them reduce their dependency on these middlemen and make a lot more.

There are many online resources that provide information about agricultural futures trade. It is best to review historical charts to find the current price, trends, and other information. Be familiar with the agricultural cycle before you make a move. Also, you should know the differences between feed and food commodities.

The primary difference between agri commodities and food products is that they don't get produced all year. The majority of crops are only grown during certain seasons. Weather can play a major role in affecting supply and demand.

FAQ

Which trading site for beginners is the best?

All depends on your comfort level with online trades. You can start by going through an experienced broker with advisors if this is your first time.

These brokers take the guesswork out of choosing companies and give solid recommendations that can help you build a portfolio steadily over time. Many brokers provide interactive tools to show you how trades function without risking any money.

You can also trade independently if your knowledge is good enough. You can create your own trading platform, access live data feeds and use research tools like real-time analysis to make informed decisions.

Regardless of which route you take, make sure to check out customer reviews before making a choice - this will give you insight into the experience and service levels of each site before committing.

Frequently Asked Questions

What are the four types of investing?

Investing can help you grow your wealth and make money long-term. There are four major types of investment: stocks, bonds mutual funds, cash equivalents, and stock.

Stocks can be divided into preferred and common stock. A common stock gives an individual ownership right of a company, including voting rights at shareholders' meetings and the potential to earn dividends. Preferred stock also gives ownership rights but with no voting privileges, as well as fixed dividend payments that offer investors a reliable income stream.

Bonds are loans that investors make to governments or companies in return for interest payments. They expire at the maturity date and can be repaid with interest payments. Bonds offer greater stability and lower risk than stock, but they have higher returns than stocks.

Mutual funds can be described as pooling investors money together to spread investment risks and diversify investments over a wide range of securities. This includes stocks, bonds, and other commodities. Professional managers manage mutual funds. They use their experience to choose profitable investments based on pre-determined criteria, such as risk level or expected return rate.

You can find cash equivalents in products like Treasury bills or money market deposits or certificates of deposit (CDs), which usually mature in one or two years. They are also less likely to be defaulted or lose value. This type of investing is mostly suitable for conservative investors who don't want to take high risks but still seek a little bit more return than depositing money at traditionally low-interest bank accounts.

Which trading platform is best?

For many traders, choosing the best platform to trade on can be difficult. It can be overwhelming to pick the right platform for you when there are so many options.

A trading platform that is the best should have all the features you require, such as advanced chart analysis tools, market data and order execution capabilities. It should also offer an intuitive and user-friendly interface.

It should offer multiple account types and low fees. You also need reliable customer service and educational materials. Demo accounts and free trials are a great way to test virtual money before investing any real money.

Consider your trading style when searching for a platform. This includes whether you are active or passive, how often you trade and what asset classes you prefer. These factors will help you narrow down your search to find the right trading platform.

Once you have chosen the platform that is right for you make sure you look at other features such stock screening tools, backtesting capability, alert systems and many more. Also, make sure that the platform you choose has appropriate security protocols in order to protect your data from theft and breaches.

MetaTrader 4/5 (MT4/MT5) and cTrader are some of the most well-known trading platforms.

Do forex traders make money?

Yes, forex traders can make money. Although it is possible to make money in the short term, you will need to be patient and willing to learn. Market fundamentals and technical analysis are better than traders who rely only on luck or guesswork.

Forex trading is not an easy task, but it can be done with the right knowledge. Before risking any real capital, it's important to find a knowledgeable mentor and have a working knowledge about risk management.

Many traders lose their money because they don't have a well-planned strategy or plan. But with discipline, you can maximize your chances of making a profit in foreign exchange markets.

Experienced forex traders develop trading plans that they stick to when trading in order to reduce their risk exposure as much as possible while still finding profitable opportunities. The key to risk management is being able to see the big picture. New traders often chase short-term gains and lose sight of a long-term strategy.

Forex traders can increase their chance of generating long-term profits by maintaining good records, learning past trades and paying attention to other aspects of trading.

Forex trading is a disciplined business. Setting rules for how much money you're willing and able to lose per trade can reduce losses and help ensure success. Furthermore, strategies such as leverage entry signals can help increase profits that are not possible without the guidance of an experienced mentor.

Be persistent, learn from successful day trader and be persistent. Profitability in the forex market trading markets is dependent on whether you're managing funds for yourself or someone else.

What is the best forex trading system or crypto trading system?

Both forex and cryptocurrency trading have their potential profits. But it all depends upon your investment goals.

Forex trading is easy for beginners and allows you to invest in different currencies. Forex trading is easier than investing in foreign currencies upfront.

However, crypto trading can offer a very immediate return due to the volatility of prices. You can cash out your tokens quickly because crypto trades are highly liquid.

In both cases it's crucial to do your research before making any investment. Any type of trading can be managed by diversifying your assets.

It is important that you understand the different trading strategies available for each type. For example, forex traders could use technical analysis or foundation analysis to help make decisions. Crypto traders may choose arbitrage or margin trading to maximise their profits. To help manage their investments, traders may use automated trading systems or bots. It is important to understand the risks and rewards associated with each strategy before investing.

How can I invest Bitcoin?

Although investing in Bitcoin may seem complex, it's actually not as difficult as you think. You only need the right information and tools to get started.

You need to be aware that there are many investment options. To get exposure to Bitcoin, you can buy it directly, use an exchange or use a financial instrument, known as a derivatives agreement.

You also need to decide where to store Bitcoin. There are many choices, such as cold storage, exchanges or custodians. Depending on your risk appetite, goals, and other factors, certain options might be more appropriate than others.

The next step is to research additional information you might need in order to be confident about your investment decisions. It is crucial to know the basics about cryptocurrencies and how they work before investing. Keep an eye on market developments and news to stay current with crypto trends.

Last but not least, develop a plan that will allow you to invest in Bitcoin according to your experience and have reasonable expectations of returns. This will help you be more successful long-term.

Statistics

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

What are the best options for storing my investment assets online?

While money can be confusing, the decision to where it should be stored can be just as complex. There are many options to protect your valuable assets.

Online storage of investment assets is easy and convenient. You can access them easily from any device. But, you should be aware that electronic breaches can happen when you use digital options.

A physical form of money like cash or gold can be safer, but it's more difficult to track and requires higher levels of protection and storage.

Another option is to keep your investments in traditional banking and investing accounts. You also have the option of self-storage facilities, which allow you to store valuables such as gold, silver or other precious metals safely outside your home.

Finally, consider looking at specialized investment companies that provide secure custody services designed specifically for large asset portfolios.

It is ultimately your decision. What will work best for you, and provide the security and safety that you require to protect your investments.