Forex pip is a small change in the exchange rate between two currencies. The value of a single pip depends on the currency pair and the trade size. It is usually equal to a small portion of the currency pair trade value. However, if the currency pair is trading in an environment of hyperinflation, the small measurement of a pip becomes meaningless.

Babypips for FX Trading

Forex traders can have two orders pending at the same time. Traders can buy EUR/USD, and then sell GBP/USD. When the price of one currency moves two pips away from the other, this is considered to be a "babypip."

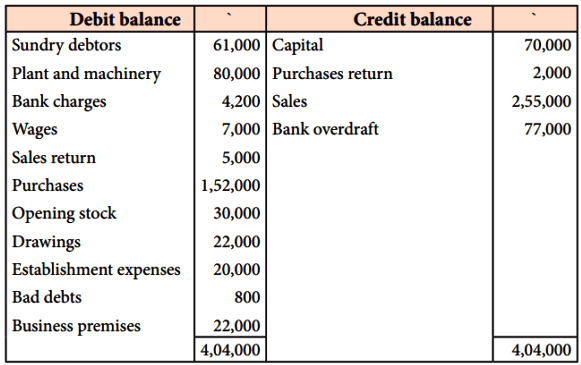

How to calculate your pip value in your trading account

The currency used to open an account can affect the value of a Pip. Then, divide the position size by your exchange rate to determine the numeric value.

You can use the online calculator to calculate your pip value based on your account currency and trade size. Enter your account currency and trade amount in the fields below and the calculator will show you the value of one pip for all Standard and Mini lots using the current market rates.

Maximize Profits by Using Leverage

You need to be aware of the maximum leverage you can use in order to maximize your profit. Leverage may increase your lot size and allow you to trade at a higher pips. It can also increase your losses. It is essential to keep your leverage moderate and not exceed it.

How to Calculate your Profits from Pip

You don't have to be an experienced forex trader to make a profit. This will help ensure that your account remains profitable and that your funds don't disappear in a hurry.

Start by looking at the major currency pair: EUR/USD/USD, US/JPY or GBP/USD. This will give you an even better overview of the market's fundamentals. It can also help you understand how to best use pips.

Pips and Dollars

The dollar will be the base currency if your forex trading account is funded in U.S. Dollars. The EUR/USD exchange rates will, for example, be $10 per unit in a U.S. dollars account while the EUR/USD value is 8.92 per unit in a euro account.

This is a common question that new traders ask. It is important to know the basics of forex pips. You could lose a lot of money if you do not understand how to calculate your Pips.

It is also important that you understand the differences between a pip or a point. Pip is a tiny change in the exchange rate of two currencies. Points are larger movements that can be tracked on charts. Newer traders often don't realize the differences between them.

FAQ

Cryptocurrency: Is it a good investment?

It's complicated. It is complicated. One, the cryptocurrency market can be volatile and unpredictable. This means that there is always risk when investing in them.

There are also potential gains if one is willing to risk their investment and do some research.

The advantages of cryptocurrency investments for portfolio diversification are also available, since they tend to be independent from traditional stock markets.

It really boils down to each individual's tolerance for risk and knowledge about the crypto market. It is definitely worth investing in cryptos if you have the knowledge and ability to make informed decisions regarding this asset class.

Where can I find ways to earn daily, and invest?

However, investing can be an excellent way to make money. It's important to know all of your options. There are many options.

One option is to invest in real property. Investing property can bring steady returns as well as long-term appreciation. Diversifying your portfolio may be an option, such as with ETFs, mutual funds or specialty fields like crypto, bonds, ETFs and mutual funds.

If you are looking to make short-term gains or generate daily income, consider investing in dividend paying stocks. Or you can look into peer lending platforms, where you loan money and get interest payments direct from the borrowers. Online trading is possible if you're comfortable with the risks.

Whatever your investment goals may be, it's important to do research about each type of investment before diving in head first as every asset carries its own set of risks associated with it. You should closely monitor your investments and know when to sell and buy accordingly. This will help you maximize your earnings and reach your financial goals.

How do I invest in Bitcoin

Investing in Bitcoin can seem complicated, but it's not as hard as you think! You only need the right information and tools to get started.

There are many options for investing. To gain exposure to Bitcoin you can either purchase it directly or use an exchange to trade.

You must also decide where you will store Bitcoin. There is a wide range of options available, including exchanges, custodians, cold storage, wallets and exchanges. Depending on your risk appetite, goals, and other factors, certain options might be more appropriate than others.

Next, find any additional information that may be necessary to make confident investment decisions. Learning the basics of cryptocurrencies and how they work before diving in is important. With that said, make sure you keep track of market news and developments so you can stay up-to-date with crypto trends.

Create a plan for investing Bitcoin based upon your level of experience. Set reasonable expectations for returns. This will increase your long-term success.

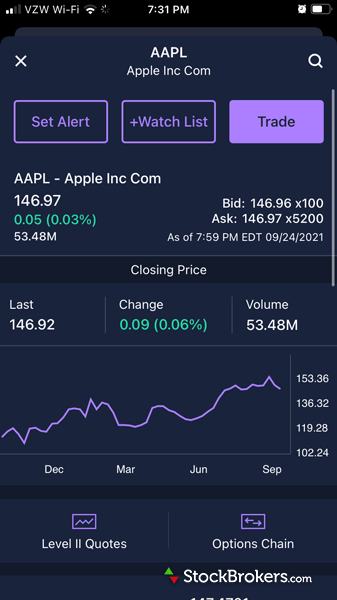

Which forex trading platform or crypto trading platform is the best?

Both crypto and forex trading can make you money, but it really comes down to your investment goals.

Forex trading involves investing in foreign currencies. This is an easy option for beginners. Forex trading is easier than investing in foreign currencies upfront.

However, crypto trading can offer a very immediate return due to the volatility of prices. It is also easy to cash out tokens quickly, as crypto trades have high liquidity.

In both cases it's crucial to do your research before making any investment. Any type of trading can be managed by diversifying your assets.

It is also important to understand the different types of trading strategies available for each type of trading. To maximize their profits, crypto traders can use arbitrage or margin trades to maximize their gains. Forex traders may use either technical analysis or fundamental analysis to assist them in making decisions. Automated trading systems and bots may also be used by some traders to help them manage investments. Before investing, it is important that you understand the risks as well as the rewards.

Which is more secure, forex or crypto?

Two types of high-risk investments, cryptocurrency trading and forex trading, are highly risky and can bring you great rewards but also huge risks.

The shorthand crypto, or cryptocurrency, is a digital money that has been created using code from blockchain technology. Because of its volatility, it can be traded on an exchange like any other money.

Forex, also known as foreign exchange currency trade, is high-leveraged investment that involves participants speculating on the value and relative strength of one currency. Due to its high risk, Forex can be an unstable investment that could result in large losses if not properly managed.

While both Forex and Crypto have their strengths and weaknesses, Crypto tends to be more risky than Forex. The limited supply of cryptocurrencies and the regulations that surround them around the globe make their prices unpredictable. However, forex markets are more steady so investors can have more control over what they invest. Before making a decision on which investment option is safer, one should consider their risk appetite and previous experience with each option.

What are the disadvantages and advantages of online investing?

Online investing offers convenience as its main benefit. Online investing makes it easy to manage your investments from anywhere on the planet with an internet connection. You can access real-time market data and make trades without having to leave your home or office. Online brokerages are often cheaper than traditional brokerages. This allows investors to get started quickly and with less money.

Online investing comes with its own set of disadvantages. For example, it can be difficult to get personalized advice and guidance when trading online, as you don't have a physical broker or financial advisor to help you make decisions. Online trading platforms can offer less security than traditional brokerages. Investors should be aware of these risks. Online trading can be more complicated than traditional investing. It is important to learn the markets and create a solid strategy before you start.

When considering investing online, it is also important that you understand the types of investments available. Investors have many choices: stocks, bonds or mutual funds. Each type of investment carries its own risks and rewards, so it is important to research each option before deciding which one is right for you. Additionally, some investments may require a minimum deposit or have other restrictions that need to be taken into consideration.

Statistics

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

External Links

How To

What are the best options for storing my investment assets online?

The decision about where to store your money can be complicated. There are many options to protect your valuable assets.

Online storage of investment assets is easy and convenient. You can access them easily from any device. The downside is that there may be electronic thefts.

Alternatively, keeping your money in physical forms like cash or gold is more secure, but it's also harder to keep track of and requires a higher level of maintenance for storage and protection.

You have other options, such as traditional banking accounts or investing accounts, as well as self storage facilities that allow for safe storage of precious metals and other valuables.

Finally, you might consider investing in specialized firms that offer safe custody services specifically designed to protect large portfolios of assets.

You make the final decision.