Emini futures, a short-term derivative instrument that can be electronically traded, are available. They are available on a wide variety of assets including stock indexes, commodities and G7 currencies. These instruments can also be used to speculate about broad market movements and as a hedging tool. They are not suitable for everyone investors, as with all financial products. It is therefore important to be aware of the risks associated with them. It is recommended to consult an experienced broker before you trade with them.

Futures can be complex and difficult to understand. They can be beneficial in speculation and hedging but can also be volatile or risky. Because these investments can involve significant amounts and could result in high losses, they can also be very volatile. Although leverage can increase the risk of losing more than the initial investment it can also help to maximize gains. These drawbacks mean that they are not appropriate for beginners. But, they are an easy way to get involved with the derivatives markets.

An E-mini is a contract that tracks the value of a stock index, such as the S&P 500. These contracts are priced at a fraction the price of a standard forwards contract. In addition to this, they can be traded almost twenty-four hours a day. These contracts are relatively small but they are highly liquid and widely traded.

The S&P 500 benchmark is widely followed by the equity markets of the United States. The index contains the 500 largest companies. Since it is a market value-weighted index, it is less volatile than individual stocks. An E-Mini's value can be affected by a drop in the index. Investors' E-Mini could lose around $200 if S&P 500 drops by 4000 points.

E-minis can be considered an important derivative. They are among the most liquid and readily accessible forms of equity derivatives. They are traded on CME (Chicago Mercantile Exchange) and other exchanges. The volumes of trading are significantly greater than those for full-sized forwards contracts. Margin financing is an option offered by many discount brokers that can reduce the margin requirement from $1,000 to as low as $1,000.

S&P 500 E-Mini was established in 1997 and has seen a steady increase in volume over the years. In fact, they now account for the vast majority of U.S. stock index futures trading.

The Emini derivative is an important one and one of our most loved instruments. They are liquid and extremely popular but can be difficult to understand. It is important that you consult a professional broker who knows the market.

E-Minis offer leverage, which is why they are so popular. An E-Mini allows investors to profit even when the price of an underlying asset falls. They can use cash to pay a small fraction of the contract value. An E-Mini can easily be closed when the index drops. You can purchase another one. Many discount brokers offer credit options to traders so they can increase their margin without incurring a large loss.

FAQ

Which is more secure, forex or crypto?

Two types of high-risk investments, cryptocurrency trading and forex trading, are highly risky and can bring you great rewards but also huge risks.

Crypto, short for cryptocurrency or digital currency, is a digital coin that was created by a piece code using blockchain technology. It can be traded like any other currency on exchanges and has been subject to speculation investments because of its volatile price swings.

Forex trading or foreign currency currency trading is a highly leveraged investment in which participants speculate about the value of one currency relative to another. Forex can be a volatile investment and could cause significant losses if it's not managed correctly.

While both Forex and Crypto have their strengths and weaknesses, Crypto tends to be more risky than Forex. Due to the small number of units and existing regulations around cryptocurrencies, cryptocurrency prices can be unpredictable. Forex markets are more stable so investors have greater control over their investments. Before making a decision on which investment option is safer, one should consider their risk appetite and previous experience with each option.

Which is more difficult forex or crypto currency?

Forex and crypto both have unique levels of complexity. Crypto may require a greater level of understanding due to its newness and connection with blockchain technology. Forex is a well-established currency with a stable trading infrastructure.

Trading cryptocurrency is more risky than forex. It's because the crypto markets can change in an unpredictable way over short time periods. You can gain an advantage over your competitors by researching historical trends in the markets in which it trades.

Forex traders must understand the dynamics of foreign exchange pairs. This includes how prices change based on news events. This also requires an in-depth understanding of technical indicators which can indicate sell or buy signals. Leverage is also an important factor to be considered, since traders can risk their capital as well as additional borrowed funds when trading currency pairs of high volatility.

For both crypto and forex, it is important to be alert, do your research well, and have a strategy for making consistent trades.

Which trading site for beginners is the best?

It all depends on your level of comfort with online trading. It's a good idea to begin with an experienced broker who has expert advisors if you are completely new to online trading.

They take the guesswork out when it comes to choosing companies and make solid recommendations that will help you build a steady portfolio over time. Many offer interactive tools to help you understand how trades work.

You can also trade independently if your knowledge is good enough. They offer customizable trading platforms, live data feeds, and research resources like real-time analytics to make well-informed decisions.

No matter which route you choose, be sure to read customer reviews before you make a decision. This will give you an insight into the service and experience of each site.

What is the best trading platform for you?

Choosing the best trading platform can be a daunting task for many traders. There are many trading platforms out there, so it can be difficult for traders to choose one that is right for them.

The best trading platform should offer the features you need, like advanced chart analysis tools, real-time market data, and sophisticated order execution capabilities. It should also have an easy-to-use interface that's intuitive and user-friendly.

You should have access to a range of account types, competitive fees, reliable customer service, and educational resources. Demo accounts and free trials are a great way to test virtual money before investing any real money.

Think about what kind of trader you are, whether you're active or passive, how frequently you intend to trade, and what asset class you want. These factors will help you narrow down your search to find the right trading platform.

After you have found the right platform for you, you should look at additional features like stock screening tools and backtesting capabilities. Alert systems are also available. Make sure your platform has the right security protocols to protect your data against theft or breaches.

MetaTrader 4/5 (MT4/MT5) is one of the most widely used trading platforms. cTrader, eToro tradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM thinkOrSwim app Store are all others.

Which forex or crypto trading strategy is best?

Both crypto and forex trading can make you money, but it really comes down to your investment goals.

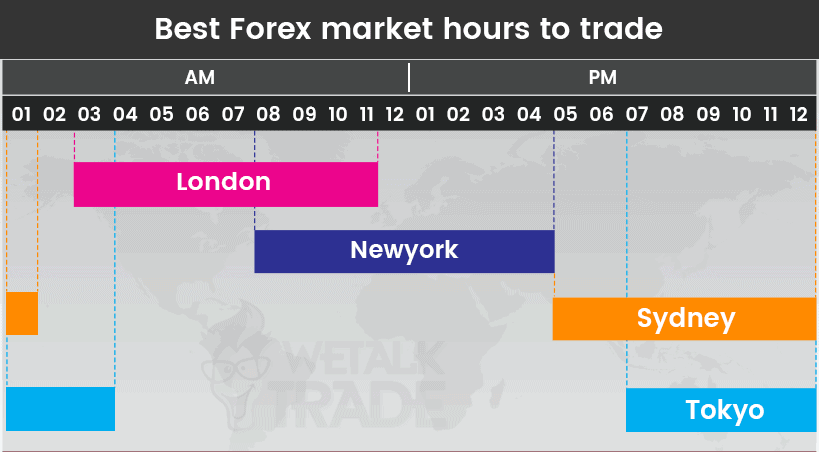

Forex trading allows you to invest in different currencies. It is a great option for beginners. You will need to invest a lower amount upfront. Additionally, forex markets are worldwide and available 24/7.

The upside is that crypto trading provides a quick return, as prices can change very rapidly due to volatility. It is also easy to cash out tokens quickly, as crypto trades have high liquidity.

In both cases it's crucial to do your research before making any investment. You can reduce your risk by diversifying assets. This will help you to be successful in any type of trading.

It is important that you understand the different trading strategies available for each type. For instance, forex traders may use technical or fundamental analysis to make their decisions. Crypto traders might use arbitrage, margin trading, or both to maximize profits. Automated trading systems and bots may also be used by some traders to help them manage investments. It is important to understand the risks and rewards associated with each strategy before investing.

Where can I find ways to earn daily, and invest?

Although investing can be a great investment, it's important that you know your options. There are many other investment options available.

One option is investing in real estate. Property investments can yield steady returns, long-term appreciation, and tax benefits. Diversifying your portfolio might be a good idea.

You could also look into investing in dividend-paying stocks or peer-to-peer lending sites that allow you to lend money and receive interest payments from borrowers. If you're comfortable taking the risks, you can also trade online with day trading strategies.

Whatever your investment goals might be, it is crucial to thoroughly research every type of investment before jumping in. Each asset has its risks and rewards. So that you can maximize your earnings, and achieve your financial goals, you must closely monitor all investments.

Statistics

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

External Links

How To

How can I ensure security for my online investment accounts?

Online investment accounts are a matter of safety. It's essential to protect your data and assets from any unwanted intrusion.

You must first ensure that the platform you're using has security. You should look for two-factor authentication and encryption technology to ensure maximum protection against hackers or other malicious actors. There should also be a policy that outlines how any personal information you have shared with them will be regulated and monitored.

It is also important to choose strong passwords that allow you to access your account. You should limit the number and time spent logging in to public networks. Avoid clicking on unfamiliar links or downloading software that is not recommended. This could lead to malicious downloadings and compromise of your funds. Also, make sure to review your account activity regularly so you can be aware of any unusualities and detect threats quickly. If necessary, take immediate action.

Thirdly, it's important to understand the terms and conditions of your online investment platform. Be aware of the fees involved in investing and any restrictions on how you may use your account.

Fourth, make sure you do thorough research about the company before investing. Look at user reviews to get a feel for how the platform works. You should also be aware of the tax implications when investing online.

Follow these steps to ensure your online account is protected from potential threats.