Ally Bank ranks as a top online bank. It has seen a 23% increase to its consumer deposit base over the last year. In addition to its high level of consumer deposit growth, Ally Financial has also been growing its automotive loan portfolio. Ally's consumer originations grew by 9.6% during Q2, compared to $9.6billion the previous quarter. The company's retail auto loan portfolio saw a nine-bps decrease in net charge offs, compared to the prior year.

Ally's credit outlook remains positive. However, the company has taken steps to reduce its longterm debt. Currently, Ally has about $42.3 billion in total debt, down from its record high of $66.2 billion in 2012. This is a decrease from the amount that Ally had at the end 2012's third quarter, when it had a tangible asset value of $3.7 billion.

Because of the restructuring of its debt, Ally now has a solid flow of cash to pay off its debt. Although Ally's debt has been reduced, its overall debt remains a major concern. That is why management is trying to bring the debt down, while at the same time growing its dividend.

Despite the challenges in the short-term, Ally's credit trends have shown strong underwriting and credit risk management. These factors have helped the company maintain its position as one of the largest and most profitable financial companies in the industry. However, the company could benefit from stronger growth.

Ally has achieved profitability for years and is set to continue its expansion. With a healthy balance sheet and a solid reputation, the company may be able to take on larger debts and offer even higher rates of return on investment. Ally is a great option for those looking to invest in the stock exchange.

To buy shares in Ally, you first need to assess the company's value. The Zacks Rank of the company is a good way to determine its value. It is currently a #2. It also holds an A rating for Value. It offers 4.7% yield.

Other things to know about Ally include its dividends. These have grown steadily over the last five-years. Investors will receive a quarterly dividend, which is currently distributed to shareholders every three years. In the second quarter 2019, the company announced that it would offer a 3.3million pool of applications for new business.

Ally, one of many banks with a large customer base, is growing as more people use the internet for their banking transactions. Ally's retail customer base has increased from 1.10 to 1.87 million in the past two year. The company also managed to increase its dealer network to more than 18,000 dealers.

Ally offers a wide array of financial products including banking, credit card, loans and other services. The company plans to sell 40% of its stakes in a joint venture based in China, as a result its recent transactions. The transaction will eventually need regulatory approvals.

FAQ

Which is best forex trading or crypto trading?

Both crypto trading and forex have potential for profit, but which one is right for you depends on your investment goals.

Forex trading involves investing in different currencies and is an accessible option for beginners. It requires a smaller capital upfront, plus forex markets are global and open 24/7.

But crypto trading is a great alternative because it offers almost instant returns as prices can fluctuate quickly due volatility. Crypto trades are also highly liquid, so cashing out your tokens quickly is possible.

In both cases it's crucial to do your research before making any investment. You can reduce your risk by diversifying assets. This will help you to be successful in any type of trading.

It is important to be familiar with the various types of trading strategies that are available for each type. For example, forex traders could use technical analysis or foundation analysis to help make decisions. Crypto traders may choose arbitrage or margin trading to maximise their profits. Some traders might also opt for automated trading systems, or bots, to manage their investments. Before investing, it is important that you understand the risks as well as the rewards.

How do forex traders make their money?

Forex traders can make good money. Although success is possible in the short-term it is not likely to last long. Long-term profits are usually a result of hard work and dedication. More successful traders are those who have a solid understanding of market fundamentals and technical analyses than those who rely on their luck or guessing.

Forex trading isn’t easy, but it is possible to earn consistent profits over time with the right strategies. It is important to find an educated mentor and develop a working knowledge of risk management before risking real capital.

Many traders fail because they lack a plan or approach. However, with discipline one can maximize his chances of making money on foreign exchange markets.

Experienced forex traders develop trading plans that they stick to when trading in order to reduce their risk exposure as much as possible while still finding profitable opportunities. It is important to manage risk. Many new traders are too eager to make quick profits and not have a long-term strategy.

Forex traders can increase their chance of generating long-term profits by maintaining good records, learning past trades and paying attention to other aspects of trading.

Forex trading is a disciplined business. Setting rules for how much money you're willing and able to lose per trade can reduce losses and help ensure success. Furthermore, strategies such as leverage entry signals can help increase profits that are not possible without the guidance of an experienced mentor.

Ultimately though, being persistent and learning from successful day traders other methods--such as risk management techniques--are necessary for profitability as a trader in forex markets regardless if you're investing your own capital or managing funds for someone else.

Where can i invest and earn daily?

It can be a great method to make money but it's important you understand all your options. You don't need to invest all of your savings in the stock exchange - there are many other options.

One option is to buy real estate. Investing property can bring steady returns as well as long-term appreciation. It is possible to diversify your portfolio with ETFs mutual funds, bonds, and specialty fields like cryptocurrency.

If you're looking for shorter-term profits or daily income, you could try investing in stocks that pay dividends or look into peer-to-peer lending platforms where you lend out money and receive interest payments directly from borrowers on a daily basis. If you're comfortable taking the risks, you can also trade online with day trading strategies.

It doesn't matter what your investment goals are, it is important to research each type of investment before you dive in headfirst. Each asset has its own set of risk factors. Make sure you closely monitor any investments and recognize when to buy and sell accordingly so you can maximize your earnings and work towards achieving your financial goals!

What are the advantages and drawbacks to online investing?

Online investing is convenient. Online investing allows you to manage your investments anywhere with an internet connection. Online trading is a great way to get real-time market data. Online brokerages typically charge less than traditional brokerages. This makes investing easier, especially if you have a smaller amount of money.

Online investing is not without its challenges. Online trading can make it difficult to receive personalized guidance and advice, since you don't have access to a financial advisor or broker to assist you with your decisions. Online trading platforms may not offer the same level or security as traditional brokerages. Investors must be aware that there are risks. Online trading can be more complex and difficult than conventional investing. Before you begin, make sure to thoroughly understand the markets.

Online investing is a complicated process. It is important to be familiar with the various types of investments that are available. Investors have many choices: stocks, bonds or mutual funds. Each type of investment carries its own risks and rewards, so it is important to research each option before deciding which one is right for you. There might be restrictions or a minimum deposit required for certain investments.

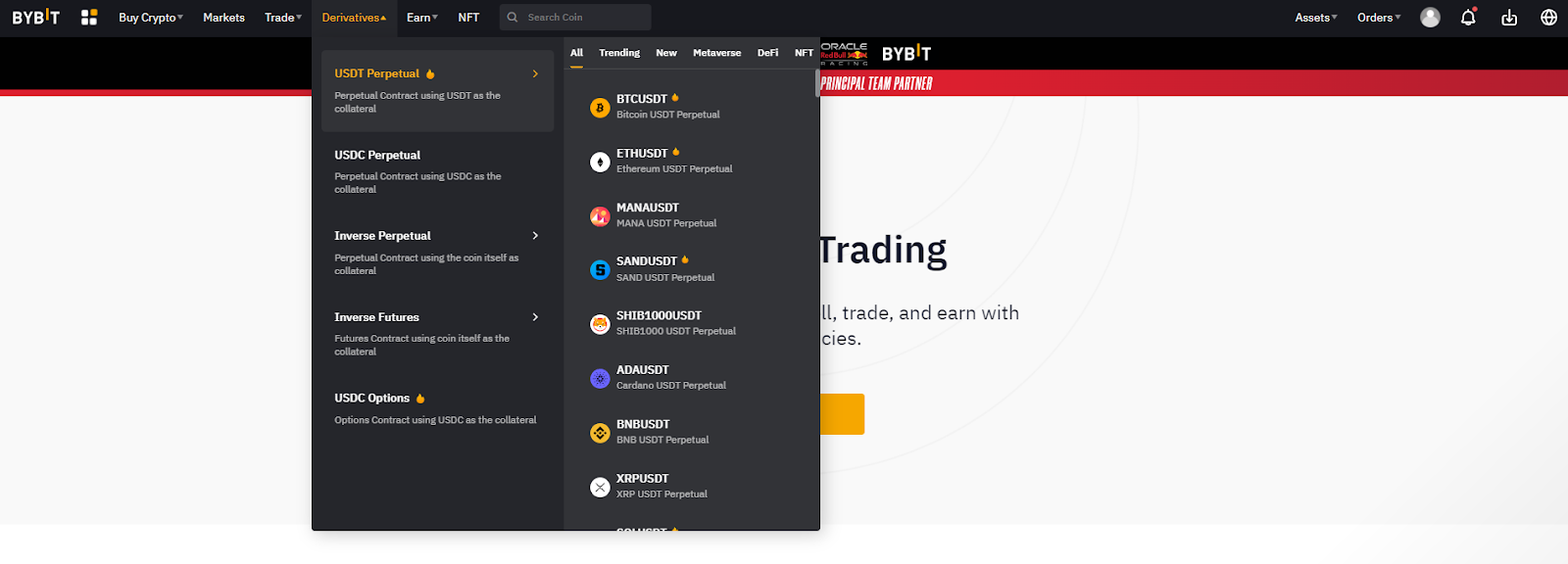

Which is the best trading platform?

Many traders can find choosing the best trading platform difficult. With so many different platforms to choose from, it can be hard to know which one is right for you.

The best trading platform must offer all of the features that you need such as chart analysis tools and real-time market data. It should also have sophisticated order execution capabilities. It must also be easy to use and intuitive.

It should offer a variety account types and affordable fees. They should also be able to provide reliable customer services and educational resources. You should look for demo accounts and free trials that allow you to practice with virtual money without risking your real cash.

When looking for a trading platform, consider what type of trader or investor you are - whether you're passive or active, how often you plan to trade, and your desired asset class mix. This will help you narrow your search for the right trading platform.

Once you have identified the platform that suits you best, it is time to explore additional features such backtesting capabilities and stock screening tools. Additionally, ensure your chosen platform provides appropriate security protocols in place to protect your data from breaches or theft.

MetaTrader 4/5 (MT4/MT5) and cTrader are some of the most well-known trading platforms.

Which is harder crypto or forex?

Forex and crypto both have unique levels of complexity. In terms of basic understanding, crypto may be slightly more difficult because it is new and related to blockchain technology. Forex has been around since the beginning and has a solid trading infrastructure.

Forex trading has fewer risks than cryptocurrency trading. Crypto markets move in unpredictable ways and can change quickly. Researching the historical trends of the crypto markets can help you gain an edge on your competition if you are looking to trade in cryptocurrency.

Forex traders must understand the dynamics of foreign exchange pairs. This includes how prices change based on news events. It also requires an acute understanding of technical indicators that can indicate buy or sell signals. Another important aspect to consider is leverage. Traders are exposed to additional risk when trading currency pairs with high volatility.

To be successful in forex and crypto trading, you need to be attentive, have solid research skills, and have a clear strategy.

Statistics

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How can I ensure the security of my online investment account?

Safety is a must when it comes to online investment accounts. It is vital to secure your assets and data against any unwelcome intrusions.

First, ensure the platform you are using is secure. You should look for two-factor authentication and encryption technology to ensure maximum protection against hackers or other malicious actors. It is also important to have a policy that details how any personal data you share with them will regulated and monitored.

Second, ensure strong passwords are used to gain account access. Also, limit the time you spend logging in to public networks. Avoid clicking on suspicious links and downloading unknown software. These can result in malicious downloads that could compromise your funds. Check your account activities regularly to be alert of any unusual activity.

It's also important to fully understand the terms, conditions and fees associated with your online investment platform. You need to be aware of all fees associated with investing as well as restrictions and limitations regarding how you can use the account.

Fourthly, research the company you are investing with and ensure they have a good track record of customer service and satisfaction. Look at user reviews to get a feel for how the platform works. Make sure to understand the tax implications of investing online.

These steps will help you ensure that your online investments account is safe and secure from any possible threats.