As blockchain technology becomes more mainstream, more companies are investing in it. This includes banks and other institutions that use it to streamline systems. This includes startups looking to establish themselves using the blockchain technology that they have created.

There are many options for investing in blockchain. You can buy cryptocurrencies like Bitcoin and Ether or invest in an exchange-traded funds (ETF), which tracks a number of companies in this industry. Or you can invest in venture capital firms that are focused on blockchain. The type of company and your investment time, risk tolerance, and investment timeline will all play a role in deciding which one to use.

Buy cryptocurrency - This is the easiest and most popular way to invest into blockchain. By buying or selling a block worth of coins, your investment is made in the underlying cryptocurrency. Because of this, it is crucial to be aware that there are numerous scams and software bugs which can cause huge losses.

Shares of Blockchain Stocks - This is a great way for you to be exposed to the tech and increase your potential to make money long term. The best companies for investing in are those who are developing new uses for blockchain, and who are also creating products and services that take advantage of it.

The exchanges offer blockchain stocks that can be purchased via a broker or online broker. It is important to research the business model and growth potential of a company before investing.

There are many types, from those that are just starting out to use the technology to more established companies that have been using it for years. The best are those that have the greatest potential and have a solid track record.

Stock indices, or ETFs, are funds that offer exposure to a variety of companies in the Blockchain industry. They often cost less than buying individual stocks. The Nasdaq Blockchain Economy Index, for example, is curated by an exchange to give you access to the best companies involved in the field.

IPOs or initial coin offerings are a good way to buy into a brand new company that isn't yet publicly traded. These investments are typically accompanied by a fair amount of public discussion, and they can be an excellent opportunity to pick up tokens that could become part of your portfolio in the future.

A variety of exchange-traded mutual funds that are focused specifically on the blockchain sector were launched in recent months. They offer another avenue for you to invest into this fast-growing market. Amplify Transformational data sharing ETF is an example of such a fund.

There are many options for investing in blockchain. The best option is likely to be exchange-traded funds. These funds are regulated and provide an easy way to invest in the blockchain industry without actually having to buy or sell crypto. These funds are also a great way to diversify your holdings and can be used by people who wish to get into the market without investing too much.

FAQ

Which is best forex trading or crypto trading?

Both forex and crypto trading offer potential profits. However, it all depends on your investment goals.

Forex trading is easy for beginners and allows you to invest in different currencies. You will need to invest a lower amount upfront. Additionally, forex markets are worldwide and available 24/7.

However, crypto trading can offer a very immediate return due to the volatility of prices. Also, crypto trades can be cashed out quickly due to their liquidity.

In both instances, it is crucial to do your research prior to making any investments. Any type of trading can be managed by diversifying your assets.

It is important to be familiar with the various types of trading strategies that are available for each type. Forex traders might use fundamental or technical analysis to make decisions. Crypto traders, on the other hand, may use arbitrage and margin trading to maximize their profits. Some traders might also opt for automated trading systems, or bots, to manage their investments. Before investing, it's important to understand both the risks and the benefits.

Which is safer, cryptography or forex?

Forex trading and cryptocurrency are two highly risky investments. The rewards and the risks can be very different.

Crypto, short for cryptocurrency, is a digital currency created from a piece of code through blockchain technology. It can trade on exchanges just like any money, and has been the subject speculative investment because of its drastic price swings.

Forex, also known as foreign exchange currency trade, is high-leveraged investment that involves participants speculating on the value and relative strength of one currency. Due to its high risk, Forex can be an unstable investment that could result in large losses if not properly managed.

Both Crypto and Forex have their advantages and disadvantages but, overall, crypto tends to carry a greater level of risk compared to Forex. Because of the limited supply and regulations around cryptocurrencies, prices can fluctuate. But forex markets move more consistently so investors have more control. When deciding which option between Cryptocurrency and Forex is safer, it will depend on your risk appetite and experience with each investment option.

Where can i invest and earn daily?

Investing can be a great way to make some money, but it's important to know what your options are. There are many options.

One option is to buy real estate. Investing property can bring steady returns as well as long-term appreciation. Diversifying your portfolio might be a good idea.

If you're looking for shorter-term profits or daily income, you could try investing in stocks that pay dividends or look into peer-to-peer lending platforms where you lend out money and receive interest payments directly from borrowers on a daily basis. You can even trade online using day trading strategies if you feel comfortable with the risks involved.

It doesn't matter what your investment goals are, it is important to research each type of investment before you dive in headfirst. Each asset has its own set of risk factors. To maximize your earnings and help you reach your financial goals, make sure to closely track any investments.

What are the advantages and disadvantages of online investing?

Online investing has one major advantage: convenience. You can manage your investments online, from anywhere you have an internet connection. Online investing allows you to have access to real-time market information and place trades without ever leaving your home. Additionally, many online brokerages offer lower fees than traditional brokerages, making it easier for investors to get started with smaller amounts of money.

However, there are some drawbacks to online investing. Online investing is not without its challenges. For instance, you may find it difficult to obtain personalized advice or guidance online as there are no financial advisors or brokers to help you make your decisions. Online trading platforms can offer less security than traditional brokerages. Investors should be aware of these risks. Online trading can be more complex and difficult than conventional investing. Before you begin, make sure to thoroughly understand the markets.

It is also important to understand the different types of investments available when considering online investing. Investors have many choices: stocks, bonds or mutual funds. Each investment has its risks and rewards. Before you decide which type of investment is best for you, it is important that your research is thorough. Some investments may also require a minimum investment or other restrictions.

What is the best trading platform for you?

Many traders find it difficult to choose the right trading platform. There are so many platforms available, it can be difficult to decide which one is best for you.

The best trading platform should include the features you are looking for, including advanced chart analysis tools as well as real-time data from the markets and sophisticated order execution capabilities. It should also have an easy-to-use interface that's intuitive and user-friendly.

It should also provide a variety of account types and competitive fees as well as reliable customer service and educational resources. You should look for demo accounts and free trials that allow you to practice with virtual money without risking your real cash.

When searching for a trading platform, think about your trader/investor type. Consider whether you're active, passive, or both. Also, think about how often you plan on trading and the asset mix you would like. This will help you narrow your search for the right trading platform.

After you have found the right platform for you, you should look at additional features like stock screening tools and backtesting capabilities. Alert systems are also available. Make sure you have the appropriate security protocols in place for your data to prevent theft or breaches.

Some of the most popular trading platforms include MetaTrader 4/5 (MT4/MT5), cTrader, eToro TradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade FXCM ThinkOrSwim App Store just to name a few!

How can I invest in Bitcoin?

Although investing in Bitcoin may seem complex, it's actually not as difficult as you think. All you need are the right tools and knowledge to get started.

It is important to realize that there are several ways to invest. You have the option to buy Bitcoin direct, trade on an exchange, or gain exposure using a financial instrument called a derivatives contract.

You will also have to decide where to store your bitcoin. There are many options such as exchanges, wallets, custodians and cold storage. Some options may be better suited than others depending on your risk tolerance and goals.

Next, find any additional information that may be necessary to make confident investment decisions. It is crucial to know the basics about cryptocurrencies and how they work before investing. With that said, make sure you keep track of market news and developments so you can stay up-to-date with crypto trends.

Finally, create a plan for investing in Bitcoin based on your level of experience and set reasonable expectations for returns - this will give you a better chance at success long-term too!

Statistics

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

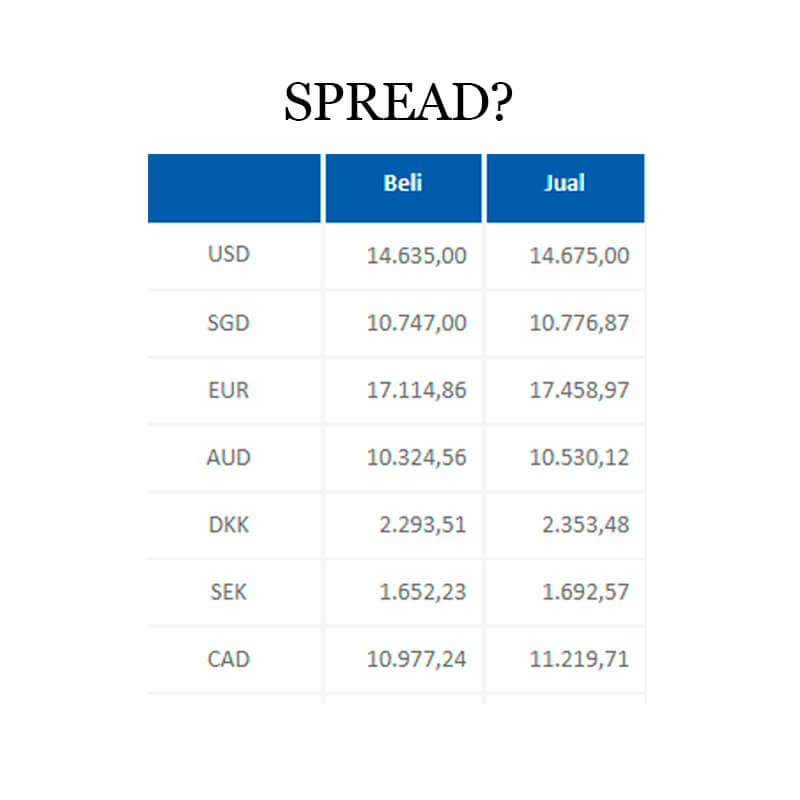

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How can you verify the legitimacy or an online investment opportunity?

Online investing requires research. Make sure you research the company behind the opportunity. Also, ensure they are registered with the relevant financial authorities. You should also be alert for industry restrictions and regulations that might apply to your investments.

Review past performance data, if possible. Check out customer reviews to see how others have experienced the investment opportunity. Do you believe it is too good to true? Be wary of claims that promise future success or substantial returns.

You should understand the investment risk profile and be familiar with the terms. Before you open an account, check what fees and commissions might be taxed. You should ensure that you are getting the terms and services you have paid for by doing due diligence checks if necessary. You can also make sure that you have an exit strategy for any investment that doesn't go according the plan. This will help reduce long-term losses.