A16z is an venture capital firm located in Menlo Park. Its portfolio includes investments in early stages of mobile communications, ecommerce, gaming and enterprise IT. The firm is also an important investor in Facebook Twitter, Airbnb, and Twitter.

A16z Venture Capital is one of the most recognizable venture capital firms in the globe. Marc Andreessen and Ben Horowitz founded the venture capital firm in 2009. It has been a part of many of most significant and successful investments made over the past few years including Airbnb, Skype (GitHub), GitHub, Twitter and GitHub.

A16z was the lead in a Series B round of Optimizely for $57 million. Optimizely is a cloud-based enterprise management SaaS. A16z also led a Series B round of $21 million in Figma, which is a web3 platform that allows team collaboration and a $50m Series D round at Roblox, a virtual-reality game developer. Other notable investments include $450 Million in Yuga Labs, which is a cloud-CAD software company, as well as $80 Million in Onshape. This cloud computing infrastructure firm provides cloud computing infrastructure.

A16z has made investments in companies working to develop crypto/blockchain technologies. A16z Crypto Investments is one of its latest investments. This company invests in companies at the early stages as well as infrastructure that will support layer 1 and 2. The portfolio includes CryptoKitties (Dfinity), and PeerStreet.

OpenCoin, a San Francisco-based cryptocurrency company, was one of the first to get venture capital. OpenCoin is one of the largest players in crypto. In April 2013, a16z invested in the company.

As with many other venture capital firms, a16z made a number of other crypto investments. Some of the other noteworthy companies that a16z has invested in are BuzzFeed, Onshape, Medium, and Databricks. A16z made investments in companies such as uBiome, Stack Exchange, Honor, Inc., Okta.

A16z also invests in leading blockchain-related companies. They are also the co-founder of Paradigm Venture Capital, which is a firm focused on investing in encryption technologies. They have made investments in a crypto fund worth $300 million and a new crypto custodian called Entropy.

Polychain Capital is another company on a16z’s investments list. This fund is first to manage a million dollars in assets and is the first crypto hedge fund. It is supported by Sequoia Capital and Tiger Global Management.

A16z has invested in many other crypto/blockchain businesses, such as Dfinity, Imply and Smartcar. Recently, the company announced a fourth crypto fund that will be valued at $4.5 billion. Most of the money will be used for seed investments, while the rest will be devoted to layer 1 and layer 2 infrastructure.

Andreessen, Horowitz (or "a16z") is one of the biggest investors in the crypto and blockchain industry. A16z invested in startups such a Netflix, Facebook, GitHub and Airbnb. A16z is not only an investor in the startup industry, but also one of the largest investors in consumer and fintech businesses, like Coinbase or Uber.

FAQ

How Can I Invest in Bitcoin?

While it can seem daunting to invest bitcoin, it is really not that difficult. All you need are the right tools and knowledge to get started.

You need to be aware that there are many investment options. To get exposure to Bitcoin, you can buy it directly, use an exchange or use a financial instrument, known as a derivatives agreement.

You also need to decide where to store Bitcoin. There are many choices, such as cold storage, exchanges or custodians. You may choose one option or another depending on your goals and risk appetite.

Next, research any additional information you may need to feel confident about your investment decisions. It is crucial to know the basics about cryptocurrencies and how they work before investing. With that said, make sure you keep track of market news and developments so you can stay up-to-date with crypto trends.

Create a plan for investing Bitcoin based upon your level of experience. Set reasonable expectations for returns. This will increase your long-term success.

Which is harder crypto or forex?

Different levels of difficulty and complexity exist for forex and crypto. Crypto is more complex because it is newer and related to blockchain technology. On the other hand, forex has been around for a long time and has a reliable trading infrastructure supporting it.

In terms of cryptocurrency trading, there are more risks when compared to forex, due to the fact that crypto markets tend to move in unpredictable ways within short periods of time. It is important to research historical trends and learn from your peers if you wish to be successful at crypto trading.

Forex traders must understand the dynamics of foreign exchange pairs. This includes how prices change based on news events. You also need to be able to read and understand technical indicators, which can signal buy or sell signals. Another important aspect to consider is leverage. Traders are exposed to additional risk when trading currency pairs with high volatility.

Forex and crypto both require keen research skills and attention to ensure successful trades.

Which is better, safe crypto or Forex?

Cryptocurrency and Forex trading are two types of highly risky investments that vary greatly in terms of rewards and risks.

Crypto, shorthand for cryptocurrency is a digital currency made from code using blockchain technology. It can trade on exchanges just like any money, and has been the subject speculative investment because of its drastic price swings.

Forex, or foreign exchange currency trading, involves highly leveraged investments in which participants speculate on the value of one currency in relation to another. Forex can pose a risky investment, and can result in significant losses if they are not managed properly.

Both Crypto and Forex have their advantages and disadvantages but, overall, crypto tends to carry a greater level of risk compared to Forex. Due to the small number of units and existing regulations around cryptocurrencies, cryptocurrency prices can be unpredictable. Forex markets are more stable so investors have greater control over their investments. The decision about which of Cryptocurrency or Forex is more secure will be based on the individual's risk appetite and their previous experience with each investment option.

Which is best forex trading or crypto trading?

Forex and crypto trading both have their opportunities for profits, but which one is best for you really depends on your investment goals.

Forex trading involves investing in different currencies and is an accessible option for beginners. This requires a smaller initial capital, and forex markets can be accessed 24/7 around the world.

The upside is that crypto trading provides a quick return, as prices can change very rapidly due to volatility. Crypto trades are also highly liquid, so cashing out your tokens quickly is possible.

In both cases it's crucial to do your research before making any investment. With any type or trading, it is important to manage your risk with proper diversification.

It is important to know the types of trading strategies you can use for each type. Forex traders might use fundamental or technical analysis to make decisions. Crypto traders, on the other hand, may use arbitrage and margin trading to maximize their profits. Additionally, some traders may opt for automated trading systems or bots to help them manage their investments. It is important to understand the risks and rewards associated with each strategy before investing.

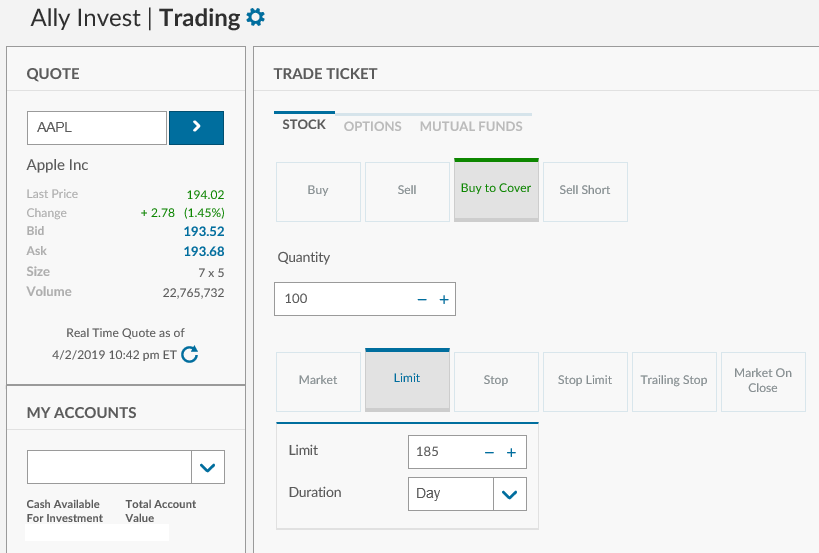

Which trading platform is best?

For many traders, choosing the best platform to trade on can be difficult. It can be confusing to choose the right one, with so many options.

A trading platform that is the best should have all the features you require, such as advanced chart analysis tools, market data and order execution capabilities. It should also offer an intuitive and user-friendly interface.

You will need to have access to multiple account types, low fees, reliable customer support, and educational resources. Try out demo accounts or free trials to see if you like the idea of using virtual money.

Think about what kind of trader you are, whether you're active or passive, how frequently you intend to trade, and what asset class you want. This will help you narrow your search for the right trading platform.

Once you have identified the platform that suits you best, it is time to explore additional features such backtesting capabilities and stock screening tools. Additionally, ensure your chosen platform provides appropriate security protocols in place to protect your data from breaches or theft.

Some of the most popular trading platforms include MetaTrader 4/5 (MT4/MT5), cTrader, eToro TradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade FXCM ThinkOrSwim App Store just to name a few!

What are the benefits and drawbacks of investing online?

The main advantage of online investing is convenience. You can manage your investments online, from anywhere you have an internet connection. You can access real-time market data and make trades without having to leave your home or office. Online brokerages typically charge less than traditional brokerages. This makes investing easier, especially if you have a smaller amount of money.

Online investing comes with its own set of disadvantages. Online investing is not without its challenges. For instance, you may find it difficult to obtain personalized advice or guidance online as there are no financial advisors or brokers to help you make your decisions. Online trading platforms might not provide the same level security as traditional brokerages. Investors need to be aware about the potential risks. Online trading is more complex than traditional investing. This is why it is crucial to be familiar with the markets and formulate a sound strategy.

You should also be aware of the different investment options available to you when investing online. Investors have many options. There are stocks, bonds mutual funds, cash equivalents and stock options. Each type of investment comes with its own risks and rewards. It is crucial to thoroughly research each one before you make a decision. Additionally, some investments may require a minimum deposit or have other restrictions that need to be taken into consideration.

Statistics

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

External Links

How To

What are the best options for storing my investment assets online?

The decision about where to store your money can be complicated. You have several options when it comes to protecting your valuable assets.

Online storage allows for easy access from any device. You can also keep an eye on your investments quickly and easily. But, you should be aware that electronic breaches can happen when you use digital options.

You can also keep your money in physical form like gold or cash, which is safer but requires more care and maintenance.

Another option is to keep your investments in traditional banking and investing accounts. You also have the option of self-storage facilities, which allow you to store valuables such as gold, silver or other precious metals safely outside your home.

Finally, you might consider investing in specialized firms that offer safe custody services specifically designed to protect large portfolios of assets.

Your decision is final. Which one works best for your needs and offers the security and safety you need to protect your investments?