Financial options offer investors the chance to buy or sell an underlying asset at a fixed price and at a particular time. The value of an option is based on the underlying asset, which could be stocks, bonds, currencies or a commodity. Options can protect an equity portfolio against price falls or increase the return of investment. These options allow you to speculate on the financial markets and reduce the risk of losing your money. You should be aware of the potential risks involved with these investments.

Options are not for everyone but they can make a good part of a portfolio. In fact, some individual investors dabble in options writing. A put option is a contract that allows a grower to sell his corn. This allows him the opportunity to profit from favorable interest rate changes.

The price of an options fluctuates in general. The premium paid for an option can be affected by transaction costs. However, the overall value of the option will usually exceed its pure value. The volatility of the underlying markets can also impact option prices.

One of the most widely used types of financial options is call and put options. Call options allow you to purchase or sell an underlying asset at fixed prices. Unlike other types of options, a call option holder does not have an obligation to buy the asset. An investor who buys a call option expects that the underlying asset will rise or fall in value, which limits his loss. The option holder can also sell the underlying asset at a fixed price or rise.

A futures contract is another option. A futures option is a type derivative that is dependent on the value an underlying commodity. These contracts are usually written in large financial institutions. The writer of an interest rate option pays the difference between the actual rate and a cap. If the rate exceeds the cap, he is required to pay a cash sum.

Real options is a rare type of financial tool. Real options enable the company to make a financial decision, which is different from other types. Real options also allow the management to make a decision without having to accept it or invest.

Another option is a collar. Collared are meant to protect investment from any adverse movement. Essentially, the buyer of the collar has the option to buy a second, lower-priced option. However, leverage can magnify the premium's value but also can result in large financial losses.

Spreads are the final option. Spreads involve buying and selling two or more different options contracts at the same time. Options are not traded on exchanges so they are considered to be over-the-counter. Their brokerage firm must approve traders.

FAQ

Which is more secure, forex or crypto?

Cryptocurrency and Forex trading are two types of highly risky investments that vary greatly in terms of rewards and risks.

Crypto, short for cryptocurrency, is a digital currency created from a piece of code through blockchain technology. Because of its volatility, it can be traded on an exchange like any other money.

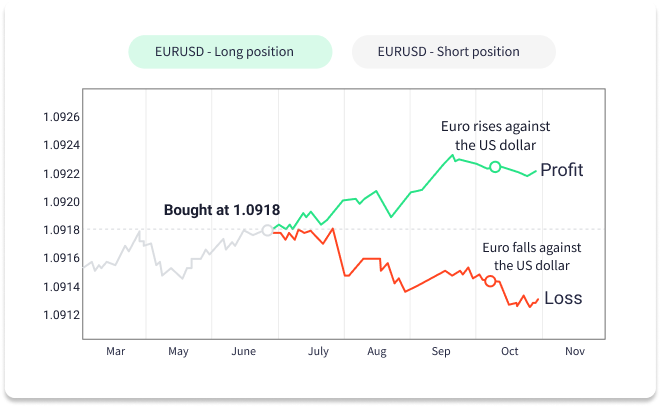

Forex, also known as foreign exchange currency trade, is high-leveraged investment that involves participants speculating on the value and relative strength of one currency. Forex, which can be unstable and cause large losses if not managed well, is an investment that should not be taken lightly.

Both Forex and Crypto have advantages and disadvantages, but crypto generally carries more risk than Forex. Cryptocurrency prices are fairly unpredictable due to the limited number of units available along with existing regulations surrounding cryptocurrencies around the world while forex markets tend to move more steadily so investors have more control over their investments. It is important to consider your own risk appetite, experience and knowledge with each investment option before deciding which Crypto or Forex is safer.

Where can I find ways to earn daily, and invest?

While investing can be a great way of making money, it is important to understand your options. There are many other investment options available.

One option is to invest in real property. Property investments can yield steady returns, long-term appreciation, and tax benefits. You may also consider diversifying your portfolio with bonds, ETFs, mutual funds, or specialty fields like cryptocurrency.

If you're looking for shorter-term profits or daily income, you could try investing in stocks that pay dividends or look into peer-to-peer lending platforms where you lend out money and receive interest payments directly from borrowers on a daily basis. Online trading is possible if you're comfortable with the risks.

No matter your investment goals, it is important that you do thorough research on each type and investment before making any major decisions. Every asset comes with its own risks. To maximize your earnings and help you reach your financial goals, make sure to closely track any investments.

What are the advantages and drawbacks to online investing?

Online investing has one major advantage: convenience. You can manage your investments online, from anywhere you have an internet connection. You can access real-time market data and make trades without having to leave your home or office. Online brokerages are often cheaper than traditional brokerages. This allows investors to get started quickly and with less money.

Online investing has its limitations. For example, it can be difficult to get personalized advice and guidance when trading online, as you don't have a physical broker or financial advisor to help you make decisions. Online trading platforms may not offer the same level or security as traditional brokerages. Investors must be aware that there are risks. Online trading can be more complex and difficult than conventional investing. Before you begin, make sure to thoroughly understand the markets.

When considering investing online, it is also important that you understand the types of investments available. Investors have many choices: stocks, bonds or mutual funds. Each investment type has its own risks, rewards, and it is important to fully research each option before making a decision. Additionally, some investments may require a minimum deposit or have other restrictions that need to be taken into consideration.

Frequently Asked Questions

What are the different types of investing you can do?

Investing allows you to increase your financial resources and potentially earn money in the long-term. There are four major types of investment: stocks, bonds mutual funds, cash equivalents, and stock.

Stocks can be divided into preferred and common stock. A common stock gives an individual ownership right of a company, including voting rights at shareholders' meetings and the potential to earn dividends. Preferred stock also gives ownership rights but with no voting privileges, as well as fixed dividend payments that offer investors a reliable income stream.

Bonds are loans that investors make to governments or companies in return for interest payments. They expire at the maturity date and can be repaid with interest payments. While bonds have a greater stability and less risk than stocks stocks, their returns are often lower than stocks.

Mutual funds are a way to pool investor money in order spread risk and diversify investments across many types of securities, including stocks, bonds and commodities. Mutual funds are managed by professional managers who use their expertise to select profitable investments in accordance with pre-set criteria such as level of risk or desired gain rate.

The cash equivalents can be products such as Treasury bills and money market deposits, CDs, and commercial paper. These products usually mature within one to three years, which means they are less susceptible to default or declines in value. This type is best for conservative investors, who don't mind taking high risks but still desire a greater return than deposits at low-interest banks accounts.

Which trading platform is best?

Many traders find it difficult to choose the right trading platform. There are so many platforms available, it can be difficult to decide which one is best for you.

The best trading platforms should provide the features you want, including advanced chart analysis tools, real time market data, and advanced order execution capabilities. It should also have an easy-to-use interface that's intuitive and user-friendly.

It should also provide a variety of account types and competitive fees as well as reliable customer service and educational resources. You should look for demo accounts and free trials that allow you to practice with virtual money without risking your real cash.

You should consider your type of investor or trader when looking for a trading platform. For example, are you active or passive? How often do you plan to trade? What asset class mix would you like? This will help you narrow your search for the right trading platform.

Once you've found the right platform, be sure to check out additional features, such as stock screening tools or backtesting, alert systems, etc. Also, make sure that the platform you choose has appropriate security protocols in order to protect your data from theft and breaches.

MetaTrader 4/5 (MT4/MT5) is one of the most widely used trading platforms. cTrader, eToro tradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM thinkOrSwim app Store are all others.

Which is better forex trading or crypto trading.

Forex and crypto trading both have their opportunities for profits, but which one is best for you really depends on your investment goals.

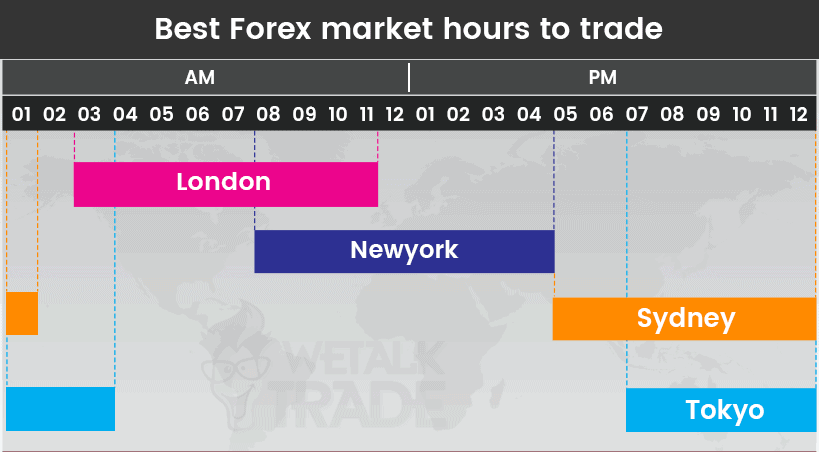

Forex trading involves investing in foreign currencies. This is an easy option for beginners. This requires a smaller initial capital, and forex markets can be accessed 24/7 around the world.

But crypto trading is a great alternative because it offers almost instant returns as prices can fluctuate quickly due volatility. It is also easy to cash out tokens quickly, as crypto trades have high liquidity.

In both cases it's crucial to do your research before making any investment. Managing your risk through proper diversification of assets will go a long way with any type of trading you choose.

Understanding the various trading strategies for different types of trading is important. For example, forex traders may use technical analysis or fundamental analysis to help them make decisions, while crypto traders may use arbitrage or margin trading to maximize their profits. Automated trading platforms or bots are also available to assist traders in managing their investments. Before you invest, make sure to understand the risks associated with each strategy.

Statistics

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

External Links

How To

How can I check the legitimacy and authenticity of online investment opportunities?

When investing online, research is essential. Check out the company behind the opportunity and make sure they are registered with the appropriate financial authorities. Also, be aware of any restrictions or industry regulations that may apply to your investments.

Review past performance data, if possible. Check out customer reviews to see how others have experienced the investment opportunity. Do you believe it is too good to true? Be wary of claims that promise future success or substantial returns.

Know the risks associated with your investment and the terms and conditions. Before you open an account, check what fees and commissions might be taxed. Due diligence checks are necessary to ensure you are receiving the services and terms you agreed to. You can also make sure that you have an exit strategy for any investment that doesn't go according the plan. This will help reduce long-term losses.