There are many charting programs that traders can use. Some systems are specifically designed for professionals and others are more for traders who wish to gain greater insight into markets.

Many of these software programs allow you to customize many of the features and tools. This can make the software more useful to a trader.

Futures, stocks and forex

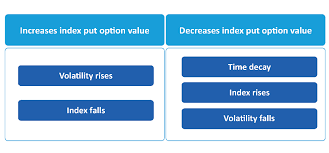

Many of these programs offer a wide range of technical indicators and patterns that can be displayed in their programs. These can be useful for identifying trading opportunities.

Many of these programs are free to download and can also be accessed via a web-based app or an app specifically for mobile devices. These are especially helpful for people who need to be connected to the market at any time.

These programs offer the ability to automate trades as well as back testing. This helps traders feel more confident and can reduce the need to rely on trial-and-error.

Investing can be a difficult and complex process. A reliable charting platform is essential. This will enable you to analyze the market's movements and predict the outcome.

Trading View offers an online charting service with many features and tools. It is also a popular choice for traders who use multiple devices.

On Trading View, there are three accounts available: Basic, Pro, and Premium. The Basic account can be used for all of your trading needs. While the Premium account offers more advanced features and more data, it is more expensive.

The Basic account allows for one chart per layout but can only have three indicators. This is a good way to get started using the tool. It can also provide server-side alerts, global data, and other features.

MultiCharts is a great program for traders who wish to expand their horizons. This platform has been around for over 20 years and has earned a reputation for being one of the best in the industry.

It is perfect for both beginners AND experts. Trading questions can be answered by the company via video tutorials or live support.

Trend Trader Pro is a highly popular and efficient trading program for those who wish to increase their forex market profits. It comes with a wide range of features and was developed by a skilled trader. It has been tested by thousands of traders and can be a great tool for achieving consistent and profitable results in the forex market.

Learn to Trade The Market is a very comprehensive course that covers the basics of trading and includes a wide range of topics. It helps traders to set up the best trading setups, devise trading strategies, and manage their open trades. This book also teaches traders how to improve their trading psychology.

FAQ

Which trading site is best suited for beginners?

It all depends upon your comfort level in online trading. If you're completely new to the online trading process, it would be a great idea for you to go through an established broker with experienced advisors.

These brokers can take the guesswork and help you build your portfolio by making solid recommendations. Many brokers offer interactive tools that allow you to see how trades work, without having to risk any real money.

Many sites allow you to trade alone if you have some knowledge or want more control over your investments. You can create your own trading platform, access live data feeds and use research tools like real-time analysis to make informed decisions.

No matter what route you choose to take, it is important that you read reviews from customers before making any commitments. They will provide insight into how each site treats customers and give you an idea of the overall experience.

Which is more difficult forex or crypto currency?

Both forex and crypto have their own levels of complexity and difficulty. Crypto is more complex because it is newer and related to blockchain technology. Forex, however, has been around for quite some time and has a reliable trade infrastructure.

There are greater risks in cryptocurrency trading than forex. This is because crypto markets can move quickly and in unpredictable ways. Researching the historical trends of the crypto markets can help you gain an edge on your competition if you are looking to trade in cryptocurrency.

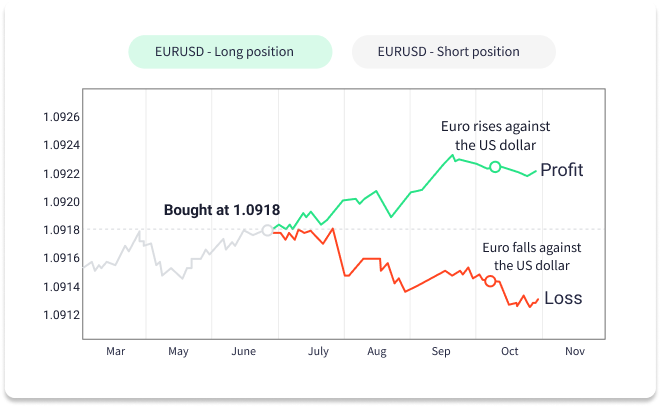

Forex traders must understand the dynamics of foreign exchange pairs. This includes how prices change based on news events. A good understanding of technical indicators is essential to identify buy and sell signals. Leverage is another factor that must be taken into account, as traders risk not only their capital but also additional borrowed funds when trading currency pairs with significant volatility.

To be successful in forex and crypto trading, you need to be attentive, have solid research skills, and have a clear strategy.

What are the advantages and disadvantages of online investing?

Online investing has the main advantage of being convenient. You can access your investments online from any location with an internet connection. Online trading allows you to access market data in real time and trades from anywhere. Many online brokerages charge lower fees than traditional ones, which makes it easier to start investing with less money.

However, online investing does have its downsides. Online investing can lead to difficulties in getting personalized advice and guidance. You don't have the support of a financial advisor, broker, or physical broker. Online trading platforms might not provide the same level security as traditional brokerages. Investors need to be aware about the potential risks. Finally, online trading can be more complex than conventional investing, so it's essential to understand the markets and develop a sound strategy before getting started.

When considering investing online, it is also important that you understand the types of investments available. Stocks, bonds, mutual funds, and cash equivalents are all options for investors. Each investment type has its own risks, rewards, and it is important to fully research each option before making a decision. Some investments may also require a minimum investment or other restrictions.

Is Cryptocurrency a Good Investing Option?

It's complicated. It is complicated. There is always risk in investing in cryptocurrency markets. They are volatile and unpredictable.

You can also make a profit if your risk is taken and you do your research.

Cryptocurrency investments can also offer portfolio diversification benefits since these assets tend to move independently of traditional stock markets.

It comes down to each person's individual tolerance for risk and knowledge in relation to the crypto markets. If you have the means to make an informed decision about this asset class and don't mind taking risks, then yes - investing in cryptocurrencies is absolutely worth considering.

Which is more secure, forex or crypto?

Two types of high-risk investments, cryptocurrency trading and forex trading, are highly risky and can bring you great rewards but also huge risks.

Crypto, which is shorthand for cryptocurrency, refers to a digital currency that was created using code and blockchain technology. It can be traded on exchanges like any other form of money and has been the subject of speculative investments due to its dramatic price swings over time.

Forex trading or foreign currency currency trading is a highly leveraged investment in which participants speculate about the value of one currency relative to another. Due to its high risk, Forex can be an unstable investment that could result in large losses if not properly managed.

Both Forex and Crypto have advantages and disadvantages, but crypto generally carries more risk than Forex. Prices for cryptocurrencies are unpredictable because of the limited availability of units as well as existing regulations. On the other hand, forex markets tends to move more steadily and investors have more control. The decision about which of Cryptocurrency or Forex is more secure will be based on the individual's risk appetite and their previous experience with each investment option.

Forex traders can make money

Yes, forex traders can earn money. Although success is possible in the short-term it is not likely to last long. Long-term profits are usually a result of hard work and dedication. More traders who are able to understand the market and can analyze technical issues will be successful than those who rely on luck or guesswork.

Although forex trading can be difficult, it is possible to make consistent profits with the right strategies and knowledge. It is essential to find a qualified mentor and learn about risk management before taking on real capital.

A lack of a strategy or plan can lead to many traders failing. However, if one is disciplined they can maximize their chances at making money in foreign exchange (forex).

Experienced forex traders develop trading plans that they stick to when trading in order to reduce their risk exposure as much as possible while still finding profitable opportunities. Risk management is key; many new traders can become too aggressive by chasing quick gains instead of having a consistent long-term strategy.

Forex traders can increase their chance of generating long-term profits by maintaining good records, learning past trades and paying attention to other aspects of trading.

In forex trading, discipline is key. By setting rules about how much you will lose on each trade, you can minimize losses and increase your chances of success. Additionally strategies such as leveraging entry signals can often increase profits.

However, regardless of whether you are investing your own capital or managing funds on behalf of someone else, persistence and learning from successful day traders are essential to being a profitable trader in forex markets.

Statistics

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

Is it safe to store my investment assets online, or should I consider other options?

The decision about where to store your money can be complicated. Your valuable assets require a strong security system and you have a few options.

Online storage allows for easy access from any device. You can also keep an eye on your investments quickly and easily. There are some risks associated with using a digital option as electronic breaches could occur.

Alternatively, keeping your money in physical forms like cash or gold is more secure, but it's also harder to keep track of and requires a higher level of maintenance for storage and protection.

You have other options, such as traditional banking accounts or investing accounts, as well as self storage facilities that allow for safe storage of precious metals and other valuables.

Finally, you might consider investing in specialized firms that offer safe custody services specifically designed to protect large portfolios of assets.

It is ultimately your decision. What will work best for you, and provide the security and safety that you require to protect your investments.