It can be exciting to invest in cryptocurrency, but there are many risks. You need to be able to identify and manage the risks involved in investing. You should have a variety portfolio. This includes traditional investments like stocks as well as cryptocurrencies. This will enable you to create an investment plan that suits your financial goals and risk tolerance.

Crypto Mining Investment

Bitcoin is the most widely-known cryptocurrency. However, there are many other options. A good strategy to invest in crypto is to buy small amounts of coins and wait for their prices to rise. Buying and holding is the most common strategy for crypto investing, but it's not always easy or profitable, as many cryptocurrencies fluctuate in value very quickly.

The price of crypto can fluctuate dramatically, unlike traditional investments. It isn't supported by governments and precious metals. James Putra is senior director of product strategies at TradeStation Crypto. He says that crypto should not be part of your total investment portfolio.

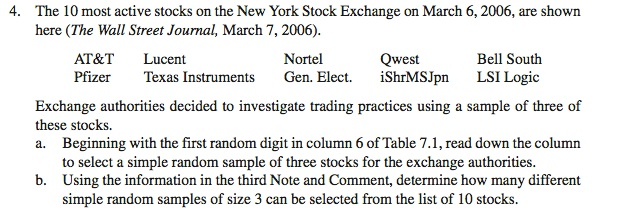

You can hedge cryptocurrencies or bet against them with contracts for difference and futures. These are financial instruments that let you bet on the future value of a particular currency. This can be an effective way to diversify your investment portfolio, but it's still highly speculative and should only be done with the guidance of a financial professional.

Reddit Crypto Investing

A good place to start when it comes to crypto investing is on the Reddit community, where users can talk about and discuss the latest news in the cryptocurrency world. Discussions can be had on everything, from market trends to the most recent ICOs (initial coin offerings), which are new projects in cryptocurrency that aim to raise capital by selling tokens.

This is a great place for research on a potential crypto project. There are often comments about the founders, team and background. You can also review the company’s mission, goals and vision.

Fight Out will transform the play-to-earn and fitness industries with its revolutionary new app. The FGHT token is currently trading at over $45 per coin, and the company plans to offer a large variety of seasonal tournaments with significant prize pools.

Reddit should also be looking at the Calvaria token. The token's RIA token is currently over 90% and it is in its final stage of presale. It has already raised $2.8 million. If it is listed on an exchange, it will be a great option for anyone wanting to invest in a decentralized gaming network.

The MEMAG token is another great option for those who love meme coins and P2E. The token is currently being beta tested for games that pay homage to arcades of old.

Don't invest in cryptos without doing your research. You should always visit the website of any ico to get more information before you make any investment decision. It's important to confirm that the token purchased is genuine and not fraudulent. If you believe that your token is a fraud, immediately notify the company.

FAQ

Which is better, safe crypto or Forex?

Forex trading and cryptocurrency are two highly risky investments. The rewards and the risks can be very different.

Crypto, short for cryptocurrency, is a digital currency created from a piece of code through blockchain technology. It can trade on exchanges just like any money, and has been the subject speculative investment because of its drastic price swings.

Forex (or foreign exchange currency trading) involves highly leveraged investments. Participants speculate on the value one currency relative to another. Due to its high risk, Forex can be an unstable investment that could result in large losses if not properly managed.

While both Forex (Cryptocurrency) and Forex (Forex) have their pros and cons, Cryptocurrency tends be more volatile than Forex. Because of the limited supply and regulations around cryptocurrencies, prices can fluctuate. But forex markets move more consistently so investors have more control. Therefore when determining which between Crypto and Forex is safer it would depend on one's own risk appetite as well as their experience with each investment option before making a final decision.

What are the disadvantages and advantages of online investing?

The main advantage of online investing is convenience. You can access your investments online from any location with an internet connection. Access real-time market data, and make trades online without leaving your office or home. Additionally, many online brokerages offer lower fees than traditional brokerages, making it easier for investors to get started with smaller amounts of money.

Online investing is not without its challenges. Online investing can lead to difficulties in getting personalized advice and guidance. You don't have the support of a financial advisor, broker, or physical broker. Additionally, online trading platforms may not offer the same level of security as traditional brokerages, so investors need to be aware of the risks involved. Finally, online trading can be more complex than conventional investing, so it's essential to understand the markets and develop a sound strategy before getting started.

When considering investing online, it is also important that you understand the types of investments available. Stocks, bonds, mutual funds, and cash equivalents are all options for investors. Each type of investment comes with its own risks and rewards. It is crucial to thoroughly research each one before you make a decision. You should also consider the fact that some investments might require a minimum deposit, or may have restrictions.

Forex and Cryptocurrencies are great investments.

It is possible to get rich trading forex or crypto. However, you need to use a strategic approach. You must stay on top of trends to know the best times to buy or sell in order to make any money in these markets.

It is also important to understand how to spot trends in prices. This will help you to predict the direction of the market. You should also trade with only the money you have the ability to lose.

To be able develop a long-term profitable strategy, it takes experience, knowledge, skills in risk management, and discipline.

Cryptocurrency prices are often volatile, so the key is to make sure that your entry position fits with your risk appetite and exit plan - meaning that if there becomes an opportunity for profit-taking or limiting losses, then do so.

The cryptocurrency market is largely unregulated and presents substantial risks. Before you sign up for any type of wallet or platform, make sure to research the coins and exchanges.

Forex trading is a complex business that involves forecasting fluctuations in currency exchange rates using technical analysis/fundamental analyses of global economic data. This type of trading requires specialized knowledge. Knowing the current conditions that affect different currencies' currency exchange rates is vital.

At the end of the day though, it's all about taking calculated risks, being willing to learn continually, and mastering an effective strategy that works best for you. With enough dedication, knowledge, and proper education, trading forex or cryptocurrency can be very lucrative.

Which is more difficult, forex or crypto?

Each currency and crypto are different in their difficulty and complexity. In terms of basic understanding, crypto may be slightly more difficult because it is new and related to blockchain technology. Forex, on the other hand has a proven trading infrastructure and has been around for many years.

There are greater risks in cryptocurrency trading than forex. This is because crypto markets can move quickly and in unpredictable ways. If you want to succeed in crypto trading, researching the historical trends in the markets where it trades can give you an edge over your competition.

Forex traders must understand the dynamics of foreign exchange pairs. This includes how prices change based on news events. You also need to be able to read and understand technical indicators, which can signal buy or sell signals. Another important aspect to consider is leverage. Traders are exposed to additional risk when trading currency pairs with high volatility.

Both forex and crypto both require attention, solid research skills and a clear strategy in order to consistently make profitable trades.

Is Cryptocurrency a Good Investing Option?

It's complicated. It is complicated. One, the cryptocurrency market can be volatile and unpredictable. This means that there is always risk when investing in them.

However, if you are willing to take that risk, and do your research, then there may be potential benefits based on events such as Initial Coin Offerings (ICOs), and shifts in market.

Because cryptocurrency assets move independently from traditional stock markets, portfolio diversification can also be possible with cryptocurrency investments.

The final decision comes down to individual risk tolerance and knowledge regarding the cryptocurrency market. If you are able to make informed decisions about this asset class, and are willing to take risks, investing in cryptocurrency is worth looking into.

Which trading platform is best?

Many traders may find it challenging to choose the best trading platform. There are so many platforms available, it can be difficult to decide which one is best for you.

The best trading platform must offer all of the features that you need such as chart analysis tools and real-time market data. It should also have sophisticated order execution capabilities. It must also be easy to use and intuitive.

You should have access to a range of account types, competitive fees, reliable customer service, and educational resources. Look for platforms that offer demo accounts or free trials so that you can practice with virtual money before risking any of your own cash.

You should consider your type of investor or trader when looking for a trading platform. For example, are you active or passive? How often do you plan to trade? What asset class mix would you like? These factors will help you narrow down the search for the right platform.

Once you've found the right platform, be sure to check out additional features, such as stock screening tools or backtesting, alert systems, etc. Additionally, ensure your chosen platform provides appropriate security protocols in place to protect your data from breaches or theft.

MetaTrader 4/5, cTrader, eToro, ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader InteractiveBrokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM ThinkOrSwim, to name a few.

Statistics

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

Are my investments safe online? Or should I look into other options?

Although money can seem complicated, it is also difficult to make the right decisions about where and how to store it. A strong security system is essential for your valuable assets. There are several options.

Storing your investment assets online provides easy access from any device and you can keep an eye on them quickly and easily. There are some risks associated with using a digital option as electronic breaches could occur.

A physical form of money like cash or gold can be safer, but it's more difficult to track and requires higher levels of protection and storage.

You may also consider traditional banking options or investing accounts. Self-storage facilities allow you to safely store precious metals, gold, or other valuables away from your home.

You may also want to consider specialized investment firms offering secure custody services that are specifically designed to protect large asset portfolios.

Your decision is final. Which one works best for your needs and offers the security and safety you need to protect your investments?