NFT Art is a revolutionary new digital art form that allows artists and designers to sell their work using a non-fungible token. This token can then be traded via the blockchain. It's a revolutionary method to make money while expressing yourself.

To trade nft artwork, you will need to establish a cryptocurrency wallet and connect it with an NFT platform. Some NFT exchanges accept cryptocurrency. Others do not. Some platforms charge fees for transactions while others offer no gas fees.

SuperRare and KnownOrigin are some of the most popular NFT art marketplaces. These platforms can only accept NFTs for curated creators. Limited editions are also available. You can also vote on the artworks you want to see through their curatorial system.

NiftyGateway offers another platform that allows NFT artists to sell and buy NFTs using fiat money. These tokens are now available to non-crypto users. The site also allows for escrow services, which can help you avoid getting scammed.

Before you trade nft, there are a few things that you should do. These steps will make sure that your work is easily sold on an NFT Art trading platform.

Original artwork is possible - Although this seems obvious, it's important to note that NFTs are digital assets and can be purchased as such. You must ensure that your art is original and represents your style.

It's okay to experiment with NFTs. They are still a relatively young form of art so it is important to remain open-minded and willing to try new things. It's a good idea also to have fun making your art.

Build your online reputation - This will help get you noticed and be bought by NFT collectors. This is done by creating a website or updating an existing one, posting process video of your work and using hashtags that will draw the right audience.

Phishing scams can be a problem for NFT art users, but it can also happen to those who use crypto for different purposes. You need to be aware of phishing scams that target crypto private keys and other important information.

Identify your crypto identity - This is essential for protecting yourself against fraud and avoiding scams. You need to claim your crypto art identity and ensure that no one else is using it for their own purposes.

You should have a digital wallet. This is essential for purchasing and selling NFTs as well as paying gas fees. A crypto wallet must be accessible on both mobile and desktop devices.

Find a community of crypto-art enthusiasts - This will allow you to connect with other people who share your passion for art. These people can help you get started and give you advice.

FAQ

How Can I Invest in Bitcoin?

Although investing in Bitcoin may seem complex, it's actually not as difficult as you think. You only need the right information and tools to get started.

It is important to realize that there are several ways to invest. You have the option to buy Bitcoin direct, trade on an exchange, or gain exposure using a financial instrument called a derivatives contract.

You will also have to decide where to store your bitcoin. There are many options such as exchanges, wallets, custodians and cold storage. Depending on your risk appetite and goals, some options might be more suitable than others.

Next, find any additional information that may be necessary to make confident investment decisions. It is essential to understand the basics of cryptocurrency and their workings before you dive in. Keep an eye on market developments and news to stay current with crypto trends.

Create a plan for investing Bitcoin based upon your level of experience. Set reasonable expectations for returns. This will increase your long-term success.

Frequently Asked questions

What are the 4 types?

Investing is a way for you to grow your money and possibly make more long-term. There are four main types of investing: stocks, bonds and mutual funds.

Stocks can be divided into two groups: common stock and preferred stock. A common stock gives an individual ownership right of a company, including voting rights at shareholders' meetings and the potential to earn dividends. The preferred stock gives you ownership rights, but no voting privileges. Investors also have the option to receive fixed dividend payments.

Bonds are loans made by investors to governments and companies in return for interest payments. The bond will expire on its maturity date. While bonds have a greater stability and less risk than stocks stocks, their returns are often lower than stocks.

Mutual funds allow investors to pool their money together to spread investment risk, diversify their investments, and diversify across a variety of securities such as stocks, bonds, or commodities. Professional managers manage mutual funds. They use their experience to choose profitable investments based on pre-determined criteria, such as risk level or expected return rate.

Cash equivalents include products such as Treasury bills, money market deposits, certificates of deposit (CDs), and commercial paper which often mature within one year or less during which time they carry minimal risks of default or downturns in their value. This type of investment is for conservative investors who do not want to take on high risk but still seek higher returns than traditional low-interest bank account deposits.

Which is harder forex or crypto?

Different levels of difficulty and complexity exist for forex and crypto. The new blockchain technology makes crypto a little more complicated in terms of fundamental understanding. On the other hand, forex has been around for a long time and has a reliable trading infrastructure supporting it.

There are greater risks in cryptocurrency trading than forex. This is because crypto markets can move quickly and in unpredictable ways. Researching the historical trends of the crypto markets can help you gain an edge on your competition if you are looking to trade in cryptocurrency.

Forex traders must understand the dynamics of foreign exchange pairs. This includes how prices change based on news events. You also need to be able to read and understand technical indicators, which can signal buy or sell signals. Leverage is another factor that must be taken into account, as traders risk not only their capital but also additional borrowed funds when trading currency pairs with significant volatility.

Forex and crypto both require keen research skills and attention to ensure successful trades.

What are the pros and cons of investing online?

The main advantage of online investing is convenience. Online investing makes it easy to manage your investments from anywhere on the planet with an internet connection. Access real-time market data, and make trades online without leaving your office or home. Online brokerages often offer lower fees than traditional brokerages. This makes it easier for investors start with smaller amounts of capital.

Online investing has its limitations. It can be difficult to get personal advice and guidance online, because you don’t have a broker or financial advisor to guide you. Online trading platforms can offer less security than traditional brokerages. Investors should be aware of these risks. Online trading is more complex than traditional investing. This is why it is crucial to be familiar with the markets and formulate a sound strategy.

It is also important for online investors to be aware of all the investment options. There are many investment options available to investors. These include stocks, bonds and mutual funds as well as cash equivalents. Each type of investment carries its own risks and rewards, so it is important to research each option before deciding which one is right for you. Some investments may also require a minimum investment or other restrictions.

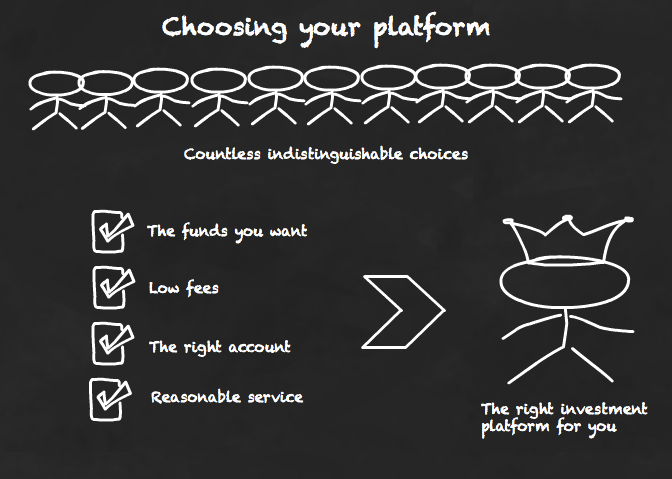

Which trading platform is best?

Choosing the best trading platform can be a daunting task for many traders. It can be confusing to choose the right one, with so many options.

The best trading platform should offer the features you need, like advanced chart analysis tools, real-time market data, and sophisticated order execution capabilities. It must also be easy to use and intuitive.

It should offer multiple account types and low fees. You also need reliable customer service and educational materials. Try out demo accounts or free trials to see if you like the idea of using virtual money.

You should consider your type of investor or trader when looking for a trading platform. For example, are you active or passive? How often do you plan to trade? What asset class mix would you like? These factors will help you narrow down the search for the right platform.

Once you have identified the platform that suits you best, it is time to explore additional features such backtesting capabilities and stock screening tools. Also, make sure that the platform you choose has appropriate security protocols in order to protect your data from theft and breaches.

Some of the most popular trading platforms include MetaTrader 4/5 (MT4/MT5), cTrader, eToro TradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade FXCM ThinkOrSwim App Store just to name a few!

Forex and Cryptocurrencies are great investments.

It is possible to get rich trading forex or crypto. However, you need to use a strategic approach. You need to be aware of the market trends so you can make the most of them.

You will also need to know how to identify patterns in prices, which can help you decide where the market is going. Also, you should only trade with money that is within your means.

It also requires a combination of experience, knowledge, risk-management skills, and discipline in order to be able to develop a profitable strategy for long-term success.

Cryptocurrency prices are often volatile, so the key is to make sure that your entry position fits with your risk appetite and exit plan - meaning that if there becomes an opportunity for profit-taking or limiting losses, then do so.

It is crucial to do your research on cryptocurrency exchanges before you sign up for any wallet.

Furthermore, forex trading involves predicting fluctuations of currency exchange rates through technical/fundamental analysis global economic data. This type trading requires specialized knowledge. It is therefore essential to have a solid understanding of the factors that affect different currencies.

It's about taking calculated risks and being open to learning. The most important thing is to find the best strategy for you. With enough dedication combined with this knowledge - you could potentially get very rich trading cryptos or forex if done correctly with proper education & research behind it!

Statistics

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

External Links

How To

How can I verify the legitimacy of an online investment opportunity?

Research is critical when investing online. Look into the company behind the opportunity. Ensure that they have been registered with the proper financial authorities. Be aware of any industry regulations and restrictions that may be applicable to your investments.

Review past performance data, if possible. To get an idea of the customer experience with the investment opportunity, look online for reviews. Be skeptical of promises of substantial future returns or future results.

Know the risks associated with your investment and the terms and conditions. Before signing up for an investment account, make sure you know what fees or commissions may be subject to tax. You should ensure that you are getting the terms and services you have paid for by doing due diligence checks if necessary. You should have an exit strategy that is clear in case something goes wrong with your investment. This could help you reduce your long-term losses.