Binance, the largest cryptocurrency exchange in the world, has entered traditional stock markets. On April 12, Binance's stock token service offered users the chance to purchase and sell a simulated version of real-world stocks. Although the service isn't new, regulators have been intrigued by it. Coinbase, a company that offers tokenized versions of real-world stocks, has offered investors the opportunity to buy shares but not actually own them. Binance's entry to the market has caused a wave of regulatory scrutiny.

Although Binance hasn't revealed all its cards, it has teamed up with a German asset management firm called CM-Equity AG to help bring its products to the market. CM-Equity, a German licensed asset management firm, specializes in investment management and asset management. The companies will exchange tokenized stocks and futures as part this deal. Some of these products may be popular with traders.

Aside from implementing the aforementioned services, Binance has also launched its own token, BNB. It is the largest crypto in the world with a market capitalization exceeding $87 billion. Like other crypto tokens, it is supported by Binance USD (a dollar-linked stablecoin) issued by Paxos Trust Co. You also have the option to choose from several pricing tiers. Takers pay higher fees, but makers get commissions free of charge up to $20,000,000 in volume. Depending on the tier, the average commissions for users of the service could be between 0.6 and 25 percent. If you're interested in trading the coin, you'll also need to fill out a lengthy application to determine your risk tolerance.

Although it may not be the right product for every investor, Binance Stock Token has proven to be a huge success with some. One noted that it offered a way to access stock liquidity that wasn't available before. Binance could be subject to fines for failing to offer prospectuses in connection with its stock offerings. The most important function of this service isn't trading, it's the analysis, listing, and marketing of tokenized shares.

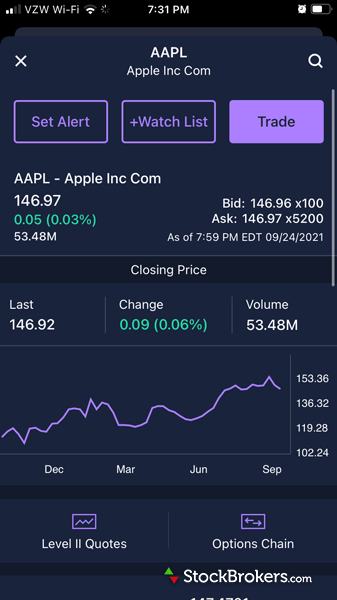

Binance has created a small collection of tokenized stock symbols to get you started. These include Apple (AAPL) and Tesla (TSLA). Both tokenized stock symbols are based on the underlying shares of these companies, and are offered in various forms. These symbols can only be sold through CM Equity AG, a German regulated broker. The CM Equity AG controls the new portal where users can trade the tokens. It will take approximately two weeks for you to swap your holdings.

Another notable feature of Binance's new service is the company's decision to create its own decentralized exchange. According to the website it has partnered "regulated, independent German financial firms" to offer stock-related services that are "comparable with other market leaders." Binance is not a centralized platform and does not own any stocks.

FAQ

Which forex or crypto trading strategy is best?

Both forex and cryptocurrency trading have their potential profits. But it all depends upon your investment goals.

Forex trading is an investment in currencies. This option is accessible to beginners. This requires a smaller initial capital, and forex markets can be accessed 24/7 around the world.

But crypto trading is a great alternative because it offers almost instant returns as prices can fluctuate quickly due volatility. Crypto trades are also highly liquid, so cashing out your tokens quickly is possible.

In both cases, it's important to do your research before making any investments. Any type of trading can be managed by diversifying your assets.

Understanding the various trading strategies for different types of trading is important. For instance, forex traders may use technical or fundamental analysis to make their decisions. Crypto traders might use arbitrage, margin trading, or both to maximize profits. To help manage their investments, traders may use automated trading systems or bots. It is important to understand the risks and rewards associated with each strategy before investing.

Which trading site for beginners is the best?

It all depends upon your comfort level in online trading. It's a good idea to begin with an experienced broker who has expert advisors if you are completely new to online trading.

These brokers can take the guesswork and help you build your portfolio by making solid recommendations. Many offer interactive tools to help you understand how trades work.

You can also trade independently if your knowledge is good enough. They offer customized trading platforms, live feeds of data, and research tools such as real-time analyses to help you make well-informed choices.

No matter which route you choose, be sure to read customer reviews before you make a decision. This will give you an insight into the service and experience of each site.

Is Cryptocurrency a Good Investment?

It's complicated. Cryptocurrency has become increasingly popular over the past few years, but whether or not it will be a successful investment depends on numerous factors. One, the cryptocurrency market can be volatile and unpredictable. This means that there is always risk when investing in them.

You can also make a profit if your risk is taken and you do your research.

Cryptocurrency investments can also offer portfolio diversification benefits since these assets tend to move independently of traditional stock markets.

It comes down to each person's individual tolerance for risk and knowledge in relation to the crypto markets. If you have the means to make an informed decision about this asset class and don't mind taking risks, then yes - investing in cryptocurrencies is absolutely worth considering.

How can I invest in Bitcoin?

Although it may seem difficult to invest in Bitcoin, it is not as complicated as you might think. To get started, you only need to have the right knowledge and tools.

It is important to realize that there are several ways to invest. You can purchase Bitcoin directly, use an exchange to trade, or use a financial instrument known as a derivatives contract to gain exposure.

You'll also need to decide where you will store your Bitcoin - there are many options available such as wallets, exchanges, custodians, and cold storage. You may choose one option or another depending on your goals and risk appetite.

Next, research any additional information you may need to feel confident about your investment decisions. It is essential to understand the basics of cryptocurrency and their workings before you dive in. Keep an eye on market developments and news to stay current with crypto trends.

Finally, you should create a plan to invest Bitcoin based in your level of expertise and set reasonable expectations about returns. This will ensure that you have a greater chance of long-term success.

Which is more difficult forex or crypto currency?

Different levels of difficulty and complexity exist for forex and crypto. The new blockchain technology makes crypto a little more complicated in terms of fundamental understanding. Forex, however, has been around for quite some time and has a reliable trade infrastructure.

Trading cryptocurrency is more risky than forex. It's because the crypto markets can change in an unpredictable way over short time periods. It is important to research historical trends and learn from your peers if you wish to be successful at crypto trading.

Forex traders must understand the dynamics of foreign exchange pairs. This includes how prices change based on news events. A good understanding of technical indicators is essential to identify buy and sell signals. Another factor to consider is leverage. When trading currency pairs that have high volatility, traders are putting their capital at risk.

Overall, both forex and crypto require attentiveness, solid research skills, and a clear strategy to make successful trades consistently.

Trading forex or Cryptocurrencies can make you rich.

You can make a fortune trading forex and crypto if you take a strategic approach. To really make money in either of these markets, you need to stay ahead of the trends and know when the best time to buy and sell is.

It is also important to understand how to spot trends in prices. This will help you to predict the direction of the market. You should also trade with only the money you have the ability to lose.

It takes a combination of knowledge, experience, risk-management skills, discipline, and patience to build a profitable strategy that will lead to long-term success.

There are many factors that can cause volatility in cryptocurrency prices. Therefore, it is crucial to ensure that your entry position aligns with your risk appetite. Also, make sure you plan for exit if there is an opportunity to profit from the market.

The cryptocurrency market is largely unregulated and presents substantial risks. Before you sign up for any type of wallet or platform, make sure to research the coins and exchanges.

Because forex trading involves the prediction of fluctuations in currency rates via technical analysis/fundamental economic analysis, this type of trading requires special knowledge that has been acquired over time. Understanding the different currency conditions is crucial.

It is all about taking calculated risk, learning constantly, and finding an effective strategy that works for you. With enough dedication combined with this knowledge - you could potentially get very rich trading cryptos or forex if done correctly with proper education & research behind it!

Statistics

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

External Links

How To

Are my investments safe online? Or should I look into other options?

Money can be complex but so can the decisions about how to store it. You have many options for protecting your valuable assets.

Online storage of investment assets is easy and convenient. You can access them easily from any device. Yet, there are risks involved when using a digital option since electronic breaches may occur.

You could also choose to store your money in physical currency like gold or cash. This is less secure but more manageable and requires more storage and protection.

You may also consider traditional banking options or investing accounts. Self-storage facilities allow you to safely store precious metals, gold, or other valuables away from your home.

Finally, consider looking at specialized investment companies that provide secure custody services designed specifically for large asset portfolios.

It is ultimately your decision. What will work best for you, and provide the security and safety that you require to protect your investments.