Forex, also known simply as foreign currency, is a place where buyers or sellers can trade currencies at a agreed price. Although it is a complex and large market, it can prove lucrative for those who are skilled in trading it.

A strategy that is based upon your market knowledge is the best way to be a successful forex trader. This will help you to make more profit and keep your budget within reach.

A clear plan of action should be established before traders start trading. This is essential because it is possible to lose a lot of money in the forex markets if your strategy and plan are not clear.

Forex is volatile, so be mindful of your capital allocation and risk tolerance. This is especially important if you're trading short-term. You could lose more if you don’t manage risk properly.

If you have no experience in the forex market, it is best to start with small trades and work your way up to bigger ones as you get more experienced. This will let you practice your strategy, learn the market and make money before you actually invest in it.

Most forex traders don't realize the importance of patience and discipline. Forex trading can be very volatile. New traders may get caught up in emotions or hunches that lead to losing money.

It is important to ask questions about the market and your strategy. This will help you keep a level head and be rational while trading. This will help you think of scenarios that might not have occurred to you before and can make you a better forex Trader.

Don't stare at your charts throughout the day. It will only make things more volatile and won't give you accurate information. You should take breaks from your trading terminal and get away from it. This will allow you to relax and focus on the task at hand.

The best way to find areas where currency rates are likely to stall is to use range trading strategies. But, remember that prices can reverse and you may not win every time.

A stop loss should always be in place before you start any trade. This is an important step for every trader. It will allow you to limit your losses in the event that you don't achieve the results you desire.

Many people will place a stoploss too high or believe it will be reached soon. This can lead to huge losses. For forex traders using leverage to maximize their profits, this is particularly true.

FAQ

How can I invest Bitcoin?

Investing in Bitcoin can seem complicated, but it's not as hard as you think! To get started, you only need to have the right knowledge and tools.

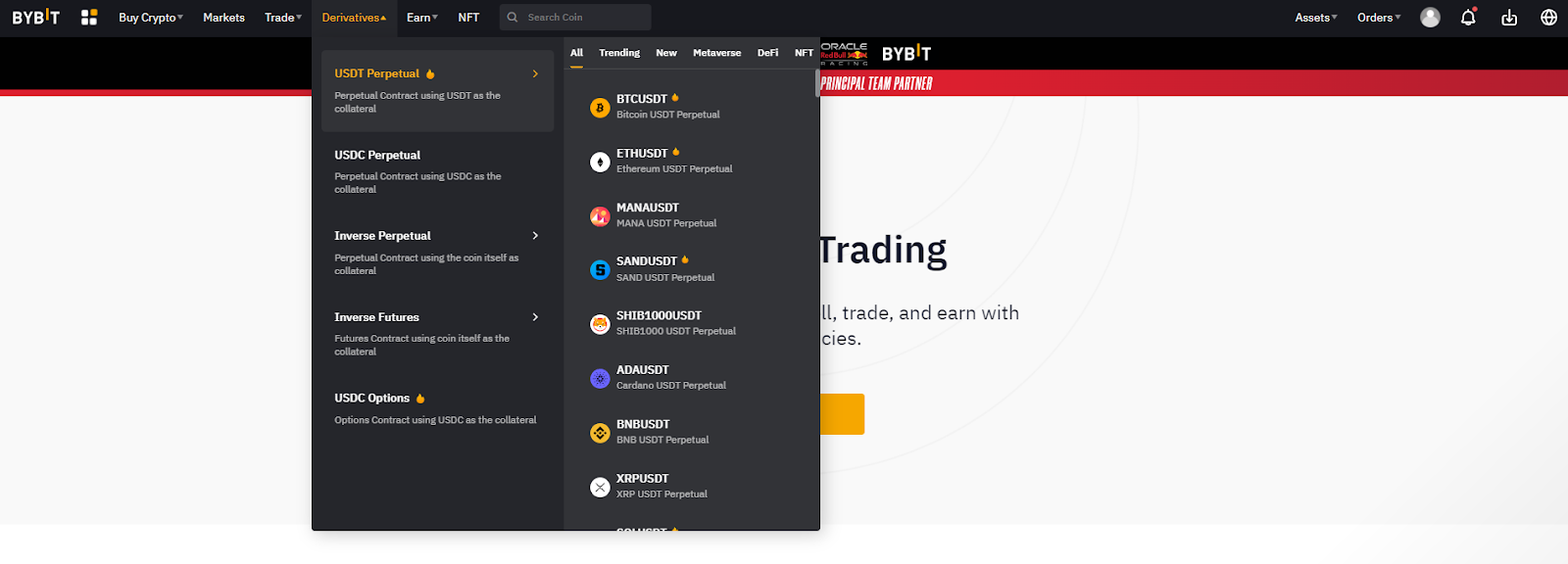

It is important to realize that there are several ways to invest. To get exposure to Bitcoin, you can buy it directly, use an exchange or use a financial instrument, known as a derivatives agreement.

You must also decide where you will store Bitcoin. There is a wide range of options available, including exchanges, custodians, cold storage, wallets and exchanges. Depending on your risk appetite, goals, and other factors, certain options might be more appropriate than others.

Next, you should research any additional information necessary to feel confident in your investment decisions. Learning the basics of cryptocurrencies and how they work before diving in is important. You should also keep up to date with market news and developments in order to stay abreast of the latest crypto trends.

Finally, you should create a plan to invest Bitcoin based in your level of expertise and set reasonable expectations about returns. This will ensure that you have a greater chance of long-term success.

Which is harder forex or crypto?

Different levels of difficulty and complexity exist for forex and crypto. The new blockchain technology makes crypto a little more complicated in terms of fundamental understanding. Forex has been around since the beginning and has a solid trading infrastructure.

Forex trading has fewer risks than cryptocurrency trading. Crypto markets move in unpredictable ways and can change quickly. If you want to succeed in crypto trading, researching the historical trends in the markets where it trades can give you an edge over your competition.

Forex traders should be able understand the dynamics among foreign exchange pairs. They need to know how prices shift based upon news and macroeconomic events. This requires a deep understanding of technical indicators that can be used to indicate buy and sell signals. Another factor to consider is leverage. When trading currency pairs that have high volatility, traders are putting their capital at risk.

For both crypto and forex, it is important to be alert, do your research well, and have a strategy for making consistent trades.

Where can you invest and make daily income?

Investing can be a great way to make some money, but it's important to know what your options are. There are other ways to make money than investing in the stock market.

Real estate is another option. Property investments can yield steady returns, long-term appreciation, and tax benefits. It is possible to diversify your portfolio with ETFs mutual funds, bonds, and specialty fields like cryptocurrency.

If you're looking for shorter-term profits or daily income, you could try investing in stocks that pay dividends or look into peer-to-peer lending platforms where you lend out money and receive interest payments directly from borrowers on a daily basis. Online trading is possible if you're comfortable with the risks.

It doesn't matter what your investment goals are, it is important to research each type of investment before you dive in headfirst. Each asset has its own set of risk factors. Make sure you closely monitor any investments and recognize when to buy and sell accordingly so you can maximize your earnings and work towards achieving your financial goals!

What is the best forex trading system or crypto trading system?

Both forex and cryptocurrency trading have their potential profits. But it all depends upon your investment goals.

Forex trading allows you to invest in different currencies. It is a great option for beginners. This requires a smaller initial capital, and forex markets can be accessed 24/7 around the world.

The upside is that crypto trading provides a quick return, as prices can change very rapidly due to volatility. The liquidity of crypto trading means that you can quickly cash out your tokens.

In both instances, it is crucial to do your research prior to making any investments. With any type or trading, it is important to manage your risk with proper diversification.

Understanding the various trading strategies for different types of trading is important. To maximize their profits, crypto traders can use arbitrage or margin trades to maximize their gains. Forex traders may use either technical analysis or fundamental analysis to assist them in making decisions. Automated trading platforms or bots are also available to assist traders in managing their investments. It is important to understand the risks and rewards associated with each strategy before investing.

Which trading site is best suited for beginners?

It all depends upon your comfort level in online trading. If you're completely new to the online trading process, it would be a great idea for you to go through an established broker with experienced advisors.

They take the guesswork out when it comes to choosing companies and make solid recommendations that will help you build a steady portfolio over time. Many offer interactive tools to help you understand how trades work.

On the other hand, if you want more control over your investments and have a bit of knowledge already, there are plenty of sites that allow you to trade independently. These sites offer customizable trading platforms, live data feeds, research resources, and real-time analytics for well-informed decisions.

No matter what route you choose to take, it is important that you read reviews from customers before making any commitments. They will provide insight into how each site treats customers and give you an idea of the overall experience.

Frequently Asked questions

What are the four types of investing?

Investing is a way for you to grow your money and possibly make more long-term. There are four main types of investing: stocks, bonds and mutual funds.

Stocks can be broken down into common stock or preferred stock. A common stock gives an individual ownership right of a company, including voting rights at shareholders' meetings and the potential to earn dividends. Preferred stock also gives ownership rights but with no voting privileges, as well as fixed dividend payments that offer investors a reliable income stream.

Bonds are loans made by investors to governments and companies in return for interest payments. The bond will expire on its maturity date. While bonds offer more stability and lower risk than stocks, the returns are usually lower than those of stocks.

Mutual funds are a way to pool investor money in order spread risk and diversify investments across many types of securities, including stocks, bonds and commodities. Professional managers manage mutual fund investments. They use their knowledge to choose profitable investments that meet pre-set criteria.

These cash equivalents are products like Treasury bills, money-market deposits, certificates or deposit (CDs), as well as commercial paper. They usually mature in one year or less and have minimal risk of losing their value or going bankrupt. This type of investment is for conservative investors who do not want to take on high risk but still seek higher returns than traditional low-interest bank account deposits.

Statistics

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

External Links

How To

How can I ensure the security of my online investment account?

Safety is a must when it comes to online investment accounts. It is crucial to safeguard your data and assets against unwelcome intrusions.

You want to ensure that the platform you use is secure. Make sure to look out for encryption technology and two-factor authentication. These security measures will give you maximum protection from hackers and malicious actors. There should also be a policy that outlines how any personal information you have shared with them will be regulated and monitored.

It is also important to choose strong passwords that allow you to access your account. You should limit the number and time spent logging in to public networks. Avoid clicking on untrue links or downloading unfamiliar software. These could result in malicious downloads and the eventual compromise of your funds. Also, make sure to review your account activity regularly so you can be aware of any unusualities and detect threats quickly. If necessary, take immediate action.

Third, you need to know the terms of your online investment platform. Be aware of the fees involved in investing and any restrictions on how you may use your account.

Fourth, ensure you research the company that you are considering investing in and make sure they have a track record of providing excellent customer service. Check out user reviews and ratings to get an idea of how the platform works and what other users have experienced. Finally, you should be aware of tax implications for investing online.

By following these steps, you can ensure that your online investment account is secure and protected from any potential threats.