Forex market trading refers to online trading that involves currency buying and selling. This method of investing is quite different to traditional investments such stocks, bonds, or real estate. Currency fluctuations mean that there is always a chance the trader could lose their money.

Foreign exchange trading, which has a daily turnover in excess of $3 trillion, is the world's largest and best-liquid market. It is open 24/7, five days a semaine, with trading centers in major financial hubs around the world including London, New York and Sydney.

Currency pairs are the most common type of trade in the Forex market, where two currencies are traded together to determine their relative value. The most used pair on the market, the Euro to US dollar (EUR/USD), is one of its most popular.

Forex market is a global and decentralized marketplace where currency traders and buyers trade. There is no central market and trading is done electronically over the counter through a broker.

Fundamental Analysis

Currency markets can be influenced by news and events that affect a country's economy or its currency. This includes changes in interest rates, inflation, trade flows and geopolitical issues. It can also be influenced by the actions of major players such as government entities and multinational companies.

Technical Analysis

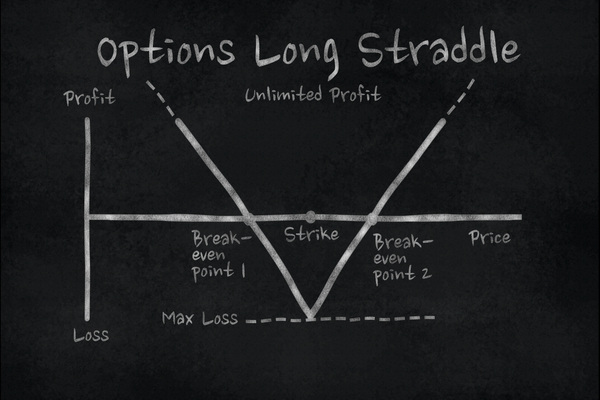

Technical analysis is often used to aid forex traders in their trading decisions. To predict price movements, technical analysis involves looking at chart patterns, trading volumes, price charts, and other indicators. This can be a great strategy for forex day traders who want maximum profits by placing trades at the right times.

Forex market volatility

The volatility of the forex market is a key factor that determines a trader's success or failure. It is the amount of change in a currency pair's value, and experienced traders will take advantage of this by placing their trades when prices are moving quickly.

Spoofing/Ghosting

This is where traders or brokers try to convince traders into placing large orders which they will not execute. This could be manipulation. It is important to verify with your broker and research the broker before opening a new account.

Leverage

Leverage allows you to trade more capital than you have. It can help you increase your profits or decrease your losses. This is a great way of trading but it should be used with caution, as it can add another layer of risk.

Scalp trading

Another form of forex trading is scalping. In this type of trade, traders attempt to gain large profits in a very short time. This strategy is most effective when the market is very volatile and if you have a good forex broker who supports scalping.

The forex market has become a huge business in recent years as more and more people are becoming aware of its potential to earn high profits by trading currencies. There are many forex trading options that will suit your investment objectives and budget. It is important to make sure that you have access to a variety of options and that they offer support.

FAQ

Which is harder, forex or crypto.

Each currency and crypto are different in their difficulty and complexity. Crypto may require a greater level of understanding due to its newness and connection with blockchain technology. On the other hand, forex has been around for a long time and has a reliable trading infrastructure supporting it.

There are greater risks in cryptocurrency trading than forex. This is because crypto markets can move quickly and in unpredictable ways. You can gain an advantage over your competitors by researching historical trends in the markets in which it trades.

Forex traders must understand the dynamics of foreign exchange pairs. This includes how prices change based on news events. It also requires an acute understanding of technical indicators that can indicate buy or sell signals. Leverage is another factor that must be taken into account, as traders risk not only their capital but also additional borrowed funds when trading currency pairs with significant volatility.

Forex and crypto both require keen research skills and attention to ensure successful trades.

What are the advantages and disadvantages of online investing?

Online investing has the main advantage of being convenient. You can manage your investments online, from anywhere you have an internet connection. You can access real-time market data and make trades without having to leave your home or office. Many online brokerages charge lower fees than traditional ones, which makes it easier to start investing with less money.

Online investing has its limitations. For example, it can be difficult to get personalized advice and guidance when trading online, as you don't have a physical broker or financial advisor to help you make decisions. Online trading platforms may not offer the same level or security as traditional brokerages. Investors must be aware that there are risks. Online trading can be more complex and difficult than conventional investing. Before you begin, make sure to thoroughly understand the markets.

It is also important for online investors to be aware of all the investment options. Investors have many options. They can choose from stocks, bonds, mutual funds and cash equivalents. Each investment type has its own risks, rewards, and it is important to fully research each option before making a decision. There might be restrictions or a minimum deposit required for certain investments.

Where can i invest and earn daily?

Investing can be a great way to make some money, but it's important to know what your options are. You don't need to invest all of your savings in the stock exchange - there are many other options.

One option is investing in real estate. Investing in property may provide steady returns and long-term appreciation. It also offers tax benefits. It is possible to diversify your portfolio with ETFs mutual funds, bonds, and specialty fields like cryptocurrency.

If you're looking for shorter-term profits or daily income, you could try investing in stocks that pay dividends or look into peer-to-peer lending platforms where you lend out money and receive interest payments directly from borrowers on a daily basis. If you are comfortable with the risk, you can trade online using day trading strategies.

Whatever your investment goals may be, it's important to do research about each type of investment before diving in head first as every asset carries its own set of risks associated with it. You must keep an eye on your investments, recognize when you should buy or sell them so that you can maximize your earnings while working towards your financial goals.

Can forex traders make any money?

Yes, forex traders can make money. While it is possible to achieve success in the short-term, long-term profits typically come from dedication and a willingness to learn. More successful traders are those who have a solid understanding of market fundamentals and technical analyses than those who rely on their luck or guessing.

Forex trading isn’t easy, but it is possible to earn consistent profits over time with the right strategies. It is important to find an educated mentor and develop a working knowledge of risk management before risking real capital.

Many traders fail due to a lack of a structured plan or approach but with discipline, one can maximize their chances of making money in the foreign exchange (forex) markets.

Forex traders who are experienced create trading plans to help them reduce their risk exposure while still finding lucrative opportunities. It is important to manage risk. Many new traders are too eager to make quick profits and not have a long-term strategy.

Forex traders can increase their long-term profitability by keeping detailed records, studying past trades as well as payments and understanding platforms that facilitate currency trading.

Having discipline really pays off in forex trading: developing rules such as how much money you're willing to lose on each trade helps minimize losses and ensure success; additionally strategies like leveraging entry signals often help increase profits beyond what could be achieved without guidance from an experienced mentor.

Ultimately though, being persistent and learning from successful day traders other methods--such as risk management techniques--are necessary for profitability as a trader in forex markets regardless if you're investing your own capital or managing funds for someone else.

Frequently Asked Question

Which are the 4 types that you should invest in?

Investing can be a great way to build your finances and earn long-term income. There are four types of investing: stocks and bonds, mutual funds and cash equivalents.

There are two types of stock: preferred stock and common stock. Common stock gives you the opportunity to vote at shareholder meetings, and earn dividends. Although preferred stock grants ownership rights, there are no voting privileges. Fixed dividend payments offer investors an income stream and provide a reliable source of income.

Bonds are loans that investors make to governments or companies in return for interest payments. They expire at the maturity date and can be repaid with interest payments. Bonds offer greater stability and lower risk than stock, but they have higher returns than stocks.

Mutual funds involve pooling investor money together in order to spread investment risk and diversify investments over many different types of securities including stocks, bonds, and commodities. Mutual funds are managed by professional managers who use their expertise to select profitable investments in accordance with pre-set criteria such as level of risk or desired gain rate.

You can find cash equivalents in products like Treasury bills or money market deposits or certificates of deposit (CDs), which usually mature in one or two years. They are also less likely to be defaulted or lose value. This type of investing is best for conservative investors who aren't willing to take high-risk but still want a higher return than depositing money in low-interest bank accounts.

Can you make it big trading Forex or Cryptocurrencies?

Trading forex and crypto can be lucrative if you are strategic. To really make money in either of these markets, you need to stay ahead of the trends and know when the best time to buy and sell is.

Knowing how to spot price patterns can help you predict where the market will go. It is important to trade only with money you can afford to lose.

It also requires a combination of experience, knowledge, risk-management skills, and discipline in order to be able to develop a profitable strategy for long-term success.

There are many factors that can cause volatility in cryptocurrency prices. Therefore, it is crucial to ensure that your entry position aligns with your risk appetite. Also, make sure you plan for exit if there is an opportunity to profit from the market.

The cryptocurrency market is largely unregulated and presents substantial risks. Before you sign up for any type of wallet or platform, make sure to research the coins and exchanges.

Furthermore, forex trading involves predicting fluctuations of currency exchange rates through technical/fundamental analysis global economic data. This type trading requires specialized knowledge. Therefore having a robust understanding of the conditions affecting different currencies is imperative.

It is about taking calculated chances, being willing and able to learn continuously and finding the right strategy that works for your needs. You can make a lot trading forex and cryptos if you have enough knowledge and dedication.

Statistics

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

What are my best options to avoid falling for online investment scams

Protecting yourself starts with you. By brushing up on how to spot scams and understanding how fraudsters' tricks work, you can protect yourself from getting duped.

Do not fall for sales pitches that sound too good-to-be true or high-pressure tactics promising guaranteed returns. Never respond to unsolicited phone calls or emails. Fraudsters use fake names often, so don't respond to unsolicited email or phone calls. You should thoroughly investigate investment opportunities and do your research on the person offering them.

Never place money on the street, in cash or via wire transfer. This should alarm you if they insist upon such payment methods. Don't forget to remember that "Scammers will attempt anything to get personal information." Be aware of the different online phishing schemes, suspicious links in emails and online ads that could lead to identity theft.

You should also use safe online investment platforms. Look for sites that are regulated by the Financial Conduct Authority (FCA) and have a good reputation. Secure Socket Layer (SSL) encryption technology is recommended to protect your data over the internet. Before you make any investment, read and understand the terms of any website or app that you use.