Forex is the largest global financial market. The foreign exchange market is a 24-hour market with an estimated turnover of US$6.5 trillion. It is used by businesses, banks, and hedge funds to buy or sell national currencies. The currency market is affected in many ways. These factors include the country's economic strength as well as social and politically relevant factors.

Trades are best made when the market is active. In addition, traders should consider the effects of leverage when trading. Leverage can make tracking losses and results difficult. Traders should also try to follow a systematic approach. A trader who follows the path of least resistance should be able maintain a profitable position while avoiding drastic price movements.

In addition, traders should be aware of the impact of different markets on the forex market. Trading atmosphere can become more volatile when there are multiple markets open at once. This can lead to significant fluctuations in the price of a specific currency pair. Trader should also be alert for major news releases that may have an immediate affect on the currency. Traders should not trade too much or blow their accounts.

It is important to understand which currency pairs are most popular in order to determine the best times to trade. There are four popular currency pairs: EUR/USD (GBP/USD), GBP/USD (USD/JPY), USD/CHF (USD/CHF). These four majors account to more than 80% each of forex trading volume. However, there are many other currency pairs that are less traded. They are usually more expensive than the majors and often have wider spreads.

Trading in the forex market is also important because of the timing of key events like speeches by heads of central banks and international meetings. These events can have an impact on dollar value. The dollar's value can fluctuate depending on whether an acquisition is completed. In the same way, strong U.S. economics can stimulate investor demand to purchase the currency.

It is important to understand the calendar of economic events if you are interested in a career as a forex trader. This calendar provides a guideline for major events that may have an impact on the currency market. You should also be aware of the potential for major news releases to cause a 70 pip decline.

Remember to consider the overlap between U.S./London sessions. This occurs between 8:00am and 5:00pm EST. This window offers the best trading opportunities, as there is more overlap between the markets.

In addition to this, the NASDAQ and New York Stock Exchange are considered to be the most influential trading centers in the foreign exchange market. Although these two markets only overlap for a few hours, their overlap can affect the currency markets. USD/JPY, one of the most popular currency pairs on NASDAQ, is also a very popular pair.

FAQ

Which is safe crypto or forex?

Forex trading and cryptocurrency are two highly risky investments. The rewards and the risks can be very different.

Crypto, short for cryptocurrency or digital currency, is a digital coin that was created by a piece code using blockchain technology. It can be traded as any other type of money on exchanges, and has been the subject for speculative investments because of its dramatic price swings.

Forex (or foreign exchange currency trading) involves highly leveraged investments. Participants speculate on the value one currency relative to another. Forex, which can be unstable and cause large losses if not managed well, is an investment that should not be taken lightly.

While both Forex (Cryptocurrency) and Forex (Forex) have their pros and cons, Cryptocurrency tends be more volatile than Forex. The limited supply of cryptocurrencies and the regulations that surround them around the globe make their prices unpredictable. However, forex markets are more steady so investors can have more control over what they invest. The decision about which of Cryptocurrency or Forex is more secure will be based on the individual's risk appetite and their previous experience with each investment option.

Frequently Asked Fragen

What are the 4 types?

Investing is a way for you to grow your money and possibly make more long-term. There are four major categories of investing - stocks, bonds, mutual funds, and cash equivalents.

There are two types of stock: preferred stock and common stock. Common stock grants an individual the right to own a company. It also gives voting rights at shareholder meetings and the possibility of earning dividends. Preferred stock also gives ownership rights but with no voting privileges, as well as fixed dividend payments that offer investors a reliable income stream.

Bonds are loans made by investors to governments and companies in return for interest payments. The bond will expire on its maturity date. Bonds provide more stability and less risk than stocks, but the returns are typically lower than those of stocks.

Mutual funds allow investors to pool their money together to spread investment risk, diversify their investments, and diversify across a variety of securities such as stocks, bonds, or commodities. Professional managers manage mutual funds. Their expertise is used to make profitable investments according to pre-set criteria like risk level and desired return rate.

There are many cash alternatives, including Treasury bills, money markets deposits, certificates-of-deposit (CDs) and commercial papers. These products often mature in one year, so they have very little risk of being defaulted on or losing value. This type of investing is mostly suitable for conservative investors who don't want to take high risks but still seek a little bit more return than depositing money at traditionally low-interest bank accounts.

What are the pros and cons of investing online?

Online investing has the main advantage of being convenient. Online investing allows you to manage your investments anywhere with an internet connection. You can access real-time market data and make trades without having to leave your home or office. Online brokerages often offer lower fees than traditional brokerages. This makes it easier for investors start with smaller amounts of capital.

Online investing is not without its challenges. It can be difficult to get personal advice and guidance online, because you don’t have a broker or financial advisor to guide you. Additionally, online trading platforms may not offer the same level of security as traditional brokerages, so investors need to be aware of the risks involved. Online trading can be more complex and difficult than conventional investing. Before you begin, make sure to thoroughly understand the markets.

You should also be aware of the different investment options available to you when investing online. Investors have many choices: stocks, bonds or mutual funds. Each investment type has its own risks, rewards, and it is important to fully research each option before making a decision. There may be restrictions on investments such as minimum deposits or other requirements.

Can forex traders make any money?

Forex traders can make good money. Although it is possible to make money in the short term, you will need to be patient and willing to learn. Traders who understand market fundamentals and technical analysis are more likely to be successful than those who rely solely on luck or guessing.

It's not easy to trade forex, but it is possible with the right knowledge strategies to produce consistent profits over time. It is crucial to find an educated mentor before you take on real capital.

Many traders fail because they lack a plan or approach. However, with discipline one can maximize his chances of making money on foreign exchange markets.

Experienced forex traders develop trading plans that they stick to when trading in order to reduce their risk exposure as much as possible while still finding profitable opportunities. It is important to manage risk. Many new traders are too eager to make quick profits and not have a long-term strategy.

By keeping good records, studying past trades and payments, and understanding platforms used for currency trades along with other aspects of trading, forex traders can improve their likelihood of generating profits over the long term.

Forex trading requires discipline. You need to establish rules that limit your losses. Leverage entry signals and other strategies can increase profits.

The bottom line is that you must be persistent and learn from successful day traders to make a profit trading forex markets. This applies regardless of whether your capital is invested or managed for another person.

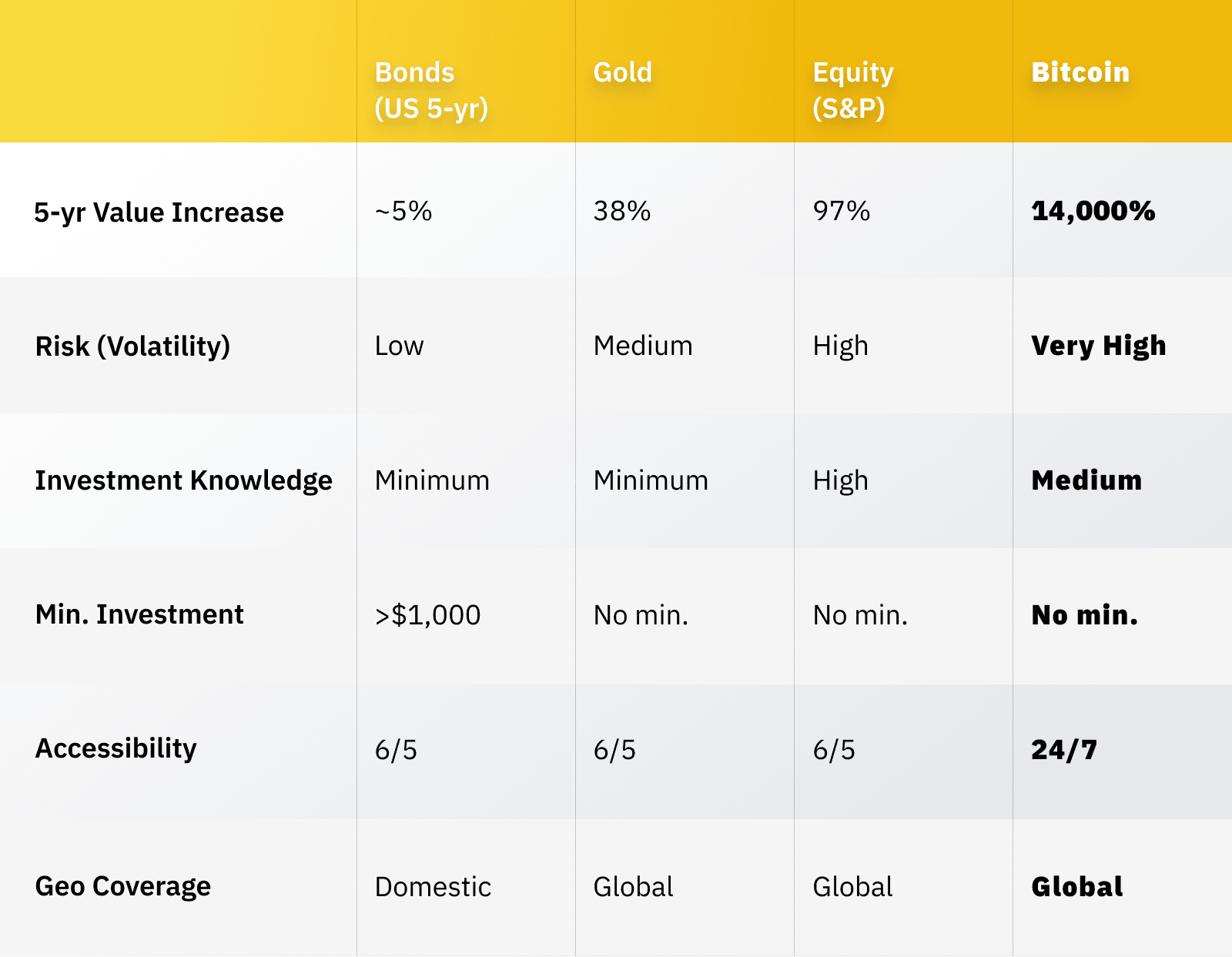

Is Cryptocurrency a Good Investment?

It's complicated. The popularity of cryptocurrency has increased over the years. However, whether or not it is a good investment depends on many factors. One, the cryptocurrency market can be volatile and unpredictable. This means that there is always risk when investing in them.

However, if you are willing to take that risk, and do your research, then there may be potential benefits based on events such as Initial Coin Offerings (ICOs), and shifts in market.

The potential for portfolio diversification is also possible through cryptocurrency investments, as these assets can move independently from traditional stock exchanges.

It really boils down to each individual's tolerance for risk and knowledge about the crypto market. If you have the means to make an informed decision about this asset class and don't mind taking risks, then yes - investing in cryptocurrencies is absolutely worth considering.

Which trading platform is the best for beginners?

It all depends on your level of comfort with online trading. You can start by going through an experienced broker with advisors if this is your first time.

They take the guesswork out when it comes to choosing companies and make solid recommendations that will help you build a steady portfolio over time. Many brokers offer interactive tools that allow you to see how trades work, without having to risk any real money.

There are many sites that let you trade on your own if you have some knowledge and want to take more control of your investments. These sites offer customizable trading platforms, live data feeds, research resources, and real-time analytics for well-informed decisions.

You can find customer reviews on any route, no matter what. These will give insight into the experience and level of service at each site before you commit.

Statistics

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

External Links

How To

How can you protect your financial and personal information while investing online?

Online investing is a risky venture. Online investments can be dangerous. You need to know the risks and how to mitigate them.

It's important to be aware of who you are dealing directly with on any investment platform or app. Be sure to choose a reputable company with good ratings and customer reviews. Before you transfer money or give personal data, be sure to investigate the background of anyone or any company with which you may work.

For all accounts, use strong passwords with two-factor authentication. You should also regularly test for viruses. Auto-login settings should be disabled on all your devices to make sure that your accounts are protected from unauthorized access. Protect yourself from phishing by never clicking links in emails from unknown senders, not downloading attachments unless you know what they are, and always double-checking a website's security certificate before entering private information into a website form.

If you want to make sure only trusted people have your finances, ensure that all bank applications are deleted from old devices. Change passwords at least once a month. Track any account changes that could alert an ID thief, such as account closing notifications or unexpected emails asking you for additional information. A variety of passwords is a smart idea for each account. This will prevent any breaches in the other accounts. Finally, invest online using VPNs whenever possible. They are usually free and simple to set up.