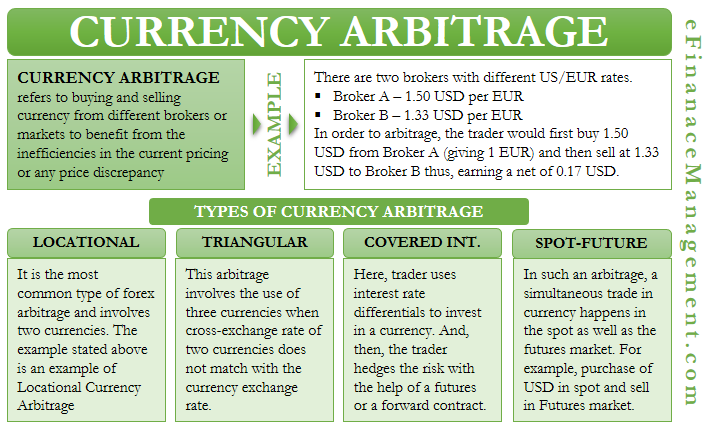

Currency arbitrage can be described as buying or selling undervalued currency in order to make money. Demand and supply determine the exchange rate of any currency. If there is more demand than supply for a currency, it will be worth more. The same goes for the supply of the same currency. Its value will decline if it is less than its demand.

An overvalued currency can be sold and a comparable amount of another currency acquired. If they have equal currencies, their prices will be equal. Triangular arbitrage allows for this.

Triangular arbitrage occurs when three or more currencies are traded simultaneously. This increases market inefficiencies. A trader might buy one dollar and sell one euro. Then, he may purchase a yen. He will profit from the spread between the two currencies as well as the difference between the two quotes.

Traders use brokers or market makers to perform this type arbitrage. These market makers and brokers will make a bid for the currency pair and then fix a price. This information can be used to buy and sell currency.

Interest rate arbitrage, another form of currency arbitrage, is also possible. A common way to trade arbitrage on the currency market is to invest in one country's rate and then convert that interest into the country's currency.

This method of trading was created to protect against exchange risk. But it can be risky if the currencies are too volatile. Additionally, losses can be hard to recover from. Since there is no guarantee of success, a trader must be careful not to place too much trust in his broker.

Another method of trading arbitrage is to short one currency against another. You can shorten one currency to take advantage of the spreads offered in brokers. Alternatively, a trader can take the opposite tack and invest in a country's currency with the intention of reducing its value.

This is the traditional way to arbitrage currency. This can also be done over the counter. There are many kinds of marketmakers that offer services for all major currencies. You need to be competitive when looking for a broker or market maker in this crowded marketplace.

While this form of trading can be profitable, there are many risks involved. Investors may be subject to default risk by their counterparts. Also, the currency market is often volatile and unpredictable. Traders should ensure that their trading accounts are flexible enough to meet all of their needs.

A cash and carry strategy is another method for trading arbitrage. By buying and selling an asset on the same day, traders can take advantage of mispricing and other trading opportunities. Cash and carry can either be done on the spot or futures market.

FAQ

Most Frequently Asked Questions

Which are the 4 types that you should invest in?

Investing is a way for you to grow your money and possibly make more long-term. There are four major categories: stocks (bonds), mutual funds (mutual funds), and cash equivalents.

Stocks can be broken down into common stock or preferred stock. Common stock gives you the opportunity to vote at shareholder meetings, and earn dividends. The preferred stock gives you ownership rights, but no voting privileges. Investors also have the option to receive fixed dividend payments.

Bonds are loans that investors make to governments or companies in return for interest payments. They expire at the maturity date and can be repaid with interest payments. While bonds have a greater stability and less risk than stocks stocks, their returns are often lower than stocks.

Mutual funds allow investors to pool their money together to spread investment risk, diversify their investments, and diversify across a variety of securities such as stocks, bonds, or commodities. Professional managers manage mutual fund investments. They use their knowledge to choose profitable investments that meet pre-set criteria.

Cash equivalents include products such as Treasury bills, money market deposits, certificates of deposit (CDs), and commercial paper which often mature within one year or less during which time they carry minimal risks of default or downturns in their value. This type of investing is best for conservative investors who aren't willing to take high-risk but still want a higher return than depositing money in low-interest bank accounts.

Forex traders can make money

Yes, forex traders are able to make money. While it is possible to achieve success in the short-term, long-term profits typically come from dedication and a willingness to learn. More traders who are able to understand the market and can analyze technical issues will be successful than those who rely on luck or guesswork.

Forex trading is not an easy task, but it can be done with the right knowledge. It is crucial to find an educated mentor before you take on real capital.

Many traders fail because of lack of a systematic plan or approach. However with discipline, one can increase their chances of making profit in the foreign currency (forex) markets.

Experienced forex traders develop trading plans that they stick to when trading in order to reduce their risk exposure as much as possible while still finding profitable opportunities. It is important to manage risk. Many new traders are too eager to make quick profits and not have a long-term strategy.

Forex traders can increase their long-term profitability by keeping detailed records, studying past trades as well as payments and understanding platforms that facilitate currency trading.

Having discipline really pays off in forex trading: developing rules such as how much money you're willing to lose on each trade helps minimize losses and ensure success; additionally strategies like leveraging entry signals often help increase profits beyond what could be achieved without guidance from an experienced mentor.

However, regardless of whether you are investing your own capital or managing funds on behalf of someone else, persistence and learning from successful day traders are essential to being a profitable trader in forex markets.

Is Cryptocurrency Good for Investment?

It's complicated. Cryptocurrency has become increasingly popular over the past few years, but whether or not it will be a successful investment depends on numerous factors. There is always risk in investing in cryptocurrency markets. They are volatile and unpredictable.

You can also make a profit if your risk is taken and you do your research.

Cryptocurrency investments can also offer portfolio diversification benefits since these assets tend to move independently of traditional stock markets.

It all comes down ultimately to an individual's risk tolerance and knowledge of the crypto market. If you can make an educated decision on this asset class and are comfortable taking risks, then investing in cryptocurrency is worth your consideration.

How can I invest in Bitcoin?

It can be difficult to invest in Bitcoin. But it isn't as hard as you think. All you need are the right tools and knowledge to get started.

First, you need to know that there are many ways to invest. To get exposure to Bitcoin, you can buy it directly, use an exchange or use a financial instrument, known as a derivatives agreement.

It is also important to choose where your bitcoin will be stored. There are many options, including wallets, exchanges and custodians. Some options may be better suited than others depending on your risk tolerance and goals.

Next, find any additional information that may be necessary to make confident investment decisions. It is important to be familiar with the basics of cryptocurrency and how they function before you begin investing. With that said, make sure you keep track of market news and developments so you can stay up-to-date with crypto trends.

Finally, create a plan for investing in Bitcoin based on your level of experience and set reasonable expectations for returns - this will give you a better chance at success long-term too!

Where can you invest and make daily income?

Although investing can be a great investment, it's important that you know your options. There are many options.

You can also invest in real estate. Investing in property may provide steady returns and long-term appreciation. It also offers tax benefits. Diversifying your portfolio might be a good idea.

If you are looking for daily income and short-term profits, then you should consider investing in stocks that pay dividends. If you are comfortable with the risk, you can trade online using day trading strategies.

No matter your investment goals, it is important that you do thorough research on each type and investment before making any major decisions. Every asset comes with its own risks. So that you can maximize your earnings, and achieve your financial goals, you must closely monitor all investments.

Which is more secure, forex or crypto?

Two types of high-risk investments, cryptocurrency trading and forex trading, are highly risky and can bring you great rewards but also huge risks.

Crypto, short for cryptocurrency, is a digital currency created from a piece of code through blockchain technology. It can trade on exchanges just like any money, and has been the subject speculative investment because of its drastic price swings.

Forex, also known as foreign exchange currency trade, is high-leveraged investment that involves participants speculating on the value and relative strength of one currency. Forex, which can be unstable and cause large losses if not managed well, is an investment that should not be taken lightly.

Both Forex and Crypto both have their benefits and drawbacks. However, Crypto has a higher risk of losing money than Forex. Because of the limited supply and regulations around cryptocurrencies, prices can fluctuate. But forex markets move more consistently so investors have more control. The decision about which of Cryptocurrency or Forex is more secure will be based on the individual's risk appetite and their previous experience with each investment option.

Statistics

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

Should I store my investment assets online or do I have other options?

Although money can seem complicated, it is also difficult to make the right decisions about where and how to store it. A strong security system is essential for your valuable assets. There are several options.

Online storage of your investment assets allows you to access them from anywhere and can be accessed quickly and easily. However, electronic breaches can occur and there are potential risks when you use a digital option.

A physical form of money like cash or gold can be safer, but it's more difficult to track and requires higher levels of protection and storage.

You can also keep your investments in traditional bank or investing accounts. There are also self-storage options that allow you safe storage of gold, silver, and other valuables, outside your home.

You might also consider looking into specialist investment firms that provide secure custody services, specifically tailored to protect large asset portfolios.

It is ultimately your decision. What will work best for you, and provide the security and safety that you require to protect your investments.