Currency arbitrage is buying and selling undervalued or overvalued currencies to make a profit. The demand and supply factors determine the currency exchange rate. The currency's value will rise if the demand is greater than its supply. Similar to the above, if there is less demand than supply for the same currency, its value will drop.

Overvaluation of a currency means that it is sold and the equivalent amount of another currency purchased. In contrast, if the value of the two currencies is equal, the prices will be equalized. Triangular arbitrage allows for this.

Triangular arbitrage happens when more than one currency trades simultaneously. It increases market inefficiencies. One trader could buy one dollar, then sell one euro and then purchase a Japanese yen. He will profit from the spread between the two currencies as well as the difference between the two quotes.

Traders will need a broker, or market maker, to execute this type of arbitrage. These brokers or marketmakers will place bids for the currency pair before setting a price. A trader can then use this information to purchase and then sell the currency.

Interest rate arbitrage is another type of currency arbitrage. A popular way to trade arbitrage in currency markets is to invest at one country's exchange rate and then convert it into the other country’s currency.

This is a way to hedge against foreign exchange risk. If the currencies involved are volatile, this can make it a risky venture. It can also be very difficult to recover from losses. Traders should not place too much faith in their broker as there is no guarantee that they will succeed.

Shorting one currency against the other is another method of trading arbitrage. By shorting a currency, you can take advantage of spread differences offered by brokers. Or, traders can choose to invest in the currency of another country in order to decrease its value.

Traditional currency arbitrage involves buying and selling currency through a broker. It is possible to also buy and sell currency over the counter. There are many types of market makers that can cater to all major currencies. With a lot of competition, it is important to find a broker or market maker that can offer competitive rates.

Although trading this way can be very profitable, there are still risks. Investors are exposed to counterparty default risk. The currency market can be volatile and unpredictable. Traders should only open a trading account that allows them to adjust their requirements.

You can also trade arbitrage by using a cash and carry strategy. By buying and selling an asset on the same day, traders can take advantage of mispricing and other trading opportunities. Cash and carry can be done in the spot or futures markets.

FAQ

Most Frequently Asked Questions

What are the four types of investing?

Investing can be a great way to build your finances and earn long-term income. There are four major categories: stocks (bonds), mutual funds (mutual funds), and cash equivalents.

There are two types of stock: preferred stock and common stock. Common stock gives you the opportunity to vote at shareholder meetings, and earn dividends. A preferred stock, however, gives an individual ownership right but without voting privileges. It also offers fixed dividend payments which provide investors with a steady income stream.

Bonds can be loans made by investors to governments or companies for interest payments. Bonds offer greater stability and lower risk than stock, but they have higher returns than stocks.

Mutual funds are a way to pool investor money in order spread risk and diversify investments across many types of securities, including stocks, bonds and commodities. Professional managers manage mutual funds. They use their experience to choose profitable investments based on pre-determined criteria, such as risk level or expected return rate.

The cash equivalents can be products such as Treasury bills and money market deposits, CDs, and commercial paper. These products usually mature within one to three years, which means they are less susceptible to default or declines in value. This type of investing is best for conservative investors who aren't willing to take high-risk but still want a higher return than depositing money in low-interest bank accounts.

Is Cryptocurrency a Good Investment?

It's complicated. It's complicated. Although cryptocurrency has gained popularity over the last few years, it depends on many factors as to whether it will prove to be a profitable investment. There is always risk in investing in cryptocurrency markets. They are volatile and unpredictable.

On the other hand, if you're willing to take that risk and do your research, there are potential gains to be made based on events like Initial Coin Offerings (ICOs) and shifts in the marketplace.

The potential for portfolio diversification is also possible through cryptocurrency investments, as these assets can move independently from traditional stock exchanges.

It really boils down to each individual's tolerance for risk and knowledge about the crypto market. If you're able to make informed decisions and are open to taking risks, then investing is definitely something worth considering.

Where can i invest and earn daily?

While investing can be a great way of making money, it is important to understand your options. There are many other investment options available.

One option is to buy real estate. Property investments can yield steady returns, long-term appreciation, and tax benefits. It is possible to diversify your portfolio with ETFs mutual funds, bonds, and specialty fields like cryptocurrency.

If you're looking for shorter-term profits or daily income, you could try investing in stocks that pay dividends or look into peer-to-peer lending platforms where you lend out money and receive interest payments directly from borrowers on a daily basis. If you are comfortable with the risk, you can trade online using day trading strategies.

No matter your investment goals, it is important that you do thorough research on each type and investment before making any major decisions. Every asset comes with its own risks. You must keep an eye on your investments, recognize when you should buy or sell them so that you can maximize your earnings while working towards your financial goals.

How can I invest bitcoin?

Although it may seem difficult to invest in Bitcoin, it is not as complicated as you might think. All you need are the right tools and knowledge to get started.

You need to be aware that there are many investment options. You can purchase Bitcoin directly, use an exchange to trade, or use a financial instrument known as a derivatives contract to gain exposure.

You will also have to decide where to store your bitcoin. There are many options such as exchanges, wallets, custodians and cold storage. Depending on your risk appetite, goals, and other factors, certain options might be more appropriate than others.

Next, find any additional information that may be necessary to make confident investment decisions. It is essential to understand the basics of cryptocurrency and their workings before you dive in. Keep an eye on market developments and news to stay current with crypto trends.

Finally, create a plan for investing in Bitcoin based on your level of experience and set reasonable expectations for returns - this will give you a better chance at success long-term too!

Which is harder, forex or crypto.

Each currency and crypto are different in their difficulty and complexity. The new blockchain technology makes crypto a little more complicated in terms of fundamental understanding. On the other hand, forex has been around for a long time and has a reliable trading infrastructure supporting it.

Trading cryptocurrency is more risky than forex. It's because the crypto markets can change in an unpredictable way over short time periods. You can gain an advantage over your competitors by researching historical trends in the markets in which it trades.

Forex traders need a good understanding of the dynamics between foreign currencies pairs. For instance, they must be able to see how prices respond to news. A good understanding of technical indicators is essential to identify buy and sell signals. Leverage is another factor that must be taken into account, as traders risk not only their capital but also additional borrowed funds when trading currency pairs with significant volatility.

Overall, both forex and crypto require attentiveness, solid research skills, and a clear strategy to make successful trades consistently.

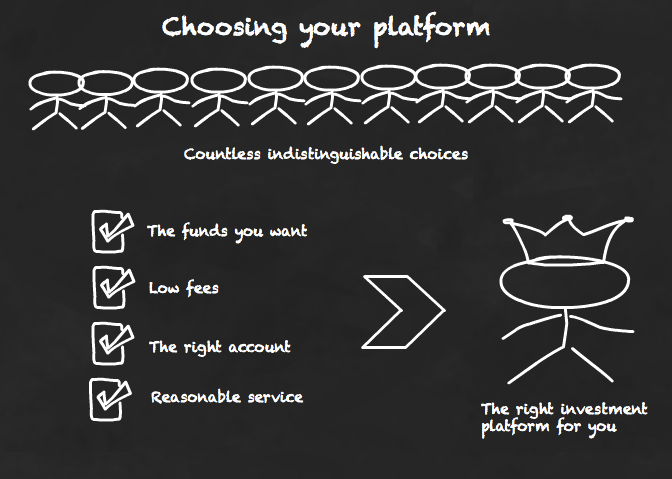

Which trading site for beginners is the best?

All depends on your comfort level with online trades. It is a great idea to start with an established broker that has experienced advisors, if you are new to online trading.

These brokers can take the guesswork and help you build your portfolio by making solid recommendations. Plus, most offer interactive tools to demonstrate how trades work without risking real money.

Many sites allow you to trade alone if you have some knowledge or want more control over your investments. They offer customized trading platforms, live feeds of data, and research tools such as real-time analyses to help you make well-informed choices.

No matter what route you choose to take, it is important that you read reviews from customers before making any commitments. They will provide insight into how each site treats customers and give you an idea of the overall experience.

Statistics

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

External Links

How To

Is it safe to store my investment assets online, or should I consider other options?

Although money can seem complicated, it is also difficult to make the right decisions about where and how to store it. You have several options when it comes to protecting your valuable assets.

Online storage allows for easy access from any device. You can also keep an eye on your investments quickly and easily. However, electronic breaches can occur and there are potential risks when you use a digital option.

A physical form of money like cash or gold can be safer, but it's more difficult to track and requires higher levels of protection and storage.

You have other options, such as traditional banking accounts or investing accounts, as well as self storage facilities that allow for safe storage of precious metals and other valuables.

Finally, consider looking at specialized investment companies that provide secure custody services designed specifically for large asset portfolios.

Your decision is final. Which one works best for your needs and offers the security and safety you need to protect your investments?