Equity can be defined as the sum of money and property owned by an individual, or a business entity. It is often measured by the market value of the company. The equity value can fluctuate over the course of a trading day. Investors have the option to use equity capital to invest in growth capital. Investors could make a profit from equity investments if the company expands. There are other financial situations where equity could be used.

Equity can be defined depending on context as either a percentage of ownership or an investment. Equity can be represented as stocks, property or other assets. To calculate equity, subtract liabilities from the assets. When a business owner has a positive balance, this means that the owner's assets exceed the amount of debt. This can be a great way for a business to grow.

Shareholders’ equity refers the percentage of a company's worth that is held by shareholders. Example: A sister and brother may own 50% of a bakery. To start their own business, they each took out loans. Now, their business has a market value of roughly $800,000. Their total assets are approximately $120,000. Their shares can be sold for $25,000 each using this number.

An investor can also use equity for the acquisition of another company. A company whose book value exceeds its equity market value is generally considered a great buy. While equity can be difficult to value, investors may have it valued in order to determine its market worth. Buying and selling a company's ownership rights can help businesses raise the capital they need to succeed.

Another way to measure equity in a business is using the accounting equation. Equity is calculated by adding the net earnings of a business and subtracting the liabilities. Retained earnings are an important factor when calculating shareholder equity. The company that reinvests profits in its operations will see a rise in retained earnings. Eventually, these accumulated earnings surpass the amount of equity in the business. These earnings become stockholder equity.

Ownership equity is the last claim against a business's assets. When a business is liquidated, ownership equity refers to the remaining money. Sometimes referred to as risk capital, this is the last claim against a business's property. It can be difficult to increase this amount. It is possible to increase ownership equity by increasing the number of shares. This can increase ownership equity, but it can also cost more.

Regardless of how the business owner measures the equity of a company, there are many factors that can affect the value of a company. It is important to determine the equity value of a company by assessing its book value, projected growth and corporate stage. Also, if the company is thinly traded, its equity can experience a significant shift in value.

Equity can also be used to determine the value of one piece of equipment or an entire company. Equity can also be used for measuring inventory value, the value a single stock issued to a company, and any other assets.

FAQ

Frequently Asked questions

What are the different types of investing you can do?

Investing is a way to grow your finances while potentially earning money over the long term. There are four major types of investment: stocks, bonds mutual funds, cash equivalents, and stock.

There are two kinds of stock: common stock and preferred stocks. A common stock gives an individual ownership right of a company, including voting rights at shareholders' meetings and the potential to earn dividends. While preferred stock does not grant voting rights, it gives owners ownership rights and fixed dividend payments. This provides investors with an income stream that is reliable.

Bonds are loans by investors that are made to governments or businesses in exchange for interest payments. Although bonds are more stable and less risky than stocks they offer a higher return than stocks.

Mutual funds are a way to pool investor money in order spread risk and diversify investments across many types of securities, including stocks, bonds and commodities. Professional managers oversee mutual funds and use their expertise to pick profitable investments that fit pre-set criteria. These include risk tolerance or potential return.

There are many cash alternatives, including Treasury bills, money markets deposits, certificates-of-deposit (CDs) and commercial papers. These products often mature in one year, so they have very little risk of being defaulted on or losing value. This type investment is best suited for conservative investors who don’t want to take too many risks, but still want a bit more return than depositing in traditional low-interest bank funds.

Trading forex or Cryptocurrencies can make you rich.

Yes, you can get rich trading crypto and forex if you use a strategic approach. To really make money in either of these markets, you need to stay ahead of the trends and know when the best time to buy and sell is.

Knowing how to spot price patterns can help you predict where the market will go. You should also trade with only the money you have the ability to lose.

It also requires a combination of experience, knowledge, risk-management skills, and discipline in order to be able to develop a profitable strategy for long-term success.

Cryptocurrency prices are often volatile, so the key is to make sure that your entry position fits with your risk appetite and exit plan - meaning that if there becomes an opportunity for profit-taking or limiting losses, then do so.

The cryptocurrency market is largely unregulated and presents substantial risks. Before you sign up for any type of wallet or platform, make sure to research the coins and exchanges.

Forex trading is a complex business that involves forecasting fluctuations in currency exchange rates using technical analysis/fundamental analyses of global economic data. This type of trading requires specialized knowledge. It is therefore essential to have a solid understanding of the factors that affect different currencies.

At the end of the day though, it's all about taking calculated risks, being willing to learn continually, and mastering an effective strategy that works best for you. With enough dedication combined with this knowledge - you could potentially get very rich trading cryptos or forex if done correctly with proper education & research behind it!

How Can I Invest in Bitcoin?

Although investing in Bitcoin may seem complex, it's actually not as difficult as you think. You only need the right information and tools to get started.

The first thing to understand is that there are different ways of investing. To gain exposure, you can either buy Bitcoin directly or trade it on an exchange.

You must also decide where you will store Bitcoin. There is a wide range of options available, including exchanges, custodians, cold storage, wallets and exchanges. There are many options available, but some might be more appropriate than others, depending on what your goals and risk appetite are.

The next step is to research additional information you might need in order to be confident about your investment decisions. Learning the basics of cryptocurrencies and how they work before diving in is important. To stay on top of crypto trends, keep an eye out for market developments and news.

Finally, you should create a plan to invest Bitcoin based in your level of expertise and set reasonable expectations about returns. This will ensure that you have a greater chance of long-term success.

Where can I earn daily and invest my money?

Investing can be a great way to make some money, but it's important to know what your options are. You don't have to put your entire savings into the stock market - there are plenty of other options.

One option is to buy real estate. Property investments can yield steady returns, long-term appreciation, and tax benefits. You may also consider diversifying your portfolio with bonds, ETFs, mutual funds, or specialty fields like cryptocurrency.

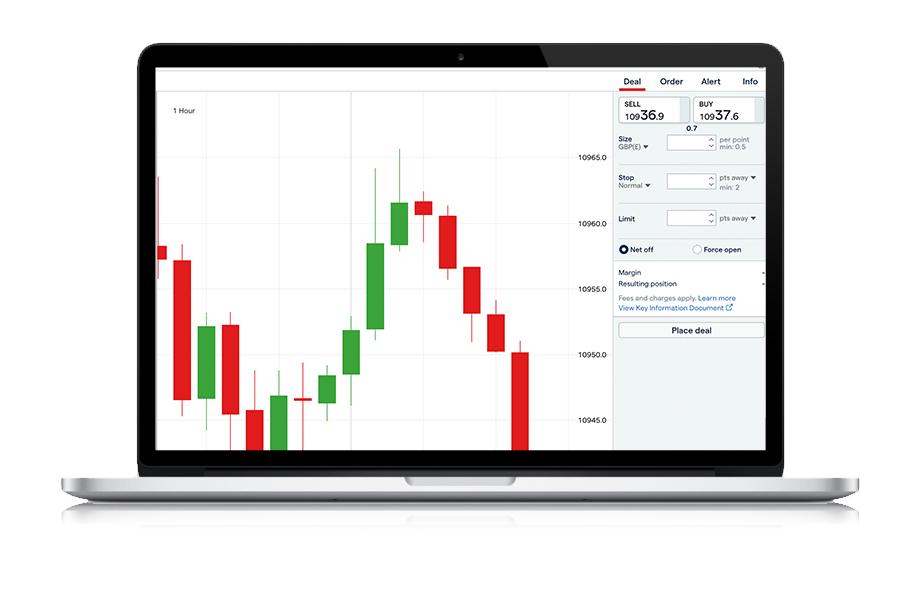

If you are looking for short-term income or daily profits, you might consider investing in dividend-paying stocks. You may also want to look into peer-to–peer lending platforms that allow you borrow money from other borrowers and receive interest payments on a daily basis. If you're comfortable taking the risks, you can also trade online with day trading strategies.

Whatever your investment goals might be, it is crucial to thoroughly research every type of investment before jumping in. Each asset has its risks and rewards. You must keep an eye on your investments, recognize when you should buy or sell them so that you can maximize your earnings while working towards your financial goals.

Which is more safe, crypto or forex

Cryptocurrency and Forex trading are two types of highly risky investments that vary greatly in terms of rewards and risks.

Crypto, which is shorthand for cryptocurrency, refers to a digital currency that was created using code and blockchain technology. It can be traded on exchanges like any other form of money and has been the subject of speculative investments due to its dramatic price swings over time.

Forex (or foreign exchange currency trading) involves highly leveraged investments. Participants speculate on the value one currency relative to another. Forex can pose a risky investment, and can result in significant losses if they are not managed properly.

While both Forex and Crypto have their strengths and weaknesses, Crypto tends to be more risky than Forex. Due to the small number of units and existing regulations around cryptocurrencies, cryptocurrency prices can be unpredictable. Forex markets are more stable so investors have greater control over their investments. The decision about which of Cryptocurrency or Forex is more secure will be based on the individual's risk appetite and their previous experience with each investment option.

What are the pros and cons of investing online?

Online investing has the main advantage of being convenient. Online investing makes it easy to manage your investments from anywhere on the planet with an internet connection. Online investing allows you to have access to real-time market information and place trades without ever leaving your home. Online brokerages are often cheaper than traditional brokerages. This allows investors to get started quickly and with less money.

However, there are some drawbacks to online investing. Online trading can make it difficult to receive personalized guidance and advice, since you don't have access to a financial advisor or broker to assist you with your decisions. Online trading platforms may not offer as much security as traditional brokerages. Therefore, investors should be aware of the risks. Online trading can be more complicated than traditional investing. It is important to learn the markets and create a solid strategy before you start.

When considering investing online, it is also important that you understand the types of investments available. Stocks, bonds, mutual funds, and cash equivalents are all options for investors. Each type of investment carries its own risks and rewards, so it is important to research each option before deciding which one is right for you. There may be restrictions on investments such as minimum deposits or other requirements.

Statistics

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

What are the best ways to avoid investing online scams?

Protection begins with you. To avoid being conned, learn how to recognize scams and understand how fraudsters operate.

Do not fall for sales pitches that sound too good-to-be true or high-pressure tactics promising guaranteed returns. Unsolicited email or phone calls should not be answered. Fraudsters frequently use fake names. Don't trust anyone just because they are a person. Investigate investment opportunities thoroughly and independently, including researching the individual offering them before making any commitments.

Never invest your money in cash, on the spot or by wire transfer. If an offer to pay with these methods of payment is made, you should immediately be suspicious. Keep in mind that fraudsters will try everything to get your personal details. Protect yourself from identity theft by being mindful of different types of online phishing schemes and suspicious links sent via email or online ads.

It's also important to use secure online investment platforms. Look out for sites that are regulated and respected by the Financial Conduct Authority. Secure Socket Layer or SSL encryption is an option that protects your data as it travels via the internet. Before investing, ensure you fully understand all terms and conditions. This includes any fees or charges.