Equity is the term that describes the value of money or property owned or controlled by an individual or entity. It is often measured in terms of the company's value. The equity value a company may change over the course a trading session. Equity can be used by investors to finance growth capital. If the company grows, investors may make a profit on their investment. Equity can also be applied in many other financial scenarios.

Equity can be defined depending on context as either a percentage of ownership or an investment. Stocks, property, and any other assets can represent equity. To calculate equity, subtract the liabilities from the assets. When a business owner has a positive balance, this means that the owner's assets exceed the amount of debt. This can be a great way of growing a company.

The equity of shareholders is the value that they hold in a company. One example is that a brother and sister own half of a bakery. Each took out loans to begin their business. Now, the business has a book value of about $800,000, and they have a total of about $120,000 worth of assets. They can sell their shares at $25,000 each using this figure.

Equity can also be used by investors to buy another company. A company with a greater book value than its equity value is considered a solid buy. Although equity can be hard to gauge, investors can have a valuation done to estimate its market value. The ability to buy and sell ownership rights in a company can help businesses raise capital.

The accounting equation is another common method to measure equity. You add the net earnings from a company to subtract the liabilities to calculate equity. Shareholder equity is calculated using the net earnings of a business and subtracting the liabilities. The company that reinvests profits in its operations will see a rise in retained earnings. These accumulated earnings eventually exceed the company's equity. These earnings are then used to create stockholder equity.

Ownership equity is the last claim against a business's assets. The remaining money is owned equity when a business dissolves. This is sometimes referred to risk capital and it is the last claim on a business's assets. It is not easy to raise this amount. It is possible increase ownership equity simply by increasing the number or shares. This can increase the owner’s ownership percentage but also requires more money.

Whatever the method used by the business owners to determine the equity of their company, there can be many factors that affect its value. It is important to determine the equity value of a company by assessing its book value, projected growth and corporate stage. A company's equity value can be affected by a small trading volume.

Equity can also be used to determine the value of one piece of equipment or an entire company. Equity can be used to determine the value inventory, the market value of stock issued by businesses, and other assets.

FAQ

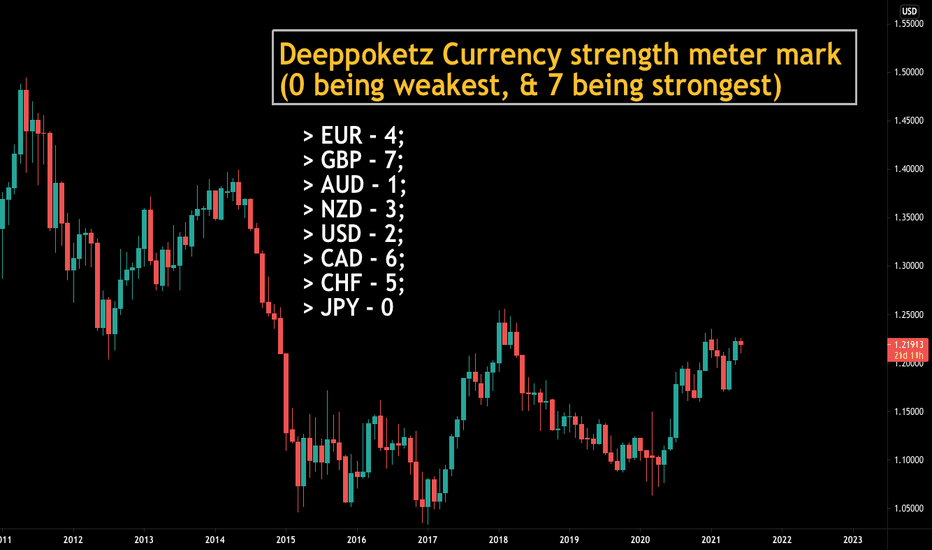

Do forex traders make money?

Forex traders can make a lot of money. While it is possible to achieve success in the short-term, long-term profits typically come from dedication and a willingness to learn. Market fundamentals and technical analysis are better than traders who rely only on luck or guesswork.

It's not easy to trade forex, but it is possible with the right knowledge strategies to produce consistent profits over time. It is essential to find a qualified mentor and learn about risk management before taking on real capital.

Many traders fail due to a lack of a structured plan or approach but with discipline, one can maximize their chances of making money in the foreign exchange (forex) markets.

Experienced forex traders make trading plans that they stick with when trading. This helps them reduce their risk exposure, while still finding profitable opportunities. It is important to manage risk. Many new traders are too eager to make quick profits and not have a long-term strategy.

Forex traders can increase their chance of generating long-term profits by maintaining good records, learning past trades and paying attention to other aspects of trading.

In forex trading, discipline is key. By setting rules about how much you will lose on each trade, you can minimize losses and increase your chances of success. Additionally strategies such as leveraging entry signals can often increase profits.

However, regardless of whether you are investing your own capital or managing funds on behalf of someone else, persistence and learning from successful day traders are essential to being a profitable trader in forex markets.

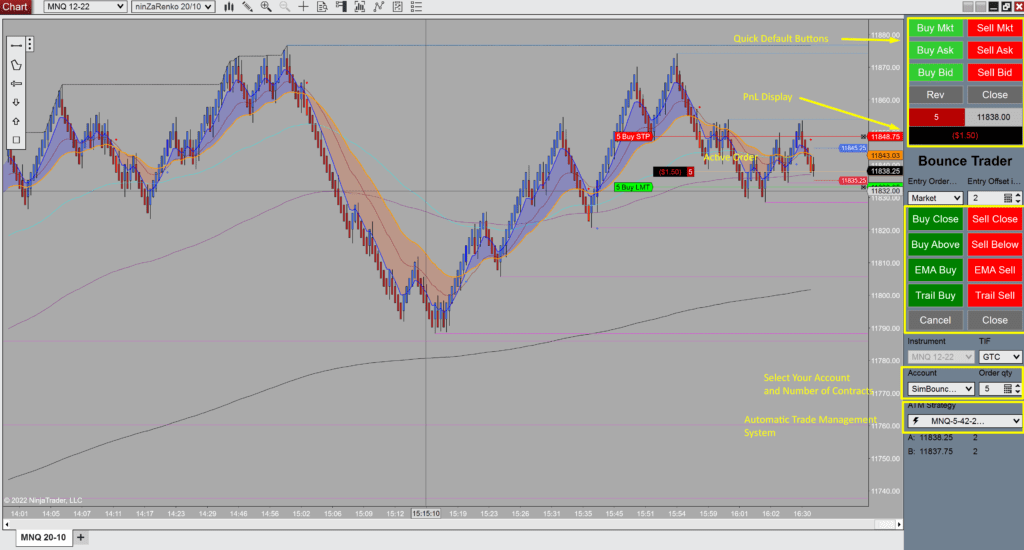

What is the best trading platform for you?

For many traders, choosing the best platform to trade on can be difficult. There are many trading platforms out there, so it can be difficult for traders to choose one that is right for them.

The best trading platforms should provide the features you want, including advanced chart analysis tools, real time market data, and advanced order execution capabilities. It should also have an easy-to-use interface that's intuitive and user-friendly.

You should have access to a range of account types, competitive fees, reliable customer service, and educational resources. Look for platforms that offer demo accounts or free trials so that you can practice with virtual money before risking any of your own cash.

When looking for a trading platform, consider what type of trader or investor you are - whether you're passive or active, how often you plan to trade, and your desired asset class mix. These factors will help you narrow down the search for the right platform.

Once you've identified the platform that's right for you, make sure to look into additional features such as stock screening tools, backtesting capabilities, alert systems, and more. You should also ensure that your chosen platform offers appropriate security protocols to protect your information from theft and breaches.

MetaTrader 4/5 (MT4/MT5) and cTrader are some of the most well-known trading platforms.

Where can I earn daily and invest my money?

However, investing can be an excellent way to make money. It's important to know all of your options. You don't need to invest all of your savings in the stock exchange - there are many other options.

One option is to buy real estate. Investing property can bring steady returns as well as long-term appreciation. Diversifying your portfolio may be an option, such as with ETFs, mutual funds or specialty fields like crypto, bonds, ETFs and mutual funds.

If you are looking for daily income and short-term profits, then you should consider investing in stocks that pay dividends. Online trading is possible if you're comfortable with the risks.

Whatever your investment goals may, it's important that you research all types of investments before investing. Every asset has its own risks. So that you can maximize your earnings, and achieve your financial goals, you must closely monitor all investments.

Is Cryptocurrency a Good Investment?

It's complicated. It's complex. While cryptocurrency has grown in popularity over recent years, the success of an investment depends on many factors. One thing is certain: the cryptocurrency market can be unpredictable and volatile so investing in it will always come with risk.

There are also potential gains if one is willing to risk their investment and do some research.

The potential for portfolio diversification is also possible through cryptocurrency investments, as these assets can move independently from traditional stock exchanges.

The final decision comes down to individual risk tolerance and knowledge regarding the cryptocurrency market. If you have the means to make an informed decision about this asset class and don't mind taking risks, then yes - investing in cryptocurrencies is absolutely worth considering.

Can you make it big trading Forex or Cryptocurrencies?

It is possible to get rich trading forex or crypto. However, you need to use a strategic approach. You need to be aware of the market trends so you can make the most of them.

You will also need to know how to identify patterns in prices, which can help you decide where the market is going. You should also trade with only the money you have the ability to lose.

You will need to have experience, knowledge and skills as well as discipline to create a long-term profitable strategy.

There are many factors that can cause volatility in cryptocurrency prices. Therefore, it is crucial to ensure that your entry position aligns with your risk appetite. Also, make sure you plan for exit if there is an opportunity to profit from the market.

Researching potential cryptocurrency exchanges and coins before signing up is vital, as they are not well-regulated and can pose significant risks.

Additionally, since forex trading involves predicting fluctuations in currency exchange rates through technical analysis/fundamental analysis of global economic data this type of trading needs specialized knowledge acquired over time. Therefore having a robust understanding of the conditions affecting different currencies is imperative.

It is all about taking calculated risk, learning constantly, and finding an effective strategy that works for you. With enough dedication and the right education, you could make a fortune trading forex or cryptos.

Which is harder, forex or crypto.

Different levels of difficulty and complexity exist for forex and crypto. In terms of basic understanding, crypto may be slightly more difficult because it is new and related to blockchain technology. Forex has been around since the beginning and has a solid trading infrastructure.

Forex trading has fewer risks than cryptocurrency trading. Crypto markets move in unpredictable ways and can change quickly. You can gain an advantage over your competitors by researching historical trends in the markets in which it trades.

Forex traders should be able understand the dynamics among foreign exchange pairs. They need to know how prices shift based upon news and macroeconomic events. This also requires an in-depth understanding of technical indicators which can indicate sell or buy signals. Leverage is another factor that must be taken into account, as traders risk not only their capital but also additional borrowed funds when trading currency pairs with significant volatility.

For both crypto and forex, it is important to be alert, do your research well, and have a strategy for making consistent trades.

Statistics

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How can I make sure my online investment account is secure?

Online investment accounts require security. Protecting your assets and data from unwanted intrusion is essential.

First, you want to make sure the platform you're using is secure. Secure platforms should include encryption technology, two factor authentication, and other security features that provide maximum protection against hackers and malicious actors. You should also have a policy that describes how your personal information will be monitored and controlled.

Second, ensure strong passwords are used to gain account access. Also, limit the time you spend logging in to public networks. Avoid clicking on unfamiliar links or downloading software that is not recommended. This could lead to malicious downloadings and compromise of your funds. Finally, review your account activities periodically so that you are aware of any changes or irregularities in order to detect potential threats quickly and take immediate action if necessary.

It's also important to fully understand the terms, conditions and fees associated with your online investment platform. You should be familiar with all fees and restrictions regarding how your account can be used.

Fourth, make sure you do thorough research about the company before investing. Check out user reviews and ratings to get an idea of how the platform works and what other users have experienced. Finally, you should be aware of tax implications for investing online.

These steps will ensure your online investment account is protected against any possible threats.