DappRadar is an app store that allows users to discover and track decentralized applications. It provides a variety of useful functions, including portfolio management, payment options and stake-taking. The company claims it has over 8,000 dapps supported and around four million users.

DappRadar is planning to launch a native cryptocurrency called RADAR. This token, called RADAR, will be based upon the Ethereum blockchain. It will be used as a payment method for the service. In addition, RADAR holders can receive early access to the DappRadar PRO section, which features exclusive analysis and new collections. RADAR holders are eligible to participate in the staking process and receive rewards.

Although RADAR's primary purpose is to reward users with tokens, it will also be used to encourage DappRadar users to make contributions. This includes voting and staking. Moreover, the RADAR holders can help in deciding product decisions.

In order to boost the dapps on the Ethereum network, RADAR can be used as a staker. Likewise, holders of RADAR can vote on initiatives and take part in the DappRadar Community. The token can be used as a governance token by the DappRadar DAO. RADAR will help in enabling the platform to provide better portfolio tools and broaden its coverage.

DappRadar, an open source project, is DappRadar. It has partnered in the LayerZero protocols to make smart contracts work across all chains. Through this protocol, DappRadar can eliminate the need for gas fees on the Ethereum blockchain.

DappRadar recently released a report that shows the total number dapps on its platform has increased 396% since the first quarter 2021. Dapps are also being used daily by over 2.4 million wallets. For this reason, the company believes that the multichain blockchain industry is the future. It aims to create an ecosystem that benefits developers and users.

Currently, the total supply for the RADAR token stands at 10 billion. DappRadar is currently working on a second phase to expand the use of the token. RADAR can also easily be traded over the Web3 network.

DappRadar also offers four utility tokens to its platform. These include Contribute2Earn. Boosts. Portfolio. and Polygon. You can either purchase these services on the Marketplace or through an Airdrop.

DappRadar's newly announced cross-chain token stake mechanism is a breakthrough innovation. It eliminates bridge assets which dramatically reduces stake fees. It ensures a seamless user experience on all chain chains.

DappRadar was a pioneer within the multichain Blockchain sector. DappRadar aims to be the leading platform that allows users to find and analyze decentralized apps. This is why the company is determined to provide the largest app store in the entire world.

DappRadar continues to work on a full-scale dapp shop. Dapps with a strong community can unlock many possibilities and gain more power.

FAQ

Is Cryptocurrency a Good Investing Option?

It's complicated. It's complex. While cryptocurrency has grown in popularity over recent years, the success of an investment depends on many factors. One thing is certain: the cryptocurrency market can be unpredictable and volatile so investing in it will always come with risk.

There are also potential gains if one is willing to risk their investment and do some research.

The advantages of cryptocurrency investments for portfolio diversification are also available, since they tend to be independent from traditional stock markets.

In the end, it really comes down to an individual's personal tolerance for risk and knowledge related to the crypto market. It is definitely worth investing in cryptos if you have the knowledge and ability to make informed decisions regarding this asset class.

Forex and Cryptocurrencies are great investments.

You can make a fortune trading forex and crypto if you take a strategic approach. To really make money in either of these markets, you need to stay ahead of the trends and know when the best time to buy and sell is.

Additionally, you'll need to learn how to recognize patterns in prices. These patterns will assist you in determining where the market is headed. You should also trade with only the money you have the ability to lose.

You will need to have experience, knowledge and skills as well as discipline to create a long-term profitable strategy.

Prices for cryptocurrencies are volatile. The key is to ensure your entry position meets your risk appetite.

The cryptocurrency market is largely unregulated and presents substantial risks. Before you sign up for any type of wallet or platform, make sure to research the coins and exchanges.

Additionally, since forex trading involves predicting fluctuations in currency exchange rates through technical analysis/fundamental analysis of global economic data this type of trading needs specialized knowledge acquired over time. Therefore having a robust understanding of the conditions affecting different currencies is imperative.

It's about taking calculated risks and being open to learning. The most important thing is to find the best strategy for you. If you put in enough effort and have the right education, you can potentially make a lot of money trading forex or cryptos.

Which is more difficult, forex or crypto?

Crypto and forex have their own unique levels of difficulty and complexity. Crypto is more complex because it is newer and related to blockchain technology. Forex has been around since the beginning and has a solid trading infrastructure.

Trading cryptocurrency is more risky than forex. It's because the crypto markets can change in an unpredictable way over short time periods. If you want to succeed in crypto trading, researching the historical trends in the markets where it trades can give you an edge over your competition.

Forex traders need to be able to comprehend the dynamics between foreign currency pairs. For example, how prices react to news. It also requires an acute understanding of technical indicators that can indicate buy or sell signals. Another important aspect to consider is leverage. Traders are exposed to additional risk when trading currency pairs with high volatility.

For both crypto and forex, it is important to be alert, do your research well, and have a strategy for making consistent trades.

Which trading website is best for beginners

Your level of experience with online trading will determine your ability to trade. It's a good idea to begin with an experienced broker who has expert advisors if you are completely new to online trading.

These brokers take the guesswork out of choosing companies and give solid recommendations that can help you build a portfolio steadily over time. Plus, most offer interactive tools to demonstrate how trades work without risking real money.

Many sites allow you to trade alone if you have some knowledge or want more control over your investments. These sites offer customizable trading platforms, live data feeds, research resources, and real-time analytics for well-informed decisions.

No matter which route you choose, be sure to read customer reviews before you make a decision. This will give you an insight into the service and experience of each site.

Which is best forex trading or crypto trading?

Both crypto trading and forex have potential for profit, but which one is right for you depends on your investment goals.

Forex trading involves investing in different currencies and is an accessible option for beginners. This requires a smaller initial capital, and forex markets can be accessed 24/7 around the world.

However, crypto trading can offer a very immediate return due to the volatility of prices. Also, crypto trades can be cashed out quickly due to their liquidity.

In both cases it's crucial to do your research before making any investment. Any type of trading can be managed by diversifying your assets.

It is important to know the types of trading strategies you can use for each type. For example, forex traders may use technical analysis or fundamental analysis to help them make decisions, while crypto traders may use arbitrage or margin trading to maximize their profits. Automated trading platforms or bots are also available to assist traders in managing their investments. Before you invest, make sure to understand the risks associated with each strategy.

Where can I find ways to earn daily, and invest?

While investing can be a great way of making money, it is important to understand your options. There are other ways to make money than investing in the stock market.

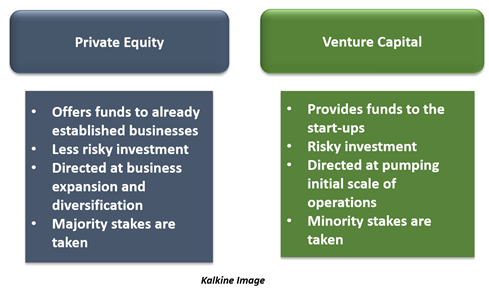

One option is to buy real estate. Investing property can bring steady returns as well as long-term appreciation. You may also consider diversifying your portfolio with bonds, ETFs, mutual funds, or specialty fields like cryptocurrency.

If you are looking for short-term income or daily profits, you might consider investing in dividend-paying stocks. You may also want to look into peer-to–peer lending platforms that allow you borrow money from other borrowers and receive interest payments on a daily basis. If you are comfortable with the risk, you can trade online using day trading strategies.

Whatever your investment goals may, it's important that you research all types of investments before investing. Every asset has its own risks. To maximize your earnings and help you reach your financial goals, make sure to closely track any investments.

Statistics

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

External Links

How To

What are the best options for storing my investment assets online?

While money can be confusing, the decision to where it should be stored can be just as complex. There are many options to protect your valuable assets.

You can easily access your investment assets online from any device. It also makes it easy to keep track of them quickly and easily. There are some risks associated with using a digital option as electronic breaches could occur.

You could also choose to store your money in physical currency like gold or cash. This is less secure but more manageable and requires more storage and protection.

You have other options, such as traditional banking accounts or investing accounts, as well as self storage facilities that allow for safe storage of precious metals and other valuables.

Finally, you might consider investing in specialized firms that offer safe custody services specifically designed to protect large portfolios of assets.

It is ultimately your decision. What will work best for you, and provide the security and safety that you require to protect your investments.