Commodity Market Analysis is the process of studying the price of commodities to forecast future price movements. Both technical and fundamental techniques can be used to perform this analysis. For commodity trading to succeed, traders must have the right tools.

Fundamental analysis

This market analysis is based upon the concept of supply/demand for a specific commodity. The supply of a commodity is affected by weather conditions, production regulations as well as new supply lines. This is not an easy task, but many traders have been successful in the commodity market using this method.

Technical analysis

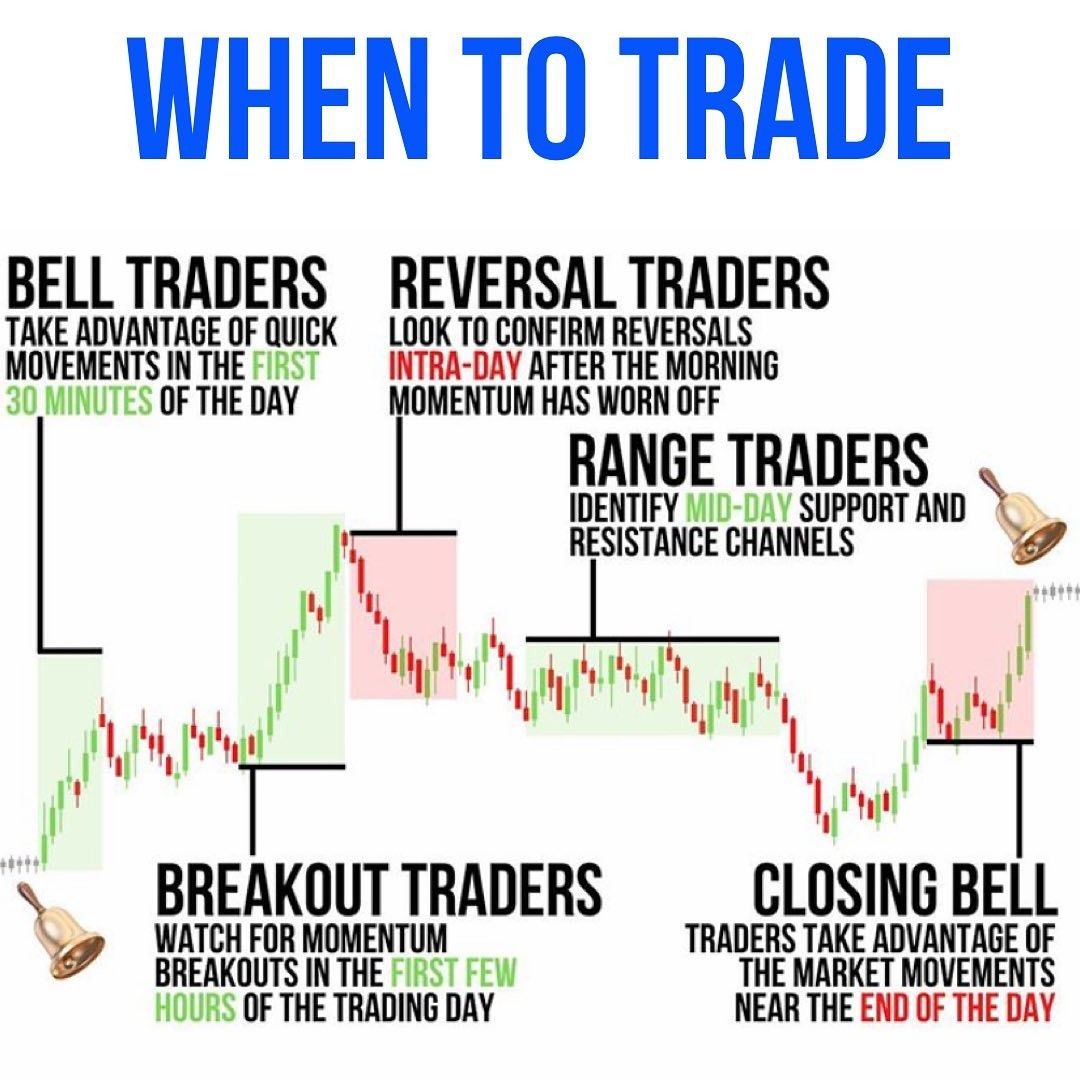

The technical analysis approach to commodity market is based on the assumption that prices move in clearly defined patterns and trends that can repeat over time. Traders have many technical indicators that they can use in commodity markets. It is important to select the one that best suits your trading style.

Stochastics or the RSI indicator are widely used in commodity markets analysis. These indicators can be used as indicators to measure the overbought/oversold levels of price. They can also be used depending on market direction to confirm buy/sell signals.

Using technical analysis in commodity trading is very important and can be a great way to make profits, but it is essential that you know how to interpret the data and how to use it effectively. This is especially important if you want to trade for long periods of time, such as monthly or weekly futures.

The key to understanding the market is to make a decision on entering or leaving the market. This is a critical aspect of any strategy that is built on technical analysis. While it may seem difficult to master this skill, it is possible to improve your skills.

The difference between a basic and technical approach is that a trader who looks at the future will be more successful than one who looks back on the past. This means that a fundamental analyst must be knowledgeable about the current state of the market while a technical trader can use the information from past markets to determine the future.

FAQ

How Can I Invest in Bitcoin?

Although investing in Bitcoin may seem complex, it's actually not as difficult as you think. All you need are the right tools and knowledge to get started.

There are many options for investing. You can purchase Bitcoin directly, use an exchange to trade, or use a financial instrument known as a derivatives contract to gain exposure.

You also need to decide where to store Bitcoin. There are many choices, such as cold storage, exchanges or custodians. Depending on your risk appetite and goals, some options might be more suitable than others.

Next, you should research any additional information necessary to feel confident in your investment decisions. It is crucial to know the basics about cryptocurrencies and how they work before investing. You should also keep up to date with market news and developments in order to stay abreast of the latest crypto trends.

Finally, you should create a plan to invest Bitcoin based in your level of expertise and set reasonable expectations about returns. This will ensure that you have a greater chance of long-term success.

Which trading site for beginners is the best?

It all depends on your level of comfort with online trading. You can start by going through an experienced broker with advisors if this is your first time.

They take the guesswork out when it comes to choosing companies and make solid recommendations that will help you build a steady portfolio over time. Most brokers also offer interactive tools to show how trades work and help you avoid losing real money.

There are many sites that let you trade on your own if you have some knowledge and want to take more control of your investments. These sites offer customizable trading platforms, live data feeds, research resources, and real-time analytics for well-informed decisions.

You can find customer reviews on any route, no matter what. These will give insight into the experience and level of service at each site before you commit.

Which is safe crypto or forex?

Cryptocurrency and Forex trading are two types of highly risky investments that vary greatly in terms of rewards and risks.

Crypto, short for cryptocurrency or digital currency, is a digital coin that was created by a piece code using blockchain technology. It can trade on exchanges just like any money, and has been the subject speculative investment because of its drastic price swings.

Forex trading or foreign currency currency trading is a highly leveraged investment in which participants speculate about the value of one currency relative to another. Forex can be a volatile investment and could cause significant losses if it's not managed correctly.

Both Forex and Crypto both have their benefits and drawbacks. However, Crypto has a higher risk of losing money than Forex. The limited supply of cryptocurrencies and the regulations that surround them around the globe make their prices unpredictable. However, forex markets are more steady so investors can have more control over what they invest. When deciding which option between Cryptocurrency and Forex is safer, it will depend on your risk appetite and experience with each investment option.

Which is harder forex or crypto?

Different levels of difficulty and complexity exist for forex and crypto. In terms of basic understanding, crypto may be slightly more difficult because it is new and related to blockchain technology. Forex has been around since the beginning and has a solid trading infrastructure.

Forex trading has fewer risks than cryptocurrency trading. Crypto markets move in unpredictable ways and can change quickly. Researching the historical trends of the crypto markets can help you gain an edge on your competition if you are looking to trade in cryptocurrency.

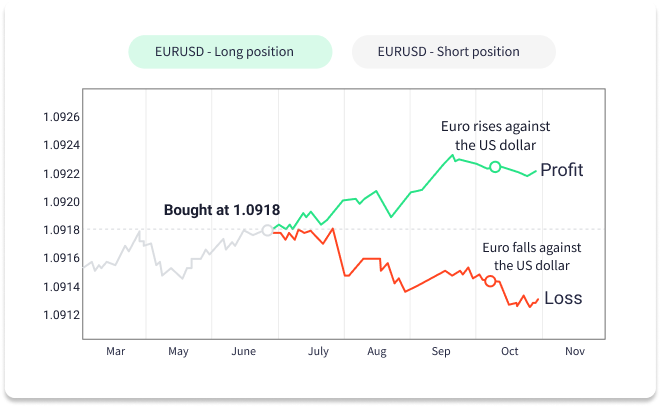

Forex traders must understand the dynamics of foreign exchange pairs. This includes how prices change based on news events. You also need to be able to read and understand technical indicators, which can signal buy or sell signals. Leverage is also an important factor to be considered, since traders can risk their capital as well as additional borrowed funds when trading currency pairs of high volatility.

For both crypto and forex, it is important to be alert, do your research well, and have a strategy for making consistent trades.

Is Cryptocurrency a Good Investment?

It's complicated. It's complex. While cryptocurrency has grown in popularity over recent years, the success of an investment depends on many factors. The cryptocurrency market is volatile and unpredictable, so investors must be aware of the risks.

However, if you are willing to take that risk, and do your research, then there may be potential benefits based on events such as Initial Coin Offerings (ICOs), and shifts in market.

Because cryptocurrency assets move independently from traditional stock markets, portfolio diversification can also be possible with cryptocurrency investments.

It really boils down to each individual's tolerance for risk and knowledge about the crypto market. If you have the means to make an informed decision about this asset class and don't mind taking risks, then yes - investing in cryptocurrencies is absolutely worth considering.

What are the disadvantages and advantages of online investing?

Online investing has one major advantage: convenience. Online investing makes it easy to manage your investments from anywhere on the planet with an internet connection. Online trading allows you to access market data in real time and trades from anywhere. Online brokerages are often cheaper than traditional brokerages. This allows investors to get started quickly and with less money.

Online investing has its limitations. Online investing can lead to difficulties in getting personalized advice and guidance. You don't have the support of a financial advisor, broker, or physical broker. Online trading platforms might not provide the same level security as traditional brokerages. Investors need to be aware about the potential risks. Finally, online trading can be more complex than conventional investing, so it's essential to understand the markets and develop a sound strategy before getting started.

When considering investing online, it is also important that you understand the types of investments available. Investors have many options. They can choose from stocks, bonds, mutual funds and cash equivalents. Each investment comes with its own risks. You should research all options before you decide on the right one. There might be restrictions or a minimum deposit required for certain investments.

Statistics

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How can I ensure security for my online investment accounts?

Safety is a must when it comes to online investment accounts. It is crucial to safeguard your data and assets against unwelcome intrusions.

First, make sure that your platform is secure. You should look for two-factor authentication and encryption technology to ensure maximum protection against hackers or other malicious actors. There should also be a policy that outlines how any personal information you have shared with them will be regulated and monitored.

Second, ensure strong passwords are used to gain account access. Also, limit the time you spend logging in to public networks. Avoid clicking suspicious links or downloading unfamiliar software--these can lead to malicious downloads and ultimate compromises of your funds. Check your account activities regularly to be alert of any unusual activity.

It's also important to fully understand the terms, conditions and fees associated with your online investment platform. You should be familiar with all fees and restrictions regarding how your account can be used.

Fourth, ensure you research the company that you are considering investing in and make sure they have a track record of providing excellent customer service. You can read user reviews and ratings about the platform to see how it works and what users have said about it. Make sure to understand the tax implications of investing online.

These steps will help you ensure that your online investments account is safe and secure from any possible threats.