Cnet stocks or ecommerce stock are a great option to invest in an expanding online retail market. They are a popular choice for day traders because of their potential for volatility, but long-term investors also can turn a profit with these stocks as they have the opportunity to rise over time.

It doesn’t matter if the goal is to build an investment portfolio or to just learn about the ecommerce sector, it is important to be aware of what you are getting into. There are many types of stocks in e-commerce that investors have access to.

Composerve is the first e-commerce stock you should consider investing in. This company offers software and services that help businesses build a website. The platform is completely free and offers a range of services that will help businesses grow their online presence.

Another stock to consider is global-e. This company develops cross-border software that allows online retailers to reach more users worldwide. Its platform uses big data, localization, and cross-border experiences to increase sales.

This e-commerce stock is up nearly 40% over the past year, even as its peers have been hit by the market's selloff. Wall Street analysts rate the company as a "Strong buy" and they continue to witness strong revenue growth.

Roblox is a virtual gaming world that is beloved by tens of millions of children around the globe. It's a prominent name in the metaverse industry, an emerging space in which companies seek to take advantage of the potential of augmented or virtual reality technology.

The best way to find out if Roblox is a good investment for you is to check its financials. You can do this by comparing the company's earnings, revenues, and other key metrics with its peers in the gaming industry.

Additionally, you can view the company’s success story and learn more about its current CEO. To see how it ranks against other companies in the same industry, you can also view its competitors.

CompuServe is a global technology services provider that provides a wide range of services to businesses. Its services include cloud computing and digital marketing. The company also has a number of other services that can help you grow your business and become more successful.

Investing in these types of stocks is risky, so you should only do so with money you can afford to lose. It is also crucial to conduct your own research and find a trustworthy broker.

To find the best broker for your needs, compare fees and asset types of brokers to see which one suits you. A good idea is to regularly review your trading accounts to determine how it is performing.

There are many opportunities for growth in the ecommerce market. Many of the largest players are still growing. Investors have been reducing their exposure to ecommerce companies with high growth in recent months due inflation and higher rates. There are still some bargains in this fast growing space.

FAQ

Do forex traders make money?

Yes, forex traders can earn money. It is possible to succeed in the short-term but long-term success usually comes from hard work and willingness to learn. Market fundamentals and technical analysis are better than traders who rely only on luck or guesswork.

It's not easy to trade forex, but it is possible with the right knowledge strategies to produce consistent profits over time. It is crucial to find an educated mentor before you take on real capital.

Many traders fail because they lack a plan or approach. However, with discipline one can maximize his chances of making money on foreign exchange markets.

Experienced forex traders create trading strategies that they follow when trading to minimize their risk exposure and still find profitable opportunities. The key to risk management is being able to see the big picture. New traders often chase short-term gains and lose sight of a long-term strategy.

Forex traders can increase their long-term profitability by keeping detailed records, studying past trades as well as payments and understanding platforms that facilitate currency trading.

Forex trading is all about discipline. Developing rules, such as what you are willing to lose on each trade, helps reduce losses and ensure success. Strategies like leveraging entry signals can help increase profits beyond those that could be achieved without the guidance of an experienced mentor.

Be persistent, learn from successful day trader and be persistent. Profitability in the forex market trading markets is dependent on whether you're managing funds for yourself or someone else.

Cryptocurrency: Is it a good investment?

It's complicated. Cryptocurrency has become increasingly popular over the past few years, but whether or not it will be a successful investment depends on numerous factors. On one hand, the cryptocurrency market is highly volatile and unpredictable so there's always a risk involved when investing in them.

If you're willing and able to take the risk and research properly, there are many opportunities to make money based upon events like Initial Coin Offerings and market shifts.

The advantages of cryptocurrency investments for portfolio diversification are also available, since they tend to be independent from traditional stock markets.

It all comes down ultimately to an individual's risk tolerance and knowledge of the crypto market. If you are able to make informed decisions about this asset class, and are willing to take risks, investing in cryptocurrency is worth looking into.

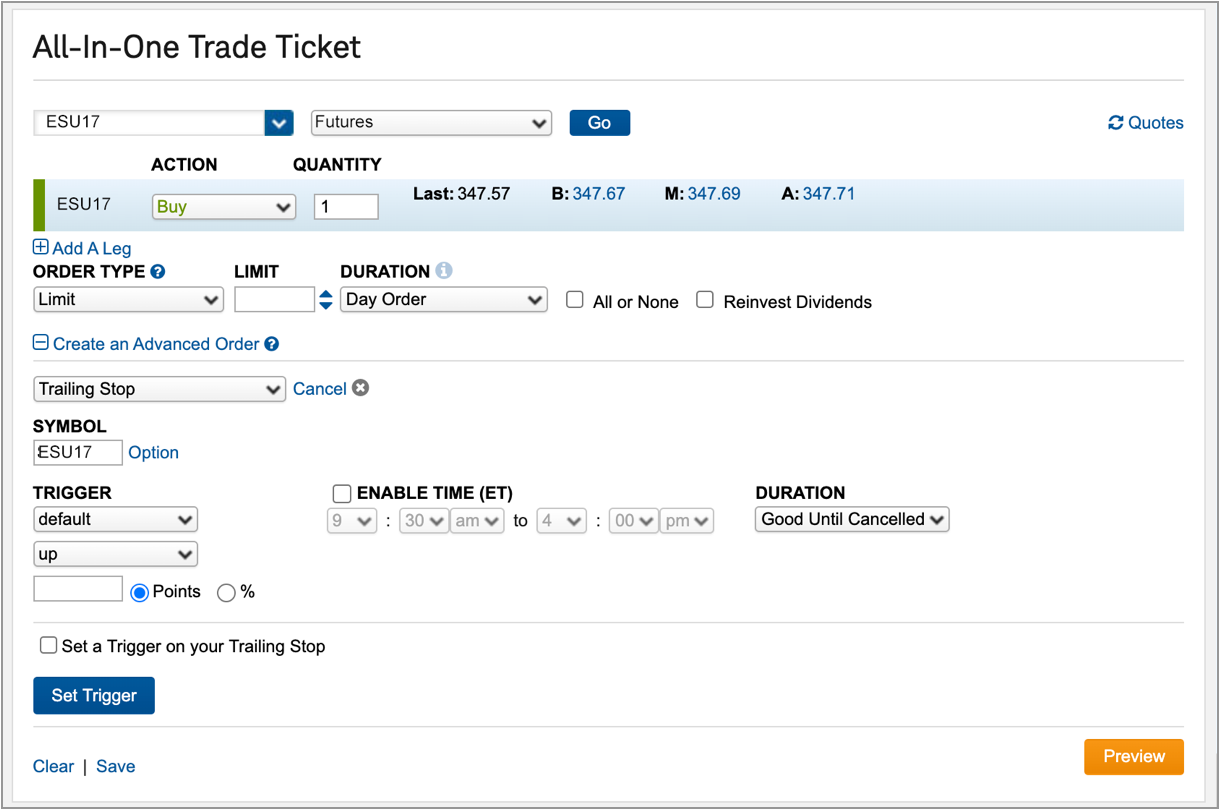

Which trading platform is the best?

For many traders, choosing the best platform to trade on can be difficult. There are many trading platforms out there, so it can be difficult for traders to choose one that is right for them.

The best trading platform must offer all of the features that you need such as chart analysis tools and real-time market data. It should also have sophisticated order execution capabilities. It must also be easy to use and intuitive.

It should also provide a variety of account types and competitive fees as well as reliable customer service and educational resources. You should look for demo accounts and free trials that allow you to practice with virtual money without risking your real cash.

Consider your trading style when searching for a platform. This includes whether you are active or passive, how often you trade and what asset classes you prefer. This information will help you narrow down your search and find the best trading platform.

After you have found the right platform for you, you should look at additional features like stock screening tools and backtesting capabilities. Alert systems are also available. You should also ensure that your chosen platform offers appropriate security protocols to protect your information from theft and breaches.

Some of the most popular trading platforms include MetaTrader 4/5 (MT4/MT5), cTrader, eToro TradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade FXCM ThinkOrSwim App Store just to name a few!

Can one get rich trading Cryptocurrencies or forex?

If you have a strategy, it is possible to make a lot of money trading forex and crypto. You need to be aware of the market trends so you can make the most of them.

Additionally, you'll need to learn how to recognize patterns in prices. These patterns will assist you in determining where the market is headed. You should also trade with only the money you have the ability to lose.

For long-term success, you will need to combine experience, knowledge, risk management skills, and discipline.

The volatility of cryptocurrency prices is a problem. It is important to ensure that your entry position matches your risk appetite and exit strategy. This means that you should take profit or limit losses if you have the opportunity.

Researching potential cryptocurrency exchanges and coins before signing up is vital, as they are not well-regulated and can pose significant risks.

Because forex trading involves the prediction of fluctuations in currency rates via technical analysis/fundamental economic analysis, this type of trading requires special knowledge that has been acquired over time. Knowing the current conditions that affect different currencies' currency exchange rates is vital.

It is about taking calculated chances, being willing and able to learn continuously and finding the right strategy that works for your needs. With enough dedication and the right education, you could make a fortune trading forex or cryptos.

What are the disadvantages and advantages of online investing?

Online investing is convenient. Online investing allows you to manage your investments anywhere with an internet connection. Online trading allows you to access market data in real time and trades from anywhere. Online brokerages are often cheaper than traditional brokerages. This allows investors to get started quickly and with less money.

However, online investing does have its downsides. Online investing is not without its challenges. For instance, you may find it difficult to obtain personalized advice or guidance online as there are no financial advisors or brokers to help you make your decisions. Online trading platforms can offer less security than traditional brokerages. Investors should be aware of these risks. Finally, online trading can be more complex than conventional investing, so it's essential to understand the markets and develop a sound strategy before getting started.

Online investing is a complicated process. It is important to be familiar with the various types of investments that are available. Stocks, bonds, mutual funds, and cash equivalents are all options for investors. Each type of investment carries its own risks and rewards, so it is important to research each option before deciding which one is right for you. Some investments may also require a minimum investment or other restrictions.

Where can I earn daily and invest my money?

However, investing can be an excellent way to make money. It's important to know all of your options. There are many other investment options available.

One option is investing in real estate. Property investments can yield steady returns, long-term appreciation, and tax benefits. Consider diversifying your portfolio by investing in bonds, ETFs or mutual funds. You might also want to consider specialty fields such as cryptocurrency.

You could also look into investing in dividend-paying stocks or peer-to-peer lending sites that allow you to lend money and receive interest payments from borrowers. You can even trade online using day trading strategies if you feel comfortable with the risks involved.

Whatever your investment goals might be, it is crucial to thoroughly research every type of investment before jumping in. Each asset has its risks and rewards. You should closely monitor your investments and know when to sell and buy accordingly. This will help you maximize your earnings and reach your financial goals.

Statistics

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

External Links

How To

How can I ensure the security of my online investment account?

Online investment accounts should be safe. It is vital to secure your assets and data against any unwelcome intrusions.

First, ensure the platform you are using is secure. You should look for two-factor authentication and encryption technology to ensure maximum protection against hackers or other malicious actors. It is also important to have a policy that details how any personal data you share with them will regulated and monitored.

It is important to use strong passwords and limit your access to public networks. Avoid clicking on unfamiliar links or downloading software that is not recommended. This could lead to malicious downloadings and compromise of your funds. Finally, review your account activities periodically so that you are aware of any changes or irregularities in order to detect potential threats quickly and take immediate action if necessary.

Third, you need to know the terms of your online investment platform. You should be familiar with all fees and restrictions regarding how your account can be used.

Fourth, ensure you research the company that you are considering investing in and make sure they have a track record of providing excellent customer service. Review and rate the platform and see what other users think. Finally, make sure you are aware of any tax implications associated with investing online.

These steps will help you ensure that your online investments account is safe and secure from any possible threats.