Soybean options are contracts that can be exchanged on the Chicago Board of Trade. They offer excellent liquidity and hedging capabilities, allowing for risk management and investment opportunities. But before you purchase, here are some things to keep in mind.

The soybean crop in Argentina has been plagued by drought and weather-related issues. Analysts suspect that the recent storm could cause damage to the harvest. Moreover, the USDA's annual planting-expectations report is released every year, giving investors a good indication of what supply will look like in the coming months. Soybean futures may suffer if plantings actually occur below expectations.

The harvest of soybeans can also affect their price. The harvesting of soybeans takes approximately eight months. Prices can fluctuate based on how many are harvested. Nonetheless, the number of bushels is only a part of the underlying futures price.

The soybean market is also affected by South America's drought. In recent weeks, futures reached six-month peak levels. However, investors are trying to adjust their positions before year's end.

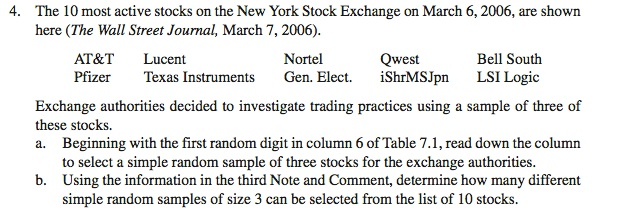

In recent days, wheat and corn futures have both risen. The Chicago Board of Trade's futures contract for wheat traded higher on Wednesday. These commodities are linked to the possible demand upturn when China reopens next Year.

As soybean season continues, traders worry that the drought may affect the harvest. Although the weather report indicates that there has been some rain in the area, it isn't clear if this has been sustained.

Other factors influence soybean prices. These include diseased crops and delays in harvesting. They also affect the yields of soybeans. Although these factors can have an impact on soybean futures prices, a greater number of bushels is often required to affect the price.

Finally, investors are beginning the process of selling their soybean futures investments. Many of them are taking profits on their positions before the end of the year. This is because the difference between the soybean futures price and the spot price is sufficient to cover carrying costs.

Futures of soybean are simple to trade and offer excellent liquidity. They can also be traded on the Globex platform and the CBT. When buying, you need to know the date of delivery and the amount you want to buy. To find out more, check out the CME Group website. Daily price data can be found for soybean futures and corn on this site. Although CME Group does not publish market data in real time, they do offer reliable, deep-liquid options regarding Soybean Futures.

The CME Institute offers courses that provide more information on the past and present state of the futures markets.

FAQ

How Can I Invest in Bitcoin?

Investing in Bitcoin can seem complicated, but it's not as hard as you think! All you need are the right tools and knowledge to get started.

It is important to realize that there are several ways to invest. To gain exposure, you can either buy Bitcoin directly or trade it on an exchange.

You must also decide where you will store Bitcoin. There is a wide range of options available, including exchanges, custodians, cold storage, wallets and exchanges. Depending on your risk appetite, goals, and other factors, certain options might be more appropriate than others.

Next, find any additional information that may be necessary to make confident investment decisions. Before you start investing in cryptocurrencies, it is important to learn the basics and understand how they work. To stay on top of crypto trends, keep an eye out for market developments and news.

Finally, you should create a plan to invest Bitcoin based in your level of expertise and set reasonable expectations about returns. This will ensure that you have a greater chance of long-term success.

Frequently Asked Questions

What are the 4 types of investing?

Investing can be a great way to build your finances and earn long-term income. There are four major categories of investing - stocks, bonds, mutual funds, and cash equivalents.

There are two types of stock: preferred stock and common stock. A common stock gives an individual ownership right of a company, including voting rights at shareholders' meetings and the potential to earn dividends. A preferred stock, however, gives an individual ownership right but without voting privileges. It also offers fixed dividend payments which provide investors with a steady income stream.

Bonds are loans by investors that are made to governments or businesses in exchange for interest payments. Bonds provide more stability and less risk than stocks, but the returns are typically lower than those of stocks.

Mutual funds allow investors to pool their money together to spread investment risk, diversify their investments, and diversify across a variety of securities such as stocks, bonds, or commodities. Professional managers manage mutual funds. Their expertise is used to make profitable investments according to pre-set criteria like risk level and desired return rate.

There are many cash alternatives, including Treasury bills, money markets deposits, certificates-of-deposit (CDs) and commercial papers. These products often mature in one year, so they have very little risk of being defaulted on or losing value. This type of investment is for conservative investors who do not want to take on high risk but still seek higher returns than traditional low-interest bank account deposits.

Which is more safe, crypto or forex

Forex trading and cryptocurrency are both highly risky investments with varying rewards and risks.

Crypto, short for cryptocurrency or digital currency, is a digital coin that was created by a piece code using blockchain technology. It can be traded as any other type of money on exchanges, and has been the subject for speculative investments because of its dramatic price swings.

Forex (or foreign exchange currency trading) involves highly leveraged investments. Participants speculate on the value one currency relative to another. Forex, which can be unstable and cause large losses if not managed well, is an investment that should not be taken lightly.

Both Crypto and Forex have their advantages and disadvantages but, overall, crypto tends to carry a greater level of risk compared to Forex. Due to the small number of units and existing regulations around cryptocurrencies, cryptocurrency prices can be unpredictable. Forex markets are more stable so investors have greater control over their investments. Therefore when determining which between Crypto and Forex is safer it would depend on one's own risk appetite as well as their experience with each investment option before making a final decision.

What are the advantages and disadvantages of online investing?

Online investing has one major advantage: convenience. You can access your investments online from any location with an internet connection. Access real-time market data, and make trades online without leaving your office or home. Online brokerages often offer lower fees than traditional brokerages. This makes it easier for investors start with smaller amounts of capital.

Online investing comes with its own set of disadvantages. Online trading can make it difficult to receive personalized guidance and advice, since you don't have access to a financial advisor or broker to assist you with your decisions. Online trading platforms may not offer the same level or security as traditional brokerages. Investors must be aware that there are risks. Finally, online trading can be more complex than conventional investing, so it's essential to understand the markets and develop a sound strategy before getting started.

When considering investing online, it is also important that you understand the types of investments available. Investors have many choices: stocks, bonds or mutual funds. Each type of investment carries its own risks and rewards, so it is important to research each option before deciding which one is right for you. There might be restrictions or a minimum deposit required for certain investments.

Where can I find ways to earn daily, and invest?

Although investing can be a great investment, it's important that you know your options. There are many other investment options available.

One option is investing in real estate. Investing in property can provide steady returns with long-term appreciation and tax benefits. You may also consider diversifying your portfolio with bonds, ETFs, mutual funds, or specialty fields like cryptocurrency.

If you are looking to make short-term gains or generate daily income, consider investing in dividend paying stocks. Or you can look into peer lending platforms, where you loan money and get interest payments direct from the borrowers. If you're comfortable taking the risks, you can also trade online with day trading strategies.

It doesn't matter what your investment goals are, it is important to research each type of investment before you dive in headfirst. Each asset has its own set of risk factors. To maximize your earnings and help you reach your financial goals, make sure to closely track any investments.

Is Cryptocurrency a Good Investing Option?

It's complicated. Cryptocurrency has become increasingly popular over the past few years, but whether or not it will be a successful investment depends on numerous factors. The cryptocurrency market is volatile and unpredictable, so investors must be aware of the risks.

There are also potential gains if one is willing to risk their investment and do some research.

Cryptocurrency investments can also offer portfolio diversification benefits since these assets tend to move independently of traditional stock markets.

It really boils down to each individual's tolerance for risk and knowledge about the crypto market. If you're able to make informed decisions and are open to taking risks, then investing is definitely something worth considering.

Statistics

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How can I verify the legitimacy of an online investment opportunity?

Research is critical when investing online. It is important to research the company offering the opportunity. Check that they are registered with appropriate financial authorities. Also, make sure to check for any industry regulations that could affect your investments.

Review past performance data, if possible. Find customer reviews online to find out how people have felt about the investment opportunity. Do you believe it is too good to true? Be wary of claims that promise future success or substantial returns.

Learn about the investment's risk profile and review the terms and condition. Verify exactly what fees and commissions you may be taxed on before signing up for an account. You should ensure that you are getting the terms and services you have paid for by doing due diligence checks if necessary. Finally, ensure you have a clear exit strategy in case your investment doesn't go according to plan - this could help reduce losses in the long run!