The Chicago Mercantile Exchange (CME), located in Chicago, Illinois, is the largest options and futures contracts exchange in the world. CME markets a wide range of benchmark products across all major asset classes, including equity indexes, foreign exchange, energy, agriculture commodities and metals. CME Globex Trading System is a global electronic trading system that trades over 90% of the exchange’s volume.

CME is a major derivatives clearinghouse. CME Group is the world's biggest derivatives marketplace. CME Clearing offers clearing and settlement services for swap-traded contracts. CME Globex Trading System is an electronic trading platform, used by most members.

Globex is an open-access trading marketplace that operates virtually around the clock. Globex has a large selection of options products and traditional futures that are traded via open outcry.

CME Globex was established in 1992 and is the first worldwide electronic trading system for options or futures. It was created to enhance the trading efficiency of the exchange's open outcry system and to extend trading hours.

Agricultural Markets

CME Group manages the Chicago Board of Trade and Kansas City Board of Trade Designated Contract Markets. These markets offer futures on corn and soybeans as well as other agricultural commodities. CBOT, KCBT and other markets provide liquidity to traders and farmers who trade in these commodities.

CME widened its hours to 21 hour a day from Sunday, May 20th for a wide range of oilseed futures, options, and options. This was done in response to over 4,000 farmers and traders.

The new hours provide traders and investors with more time to manage the risk in the oilseed and grain markets. It also enhances liquidity and improves market performance. Liquidity facilitates price discovery and movement on the market, and reduces transaction costs.

USDA Reports, Trading Hours

CME Group's futures markets are likely to be affected by the United States Department of Agriculture's key agricultural reports over the coming weeks. These reports will trigger immediate reactions that will affect prices. This could result in massive spikes or drops in trading activity.

CME Group changes its regulations and rules constantly. The CME Group will continue to update the list of trading hours. These changes are frequently made in response to customer feedback and to comply with specific regulatory requirements.

Globex Trading Hours

Almost all of CME's trading occurs electronically on its CME Globex trading platform, which is used to trade over 90% of its total volume. It is the world's largest electronic trading platform. It's the only system that supports all exchange products, even its proprietary trading platform, CME SPAN.

FAQ

Which is more safe, crypto or forex

Forex trading and cryptocurrency are two highly risky investments. The rewards and the risks can be very different.

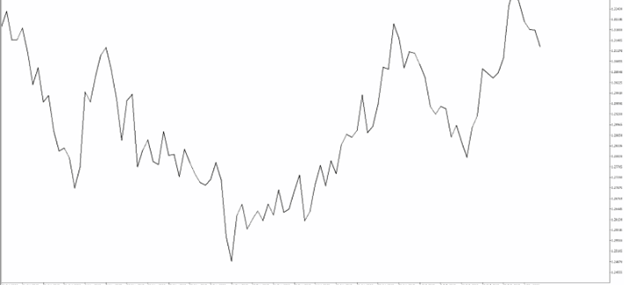

Crypto, which is shorthand for cryptocurrency, refers to a digital currency that was created using code and blockchain technology. It can be traded on exchanges like any other form of money and has been the subject of speculative investments due to its dramatic price swings over time.

Forex (or foreign exchange currency trading) involves highly leveraged investments. Participants speculate on the value one currency relative to another. Forex is a high-risk investment that can lead to large losses if it is not managed properly.

Both Forex and Crypto have advantages and disadvantages, but crypto generally carries more risk than Forex. Because of the limited supply and regulations around cryptocurrencies, prices can fluctuate. But forex markets move more consistently so investors have more control. It is important to consider your own risk appetite, experience and knowledge with each investment option before deciding which Crypto or Forex is safer.

Trading forex or Cryptocurrencies can make you rich.

Trading forex and crypto can be lucrative if you are strategic. You need to be aware of the market trends so you can make the most of them.

Also, you will need to be able to spot patterns in prices. This can help you determine where the market is heading. Trading with money you can afford is a good way to reduce your risk.

For long-term success, you will need to combine experience, knowledge, risk management skills, and discipline.

Prices for cryptocurrencies are volatile. The key is to ensure your entry position meets your risk appetite.

It is crucial to do your research on cryptocurrency exchanges before you sign up for any wallet.

Forex trading is a complex business that involves forecasting fluctuations in currency exchange rates using technical analysis/fundamental analyses of global economic data. This type of trading requires specialized knowledge. Knowing the current conditions that affect different currencies' currency exchange rates is vital.

It's about taking calculated risks and being open to learning. The most important thing is to find the best strategy for you. If you put in enough effort and have the right education, you can potentially make a lot of money trading forex or cryptos.

Is Cryptocurrency an Investment Worth It?

It's complicated. The popularity of cryptocurrency has increased over the years. However, whether or not it is a good investment depends on many factors. The cryptocurrency market is volatile and unpredictable, so investors must be aware of the risks.

However, if you are willing to take that risk, and do your research, then there may be potential benefits based on events such as Initial Coin Offerings (ICOs), and shifts in market.

Because cryptocurrency assets are not subject to traditional stock market movements, they can be used as a portfolio diversification tool.

In the end, it really comes down to an individual's personal tolerance for risk and knowledge related to the crypto market. If you're able to make informed decisions and are open to taking risks, then investing is definitely something worth considering.

Which is better forex trading or crypto trading.

Both forex and crypto trading offer potential profits. However, it all depends on your investment goals.

Forex trading involves investing in different currencies and is an accessible option for beginners. You will need to invest a lower amount upfront. Additionally, forex markets are worldwide and available 24/7.

But crypto trading is a great alternative because it offers almost instant returns as prices can fluctuate quickly due volatility. It is also easy to cash out tokens quickly, as crypto trades have high liquidity.

Both cases require that you do extensive research before investing. With any type or trading, it is important to manage your risk with proper diversification.

It is also important to understand the different types of trading strategies available for each type of trading. Forex traders might use fundamental or technical analysis to make decisions. Crypto traders, on the other hand, may use arbitrage and margin trading to maximize their profits. To help manage their investments, traders may use automated trading systems or bots. Before investing, it is important that you understand the risks as well as the rewards.

Where can I find ways to earn daily, and invest?

Although investing can be a great investment, it's important that you know your options. There are other ways to make money than investing in the stock market.

You can also invest in real estate. You can earn steady returns while also enjoying long-term appreciation and tax advantages by investing in real estate. It is possible to diversify your portfolio with ETFs mutual funds, bonds, and specialty fields like cryptocurrency.

If you are looking for short-term income or daily profits, you might consider investing in dividend-paying stocks. You may also want to look into peer-to–peer lending platforms that allow you borrow money from other borrowers and receive interest payments on a daily basis. If you are comfortable with the risk, you can trade online using day trading strategies.

Whatever your investment goals may, it's important that you research all types of investments before investing. Every asset has its own risks. Make sure you closely monitor any investments and recognize when to buy and sell accordingly so you can maximize your earnings and work towards achieving your financial goals!

Frequently Asked questions

What are the 4 types?

Investing is a way to grow your finances while potentially earning money over the long term. There are four types of investing: stocks and bonds, mutual funds and cash equivalents.

Stocks can be broken down into common stock or preferred stock. A common stock gives an individual ownership right of a company, including voting rights at shareholders' meetings and the potential to earn dividends. A preferred stock, however, gives an individual ownership right but without voting privileges. It also offers fixed dividend payments which provide investors with a steady income stream.

Bonds are loans by investors that are made to governments or businesses in exchange for interest payments. While bonds have a greater stability and less risk than stocks stocks, their returns are often lower than stocks.

Mutual funds are a way to pool investor money in order spread risk and diversify investments across many types of securities, including stocks, bonds and commodities. Professional managers manage mutual funds. They use their experience to choose profitable investments based on pre-determined criteria, such as risk level or expected return rate.

There are many cash alternatives, including Treasury bills, money markets deposits, certificates-of-deposit (CDs) and commercial papers. These products often mature in one year, so they have very little risk of being defaulted on or losing value. This type of investing is mostly suitable for conservative investors who don't want to take high risks but still seek a little bit more return than depositing money at traditionally low-interest bank accounts.

Statistics

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How can I safeguard my personal and financial information online when I invest?

Online investment is not without risk. Online investments are a risky way to protect your financial and personal information.

Start by being mindful of who you're dealing with on any investment app or platform. Reputable companies have good customer ratings and reviews. Before you transfer funds to them or give out personal information, do your research.

Secure passwords and two-factor authentication should be used on all accounts. Also, make sure to regularly check for viruses. Your devices should be disabled from auto-login to prevent others from accessing your accounts without your consent. Protect yourself from phishing by never clicking links in emails from unknown senders, not downloading attachments unless you know what they are, and always double-checking a website's security certificate before entering private information into a website form.

If you want to make sure only trusted people have your finances, ensure that all bank applications are deleted from old devices. Change passwords at least once a month. Keep track of any account changes that might alert an identity thief such as account closure notifications or unexpected emails asking for additional identification information. Also, you should use different passwords on each account to ensure that any breach in one doesn't cause others to be compromised. The last thing is to make use of VPNs for investing online when possible. These are often free and easy to setup!