Tradovate, LLC, a futures brokerage firm, offers a wide variety of trading tools and features for its clients. Rick Tomsic started the firm and it offers a modern platform that is powerful for active futures traders. Its mission: To provide technology that is innovative for the futures sector, but also to keep it affordable and accessible. In addition to its competitive commissions, it offers several features that make it a top choice for investors.

The broker's proprietary platform includes a variety of charts, which include basic candlestick, bar, and line charts, as well as advanced Heikin-Ashi and Renko charts. It supports market profile and volume charting. Other indicators include trend lines and moving averages as well as Fibonacci's retracement. There are many customizable indicators that can be created by users.

Tradovate offers a community of investors, who can share tips and strategies. Investors can learn from each other and gain valuable experience through their trades. If you're a first-time investor, you can use the free two-week demo to get a feel for the platform. To gain access to the full suite of trading instruments, you can sign-up for a membership. This plan is $25 per month.

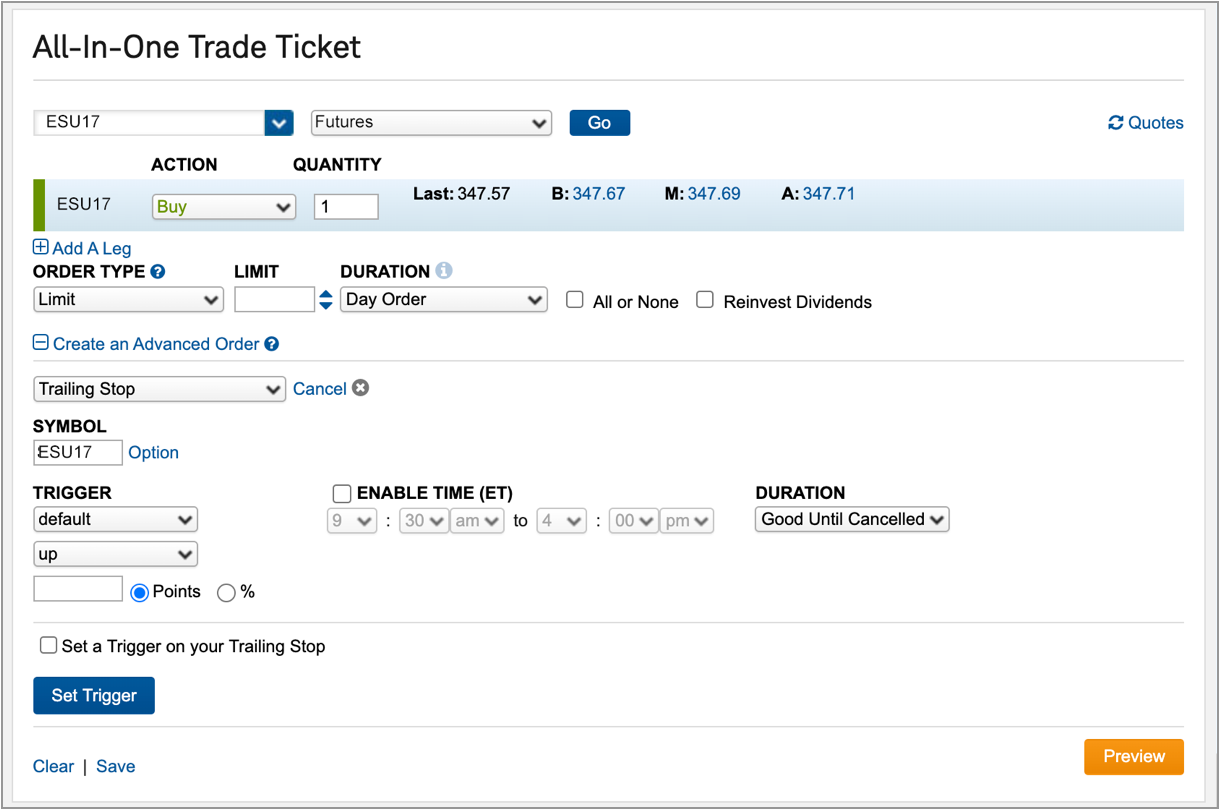

Another feature of the platform is the ability to set up stop limits and conditional bracket orders. These options allow automated, one click order entry. Tradovate provides integrations with third-party data solutions. A user-friendly interface makes it easy for users of Tradovate to benefit from its features. There are also multiple depth-of-market screens to assist with charting.

Tradovate offers commission-free trades on its FairX exchange in an ongoing effort to support the futures industry. Retail investors will be able to trade at a lower cost with this offering. Tradovate is the first broker that will offer trading services to the exchange upon its launch.

Tradovate broker specializes on providing traders with a variety tools, indicators and features that will help them achieve success. Its proprietary system can be overwhelming for new traders. The broker offers a unique platform that will allow experienced traders to optimize and create their strategies while decreasing costs.

Tradovate trial accounts may be signed up by traders who want to make money on futures trades. After they complete the test run, they will be able to decide whether or not they want the company to continue. There are no minimum funds requirements or inactivity fees, unlike most brokers.

No matter what plan you choose, all members have access the same comprehensive platform which offers a wealth educational resources. Trades are executed on a real-time basis, so you'll know when prices change. You can personalize your watchlist to be notified when a price changes. You can also choose from different order types such as trailing stops, stop-limit orders, and conditional bracket orders.

Tradovate may require some training, but the platform's innovative features make it an attractive choice for traders. For those who wish to trade while on the move, the mobile app is available.

FAQ

Which is safe crypto or forex?

Forex trading and cryptocurrency are two highly risky investments. The rewards and the risks can be very different.

The shorthand crypto, or cryptocurrency, is a digital money that has been created using code from blockchain technology. It can be traded as any other type of money on exchanges, and has been the subject for speculative investments because of its dramatic price swings.

Forex or foreign currency trading involves high-leveraged investments that allow participants to speculate on the relative value of one currency. Forex, which can be unstable and cause large losses if not managed well, is an investment that should not be taken lightly.

While both Forex (Cryptocurrency) and Forex (Forex) have their pros and cons, Cryptocurrency tends be more volatile than Forex. Because of the limited supply and regulations around cryptocurrencies, prices can fluctuate. But forex markets move more consistently so investors have more control. Therefore when determining which between Crypto and Forex is safer it would depend on one's own risk appetite as well as their experience with each investment option before making a final decision.

Where can I find ways to earn daily, and invest?

Although investing can be a great investment, it's important that you know your options. You don't have to put your entire savings into the stock market - there are plenty of other options.

You can also invest in real estate. Investing property can bring steady returns as well as long-term appreciation. It is possible to diversify your portfolio with ETFs mutual funds, bonds, and specialty fields like cryptocurrency.

You could also look into investing in dividend-paying stocks or peer-to-peer lending sites that allow you to lend money and receive interest payments from borrowers. Online trading is possible if you're comfortable with the risks.

Whatever your investment goals may, it's important that you research all types of investments before investing. Every asset has its own risks. So that you can maximize your earnings, and achieve your financial goals, you must closely monitor all investments.

Which forex trading platform or crypto trading platform is the best?

Both crypto and forex trading can make you money, but it really comes down to your investment goals.

Forex trading is an investment in currencies. This option is accessible to beginners. This requires a smaller initial capital, and forex markets can be accessed 24/7 around the world.

On the other hand, crypto trading offers an almost immediate return as prices can fluctuate quite rapidly due to their volatility. The liquidity of crypto trading means that you can quickly cash out your tokens.

Both cases require that you do extensive research before investing. Any type of trading can be managed by diversifying your assets.

It is important to know the types of trading strategies you can use for each type. Forex traders might use fundamental or technical analysis to make decisions. Crypto traders, on the other hand, may use arbitrage and margin trading to maximize their profits. Automated trading platforms or bots are also available to assist traders in managing their investments. Before investing, it is important that you understand the risks as well as the rewards.

How can I invest bitcoin?

It can be difficult to invest in Bitcoin. But it isn't as hard as you think. You only need the right information and tools to get started.

It is important to realize that there are several ways to invest. To gain exposure to Bitcoin you can either purchase it directly or use an exchange to trade.

You will also have to decide where to store your bitcoin. There are many options such as exchanges, wallets, custodians and cold storage. Some options may be better suited than others depending on your risk tolerance and goals.

Next, research any additional information you may need to feel confident about your investment decisions. Learning the basics of cryptocurrencies and how they work before diving in is important. You should also keep up to date with market news and developments in order to stay abreast of the latest crypto trends.

Final, make a plan to invest in Bitcoin. This will be based on your experience level and allow you to set reasonable expectations for return. You'll have a better chance of success over the long-term.

Which trading site is best suited for beginners?

Your level of experience with online trading will determine your ability to trade. If you're totally new to the process, then going through an established broker with expert advisors would be a great place to start.

These brokers eliminate the guesswork involved in choosing companies. They make solid recommendations and can help you build a consistent portfolio over time. Many brokers provide interactive tools to show you how trades function without risking any money.

On the other hand, if you want more control over your investments and have a bit of knowledge already, there are plenty of sites that allow you to trade independently. These sites offer customizable trading platforms, live data feeds, research resources, and real-time analytics for well-informed decisions.

You can find customer reviews on any route, no matter what. These will give insight into the experience and level of service at each site before you commit.

What are the pros and cons of investing online?

Online investing has one major advantage: convenience. With online investing, you can manage your investments from anywhere in the world with an internet connection. Online trading is a great way to get real-time market data. Many online brokerages charge lower fees than traditional ones, which makes it easier to start investing with less money.

Online investing comes with its own set of disadvantages. Online trading can make it difficult to receive personalized guidance and advice, since you don't have access to a financial advisor or broker to assist you with your decisions. Online trading platforms can offer less security than traditional brokerages. Investors should be aware of these risks. Online trading can be more complex and difficult than conventional investing. Before you begin, make sure to thoroughly understand the markets.

It is also important for online investors to be aware of all the investment options. Stocks, bonds, mutual funds, and cash equivalents are all options for investors. Each type of investment comes with its own risks and rewards. It is crucial to thoroughly research each one before you make a decision. You should also consider the fact that some investments might require a minimum deposit, or may have restrictions.

Statistics

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

External Links

How To

What are my best options to avoid falling for online investment scams

Protection starts with you. Protect yourself by knowing how to spot fraudsters' tricks and learning how they work.

Pay attention to offers that look too good for you, such as high-pressure sales tactics and guarantees of returns. Never respond to unsolicited phone calls or emails. Fake names are often used by fraudsters. Never trust anyone based solely on their name. Before you commit to any investment opportunity, make sure you thoroughly research the person who is offering it.

Never invest in cash on the spot, in cash or by wire transfer. Any offer that requires these payment methods should be regarded as a red flag. Never forget that scammers will try any means to steal your personal data. Protect yourself from identity theft by being mindful of different types of online phishing schemes and suspicious links sent via email or online ads.

It's also important to use secure online investment platforms. Sites that are licensed by the Financial Conduct Authority and have a strong reputation should be considered. Secure Socket Layer or SSL encryption is an option that protects your data as it travels via the internet. Make sure you understand the terms and conditions of any site or app you use before investing, including any fees or charges that may be applicable.