The world of digital art and technology has seen a huge surge in popularity thanks to Non-Fungible Tokens (NFTs). They are a crypto coin used to purchase digital assets like digital artwork and digital gaming items. NFTs do not have the same identifier as fungible tokens and are therefore not interchangeable. This makes it possible to trade and collect the digital item. It also allows the artist to retain ownership of the original artwork.

The NFT has transformed the way we use Blockchain technology. Artists can now make money through a curated platform. Only authorized artists can mint and sell digital tokens through these platforms. Many artists are jumping on the NFT bandwagon. Some are questioning its security.

In addition to allowing artists to monetize their work, NFTs also create a sense of scarcity in the digital world. Scarcity increases the value of the asset. A single copy of a work is more valuable than multiple copies. You can also increase the cost of the NFT if you have limited editions.

NFTs were around for a while. However, they are now being adopted in art and gaming. There are many NFT online marketplaces. SuperRare, Rarible and OpenSea are some of the most sought-after NFT marketplaces.

Some people doubt the legitimacy of NFTs. However, many artists believe that they are legitimate. They are confident that the technology will transform the industry. The NFT could also help usher in an era of art.

In addition, NFTs can provide transparency to collectors. Collectors can purchase art pieces and verify their authenticity via the blockchain. This means that artists will be compensated for each sale.

Although digital art is well-established, it is still undervalued. Artists are tired of the low return on their labor. NFTs might be a new way to help artists grow.

Another unique NFT platform is MusicArt. Music industry executives founded the company. They created MusicArt to be a platform where musicians can share their music, exchange digital arts, and celebrate it. MusicArt will soon be live and accept a variety of cryptocurrency.

NFTs are not like fungible tokens which can be exchanged and copied. Each digital item is assigned a unique identifier. A vetted process ensures that artwork is high-quality.

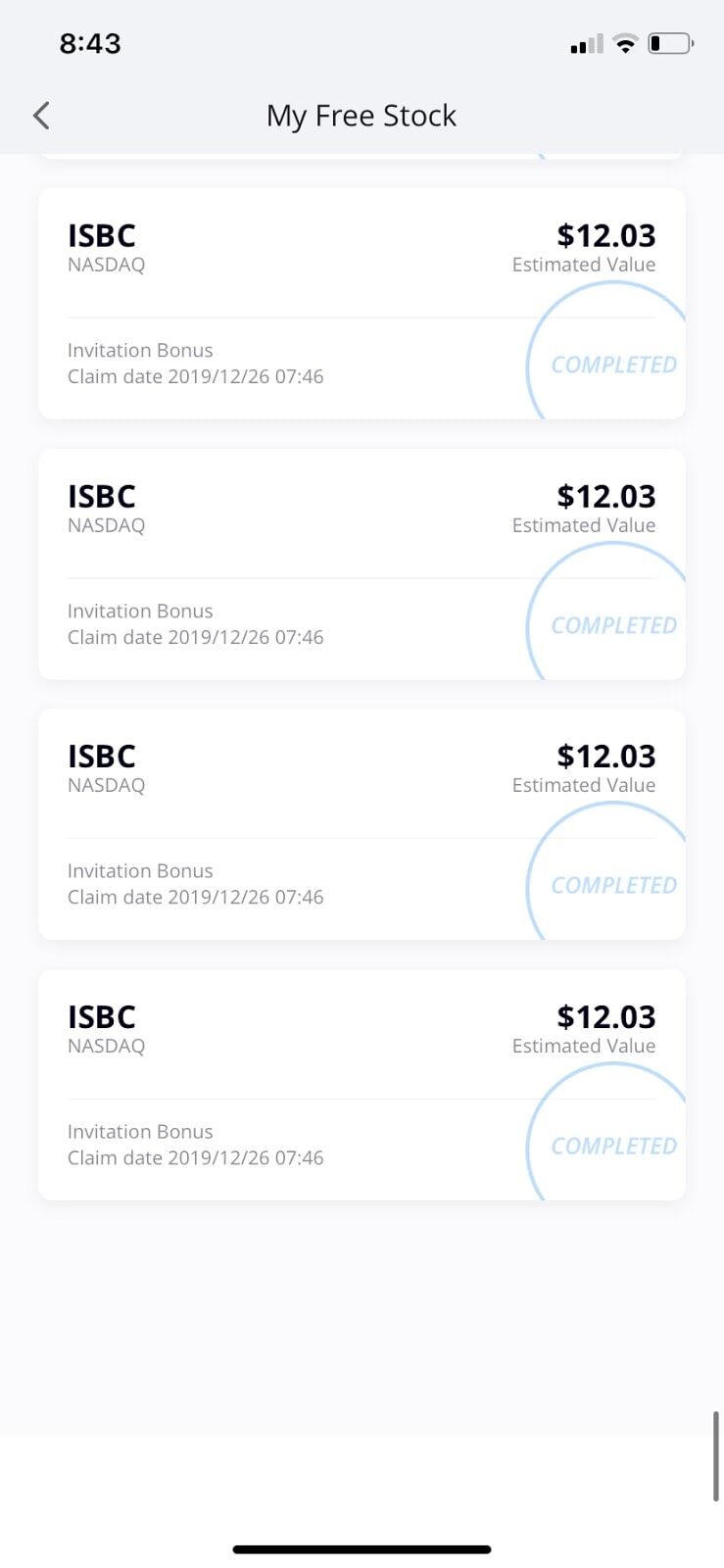

You should visit a reputable platform to buy or sell digital art. In an effort to find investors for their unique work, many artists have moved to NFTs. However, you will need to own your crypto wallet.

MetaMask is one of the best. You can use this Chrome extension to buy and hold cryptocurrencies from your computer or smartphone. You can also buy or hold BUSD which is the currency on Binance.

FAQ

Which trading site for beginners is the best?

Your level of experience with online trading will determine your ability to trade. It's a good idea to begin with an experienced broker who has expert advisors if you are completely new to online trading.

They take the guesswork out when it comes to choosing companies and make solid recommendations that will help you build a steady portfolio over time. Many offer interactive tools to help you understand how trades work.

Many sites allow you to trade alone if you have some knowledge or want more control over your investments. These sites offer customizable trading platforms, live data feeds, research resources, and real-time analytics for well-informed decisions.

No matter which route you choose, be sure to read customer reviews before you make a decision. This will give you an insight into the service and experience of each site.

How can I invest bitcoin?

Although investing in Bitcoin may seem complex, it's actually not as difficult as you think. You just need the right knowledge, tools, and resources to get started.

There are many options for investing. To get exposure to Bitcoin, you can buy it directly, use an exchange or use a financial instrument, known as a derivatives agreement.

You'll also need to decide where you will store your Bitcoin - there are many options available such as wallets, exchanges, custodians, and cold storage. Depending on your risk appetite, goals, and other factors, certain options might be more appropriate than others.

The next step is to research additional information you might need in order to be confident about your investment decisions. It is important to be familiar with the basics of cryptocurrency and how they function before you begin investing. It is important to keep abreast with developments and market news so that you are up-to-date on crypto trends.

Finally, create a plan for investing in Bitcoin based on your level of experience and set reasonable expectations for returns - this will give you a better chance at success long-term too!

Is Cryptocurrency a Good Investment?

It's complicated. It's complicated. Although cryptocurrency has gained popularity over the last few years, it depends on many factors as to whether it will prove to be a profitable investment. One, the cryptocurrency market can be volatile and unpredictable. This means that there is always risk when investing in them.

However, if you are willing to take that risk, and do your research, then there may be potential benefits based on events such as Initial Coin Offerings (ICOs), and shifts in market.

Cryptocurrency investments can also offer portfolio diversification benefits since these assets tend to move independently of traditional stock markets.

It all comes down ultimately to an individual's risk tolerance and knowledge of the crypto market. If you have the means to make an informed decision about this asset class and don't mind taking risks, then yes - investing in cryptocurrencies is absolutely worth considering.

Frequently Asked Questions

What are the four types of investing?

Investing is a way for you to grow your money and possibly make more long-term. There are four types of investing: stocks and bonds, mutual funds and cash equivalents.

There are two kinds of stock: common stock and preferred stocks. Common stock grants an individual the right to own a company. It also gives voting rights at shareholder meetings and the possibility of earning dividends. The preferred stock gives you ownership rights, but no voting privileges. Investors also have the option to receive fixed dividend payments.

Bonds are loans by investors that are made to governments or businesses in exchange for interest payments. Although bonds are more stable and less risky than stocks they offer a higher return than stocks.

Mutual funds can be described as pooling investors money together to spread investment risks and diversify investments over a wide range of securities. This includes stocks, bonds, and other commodities. Professional managers manage mutual funds. Their expertise is used to make profitable investments according to pre-set criteria like risk level and desired return rate.

There are many cash alternatives, including Treasury bills, money markets deposits, certificates-of-deposit (CDs) and commercial papers. These products often mature in one year, so they have very little risk of being defaulted on or losing value. This type of investment is for conservative investors who do not want to take on high risk but still seek higher returns than traditional low-interest bank account deposits.

Which is safer, cryptography or forex?

Cryptocurrency and Forex trading are two types of highly risky investments that vary greatly in terms of rewards and risks.

Crypto, which is shorthand for cryptocurrency, refers to a digital currency that was created using code and blockchain technology. It can be traded like any other currency on exchanges and has been subject to speculation investments because of its volatile price swings.

Forex or foreign currency trading involves high-leveraged investments that allow participants to speculate on the relative value of one currency. Due to its high risk, Forex can be an unstable investment that could result in large losses if not properly managed.

While both Forex (Cryptocurrency) and Forex (Forex) have their pros and cons, Cryptocurrency tends be more volatile than Forex. Due to the small number of units and existing regulations around cryptocurrencies, cryptocurrency prices can be unpredictable. Forex markets are more stable so investors have greater control over their investments. Therefore when determining which between Crypto and Forex is safer it would depend on one's own risk appetite as well as their experience with each investment option before making a final decision.

What are the advantages and disadvantages of online investing?

Online investing has the main advantage of being convenient. You can manage your investments online, from anywhere you have an internet connection. Online investing allows you to have access to real-time market information and place trades without ever leaving your home. Online brokerages typically charge less than traditional brokerages. This makes investing easier, especially if you have a smaller amount of money.

Online investing has its limitations. For example, it can be difficult to get personalized advice and guidance when trading online, as you don't have a physical broker or financial advisor to help you make decisions. Online trading platforms may not offer as much security as traditional brokerages. Therefore, investors should be aware of the risks. Finally, online trading can be more complex than conventional investing, so it's essential to understand the markets and develop a sound strategy before getting started.

Online investing is a complicated process. It is important to be familiar with the various types of investments that are available. Investors have many choices: stocks, bonds or mutual funds. Each investment type has its own risks, rewards, and it is important to fully research each option before making a decision. There may be restrictions on investments such as minimum deposits or other requirements.

Statistics

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

External Links

How To

How can I verify the legitimacy of an online investment opportunity?

Online investing requires research. You should research the company that is offering the opportunity. Make sure they are registered with financial authorities. Additionally, look out for any industry regulations or restrictions that could apply to your investments.

Review past performance data, if possible. You can find customer reviews online that give insight into the experience of customers with the investment opportunity. It's possible to make a good investment, but be skeptical of claims that guarantee future results.

Understand the risk profile of the investment and familiarise yourself with the terms and conditions. Verify exactly what fees and commissions you may be taxed on before signing up for an account. Make sure you're getting what you paid for in terms of terms and services offered by conducting due diligence checks as necessary. You should have an exit strategy that is clear in case something goes wrong with your investment. This could help you reduce your long-term losses.