Commodity trading companies play a critical role in global capitalism. They control key raw materials used to produce goods in a variety of industries, from oil and metals to grain and rice. They store, transport, and process these commodities globally and trade them on worldwide markets.

They are also crucial in hedging and trading in commodity derivatives. These tools are used to profit from price fluctuations and market disruptions.

These companies are often family-owned or unlisted and thus are often immune to financial regulators' scrutiny. These shadowy companies make billions every year and have a huge influence on the world's economic landscape.

Glencore is a powerful commodity trading firm based out of Baar, Switzerland. The company has assets spanning the world and is one of the top four global energy commodity traders.

It handles about a third the world's oil trade and is a top physical supplier for zinc, lead, nickel. It also owns several industrial facilities, including smelting, mines, and other facilities, in the US, Australia, and Europe.

Archer Daniels Midland is another of the most important commodity trading companies in the world. The Decatur, Illinois-based business sells and purchases multiple crops including wheat, barley and soya beans. The company operates processing plants, railcars trucks, river barges, and trucks that deliver its products all over the world.

ADM has grown to be a major player in agribusiness. The company's profits increased by more than 50% last year while its stock rose 28%.

Trafigura, headquartered in Geneva, has a vast array of refineries around the globe and is a major buyer of Iraqi crude. It also sold and bought petroleum in Syria as fuel for the government under Bashar alAssad's control.

It was founded in 1885 in Switzerland and has been one of the most successful companies on the planet. In 2022, its profits grew to $7 billion, almost twice the amount in 2021. It is one of the world's largest brokers and charterers of black gold, making the bulk of its profits from trading.

Public Eye discovered that many commodities trading companies take advantage of non-democratic country to mine and grow raw materials. They have destroyed forests in Honduras, deforested land Indonesia and grown sugarcane on Brazil's unlicensed soil.

They also use their influence to control land or people in Africa. They evict villages to make way coffee plantations, and sell off palm oil plantations that deprive native communities of their livelihoods.

This is a major issue for the environment. It has prompted a call for urgent action by environmental activists around the world. The International Panel on Climate Change (IPCC) calls for a global response. However, it can be difficult to know how this should be done.

This is a critical issue as these companies make up a large part of the global supply chains for critical materials. They also have an impact on communities. They need to be held accountable for their activities and must take responsibility for the human rights and environmental impacts of their operations.

FAQ

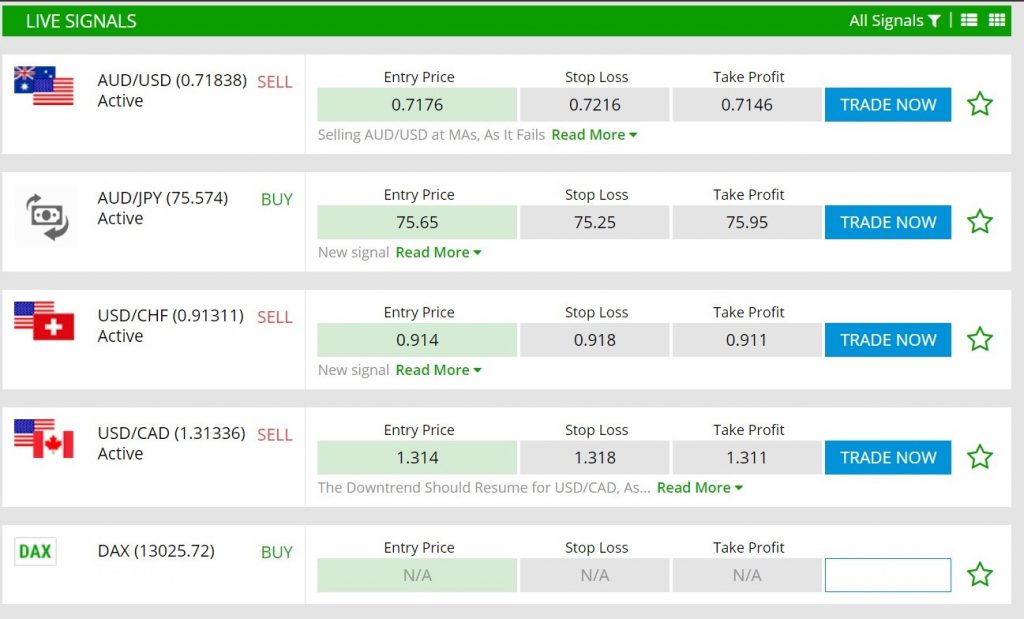

Which trading platform is the best?

Many traders may find it challenging to choose the best trading platform. With so many different platforms to choose from, it can be hard to know which one is right for you.

A trading platform that is the best should have all the features you require, such as advanced chart analysis tools, market data and order execution capabilities. It should also feature an intuitive, user-friendly interface.

It should offer multiple account types and low fees. You also need reliable customer service and educational materials. Demo accounts and free trials are a great way to test virtual money before investing any real money.

You should consider your type of investor or trader when looking for a trading platform. For example, are you active or passive? How often do you plan to trade? What asset class mix would you like? These factors will help you narrow down your search to find the right trading platform.

After you have found the right platform for you, you should look at additional features like stock screening tools and backtesting capabilities. Alert systems are also available. Additionally, ensure your chosen platform provides appropriate security protocols in place to protect your data from breaches or theft.

MetaTrader 4/5 (MT4/MT5) and cTrader are some of the most well-known trading platforms.

Which forex trading platform or crypto trading platform is the best?

Forex and crypto trading both have their opportunities for profits, but which one is best for you really depends on your investment goals.

Forex trading is an investment in currencies. This option is accessible to beginners. It requires a smaller capital upfront, plus forex markets are global and open 24/7.

But crypto trading is a great alternative because it offers almost instant returns as prices can fluctuate quickly due volatility. It is also easy to cash out tokens quickly, as crypto trades have high liquidity.

Both cases require that you do extensive research before investing. You can reduce your risk by diversifying assets. This will help you to be successful in any type of trading.

It is important to be familiar with the various types of trading strategies that are available for each type. To maximize their profits, crypto traders can use arbitrage or margin trades to maximize their gains. Forex traders may use either technical analysis or fundamental analysis to assist them in making decisions. Automated trading systems and bots may also be used by some traders to help them manage investments. Before investing, it is important that you understand the risks as well as the rewards.

Which trading website is best for beginners

It all depends on your level of comfort with online trading. If you're completely new to the online trading process, it would be a great idea for you to go through an established broker with experienced advisors.

These brokers remove the guesswork from choosing companies and offer solid recommendations to help you build your portfolio. Many offer interactive tools to help you understand how trades work.

If you are more confident and have some knowledge, you can trade your investments independently on many websites. They provide customizable trading platforms and live data feeds. You can also access research resources such as real-time statistics to help you make informed decisions.

Regardless of which route you take, make sure to check out customer reviews before making a choice - this will give you insight into the experience and service levels of each site before committing.

How Can I Invest in Bitcoin?

While it can seem daunting to invest bitcoin, it is really not that difficult. All you need is the right knowledge and tools to get started.

First, you need to know that there are many ways to invest. You have the option to buy Bitcoin direct, trade on an exchange, or gain exposure using a financial instrument called a derivatives contract.

You also need to decide where to store Bitcoin. There are many choices, such as cold storage, exchanges or custodians. Some options may be better suited than others depending on your risk tolerance and goals.

Next, gather any additional information to help you feel confident about your investment decision. It is important to be familiar with the basics of cryptocurrency and how they function before you begin investing. It is important to keep abreast with developments and market news so that you are up-to-date on crypto trends.

Finally, you should create a plan to invest Bitcoin based in your level of expertise and set reasonable expectations about returns. This will ensure that you have a greater chance of long-term success.

Do forex traders make money?

Yes, forex traders can make money. It's possible to make short-term gains, but the long-term benefits of forex trading are often based on dedication and a willingness for learning. More successful traders are those who have a solid understanding of market fundamentals and technical analyses than those who rely on their luck or guessing.

Forex trading is not an easy task, but it can be done with the right knowledge. Before you risk real capital, it is important to find a mentor who is knowledgeable about risk management.

Many traders fail due to a lack of a structured plan or approach but with discipline, one can maximize their chances of making money in the foreign exchange (forex) markets.

Forex traders who are experienced create trading plans to help them reduce their risk exposure while still finding lucrative opportunities. Risk management is key; many new traders can become too aggressive by chasing quick gains instead of having a consistent long-term strategy.

Forex traders can increase their chances of making long-term profits by keeping records, understanding currency trading platforms, and studying past trades, payments, and by keeping accurate records.

Forex trading is a disciplined business. Setting rules for how much money you're willing and able to lose per trade can reduce losses and help ensure success. Furthermore, strategies such as leverage entry signals can help increase profits that are not possible without the guidance of an experienced mentor.

Ultimately though, being persistent and learning from successful day traders other methods--such as risk management techniques--are necessary for profitability as a trader in forex markets regardless if you're investing your own capital or managing funds for someone else.

Which is safe crypto or forex?

Cryptocurrency and Forex trading are two types of highly risky investments that vary greatly in terms of rewards and risks.

Crypto, shorthand for cryptocurrency is a digital currency made from code using blockchain technology. It can be traded like any other currency on exchanges and has been subject to speculation investments because of its volatile price swings.

Forex, also known as foreign exchange currency trade, is high-leveraged investment that involves participants speculating on the value and relative strength of one currency. Due to its high risk, Forex can be an unstable investment that could result in large losses if not properly managed.

Both Crypto and Forex have their advantages and disadvantages but, overall, crypto tends to carry a greater level of risk compared to Forex. Because of the limited supply and regulations around cryptocurrencies, prices can fluctuate. But forex markets move more consistently so investors have more control. The decision about which of Cryptocurrency or Forex is more secure will be based on the individual's risk appetite and their previous experience with each investment option.

Statistics

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

External Links

How To

How can I ensure that my financial and personal information is safe when investing online?

Online investments require security. To protect your personal and financial information, you need to be aware of the risks associated with online investments and take steps to minimize them.

Be mindful of whom you are dealing with when using any investment app. It is important to only work with a reliable company that has received positive reviews and ratings from customers. Before you transfer funds or provide any personal information, it is important to check the background of each company or individual that you are considering.

Secure passwords and two-factor authentication should be used on all accounts. Also, make sure to regularly check for viruses. Your devices should be disabled from auto-login to prevent others from accessing your accounts without your consent. You can protect yourself against phishing by not clicking on emails from unknown senders, never downloading attachments, and always checking the security certificate of a website before entering any private information.

To ensure only trustworthy individuals have access to your finances, delete all bank applications from outdated devices. Also, change passwords every few months. Keep track of account changes that might alert identity thieves such as account closure notices or unexpected emails asking to verify information. To prevent a breach of one account, it's smart to have different passwords for each account. And lastly, use VPNs while investing online whenever possible -- they're usually free and easy to set up!