Shiba Inu is an extremely popular cryptocurrency and is considered to be a "Dogecoin Killer." However, there are risks to the coin. Its price has fluctuated significantly over the past one year. Before investing in Shiba it's important that you evaluate your investment goals.

This is due to the fact that cryptoassets don't have consumer protection and are extremely volatile. If you decide to sell your assets, you could be subject to income tax. It is a good idea for diversifying your portfolio by adding volatile assets to it. You can purchase tokens in smaller amounts if you don't have the funds to make a large purchase.

Make sure you only invest in a trustworthy crypto exchange so you don't lose your money. Keep your tokens safe in a secure wallet. Be careful not to send money to unreliable addresses. You should avoid social media scams.

The popularity of Shiba inu is high but its price is low. If you are looking for an investment that will yield rapid returns, Shiba Inu is not the right choice. However, the coin has a lot of potential for long-term investors.

The cryptocurrency has gained massive popularity online, even though it was a difficult start. Elon Musk tweeted about it's success, and so did many others. As it becomes more popular, so will the cost. This means you can still expect a positive ROI long-term.

It currently ranks 15th in market capitalization. It is also one of the most tradeable cryptocurrencies. It is possible to buy it on Binance Pro and Gemini, as well as Coinbase Pro. Some exchanges allow you to purchase it directly in fiat currencies. However, buying via a centralized marketplace is more tightly regulated. Be sure to research your country before you make any purchases.

The Shiba Inu community has seen a significant increase in its number over the last year. However, some negative developments have occurred with cryptocurrency. The price has fluctuated a lot, and has fallen back to the lowest level since May's last week. The coin still has the potential to make you wealthy.

Shiba Inu investment can be a great opportunity to earn quick cash. You can use Shiba Inu whether you are a beginner or a veteran investor. To earn Shiba Inu tokens, you can also take part in online surveys. These tokens are then available for high-frequency trading and news-based trading.

This cryptocurrency's only problem is its volatility. It's a bit of a gamble, but Shiba Inu is a good choice if you're looking for a cryptocurrency that isn't prone to regulatory crackdowns. It's possible to make a fortune if your patience and time allow you to understand the intricacies of the cryptocurrency world.

Investors should be wary of SHIB scams. SHIB frauds typically occur through social media. However, there are other sources of shady schemes, so you need to be vigilant.

FAQ

Which is harder crypto or forex?

Crypto and forex have their own unique levels of difficulty and complexity. In terms of basic understanding, crypto may be slightly more difficult because it is new and related to blockchain technology. Forex is a well-established currency with a stable trading infrastructure.

Forex trading has fewer risks than cryptocurrency trading. Crypto markets move in unpredictable ways and can change quickly. Researching the historical trends of the crypto markets can help you gain an edge on your competition if you are looking to trade in cryptocurrency.

Forex traders need a good understanding of the dynamics between foreign currencies pairs. For instance, they must be able to see how prices respond to news. This also requires an in-depth understanding of technical indicators which can indicate sell or buy signals. Leverage is also an important factor to be considered, since traders can risk their capital as well as additional borrowed funds when trading currency pairs of high volatility.

Both forex and crypto both require attention, solid research skills and a clear strategy in order to consistently make profitable trades.

What are the benefits and drawbacks of investing online?

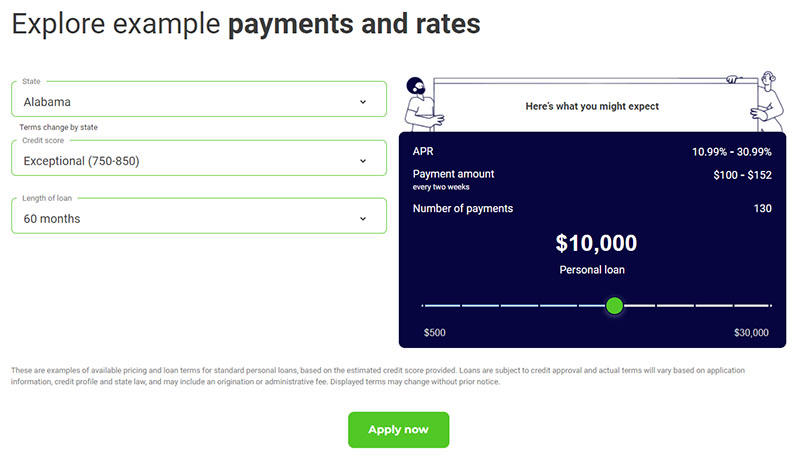

Online investing is convenient. Online investing allows you to manage your investments anywhere with an internet connection. Access real-time market data, and make trades online without leaving your office or home. Online brokerages often offer lower fees than traditional brokerages. This makes it easier for investors start with smaller amounts of capital.

However, there are some drawbacks to online investing. Online investing can lead to difficulties in getting personalized advice and guidance. You don't have the support of a financial advisor, broker, or physical broker. Online trading platforms may not offer the same level or security as traditional brokerages. Investors must be aware that there are risks. Online trading is more complex than traditional investing. This is why it is crucial to be familiar with the markets and formulate a sound strategy.

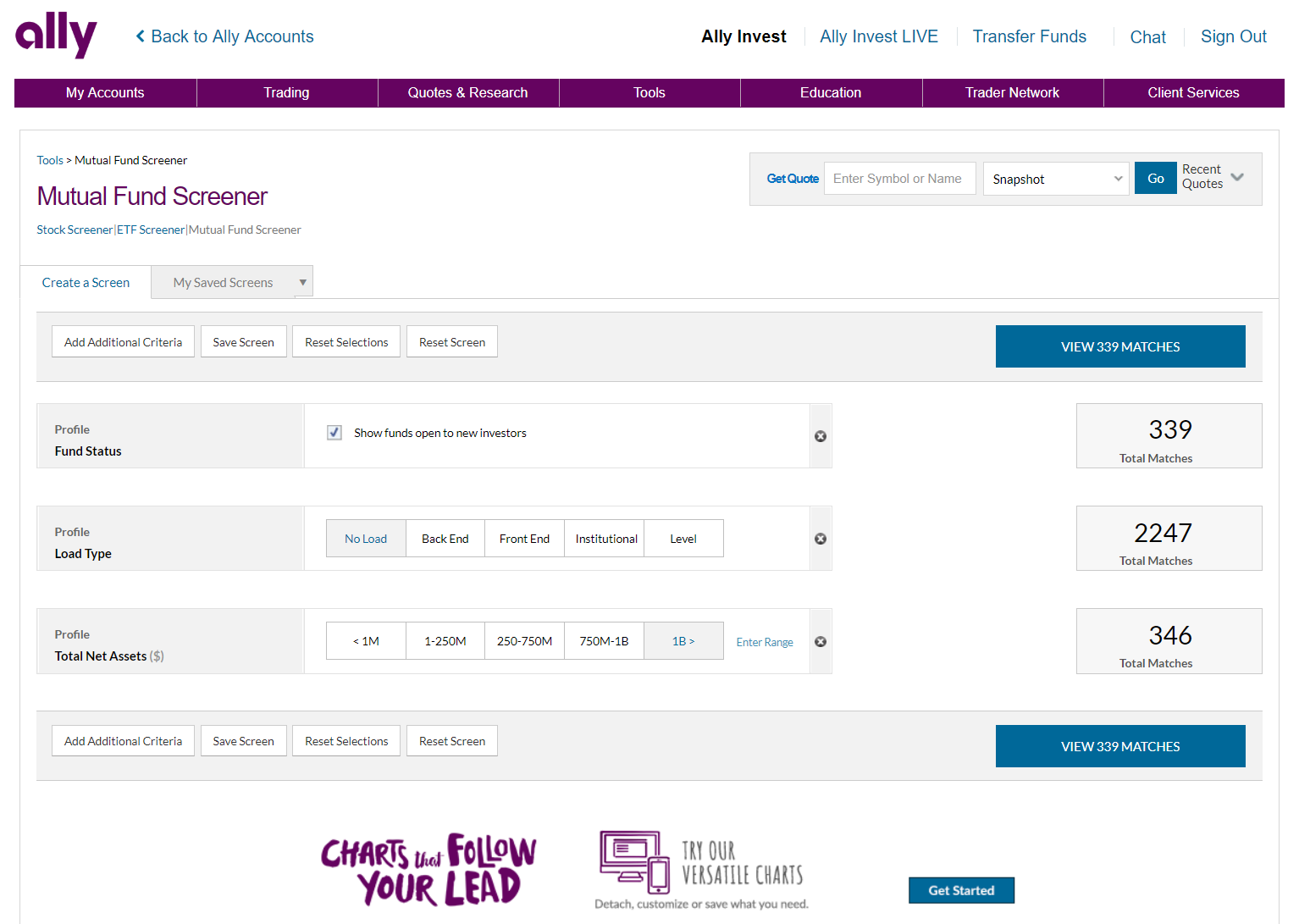

When considering investing online, it is also important that you understand the types of investments available. Investors have many options. They can choose from stocks, bonds, mutual funds and cash equivalents. Each type of investment comes with its own risks and rewards. It is crucial to thoroughly research each one before you make a decision. You should also consider the fact that some investments might require a minimum deposit, or may have restrictions.

Where can i invest and earn daily?

It can be a great method to make money but it's important you understand all your options. You don't have to put your entire savings into the stock market - there are plenty of other options.

One option is to invest in real property. Investing in property may provide steady returns and long-term appreciation. It also offers tax benefits. Diversifying your portfolio might be a good idea.

If you are looking for daily income and short-term profits, then you should consider investing in stocks that pay dividends. If you are comfortable with the risk, you can trade online using day trading strategies.

Whatever your investment goals may, it's important that you research all types of investments before investing. Every asset has its own risks. You must keep an eye on your investments, recognize when you should buy or sell them so that you can maximize your earnings while working towards your financial goals.

Which trading site is best suited for beginners?

Your level of experience with online trading will determine your ability to trade. If you're totally new to the process, then going through an established broker with expert advisors would be a great place to start.

These brokers take the guesswork out of choosing companies and give solid recommendations that can help you build a portfolio steadily over time. Many brokers provide interactive tools to show you how trades function without risking any money.

There are many sites that let you trade on your own if you have some knowledge and want to take more control of your investments. These sites offer customizable trading platforms, live data feeds, research resources, and real-time analytics for well-informed decisions.

No matter which route you choose, be sure to read customer reviews before you make a decision. This will give you an insight into the service and experience of each site.

Which forex or crypto trading strategy is best?

Both crypto trading and forex have potential for profit, but which one is right for you depends on your investment goals.

Forex trading involves investing in different currencies and is an accessible option for beginners. You will need to invest a lower amount upfront. Additionally, forex markets are worldwide and available 24/7.

But crypto trading is a great alternative because it offers almost instant returns as prices can fluctuate quickly due volatility. The liquidity of crypto trading means that you can quickly cash out your tokens.

Both cases require that you do extensive research before investing. Managing your risk through proper diversification of assets will go a long way with any type of trading you choose.

It is important to be familiar with the various types of trading strategies that are available for each type. For example, forex traders could use technical analysis or foundation analysis to help make decisions. Crypto traders may choose arbitrage or margin trading to maximise their profits. Some traders might also opt for automated trading systems, or bots, to manage their investments. Before you invest, make sure to understand the risks associated with each strategy.

Most Frequently Asked Questions

What are the four types of investing?

Investing allows you to increase your financial resources and potentially earn money in the long-term. There are four types of investing: stocks and bonds, mutual funds and cash equivalents.

There are two types of stock: preferred stock and common stock. A common stock allows an individual to have a share of the company. It includes voting rights at shareholder's meetings and the ability to earn dividends. A preferred stock, however, gives an individual ownership right but without voting privileges. It also offers fixed dividend payments which provide investors with a steady income stream.

Bonds are loans by investors that are made to governments or businesses in exchange for interest payments. While bonds offer more stability and lower risk than stocks, the returns are usually lower than those of stocks.

Mutual funds involve pooling investor money together in order to spread investment risk and diversify investments over many different types of securities including stocks, bonds, and commodities. Professional managers manage mutual fund investments. They use their knowledge to choose profitable investments that meet pre-set criteria.

Cash equivalents include products such as Treasury bills, money market deposits, certificates of deposit (CDs), and commercial paper which often mature within one year or less during which time they carry minimal risks of default or downturns in their value. This type is best for conservative investors, who don't mind taking high risks but still desire a greater return than deposits at low-interest banks accounts.

Statistics

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How can I verify the legitimacy of an online investment opportunity?

It is important to do your research before investing online. You should research the company that is offering the opportunity. Make sure they are registered with financial authorities. Also, be aware of any restrictions or industry regulations that may apply to your investments.

Review past performance data, if possible. Look for current customer reviews online to get a sense of how customers have experienced the investment opportunity. Be skeptical of promises of substantial future returns or future results.

You should understand the investment risk profile and be familiar with the terms. Before opening an account, confirm the exact fees and commissions on which you might be taxed. Do your due diligence and make sure you get what you pay for. You should have an exit strategy that is clear in case something goes wrong with your investment. This could help you reduce your long-term losses.