Spreads options are an important component of any trading strategy, but they can get quite complicated. Before you start pursuing spread trades, consider how the options fit in with your overall investment strategy.

Spread is the difference between two options' strike prices. There are three main types of spreads: vertical, horizontal and diagonal.

Spread the Bull Call

A bull call spread, which is a simple strategy, allows you make more money by selling an option position rather than buying it. It is a combination of selling a call option that has a lower strike price, and buying one with a higher price.

This spread gives you the opportunity to gain more premium for a smaller outlay, and it also reduces the risk that your underlying asset will fall in value. The strategy is not without its limitations. However, it requires that the underlying assets be expected to move in an appropriate direction.

A bull call spread is another option to increase your profit if you believe that the underlying asset may rise in price over time. This strategy includes a long call and short call at the strike price higher than the current price.

Horizontal Spread

A horizontal spread is a variation of a calendar spread and it consists of buying and selling options at different points in time. You can achieve this by using different expiration months on each contract.

It is important that you remember that a horizontal spread can have multiple uses and that you should always consult with your broker before setting one up.

Another way to make money from a calendar spread, is to roll it. This allows you to buy the back-monthly contract and sell your front-month contract.

Two orders must be placed with your broker to make this strategy profitable. The first order is to sell the front-month contract, and the second is to buy the back-month contract.

Next, determine if you believe the market will move in the expected direction. If the market moves in the wrong direction, you can lose all of your money on the spread.

A bear order spread is an identical strategy. However, the underlying security may move in the opposite way to the original move. While you may lose money with a bear call spread, you won't suffer as much loss as with a bullcall spread.

It is important to keep in mind that this spread is credit-based, and therefore the loss potential cannot exceed the spread's premium. The spread's width and the strike price difference will determine the maximum loss.

This strategy is great for traders who expect a fall in security value, but don't want the risk of it going up instead. It is risky though and beginners should avoid it.

FAQ

Which is harder crypto or forex?

Forex and crypto both have unique levels of complexity. Crypto may require a greater level of understanding due to its newness and connection with blockchain technology. On the other hand, forex has been around for a long time and has a reliable trading infrastructure supporting it.

Trading cryptocurrency is more risky than forex. It's because the crypto markets can change in an unpredictable way over short time periods. Researching the historical trends of the crypto markets can help you gain an edge on your competition if you are looking to trade in cryptocurrency.

Forex traders need to be able to comprehend the dynamics between foreign currency pairs. For example, how prices react to news. It also requires an acute understanding of technical indicators that can indicate buy or sell signals. Leverage is another factor that must be taken into account, as traders risk not only their capital but also additional borrowed funds when trading currency pairs with significant volatility.

For both crypto and forex, it is important to be alert, do your research well, and have a strategy for making consistent trades.

Is Cryptocurrency a Good Investing Option?

It's complicated. Cryptocurrency has become increasingly popular over the past few years, but whether or not it will be a successful investment depends on numerous factors. There is always risk in investing in cryptocurrency markets. They are volatile and unpredictable.

On the other hand, if you're willing to take that risk and do your research, there are potential gains to be made based on events like Initial Coin Offerings (ICOs) and shifts in the marketplace.

Because cryptocurrency assets are not subject to traditional stock market movements, they can be used as a portfolio diversification tool.

It really boils down to each individual's tolerance for risk and knowledge about the crypto market. If you're able to make informed decisions and are open to taking risks, then investing is definitely something worth considering.

Where can I earn daily and invest my money?

It can be a great method to make money but it's important you understand all your options. You don't have to put your entire savings into the stock market - there are plenty of other options.

One option is to buy real estate. Property investments can yield steady returns, long-term appreciation, and tax benefits. Consider diversifying your portfolio by investing in bonds, ETFs or mutual funds. You might also want to consider specialty fields such as cryptocurrency.

If you are looking for daily income and short-term profits, then you should consider investing in stocks that pay dividends. Trading online with day trading strategies is also possible, if you are comfortable with taking on the risks.

Whatever your investment goals may, it's important that you research all types of investments before investing. Every asset has its own risks. You should closely monitor your investments and know when to sell and buy accordingly. This will help you maximize your earnings and reach your financial goals.

Which trading site is best suited for beginners?

It all depends on how comfortable you are with online trading. If you're totally new to the process, then going through an established broker with expert advisors would be a great place to start.

These brokers remove the guesswork from choosing companies and offer solid recommendations to help you build your portfolio. Plus, most offer interactive tools to demonstrate how trades work without risking real money.

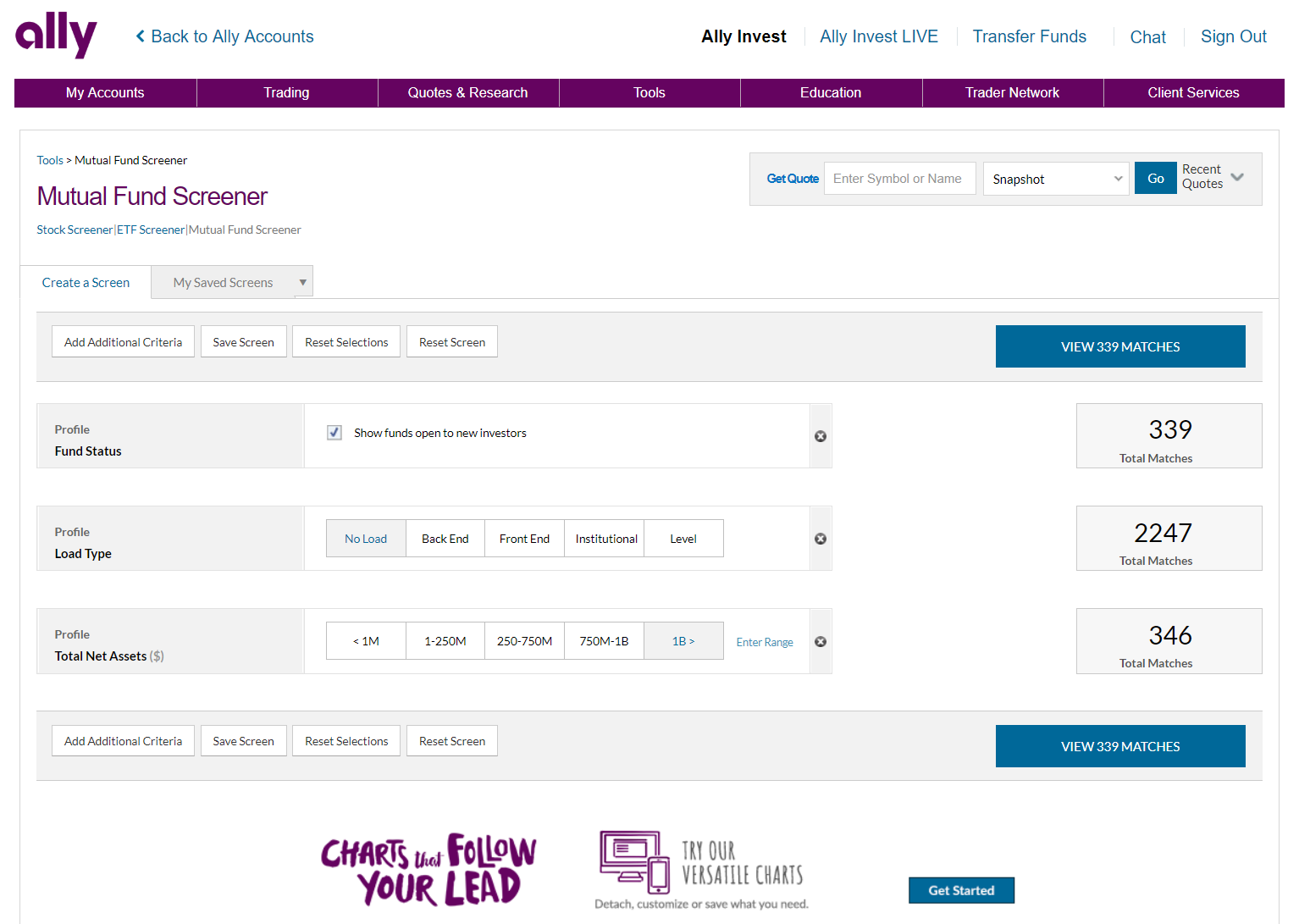

There are many sites that let you trade on your own if you have some knowledge and want to take more control of your investments. They provide customizable trading platforms and live data feeds. You can also access research resources such as real-time statistics to help you make informed decisions.

Regardless of which route you take, make sure to check out customer reviews before making a choice - this will give you insight into the experience and service levels of each site before committing.

How can I invest in Bitcoin?

Although it may seem difficult to invest in Bitcoin, it is not as complicated as you might think. All you need is the right knowledge and tools to get started.

You need to be aware that there are many investment options. You have the option to buy Bitcoin direct, trade on an exchange, or gain exposure using a financial instrument called a derivatives contract.

You must also decide where you will store Bitcoin. There is a wide range of options available, including exchanges, custodians, cold storage, wallets and exchanges. Depending on your risk appetite and goals, some options might be more suitable than others.

Next, find any additional information that may be necessary to make confident investment decisions. Learning the basics of cryptocurrencies and how they work before diving in is important. With that said, make sure you keep track of market news and developments so you can stay up-to-date with crypto trends.

Finally, create a plan for investing in Bitcoin based on your level of experience and set reasonable expectations for returns - this will give you a better chance at success long-term too!

Most Frequently Asked Questions

Which are the 4 types that you should invest in?

Investing is a way to grow your finances while potentially earning money over the long term. There are four main types of investing: stocks, bonds and mutual funds.

Stocks can be broken down into common stock or preferred stock. Common stock gives you the opportunity to vote at shareholder meetings, and earn dividends. Preferred stock also gives ownership rights but with no voting privileges, as well as fixed dividend payments that offer investors a reliable income stream.

Bonds are loans from investors made to governments or companies in exchange for interest payments until the bond expires on its maturity date. Although bonds are more stable and less risky than stocks they offer a higher return than stocks.

Mutual funds can be described as pooling investors money together to spread investment risks and diversify investments over a wide range of securities. This includes stocks, bonds, and other commodities. Mutual funds are managed by professional managers who use their expertise to select profitable investments in accordance with pre-set criteria such as level of risk or desired gain rate.

The cash equivalents can be products such as Treasury bills and money market deposits, CDs, and commercial paper. These products usually mature within one to three years, which means they are less susceptible to default or declines in value. This type is best for conservative investors, who don't mind taking high risks but still desire a greater return than deposits at low-interest banks accounts.

Statistics

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

External Links

How To

How can I check the legitimacy and authenticity of online investment opportunities?

Research is critical when investing online. You should research the company that is offering the opportunity. Make sure they are registered with financial authorities. Additionally, look out for any industry regulations or restrictions that could apply to your investments.

Review past performance data, if possible. Find customer reviews online to find out how people have felt about the investment opportunity. Do you believe it is too good to true? Be wary of claims that promise future success or substantial returns.

Understand the risk profile of the investment and familiarise yourself with the terms and conditions. Before you open an account, check what fees and commissions might be taxed. Make sure you're getting what you paid for in terms of terms and services offered by conducting due diligence checks as necessary. You can also make sure that you have an exit strategy for any investment that doesn't go according the plan. This will help reduce long-term losses.