The stock market can give you incredible returns. Before you make a purchase, however, it is essential to thoroughly research all options. Markets can be risky so make sure you choose a trusted broker. Your goals should be considered when you are looking for an online stock brokerage. A broker that offers an advisory service might be a good choice if you're saving for retirement. Trading penny stocks is also possible but can be difficult.

There are many outstanding brokers out there. However, it is important you take into consideration your trading style. For example, a day trader might prefer a broker that provides a user-friendly platform. You might also prefer advanced trading platforms if you are long-term investment.

You can also inspect the reputation of the broker. A list of all brokers registered with the Financial Industry Regulatory Authority is available at FINRA. It is important to find a broker with a strong track record and who is regulated or licensed by an authority. Often, brokers that are not regulated by a local authority can be linked to blacklisted companies. It is vital to investigate the broker before you sign up.

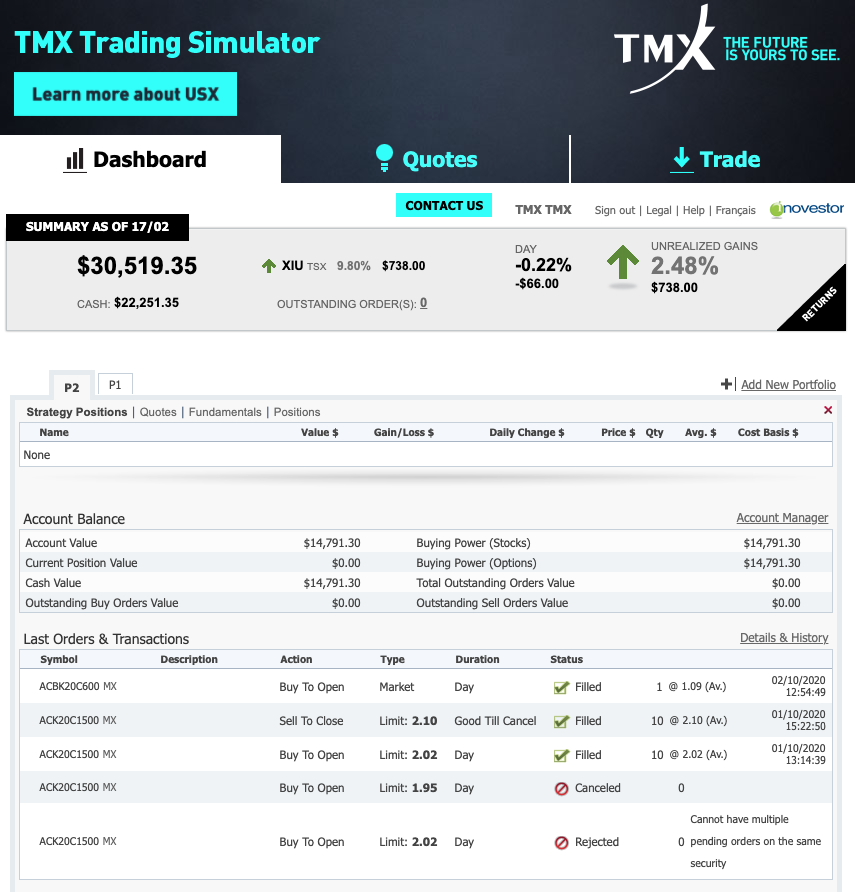

A demo account is a great way to get started in trading. Having a demo account will help you test your strategy and refine it before you invest real money. A demo account is a great way to experience the platform and test it out.

Many research can be done online, even without meeting up with your broker. Many of the top online stock brokers offer free demo accounts. These demo accounts let you see the market in action and allow you to test out your strategies prior to investing.

Be aware of the broker's commission fees and other services. A full-service broker typically offers a variety of services. But, a discount broker only provides stock trading. Before opening an Account, be sure to check out how the platform is set-up and what the trading costs are. Compare the commission rates from different brokers to find out which one offers the lowest rate.

The broker's customer service should be examined. A broker should be able to access a knowledgeable support team if there are any problems with the system. You can read reviews from trusted sources to get a feel for the company.

TD Ameritrade has a strong reputation as an American online brokerage. Their products and services include commission-free trading of thousands of stocks and ETFs. The firm has been in business since 1971 and was previously known as Ameritrade. They have approximately 12 million clients.

FAQ

Which platform is the best for trading?

Many traders may find it challenging to choose the best trading platform. It can be confusing to choose the right one, with so many options.

The best trading platform should include the features you are looking for, including advanced chart analysis tools as well as real-time data from the markets and sophisticated order execution capabilities. It should also offer an intuitive and user-friendly interface.

You will need to have access to multiple account types, low fees, reliable customer support, and educational resources. Demo accounts and free trials are a great way to test virtual money before investing any real money.

You should consider your type of investor or trader when looking for a trading platform. For example, are you active or passive? How often do you plan to trade? What asset class mix would you like? These factors will help you narrow down your search to find the right trading platform.

Once you have identified the platform that suits you best, it is time to explore additional features such backtesting capabilities and stock screening tools. Make sure your platform has the right security protocols to protect your data against theft or breaches.

MetaTrader 4/5 (MT4/MT5) and cTrader are some of the most well-known trading platforms.

Which is better, safe crypto or Forex?

Forex trading and cryptocurrency are risky investments. They have varying returns and potential risks.

Crypto, short for cryptocurrency, is a digital currency created from a piece of code through blockchain technology. It can trade on exchanges just like any money, and has been the subject speculative investment because of its drastic price swings.

Forex trading or foreign currency currency trading is a highly leveraged investment in which participants speculate about the value of one currency relative to another. Forex, which can be unstable and cause large losses if not managed well, is an investment that should not be taken lightly.

Both Forex and Crypto both have their benefits and drawbacks. However, Crypto has a higher risk of losing money than Forex. The limited supply of cryptocurrencies and the regulations that surround them around the globe make their prices unpredictable. However, forex markets are more steady so investors can have more control over what they invest. When deciding which option between Cryptocurrency and Forex is safer, it will depend on your risk appetite and experience with each investment option.

What are the pros and cons of investing online?

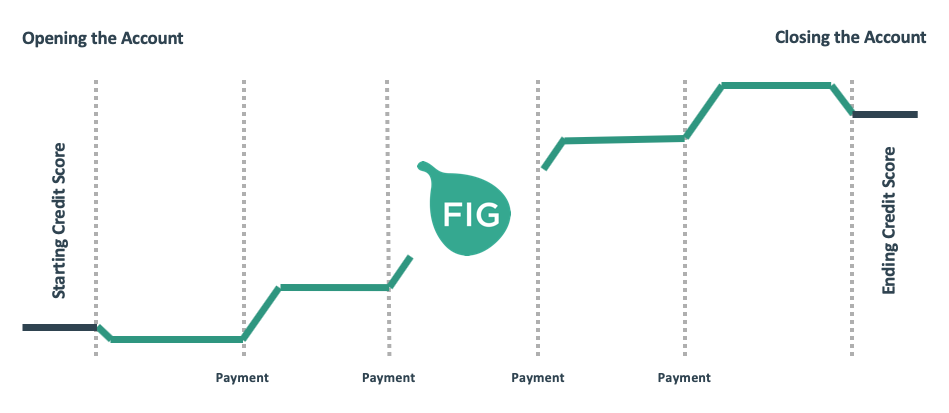

Online investing offers convenience as its main benefit. You can access your investments online from any location with an internet connection. Online trading is a great way to get real-time market data. Many online brokerages charge lower fees than traditional ones, which makes it easier to start investing with less money.

Online investing is not without its challenges. For example, it can be difficult to get personalized advice and guidance when trading online, as you don't have a physical broker or financial advisor to help you make decisions. Additionally, online trading platforms may not offer the same level of security as traditional brokerages, so investors need to be aware of the risks involved. Finally, online trading can be more complex than conventional investing, so it's essential to understand the markets and develop a sound strategy before getting started.

It is also important for online investors to be aware of all the investment options. Stocks, bonds, mutual funds, and cash equivalents are all options for investors. Each investment comes with its own risks. You should research all options before you decide on the right one. There might be restrictions or a minimum deposit required for certain investments.

How Can I Invest in Bitcoin?

Investing in Bitcoin can seem complicated, but it's not as hard as you think! You only need the right information and tools to get started.

It is important to realize that there are several ways to invest. You have the option to buy Bitcoin direct, trade on an exchange, or gain exposure using a financial instrument called a derivatives contract.

You must also decide where you will store Bitcoin. There is a wide range of options available, including exchanges, custodians, cold storage, wallets and exchanges. There are many options available, but some might be more appropriate than others, depending on what your goals and risk appetite are.

Next, find any additional information that may be necessary to make confident investment decisions. It is important to be familiar with the basics of cryptocurrency and how they function before you begin investing. With that said, make sure you keep track of market news and developments so you can stay up-to-date with crypto trends.

Finally, create a plan for investing in Bitcoin based on your level of experience and set reasonable expectations for returns - this will give you a better chance at success long-term too!

Can you make it big trading Forex or Cryptocurrencies?

It is possible to get rich trading forex or crypto. However, you need to use a strategic approach. You need to be aware of the market trends so you can make the most of them.

You will also need to know how to identify patterns in prices, which can help you decide where the market is going. It is important to trade only with money you can afford to lose.

To be able develop a long-term profitable strategy, it takes experience, knowledge, skills in risk management, and discipline.

Cryptocurrency prices are often volatile, so the key is to make sure that your entry position fits with your risk appetite and exit plan - meaning that if there becomes an opportunity for profit-taking or limiting losses, then do so.

The cryptocurrency market is largely unregulated and presents substantial risks. Before you sign up for any type of wallet or platform, make sure to research the coins and exchanges.

Forex trading is a complex business that involves forecasting fluctuations in currency exchange rates using technical analysis/fundamental analyses of global economic data. This type of trading requires specialized knowledge. Knowing the current conditions that affect different currencies' currency exchange rates is vital.

At the end of the day though, it's all about taking calculated risks, being willing to learn continually, and mastering an effective strategy that works best for you. You can make a lot trading forex and cryptos if you have enough knowledge and dedication.

Do forex traders make money?

Yes, forex traders can earn money. Although it is possible to make money in the short term, you will need to be patient and willing to learn. Market fundamentals and technical analysis are better than traders who rely only on luck or guesswork.

It's not easy to trade forex, but it is possible with the right knowledge strategies to produce consistent profits over time. It is crucial to find an educated mentor before you take on real capital.

Many traders fail because they lack a plan or approach. However, with discipline one can maximize his chances of making money on foreign exchange markets.

Experienced forex traders develop trading plans that they stick to when trading in order to reduce their risk exposure as much as possible while still finding profitable opportunities. It is important to manage risk. Many new traders are too eager to make quick profits and not have a long-term strategy.

Forex traders can increase their chance of generating long-term profits by maintaining good records, learning past trades and paying attention to other aspects of trading.

Forex trading is a disciplined business. Setting rules for how much money you're willing and able to lose per trade can reduce losses and help ensure success. Furthermore, strategies such as leverage entry signals can help increase profits that are not possible without the guidance of an experienced mentor.

The bottom line is that you must be persistent and learn from successful day traders to make a profit trading forex markets. This applies regardless of whether your capital is invested or managed for another person.

Statistics

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

External Links

How To

How can you protect your financial and personal information while investing online?

Online investment is not without risk. To protect your personal and financial information, you need to be aware of the risks associated with online investments and take steps to minimize them.

You must be mindful of who your investment platform or app is dealing with. Make sure you're working with a reputable company that has good customer reviews and ratings. Before you transfer funds or provide personal data, make sure to research the background of all companies and individuals with whom you are working.

Use strong passwords and two-factor authentication on all accounts and check for viruses regularly. To ensure your account security, disable auto-login on all devices. Protect yourself from phishing by never clicking links in emails from unknown senders, not downloading attachments unless you know what they are, and always double-checking a website's security certificate before entering private information into a website form.

Make sure that only trustworthy people have access to your finances by deleting all bank applications from old devices when getting rid of them and changing passwords every few months if possible. Keep track of account changes that might alert identity thieves such as account closure notices or unexpected emails asking to verify information. Also, you should use different passwords on each account to ensure that any breach in one doesn't cause others to be compromised. The last thing is to make use of VPNs for investing online when possible. These are often free and easy to setup!