Forex pips refer to the smallest change in a currency pair's value. These are used for calculating the profit or loss that can reasonably be expected from a trade. They can also serve to place stop-loss or limit orders. This allows traders the ability to limit losses in a market that is falling.

The currency's price is generally set at four decimal places. However, a few pairs may be priced at five or six. The base currency is used as the basis for the calculation of the pip price. The account usually determines the base currency. Before entering into a trade, it is important to verify the exact value of each pip. You will need to know the pip value before you can determine if the trade is reasonable.

A calculator can be used to calculate the pip value for a currency pair. This is a great way of determining whether or not a trade will succeed. Many service providers will do this automatically for you. Then you can decide if it is worth taking the risk. If a trader has a $5,000 account, for example, $50 would be lost each time they place a trade. But this percentage can be reduced if the pip calculation is accurate.

Forex traders use pips as a common tool. Pips are often displayed on Profit and Loss statements by brokers. A pip isn't always visible. Sometimes it is hidden. If you don't know what a pip is, it will be difficult to decide the size of the best position. To avoid making a mistake and committing to a trade which is not worthwhile, you must determine the exact number required to cover all possible losses.

Forex pips can be used to calculate the exact value of a position. However, they aren't the most accurate way to measure risk. Calculating the pips value can help a trader to determine the right size of a position, especially if they have a stop-loss order. A good rule of thumb is to calculate the total pips that you will need to lose in a given trade before deciding to enter it. This will allow you to cancel a trade in many cases.

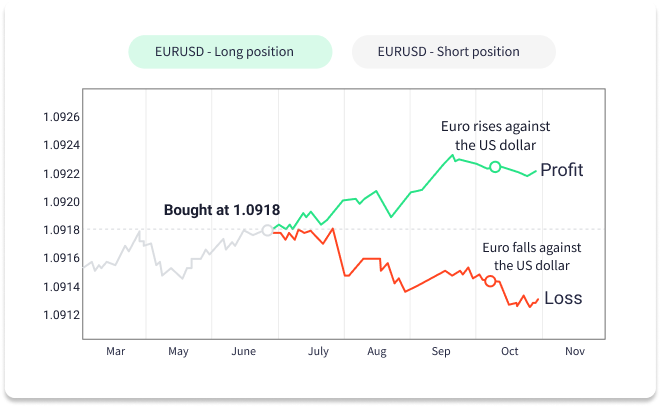

For example, if your EUR/USD trade is going well, you would want to place a stop-loss or stop order 50 pips below your entry price. This will allow your to take profits when you are in the market's favor. If you trade a long position, your take-profit order should be set at 70pips above the entry price. Knowing the number of pips required to make profit will allow you to calculate the amount you will need to put into the trade.

A key step in any money management strategy is to determine how many pips to place in a trade. Some brokers advertise spreads of 0.6 pips. The spread may change if the exchange rate of the pair is drastically changed. Extreme cases, such as currency devaluation or hyperinflation, can result in exchange rates going unmanageable.

FAQ

Is Cryptocurrency a Good Investing Option?

It's complicated. It's complex. While cryptocurrency has grown in popularity over recent years, the success of an investment depends on many factors. One, the cryptocurrency market can be volatile and unpredictable. This means that there is always risk when investing in them.

However, if you are willing to take that risk, and do your research, then there may be potential benefits based on events such as Initial Coin Offerings (ICOs), and shifts in market.

The advantages of cryptocurrency investments for portfolio diversification are also available, since they tend to be independent from traditional stock markets.

It really boils down to each individual's tolerance for risk and knowledge about the crypto market. It is definitely worth investing in cryptos if you have the knowledge and ability to make informed decisions regarding this asset class.

How Can I Invest in Bitcoin?

Although investing in Bitcoin may seem complex, it's actually not as difficult as you think. All you need is the right knowledge and tools to get started.

There are many options for investing. You can purchase Bitcoin directly, use an exchange to trade, or use a financial instrument known as a derivatives contract to gain exposure.

You'll also need to decide where you will store your Bitcoin - there are many options available such as wallets, exchanges, custodians, and cold storage. You may choose one option or another depending on your goals and risk appetite.

Next, you should research any additional information necessary to feel confident in your investment decisions. It is important to be familiar with the basics of cryptocurrency and how they function before you begin investing. To stay on top of crypto trends, keep an eye out for market developments and news.

Last but not least, develop a plan that will allow you to invest in Bitcoin according to your experience and have reasonable expectations of returns. This will help you be more successful long-term.

Which is more secure, forex or crypto?

Forex trading and cryptocurrency are two highly risky investments. The rewards and the risks can be very different.

Crypto, short for cryptocurrency or digital currency, is a digital coin that was created by a piece code using blockchain technology. It can be traded like any other currency on exchanges and has been subject to speculation investments because of its volatile price swings.

Forex, also known as foreign exchange currency trade, is high-leveraged investment that involves participants speculating on the value and relative strength of one currency. Forex, which can be unstable and cause large losses if not managed well, is an investment that should not be taken lightly.

Both Crypto and Forex have their advantages and disadvantages but, overall, crypto tends to carry a greater level of risk compared to Forex. Because of the limited supply and regulations around cryptocurrencies, prices can fluctuate. But forex markets move more consistently so investors have more control. The decision about which of Cryptocurrency or Forex is more secure will be based on the individual's risk appetite and their previous experience with each investment option.

What are the pros and cons of investing online?

Online investing offers convenience as its main benefit. You can manage your investments online, from anywhere you have an internet connection. You can access real-time market data and make trades without having to leave your home or office. Many online brokerages charge lower fees than traditional ones, which makes it easier to start investing with less money.

However, online investing does have its downsides. For example, it can be difficult to get personalized advice and guidance when trading online, as you don't have a physical broker or financial advisor to help you make decisions. Additionally, online trading platforms may not offer the same level of security as traditional brokerages, so investors need to be aware of the risks involved. Online trading is more complex than traditional investing. This is why it is crucial to be familiar with the markets and formulate a sound strategy.

You should also be aware of the different investment options available to you when investing online. Investors have many options. They can choose from stocks, bonds, mutual funds and cash equivalents. Each investment has its risks and rewards. Before you decide which type of investment is best for you, it is important that your research is thorough. There might be restrictions or a minimum deposit required for certain investments.

Where can i invest and earn daily?

It can be a great method to make money but it's important you understand all your options. There are other ways to make money than investing in the stock market.

One option is to buy real estate. Investing property can bring steady returns as well as long-term appreciation. Consider diversifying your portfolio by investing in bonds, ETFs or mutual funds. You might also want to consider specialty fields such as cryptocurrency.

If you are looking for daily income and short-term profits, then you should consider investing in stocks that pay dividends. Trading online with day trading strategies is also possible, if you are comfortable with taking on the risks.

It doesn't matter what your investment goals are, it is important to research each type of investment before you dive in headfirst. Each asset has its own set of risk factors. So that you can maximize your earnings, and achieve your financial goals, you must closely monitor all investments.

Which forex trading platform or crypto trading platform is the best?

Both forex and crypto trading offer potential profits. However, it all depends on your investment goals.

Forex trading involves investing in foreign currencies. This is an easy option for beginners. It requires a smaller capital upfront, plus forex markets are global and open 24/7.

On the other hand, crypto trading offers an almost immediate return as prices can fluctuate quite rapidly due to their volatility. It is also easy to cash out tokens quickly, as crypto trades have high liquidity.

In both cases it's crucial to do your research before making any investment. With any type or trading, it is important to manage your risk with proper diversification.

It is also important to understand the different types of trading strategies available for each type of trading. For example, forex traders may use technical analysis or fundamental analysis to help them make decisions, while crypto traders may use arbitrage or margin trading to maximize their profits. Some traders might also opt for automated trading systems, or bots, to manage their investments. It is important to understand the risks and rewards associated with each strategy before investing.

Statistics

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

What precautions should I take to avoid online investment scams?

Protect yourself. By brushing up on how to spot scams and understanding how fraudsters' tricks work, you can protect yourself from getting duped.

Avoid high-pressure sales tactics, promises of guaranteed returns and offers that sound too good to be true. Unsolicited email or phone calls should not be answered. Fraudsters frequently use fake names. Don't trust anyone just because they are a person. You should thoroughly investigate investment opportunities and do your research on the person offering them.

Never invest money on the spot, in cash, or by wire transfer - if an offer insists upon these methods for payment, it should raise a huge red flag. Remember that scammers will do anything to obtain your personal information. Protect yourself from identity theft by being mindful of different types of online phishing schemes and suspicious links sent via email or online ads.

It's also important to use secure online investment platforms. You should look for sites that have good reputations and are regulated by Financial Conduct Authority (FCA). Secure Socket Layer is encryption technology that helps protect data sent over the internet. Before investing, you should read all the terms and condition of any site or app. You also need to understand any fees or other charges.