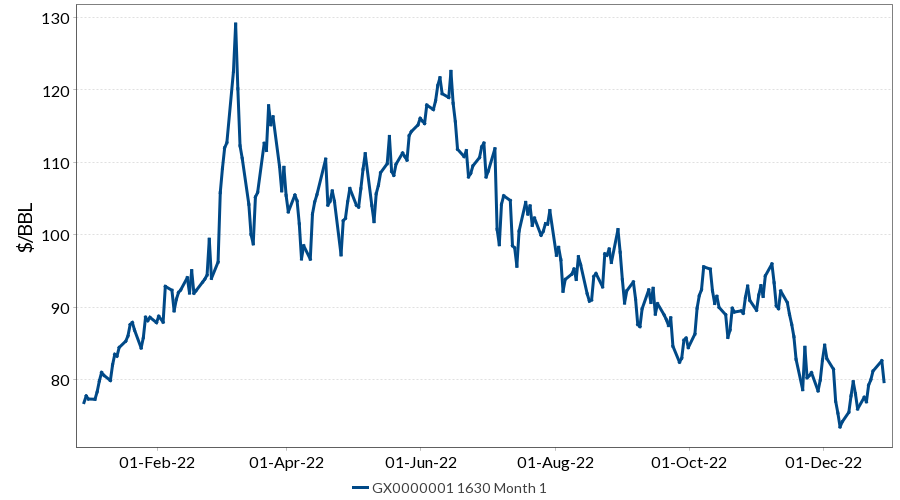

A crude oil forwards ticker, a type of futures agreement, allows investors to buy or sell a predetermined quantity of a commodity like oil, at a designated date. The price is determined using a benchmark, which is the commodity's current value in dollars and the amount of a barrel. Different crude grades are traded in different locations and may contain different levels of sulfur or other impurities.

Crude oils futures are one of the most liquid and popular contracts. They can trade on several exchanges. The New York Mercantile Exchange, NYMEX, is the most commonly traded. NYMEX provides contracts for oil as well, including natural gas, gasoline and heating oils. These commodities are the most traded with an average of more than one million contracts traded per day.

Crude oils futures allow investors to be a part of the most active and significant commodity market in world. They are traded using standard ticker-tape quotations. Futures contracts are also used by substantial energy consumers to hedge against price fluctuations.

A variety of factors affect the price of a specific grade of oil, including the production decisions made by OPEC, manufacturing industries and transportation industries. Oil speculators make money betting on the futures markets by purchasing and selling futures contracts. While some commodities are considered a "strong buy," other commodities are a "strong sell." The individual investor decides which crude oil futures is best for them.

WTI Crude Oil Futures, which are the most traded crude oils futures, are highly liquid. Refiners prefer light sweet crude due to its low sulfur level and high yields. This oil is also used in the United States as Bakken crude. The price of this contract is affected by the weekly Wednesday crude oils inventories report.

Every Wednesday at 10:30 Eastern Time the EIA releases a weekly report about petroleum status. Analysts predict that the oil sector in 2022 will be strong.

A crude oil futures contract can be bought and sold for up to nine years in advance. This is a relatively cheap way to invest in the global oil industry. To protect themselves against changes in oil prices, many companies involved in producing and distributing fuels will resort to crude oil futures.

E-mini is one of the most sought after types of crude oil futures. These contracts have a smaller size and allow private investors to access the market. Trading in this type of contract requires a minimum amount of capital. If you want to get in on the action, Schwab offers $2.25 per contract, a bargain compared to other brokers.

The most liquid of the three major types of crude oil futures is the WTI Light Sweet Crude Oil futures. The other two are Brent crude and Dubai crude. Traders on the CME and the Intercontinental Exchange (ICE) use Brent as a benchmark for prices in Europe, North Africa, and the Middle East.

FAQ

Do forex traders make money?

Yes, forex traders are able to make money. Although it is possible to make money in the short term, you will need to be patient and willing to learn. Traders who can understand market fundamentals, technical analysis and trading are more likely than those who rely exclusively on luck or guessing to succeed.

Forex trading isn't easy but with the right knowledge and strategies, it's possible to generate consistent profits over time. It is crucial to find an educated mentor before you take on real capital.

A lack of a strategy or plan can lead to many traders failing. However, if one is disciplined they can maximize their chances at making money in foreign exchange (forex).

Experienced forex traders develop trading plans that they stick to when trading in order to reduce their risk exposure as much as possible while still finding profitable opportunities. It is important to manage risk. Many new traders are too eager to make quick profits and not have a long-term strategy.

Forex traders can increase their long-term profitability by keeping detailed records, studying past trades as well as payments and understanding platforms that facilitate currency trading.

Forex trading requires discipline. You need to establish rules that limit your losses. Leverage entry signals and other strategies can increase profits.

Ultimately though, being persistent and learning from successful day traders other methods--such as risk management techniques--are necessary for profitability as a trader in forex markets regardless if you're investing your own capital or managing funds for someone else.

Which is best forex trading or crypto trading?

Both crypto and forex trading can make you money, but it really comes down to your investment goals.

Forex trading involves investing in different currencies and is an accessible option for beginners. You will need to invest a lower amount upfront. Additionally, forex markets are worldwide and available 24/7.

Crypto trading, on the other hand, offers a fast return because prices can fluctuate very quickly due to their volatility. You can cash out your tokens quickly because crypto trades are highly liquid.

In both instances, it is crucial to do your research prior to making any investments. Diversification of assets and managing your risk will make trading easier.

It is important that you understand the different trading strategies available for each type. For instance, forex traders may use technical or fundamental analysis to make their decisions. Crypto traders might use arbitrage, margin trading, or both to maximize profits. Some traders might also opt for automated trading systems, or bots, to manage their investments. It is important to understand the risks and rewards associated with each strategy before investing.

Which is harder, forex or crypto.

Each currency and crypto are different in their difficulty and complexity. Crypto may require a greater level of understanding due to its newness and connection with blockchain technology. On the other hand, forex has been around for a long time and has a reliable trading infrastructure supporting it.

There are greater risks in cryptocurrency trading than forex. This is because crypto markets can move quickly and in unpredictable ways. If you want to succeed in crypto trading, researching the historical trends in the markets where it trades can give you an edge over your competition.

Forex traders should be able understand the dynamics among foreign exchange pairs. They need to know how prices shift based upon news and macroeconomic events. A good understanding of technical indicators is essential to identify buy and sell signals. Another factor to consider is leverage. When trading currency pairs that have high volatility, traders are putting their capital at risk.

To be successful in forex and crypto trading, you need to be attentive, have solid research skills, and have a clear strategy.

Is Cryptocurrency an Investment Worth It?

It's complicated. It is complicated. One thing is certain: the cryptocurrency market can be unpredictable and volatile so investing in it will always come with risk.

However, if you are willing to take that risk, and do your research, then there may be potential benefits based on events such as Initial Coin Offerings (ICOs), and shifts in market.

Because cryptocurrency assets are not subject to traditional stock market movements, they can be used as a portfolio diversification tool.

It comes down to each person's individual tolerance for risk and knowledge in relation to the crypto markets. It is definitely worth investing in cryptos if you have the knowledge and ability to make informed decisions regarding this asset class.

Where can i invest and earn daily?

Investing can be a great way to make some money, but it's important to know what your options are. You don't have to put your entire savings into the stock market - there are plenty of other options.

Real estate is another option. Investing property can bring steady returns as well as long-term appreciation. It is possible to diversify your portfolio with ETFs mutual funds, bonds, and specialty fields like cryptocurrency.

If you're looking for shorter-term profits or daily income, you could try investing in stocks that pay dividends or look into peer-to-peer lending platforms where you lend out money and receive interest payments directly from borrowers on a daily basis. Online trading is possible if you're comfortable with the risks.

No matter your investment goals, it is important that you do thorough research on each type and investment before making any major decisions. Every asset comes with its own risks. You should closely monitor your investments and know when to sell and buy accordingly. This will help you maximize your earnings and reach your financial goals.

Which platform is the best for trading?

Many traders find it difficult to choose the right trading platform. There are many trading platforms out there, so it can be difficult for traders to choose one that is right for them.

The best trading platform must offer all of the features that you need such as chart analysis tools and real-time market data. It should also have sophisticated order execution capabilities. The interface should be intuitive and user-friendly.

You should have access to a range of account types, competitive fees, reliable customer service, and educational resources. You should look for demo accounts and free trials that allow you to practice with virtual money without risking your real cash.

Consider your trading style when searching for a platform. This includes whether you are active or passive, how often you trade and what asset classes you prefer. This will help you narrow your search for the right trading platform.

After you have found the right platform for you, you should look at additional features like stock screening tools and backtesting capabilities. Alert systems are also available. Also, make sure that the platform you choose has appropriate security protocols in order to protect your data from theft and breaches.

MetaTrader 4/5/MT5 (MT4/MT5), cTrader and eToro TradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive brokers TD Ameritrade AvaTrade IQ Options Questrade Investopedia trade idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM ThinkingOrSwim App Store are just a few of the popular trading platforms.

Statistics

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

External Links

How To

What precautions should I take to avoid online investment scams?

Protecting yourself starts with you. To avoid being conned, learn how to recognize scams and understand how fraudsters operate.

Be wary of offers that seem too good to be true, of high-pressure sales tactics and promises of guaranteed returns. Do not respond to unsolicited emails or phone calls. Fraudsters use fake names often, so don't respond to unsolicited email or phone calls. Before you commit to any investment opportunity, make sure you thoroughly research the person who is offering it.

Never place money on the street, in cash or via wire transfer. This should alarm you if they insist upon such payment methods. Never forget that scammers will try any means to steal your personal data. Be aware of the different online phishing schemes, suspicious links in emails and online ads that could lead to identity theft.

It is also important that you use secure online investment platforms. Look out for sites that are regulated and respected by the Financial Conduct Authority. Check for encryption technology, such as Secure Socket Layer (SSL), which helps protect your data when it is sent over the internet. Make sure you understand the terms and conditions of any site or app you use before investing, including any fees or charges that may be applicable.