Developing a robust ES futures chart can be easy with a trading platform. The first step in understanding the market is to get started. This includes knowing when there is a futures market open. A strong understanding of risk management is also important. Trading can be risky. A sound money management strategy can protect your capital from any turbulence.

There are many indicators available to help you gauge price movement or the stock market. One of these indicators is the Vortex Indicator. The Market Delta is another. It's not just a fancy tool, it also helps when the instrument you are interested in is not directly related to the larger stock market. This indicator can be used to help you identify when the market's on an upswing.

For pattern traders, a better choice is a Japanese candlestick. Picking a chart with a pleasing visual presentation is key. Most software trading platforms make building robust ES futures charts a breeze.

There are many technical features in the ES futures chart. To avoid losing your shirt when trading futures, you need to be able to read the chart. Once you know the basics of the market, you can then start studying news events and the market. ES futures chart analysis should incorporate both technical and fundamental studies.

Market profile charts, for example are great tools to complement your own trading strategies. This chart displays a combined price, volume and time frame on a single chart. This chart gives more information than an OHLC.

Although a chart is the most obvious method of displaying data, the ES Futures chart has many other functions. The chart contains key levels from 8AM. Other indicators that are included in the ES Chart include the Fisher Transform as well as the level break.

The best ES forwards chart is the one with the greatest number of features. This chart might show the NYSETICK, a technical indicator that indicates when the market changes. The NYSE TICK will change in size depending on whether the market is strong. It also has a "big money" component. These players control the price in pre-market or overnight trading.

An ES-related indicator inset is also included on an ES futures charts. The NASDAQ 100, the NYSE TICK, and the VIX are the most important. Some indicators are less useful than others.

The use of the correct indicators can make or break trading decisions. As with any investment ES futures may be subject to significant loss. It is vital to fully understand each investment so that you can make informed decisions about how it will impact your portfolio. It doesn't matter if you are a beginner investor or an experienced one, it will help you make the most of your investment opportunities.

FAQ

Which is the best trading platform?

Many traders may find it challenging to choose the best trading platform. It can be overwhelming to pick the right platform for you when there are so many options.

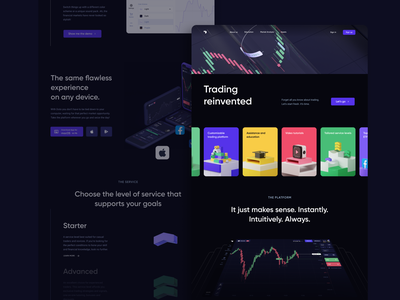

A trading platform that is the best should have all the features you require, such as advanced chart analysis tools, market data and order execution capabilities. The interface should be intuitive and user-friendly.

It should also provide a variety of account types and competitive fees as well as reliable customer service and educational resources. You should look for demo accounts and free trials that allow you to practice with virtual money without risking your real cash.

When searching for a trading platform, think about your trader/investor type. Consider whether you're active, passive, or both. Also, think about how often you plan on trading and the asset mix you would like. These factors will help you narrow down the search for the right platform.

After you have found the right platform for you, you should look at additional features like stock screening tools and backtesting capabilities. Alert systems are also available. Additionally, ensure your chosen platform provides appropriate security protocols in place to protect your data from breaches or theft.

MetaTrader 4/5 (MT4/MT5) and cTrader are some of the most well-known trading platforms.

Can forex traders make any money?

Forex traders can make good money. While it is possible to achieve success in the short-term, long-term profits typically come from dedication and a willingness to learn. More successful traders are those who have a solid understanding of market fundamentals and technical analyses than those who rely on their luck or guessing.

It's not easy to trade forex, but it is possible with the right knowledge strategies to produce consistent profits over time. It is crucial to find an educated mentor before you take on real capital.

Many traders lose their money because they don't have a well-planned strategy or plan. But with discipline, you can maximize your chances of making a profit in foreign exchange markets.

Experienced forex traders make trading plans that they stick with when trading. This helps them reduce their risk exposure, while still finding profitable opportunities. This is crucial because many traders who are new to forex trading can be too aggressive and chase quick wins instead of following a consistent, long-term strategy.

Forex traders can increase their long-term profitability by keeping detailed records, studying past trades as well as payments and understanding platforms that facilitate currency trading.

Having discipline really pays off in forex trading: developing rules such as how much money you're willing to lose on each trade helps minimize losses and ensure success; additionally strategies like leveraging entry signals often help increase profits beyond what could be achieved without guidance from an experienced mentor.

Ultimately though, being persistent and learning from successful day traders other methods--such as risk management techniques--are necessary for profitability as a trader in forex markets regardless if you're investing your own capital or managing funds for someone else.

Can you make it big trading Forex or Cryptocurrencies?

If you have a strategy, it is possible to make a lot of money trading forex and crypto. It is essential to be able to spot trends and determine the best time for you to buy and/or sell.

Also, you will need to be able to spot patterns in prices. This can help you determine where the market is heading. You should also trade with only the money you have the ability to lose.

You will need to have experience, knowledge and skills as well as discipline to create a long-term profitable strategy.

Because cryptocurrency prices can fluctuate, it is important that you make sure your entry position and exit plan are compatible. If there is an opportunity to take profits or limit losses, then go for it.

It is crucial to do your research on cryptocurrency exchanges before you sign up for any wallet.

Additionally, since forex trading involves predicting fluctuations in currency exchange rates through technical analysis/fundamental analysis of global economic data this type of trading needs specialized knowledge acquired over time. Therefore having a robust understanding of the conditions affecting different currencies is imperative.

It all comes down to taking calculated risks, learning continuously, and finding the most effective strategy for you. With enough dedication and the right education, you could make a fortune trading forex or cryptos.

Which is more difficult forex or crypto currency?

Crypto and forex have their own unique levels of difficulty and complexity. Crypto is more complex because it is newer and related to blockchain technology. On the other hand, forex has been around for a long time and has a reliable trading infrastructure supporting it.

Forex trading has fewer risks than cryptocurrency trading. Crypto markets move in unpredictable ways and can change quickly. It is important to research historical trends and learn from your peers if you wish to be successful at crypto trading.

Forex traders must understand the dynamics of foreign exchange pairs. This includes how prices change based on news events. This requires a deep understanding of technical indicators that can be used to indicate buy and sell signals. Another important aspect to consider is leverage. Traders are exposed to additional risk when trading currency pairs with high volatility.

Forex and crypto both require keen research skills and attention to ensure successful trades.

What are the benefits and drawbacks of investing online?

Online investing is convenient. You can manage your investments online, from anywhere you have an internet connection. You can access real-time market data and make trades without having to leave your home or office. Online brokerages typically charge less than traditional brokerages. This makes investing easier, especially if you have a smaller amount of money.

However, there are some drawbacks to online investing. Online investing can lead to difficulties in getting personalized advice and guidance. You don't have the support of a financial advisor, broker, or physical broker. Online trading platforms can offer less security than traditional brokerages. Investors should be aware of these risks. Online trading can be more complex and difficult than conventional investing. Before you begin, make sure to thoroughly understand the markets.

It is also important to understand the different types of investments available when considering online investing. Investors have many choices: stocks, bonds or mutual funds. Each type of investment comes with its own risks and rewards. It is crucial to thoroughly research each one before you make a decision. You should also consider the fact that some investments might require a minimum deposit, or may have restrictions.

Which forex or crypto trading strategy is best?

Both forex and crypto trading offer potential profits. However, it all depends on your investment goals.

Forex trading is easy for beginners and allows you to invest in different currencies. You will need to invest a lower amount upfront. Additionally, forex markets are worldwide and available 24/7.

Crypto trading, on the other hand, offers a fast return because prices can fluctuate very quickly due to their volatility. Also, crypto trades can be cashed out quickly due to their liquidity.

In both instances, it is crucial to do your research prior to making any investments. Managing your risk through proper diversification of assets will go a long way with any type of trading you choose.

It is important to be familiar with the various types of trading strategies that are available for each type. For example, forex traders may use technical analysis or fundamental analysis to help them make decisions, while crypto traders may use arbitrage or margin trading to maximize their profits. Some traders might also opt for automated trading systems, or bots, to manage their investments. Before you invest, make sure to understand the risks associated with each strategy.

Statistics

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How can I make sure my online investment account is secure?

Online investment accounts must be secure. It is vital to secure your assets and data against any unwelcome intrusions.

First, ensure the platform you are using is secure. Look for encryption technology, two-factor authentication, and other security measures that will provide maximum protection against potential hackers or malicious actors. There should also be a policy that outlines how any personal information you have shared with them will be regulated and monitored.

It is also important to choose strong passwords that allow you to access your account. You should limit the number and time spent logging in to public networks. Avoid clicking on untrue links or downloading unfamiliar software. These could result in malicious downloads and the eventual compromise of your funds. Also, make sure to review your account activity regularly so you can be aware of any unusualities and detect threats quickly. If necessary, take immediate action.

It is important to be familiar with the terms and conditions of any online investment platform. You need to be aware of all fees associated with investing as well as restrictions and limitations regarding how you can use the account.

Fourth, make sure you do thorough research about the company before investing. Review and rate the platform and see what other users think. Make sure to understand the tax implications of investing online.

These steps will ensure your online investment account is protected against any possible threats.