Wheat futures are contracts in which a buyer agrees on taking delivery of a set quantity of wheat at a predetermined cost and at a particular date. Many factors influence the price of a wheat futures contract, including weather patterns and global trade patterns.

Chicago SRW is the world's most liquid and largest wheat futures contract. In 2013, it traded more than 15 million tons. Because it is large in liquidity, it offers a competitive advantage over other futures.

Spreads can be used to both hedge and trade. Spreads are usually based on price differences between nearby futures contracts and those that expire after them.

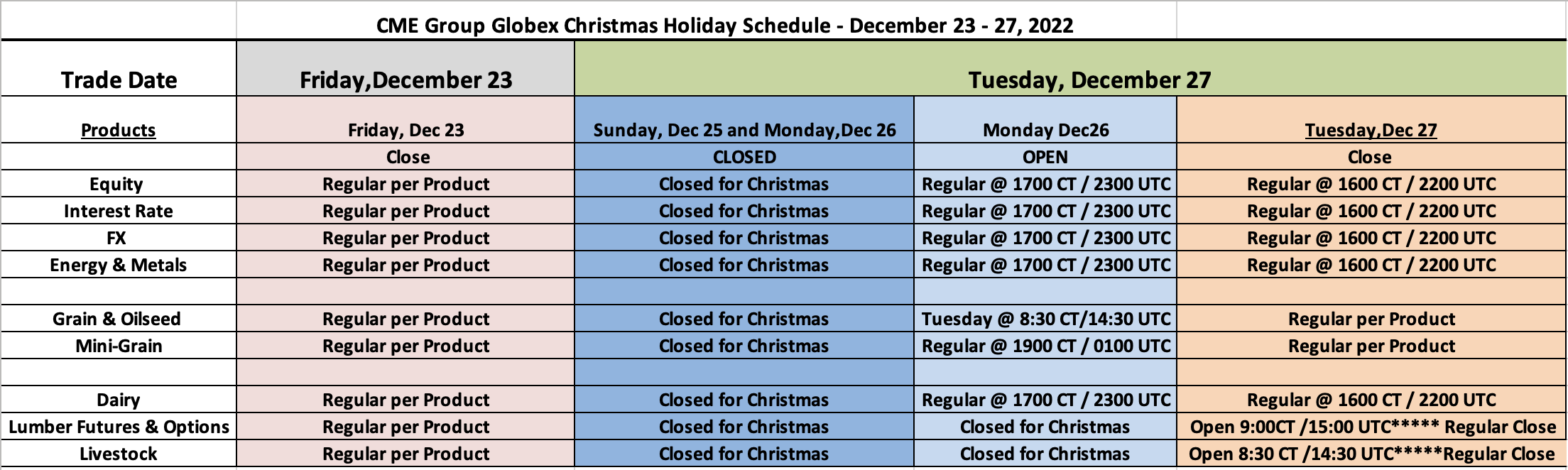

These spreads are available for trading on many different platforms including CME Globex, CME ClearPort and CME Globex. This allows traders to access a complete range of domestic and global wheat futures products.

Traders can use the Chicago Wheat and KC Wheat Futures to spread risks in the wider grain market and to hedge physical exposure. CME Group backs these contracts, providing market participants the security and stability they need.

The USDA releases reports that provide information about crop supply and demand several times per year. These reports can have an impact on the prices of wheat and corn, especially if they are published early in the morning.

These reports are not always accessible on the date of their publication and can be delayed or moved at other times. This can cause volatility in the markets and increase price volatility until they are available.

Therefore, trading in wheat and corn futures may not be as efficient as it could. The market might be underestimating or overestimating the production or demand, which can lead to price movements that traders aren't expecting.

A variety of factors, such as harvest conditions, weather and competition from commodity futures products, can also affect the price of wheat or corn futures. In order to protect their profits margins, they will likely increase wheat and corn prices if there is an unpredicted drought or flood.

For this reason, traders need to be able to distinguish between a short and long position on wheat futures. A long position is a contract where the buyer agrees that he will buy wheat from the seller at a specified price and on a particular date.

The short position on the other hand is a contract in the which the buyer agrees that he will not purchase wheat from the seller for the same price. This is what is known as "hedging", and it is the most prevalent type of market position in wheat Futures.

CME Group's Agriculture futures and options are used worldwide by more than 90% of the world's agriculture markets to manage risk as well as effectuating real-time prices discovery. These markets have been developed over the past century to aid traders in managing risk and maximising profitability.

FAQ

Forex and Cryptocurrencies are great investments.

You can make a fortune trading forex and crypto if you take a strategic approach. You need to be aware of the market trends so you can make the most of them.

You will also need to know how to identify patterns in prices, which can help you decide where the market is going. Also, you should only trade with money that is within your means.

It takes a combination of knowledge, experience, risk-management skills, discipline, and patience to build a profitable strategy that will lead to long-term success.

The volatility of cryptocurrency prices is a problem. It is important to ensure that your entry position matches your risk appetite and exit strategy. This means that you should take profit or limit losses if you have the opportunity.

The cryptocurrency market is largely unregulated and presents substantial risks. Before you sign up for any type of wallet or platform, make sure to research the coins and exchanges.

Furthermore, forex trading involves predicting fluctuations of currency exchange rates through technical/fundamental analysis global economic data. This type trading requires specialized knowledge. Understanding the different currency conditions is crucial.

It all comes down to taking calculated risks, learning continuously, and finding the most effective strategy for you. With enough dedication and the right education, you could make a fortune trading forex or cryptos.

Where can I earn daily and invest my money?

While investing can be a great way of making money, it is important to understand your options. You don't have to put your entire savings into the stock market - there are plenty of other options.

Real estate is another option. Investing property can bring steady returns as well as long-term appreciation. Diversifying your portfolio may be an option, such as with ETFs, mutual funds or specialty fields like crypto, bonds, ETFs and mutual funds.

You could also look into investing in dividend-paying stocks or peer-to-peer lending sites that allow you to lend money and receive interest payments from borrowers. If you're comfortable taking the risks, you can also trade online with day trading strategies.

No matter your investment goals, it is important that you do thorough research on each type and investment before making any major decisions. Every asset comes with its own risks. So that you can maximize your earnings, and achieve your financial goals, you must closely monitor all investments.

Which is more difficult forex or crypto currency?

Forex and crypto both have unique levels of complexity. Crypto is more complex because it is newer and related to blockchain technology. Forex, however, has been around for quite some time and has a reliable trade infrastructure.

Forex trading has fewer risks than cryptocurrency trading. Crypto markets move in unpredictable ways and can change quickly. If you want to succeed in crypto trading, researching the historical trends in the markets where it trades can give you an edge over your competition.

Forex traders need to understand the dynamics between foreign exchange pairs, such as how prices move based on news and macroeconomic events. This requires a deep understanding of technical indicators that can be used to indicate buy and sell signals. Another factor to consider is leverage. When trading currency pairs that have high volatility, traders are putting their capital at risk.

For both crypto and forex, it is important to be alert, do your research well, and have a strategy for making consistent trades.

What are the pros and cons of investing online?

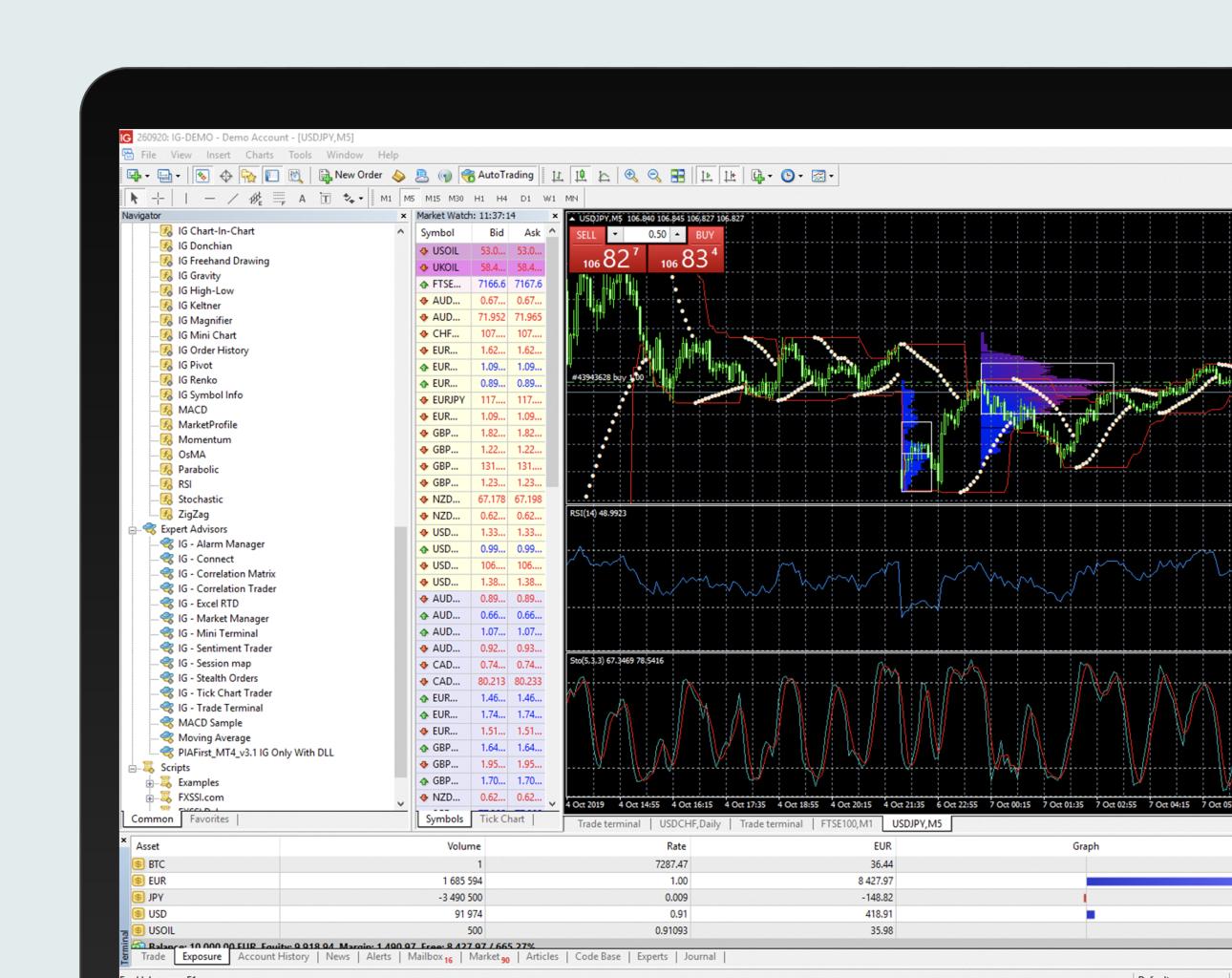

The main advantage of online investing is convenience. Online investing makes it easy to manage your investments from anywhere on the planet with an internet connection. You can access real-time market data and make trades without having to leave your home or office. Many online brokerages charge lower fees than traditional ones, which makes it easier to start investing with less money.

However, online investing does have its downsides. For example, it can be difficult to get personalized advice and guidance when trading online, as you don't have a physical broker or financial advisor to help you make decisions. Online trading platforms might not provide the same level security as traditional brokerages. Investors need to be aware about the potential risks. Online trading can be more complicated that traditional investing. Therefore, it is essential to fully understand the markets before developing a strategy.

You should also be aware of the different investment options available to you when investing online. There are many investment options available to investors. These include stocks, bonds and mutual funds as well as cash equivalents. Each type of investment carries its own risks and rewards, so it is important to research each option before deciding which one is right for you. There might be restrictions or a minimum deposit required for certain investments.

What is the best forex trading system or crypto trading system?

Forex and crypto trading both have their opportunities for profits, but which one is best for you really depends on your investment goals.

Forex trading involves investing in foreign currencies. This is an easy option for beginners. Forex trading requires less capital upfront and the forex markets are open 24 hours a day.

But crypto trading is a great alternative because it offers almost instant returns as prices can fluctuate quickly due volatility. The liquidity of crypto trading means that you can quickly cash out your tokens.

In both instances, it is crucial to do your research prior to making any investments. Managing your risk through proper diversification of assets will go a long way with any type of trading you choose.

It is also important to understand the different types of trading strategies available for each type of trading. For instance, forex traders may use technical or fundamental analysis to make their decisions. Crypto traders might use arbitrage, margin trading, or both to maximize profits. Automated trading platforms or bots are also available to assist traders in managing their investments. Before you invest, make sure to understand the risks associated with each strategy.

Is Cryptocurrency a Good Investing Option?

It's complicated. Cryptocurrency has become increasingly popular over the past few years, but whether or not it will be a successful investment depends on numerous factors. On one hand, the cryptocurrency market is highly volatile and unpredictable so there's always a risk involved when investing in them.

On the other hand, if you're willing to take that risk and do your research, there are potential gains to be made based on events like Initial Coin Offerings (ICOs) and shifts in the marketplace.

Cryptocurrency investments can also offer portfolio diversification benefits since these assets tend to move independently of traditional stock markets.

It comes down to each person's individual tolerance for risk and knowledge in relation to the crypto markets. If you have the means to make an informed decision about this asset class and don't mind taking risks, then yes - investing in cryptocurrencies is absolutely worth considering.

Statistics

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

External Links

How To

What precautions should I take to avoid online investment scams?

Protection starts with yourself. Protect yourself by knowing how to spot fraudsters' tricks and learning how they work.

Be wary of offers that seem too good to be true, of high-pressure sales tactics and promises of guaranteed returns. Do not answer unsolicited emails and phone calls. Fake names are often used by fraudsters. Never trust anyone based solely on their name. Before making any commitments, investigate all investment options thoroughly and independently.

Never invest money on the spot, in cash, or by wire transfer - if an offer insists upon these methods for payment, it should raise a huge red flag. Never forget that scammers will try any means to steal your personal data. Avoid identity theft by being aware and alert to the various types of online scams, suspicious links sent via email, or advertisements.

It's also important to use secure online investment platforms. Look for sites with a good reputation and that have been regulated by Financial Conduct Authority. Check for encryption technology, such as Secure Socket Layer (SSL), which helps protect your data when it is sent over the internet. Before investing, you should read all the terms and condition of any site or app. You also need to understand any fees or other charges.