The best stock broker platform for Americans? You have come to the right spot. We have compiled a list of the best 10 options and detailed reviews for each. These platforms will help you get the most out of your investment money, no matter if you're a beginner or an investor with experience.

First, you need to make sure that the platform meets your needs. For instance, you might need a platform that offers commission-free trading on US-listed stocks, or you might want to find one that's easy to use. You may also need a platform that allows you to access many investment options, including mutual funds, exchange-traded, and other types of funds.

Choosing the best stock broker platform should also depend on your budget. Some platforms offer free stock trades, while others require a minimum deposit. You may also need to decide whether to work with a full-service or discount broker. A good discount broker will allow you open an account with no deposit.

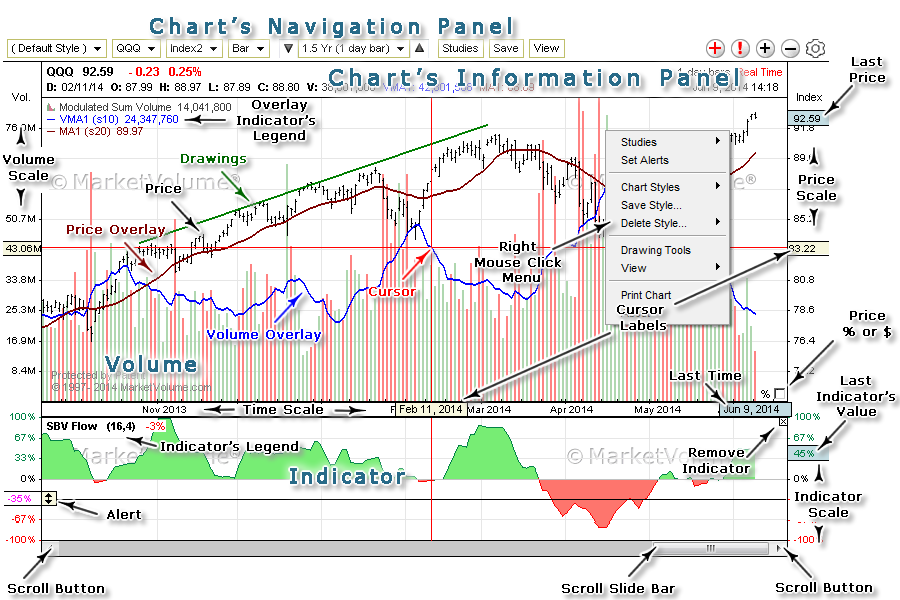

Some platforms provide commission-free trading of ETFs, foreign listed assets or both. Some platforms offer a variety of features including a powerful charting system and a direct-access routing device. You might even want to check out the platform's educational materials. You can also test the offerings of some stock brokers by opening demo accounts.

Axos SDT has an extremely intuitive platform that makes it possible to conduct no-commission trading on US-listed equities. You also have access to advanced trading tools such as a mobile app or a strategy scanner. Axos Elite offers added leverage and TipRanks premium market research.

TD Ameritrade is a top-ranked brokerage for over 12 years. It is also known for its extensive retail trading presence. This brokerage has a large selection of assets. These include stocks, mutual funds, and ETFs. Customers can access it via a mobile app. It also has third-party research from Dow Jones, Credit Suisse and Credit Suisse. Clients can also receive daily inspiration via the TD Ameritrade Market Java Email.

Another feature that makes some of the best stock brokerage platforms unique is the ability for you to trade on a paper trading account. These options allow you to experience investing with a broker in a safe way. If you are looking for the best stock broker platform, make sure you check out the quality of the customer support staff and are willing to help you with any questions.

Ally Invest, a well-known online brokerage firm, allows you to trade stocks and ETFs as well as set up savings and checking accounts. A wide variety of options are available for retirement planning as well as fixed-rate bonds. Additionally, the app is optimized for mobile investments.

Lastly, SoFi is a leading digital stock broker that allows you to trade US-listed stocks for a minimum of $5. SoFi's platform is not compatible with foreign exchanges unlike most other platforms. However they provide a wide variety of stock options and a simple mobile experience. They are also approved for a Chartered Banking app, which allows them more than just investment service.

FAQ

Is Cryptocurrency a Good Investing Option?

It's complicated. The popularity of cryptocurrency has increased over the years. However, whether or not it is a good investment depends on many factors. One, the cryptocurrency market can be volatile and unpredictable. This means that there is always risk when investing in them.

There are also potential gains if one is willing to risk their investment and do some research.

Because cryptocurrency assets are not subject to traditional stock market movements, they can be used as a portfolio diversification tool.

In the end, it really comes down to an individual's personal tolerance for risk and knowledge related to the crypto market. If you have the means to make an informed decision about this asset class and don't mind taking risks, then yes - investing in cryptocurrencies is absolutely worth considering.

Are forex traders able to make a living?

Forex traders can make good money. Although it is possible to make money in the short term, you will need to be patient and willing to learn. Traders who can understand market fundamentals, technical analysis and trading are more likely than those who rely exclusively on luck or guessing to succeed.

Forex trading is not an easy task, but it can be done with the right knowledge. It is essential to find a qualified mentor and learn about risk management before taking on real capital.

A lack of a strategy or plan can lead to many traders failing. However, if one is disciplined they can maximize their chances at making money in foreign exchange (forex).

Experienced forex traders have trading plans they adhere to while trading. This allows them to lower their risk exposure and still identify profitable opportunities. A good risk management strategy is essential. Some traders become too aggressive in pursuit of quick wins, instead of developing a consistent long term strategy.

Forex traders can increase their chances of making long-term profits by keeping records, understanding currency trading platforms, and studying past trades, payments, and by keeping accurate records.

In forex trading, discipline is key. By setting rules about how much you will lose on each trade, you can minimize losses and increase your chances of success. Additionally strategies such as leveraging entry signals can often increase profits.

However, it is important to be persistent and learn from successful day-traders in order to be profitable as a forex trader.

Can you make it big trading Forex or Cryptocurrencies?

Trading forex and crypto can be lucrative if you are strategic. You must stay on top of trends to know the best times to buy or sell in order to make any money in these markets.

Additionally, you'll need to learn how to recognize patterns in prices. These patterns will assist you in determining where the market is headed. Trading with money you can afford is a good way to reduce your risk.

To be able develop a long-term profitable strategy, it takes experience, knowledge, skills in risk management, and discipline.

There are many factors that can cause volatility in cryptocurrency prices. Therefore, it is crucial to ensure that your entry position aligns with your risk appetite. Also, make sure you plan for exit if there is an opportunity to profit from the market.

The cryptocurrency market is largely unregulated and presents substantial risks. Before you sign up for any type of wallet or platform, make sure to research the coins and exchanges.

Furthermore, forex trading involves predicting fluctuations of currency exchange rates through technical/fundamental analysis global economic data. This type trading requires specialized knowledge. Understanding the different currency conditions is crucial.

It is all about taking calculated risk, learning constantly, and finding an effective strategy that works for you. You can make a lot trading forex and cryptos if you have enough knowledge and dedication.

Which is safe crypto or forex?

Forex trading and cryptocurrency are both highly risky investments with varying rewards and risks.

Crypto, short for cryptocurrency, is a digital currency created from a piece of code through blockchain technology. It can be traded like any other currency on exchanges and has been subject to speculation investments because of its volatile price swings.

Forex, or foreign exchange currency trading, involves highly leveraged investments in which participants speculate on the value of one currency in relation to another. Forex, which can be unstable and cause large losses if not managed well, is an investment that should not be taken lightly.

Both Forex and Crypto both have their benefits and drawbacks. However, Crypto has a higher risk of losing money than Forex. Prices for cryptocurrencies are unpredictable because of the limited availability of units as well as existing regulations. On the other hand, forex markets tends to move more steadily and investors have more control. When deciding which option between Cryptocurrency and Forex is safer, it will depend on your risk appetite and experience with each investment option.

What are the pros and cons of investing online?

Online investing has the main advantage of being convenient. Online investing allows you to manage your investments anywhere with an internet connection. Online investing allows you to have access to real-time market information and place trades without ever leaving your home. Many online brokerages charge lower fees than traditional ones, which makes it easier to start investing with less money.

Online investing has its limitations. Online investing can lead to difficulties in getting personalized advice and guidance. You don't have the support of a financial advisor, broker, or physical broker. Online trading platforms may not offer as much security as traditional brokerages. Therefore, investors should be aware of the risks. Online trading can be more complex and difficult than conventional investing. Before you begin, make sure to thoroughly understand the markets.

Online investing is a complicated process. It is important to be familiar with the various types of investments that are available. Investors have many options. They can choose from stocks, bonds, mutual funds and cash equivalents. Each type of investment comes with its own risks and rewards. It is crucial to thoroughly research each one before you make a decision. Additionally, some investments may require a minimum deposit or have other restrictions that need to be taken into consideration.

Where can I earn daily and invest my money?

However, investing can be an excellent way to make money. It's important to know all of your options. There are many options.

You can also invest in real estate. You can earn steady returns while also enjoying long-term appreciation and tax advantages by investing in real estate. Consider diversifying your portfolio by investing in bonds, ETFs or mutual funds. You might also want to consider specialty fields such as cryptocurrency.

If you are looking for daily income and short-term profits, then you should consider investing in stocks that pay dividends. You can even trade online using day trading strategies if you feel comfortable with the risks involved.

No matter your investment goals, it is important that you do thorough research on each type and investment before making any major decisions. Every asset comes with its own risks. So that you can maximize your earnings, and achieve your financial goals, you must closely monitor all investments.

Statistics

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

External Links

How To

How can I verify that an investment opportunity is legitimate?

Research is critical when investing online. It is important to research the company offering the opportunity. Check that they are registered with appropriate financial authorities. Also, be aware of any restrictions or industry regulations that may apply to your investments.

Review past performance data, if possible. Check out customer reviews to see how others have experienced the investment opportunity. You should ask yourself if this sounds too good to be true. Also, be wary of claims that you can guarantee future results or significant returns.

Learn about the investment's risk profile and review the terms and condition. Before opening an account, confirm the exact fees and commissions on which you might be taxed. Do your due diligence and make sure you get what you pay for. You should also have a clear exit plan in place in case things don't go as planned. This can help to reduce your losses in the long-term.