Investors can choose from many online investment platforms. Unlike traditional savings accounts, these websites offer higher returns for investors. They can be risky. Before you sign up for any app, it's important that you do your research. Some apps require a minimum balance to be eligible for investment. Others charge yearly or monthly fees.

One option is eToro, a social trading platform that lets users copy the trades of other people. It also offers many other financial products. The service allows users to invest in fractional share and stocks as well. They can also sell and buy cryptocurrencies.

Betterment, an automatic investment service, allows you to automatically invest your money in diversified portfolios of ETFs. They offer more than 30 cryptocurrencies. You can also discuss your investments on their social platform. An optional Roth IRA account can be added.

Robinhood is another very popular app. Robinhood has a beautiful interface which allows you to trade 100% commission-free. It's also one of the cheapest platforms on the market. For a small monthly fee, you can open a Gold account, which offers larger instant deposits. Morningstar research is available to you. This account also offers greater buying power and more options for margin trading.

You can also choose from Acorns Stash and Titan robo-advisors. Each one of these apps offers unique features. If you are a beginner, Stash may be the best choice. Instead of using a computer algorithm, the app asks you about your goals, risk tolerance, and your personal preferences. This allows you to take more control of your investments than most other robo-advisors. The monthly fee is just $3, which is lower than many robo-advisors'.

Another great option for young investors is Acorns. Acorns allows you to save money and even offers an IRA account. You must be at minimum 18 years of age. While the fees are higher than those of other robo advisors, it can be well worth the convenience that comes with an automatic investment program.

M1 Finance can be a good option for investors who wish to invest in individual stocks and pies made up from different stocks. Their app also allows you to invest in real estate crowdfunding. There are also educational articles and videos that can help you get started.

Greenlight + Investing accounts are a great option for those who don't know where they should start. This offering from Community Federal Savings Bank comes with a savings account, a debit card, and financial tools to manage your investments. You can also make investments with your child's Greenlight account.

Another platform offers fractional shares. These allow you to buy pieces of a popular stock without having to buy the entire share. Fractional shares also gain in value with the stock.

There are many investment apps on the market, so it is important to compare them before opening an existing account. It is important to know the minimum balance requirements, the withdrawal and deposit times, and the fees.

FAQ

Forex traders can make money

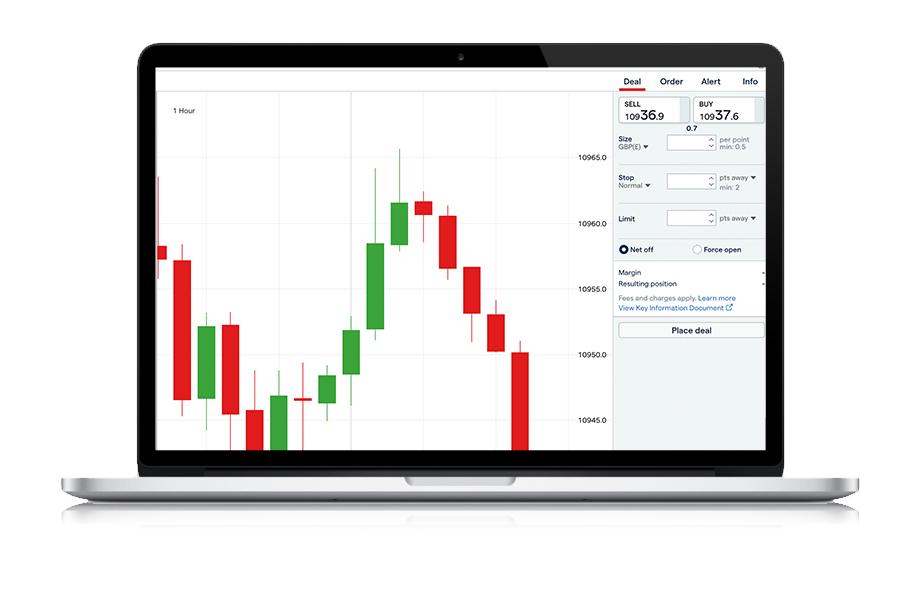

Yes, forex traders are able to make money. It's possible to make short-term gains, but the long-term benefits of forex trading are often based on dedication and a willingness for learning. Market fundamentals and technical analysis are better than traders who rely only on luck or guesswork.

It's not easy to trade forex, but it is possible with the right knowledge strategies to produce consistent profits over time. It is crucial to find an educated mentor before you take on real capital.

Many traders fail due to a lack of a structured plan or approach but with discipline, one can maximize their chances of making money in the foreign exchange (forex) markets.

Experienced forex traders create trading strategies that they follow when trading to minimize their risk exposure and still find profitable opportunities. The key to risk management is being able to see the big picture. New traders often chase short-term gains and lose sight of a long-term strategy.

By keeping good records, studying past trades and payments, and understanding platforms used for currency trades along with other aspects of trading, forex traders can improve their likelihood of generating profits over the long term.

In forex trading, discipline is key. By setting rules about how much you will lose on each trade, you can minimize losses and increase your chances of success. Additionally strategies such as leveraging entry signals can often increase profits.

The bottom line is that you must be persistent and learn from successful day traders to make a profit trading forex markets. This applies regardless of whether your capital is invested or managed for another person.

Which is safe crypto or forex?

Forex trading and cryptocurrency are risky investments. They have varying returns and potential risks.

Crypto, which is shorthand for cryptocurrency, refers to a digital currency that was created using code and blockchain technology. It can trade on exchanges just like any money, and has been the subject speculative investment because of its drastic price swings.

Forex or foreign currency trading involves high-leveraged investments that allow participants to speculate on the relative value of one currency. Due to its high risk, Forex can be an unstable investment that could result in large losses if not properly managed.

While both Forex (Cryptocurrency) and Forex (Forex) have their pros and cons, Cryptocurrency tends be more volatile than Forex. Prices for cryptocurrencies are unpredictable because of the limited availability of units as well as existing regulations. On the other hand, forex markets tends to move more steadily and investors have more control. The decision about which of Cryptocurrency or Forex is more secure will be based on the individual's risk appetite and their previous experience with each investment option.

Where can I invest and earn daily?

It can be a great method to make money but it's important you understand all your options. You don't need to invest all of your savings in the stock exchange - there are many other options.

You can also invest in real estate. Investing in property may provide steady returns and long-term appreciation. It also offers tax benefits. Diversifying your portfolio might be a good idea.

You could also look into investing in dividend-paying stocks or peer-to-peer lending sites that allow you to lend money and receive interest payments from borrowers. Online trading is possible if you're comfortable with the risks.

It doesn't matter what your investment goals are, it is important to research each type of investment before you dive in headfirst. Each asset has its own set of risk factors. To maximize your earnings and help you reach your financial goals, make sure to closely track any investments.

Trading forex or Cryptocurrencies can make you rich.

Trading forex and crypto can be lucrative if you are strategic. You must stay on top of trends to know the best times to buy or sell in order to make any money in these markets.

It is also important to understand how to spot trends in prices. This will help you to predict the direction of the market. Also, you should only trade with money that is within your means.

It also requires a combination of experience, knowledge, risk-management skills, and discipline in order to be able to develop a profitable strategy for long-term success.

Because cryptocurrency prices can fluctuate, it is important that you make sure your entry position and exit plan are compatible. If there is an opportunity to take profits or limit losses, then go for it.

It is crucial to do your research on cryptocurrency exchanges before you sign up for any wallet.

Furthermore, forex trading involves predicting fluctuations of currency exchange rates through technical/fundamental analysis global economic data. This type trading requires specialized knowledge. Therefore having a robust understanding of the conditions affecting different currencies is imperative.

It's about taking calculated risks and being open to learning. The most important thing is to find the best strategy for you. You can make a lot trading forex and cryptos if you have enough knowledge and dedication.

Frequently Asked Question

What are the 4 types?

Investing is a way for you to grow your money and possibly make more long-term. There are four types of investing: stocks and bonds, mutual funds and cash equivalents.

Stocks can be broken down into common stock or preferred stock. A common stock gives an individual ownership right of a company, including voting rights at shareholders' meetings and the potential to earn dividends. Although preferred stock grants ownership rights, there are no voting privileges. Fixed dividend payments offer investors an income stream and provide a reliable source of income.

Bonds are loans that investors make to governments or companies in return for interest payments. They expire at the maturity date and can be repaid with interest payments. Bonds provide more stability and less risk than stocks, but the returns are typically lower than those of stocks.

Mutual funds combine investor money to spread investment risk and diversify investments. They can be used to pool capital across many securities such as bonds, stocks, and commodities. Professional managers manage mutual funds. They use their experience to choose profitable investments based on pre-determined criteria, such as risk level or expected return rate.

Cash equivalents include products such as Treasury bills, money market deposits, certificates of deposit (CDs), and commercial paper which often mature within one year or less during which time they carry minimal risks of default or downturns in their value. This type is best for conservative investors, who don't mind taking high risks but still desire a greater return than deposits at low-interest banks accounts.

How Can I Invest in Bitcoin?

Although it may seem difficult to invest in Bitcoin, it is not as complicated as you might think. All you need is the right knowledge and tools to get started.

There are many options for investing. To get exposure to Bitcoin, you can buy it directly, use an exchange or use a financial instrument, known as a derivatives agreement.

You also need to decide where to store Bitcoin. There are many choices, such as cold storage, exchanges or custodians. Depending on your risk appetite, goals, and other factors, certain options might be more appropriate than others.

Next, research any additional information you may need to feel confident about your investment decisions. It is essential to understand the basics of cryptocurrency and their workings before you dive in. With that said, make sure you keep track of market news and developments so you can stay up-to-date with crypto trends.

Last but not least, develop a plan that will allow you to invest in Bitcoin according to your experience and have reasonable expectations of returns. This will help you be more successful long-term.

Statistics

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

External Links

How To

Do I need to consider other options or is it safer to keep my investment assets online?

Although money can seem complicated, it is also difficult to make the right decisions about where and how to store it. You have several options when it comes to protecting your valuable assets.

Online storage allows for easy access from any device. You can also keep an eye on your investments quickly and easily. But, you should be aware that electronic breaches can happen when you use digital options.

Alternatively, keeping your money in physical forms like cash or gold is more secure, but it's also harder to keep track of and requires a higher level of maintenance for storage and protection.

Other options include keeping your investments in traditional banking or investing accounts as well as self-storage facilities that allow you to safely store gold, silver, or other valuables outside of your home.

You may also want to consider specialized investment firms offering secure custody services that are specifically designed to protect large asset portfolios.

The final decision is up to you. What works for you? What provides the safety and security necessary to protect your investment assets?