Ally Invest provides wealth management solutions to its customers. Ally Invest provides a complete suite of investing and trading tools. These include forex, stocks, bonds, closed-end funds, and closed-end funds. The platform is intuitive and well-designed.

Ally Invest customers cannot trade cryptocurrencies. However, they are allowed to buy digital assets through a FINRA-regulated crypto broker. Customers can use their debit cards to buy cryptocurrencies at Coinbase. A customer can also link his Ally Bank account with Coinbase for crypto purchases.

The primary website is functional and works well. However, it doesn't offer the same functionality that Ally Invest Live. Ally Invest Live allows you to stream quotes, compare company and peer performance, access research data, and create a dashboard. While it is similar in content to the main Ally Invest page, the website is organized differently.

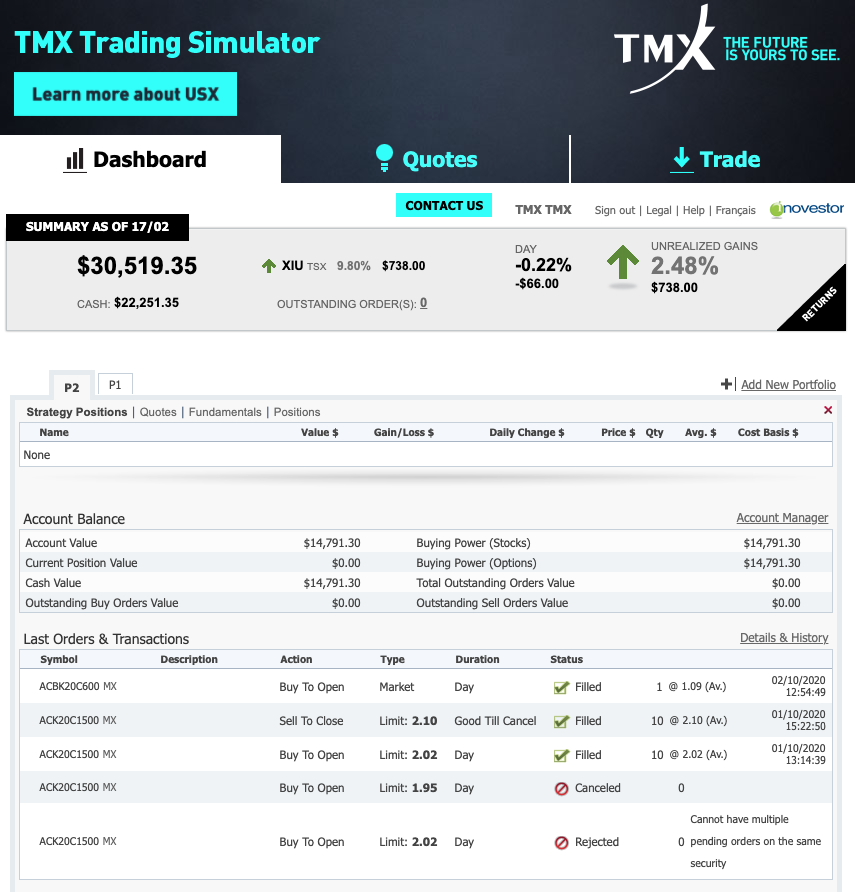

One of the biggest disadvantages of the Ally Invest website is that it does not support all or none orders. If a trader chooses to add an option, they need to manually cancel any previous order before adding the new one. It's also hard to create customized orders. Access to a trading simulation is not available. Additionally, trailing stops cannot be supported.

On the upside, the Ally Invest website is a well-designed, responsive site with a wide array of educational resources. It doesn't charge transaction fees like other online brokerages. It does not require any minimum deposit to open an account. There is also no annual fee for maintaining an account. Additionally, the cash balances have a competitively charged interest rate.

It does not have a practice account. This is another major problem. Because it doesn't allow fractional shares investments, it is difficult to diversify small portfolios. It does not support trailing stops or conditional orders.

A fractional share trading platform is a good option for investors who are just beginning to invest and don’t know much about stock options. Ally Invest offers a more viable option if your goal is to trade active options.

For experienced investors who want to make large, risky trades, however, this platform is not for them. For example, it is difficult to dollar-cost average into a portfolio. It is not a smart idea to invest all your money in penny stocks, even if you're a seasoned investor.

Another reliable online brokerage that allows cryptocurrency trading is Uphold. You can choose from hundreds of different crypto assets. They also offer zero commission trading through Ally Bank. And, they are based in the United States, which makes it secure. Uphold's services also are regulated. They charge a spread fee for any cryptocurrency trades.

It is possible to invest in cryptocurrency with a low commission rate. However, you'll need to transfer your money to an Ally Bank account before you can buy or sell a currency. You must also use a FINRA-regulated broker to trade crypto assets.

FAQ

Which is better, safe crypto or Forex?

Two types of high-risk investments, cryptocurrency trading and forex trading, are highly risky and can bring you great rewards but also huge risks.

The shorthand crypto, or cryptocurrency, is a digital money that has been created using code from blockchain technology. It can trade on exchanges just like any money, and has been the subject speculative investment because of its drastic price swings.

Forex trading or foreign currency currency trading is a highly leveraged investment in which participants speculate about the value of one currency relative to another. Forex, which can be unstable and cause large losses if not managed well, is an investment that should not be taken lightly.

Both Crypto and Forex have their advantages and disadvantages but, overall, crypto tends to carry a greater level of risk compared to Forex. Because of the limited supply and regulations around cryptocurrencies, prices can fluctuate. But forex markets move more consistently so investors have more control. It is important to consider your own risk appetite, experience and knowledge with each investment option before deciding which Crypto or Forex is safer.

Is it possible to make a lot of money trading forex and cryptocurrencies?

If you have a strategy, it is possible to make a lot of money trading forex and crypto. If you want to make real money in forex and crypto markets, it is important to keep up with the latest trends and to know when the best time to sell or buy.

Also, you will need to be able to spot patterns in prices. This can help you determine where the market is heading. Also, you should only trade with money that is within your means.

For long-term success, you will need to combine experience, knowledge, risk management skills, and discipline.

Cryptocurrency prices are often volatile, so the key is to make sure that your entry position fits with your risk appetite and exit plan - meaning that if there becomes an opportunity for profit-taking or limiting losses, then do so.

The cryptocurrency market is largely unregulated and presents substantial risks. Before you sign up for any type of wallet or platform, make sure to research the coins and exchanges.

Forex trading is a complex business that involves forecasting fluctuations in currency exchange rates using technical analysis/fundamental analyses of global economic data. This type of trading requires specialized knowledge. Therefore having a robust understanding of the conditions affecting different currencies is imperative.

It is all about taking calculated risk, learning constantly, and finding an effective strategy that works for you. With enough dedication and the right education, you could make a fortune trading forex or cryptos.

Frequently Asked questions

What are the 4 types of investing?

Investing can help you grow your wealth and make money long-term. There are four major types of investment: stocks, bonds mutual funds, cash equivalents, and stock.

Stocks can be divided into preferred and common stock. A common stock is an individual's ownership of a company. This includes voting rights at shareholder meetings as well as the ability to receive dividends. Preferred stock also gives ownership rights but with no voting privileges, as well as fixed dividend payments that offer investors a reliable income stream.

Bonds are loans from investors made to governments or companies in exchange for interest payments until the bond expires on its maturity date. Bonds offer greater stability and lower risk than stock, but they have higher returns than stocks.

Mutual funds allow investors to pool their money together to spread investment risk, diversify their investments, and diversify across a variety of securities such as stocks, bonds, or commodities. Mutual funds are managed by professional managers who use their expertise to select profitable investments in accordance with pre-set criteria such as level of risk or desired gain rate.

Cash equivalents include products such as Treasury bills, money market deposits, certificates of deposit (CDs), and commercial paper which often mature within one year or less during which time they carry minimal risks of default or downturns in their value. This type is best for conservative investors, who don't mind taking high risks but still desire a greater return than deposits at low-interest banks accounts.

Cryptocurrency: Is it a good investment?

It's complicated. Cryptocurrency has become increasingly popular over the past few years, but whether or not it will be a successful investment depends on numerous factors. One thing is certain: the cryptocurrency market can be unpredictable and volatile so investing in it will always come with risk.

There are also potential gains if one is willing to risk their investment and do some research.

Cryptocurrency investments can also offer portfolio diversification benefits since these assets tend to move independently of traditional stock markets.

It really boils down to each individual's tolerance for risk and knowledge about the crypto market. It is definitely worth investing in cryptos if you have the knowledge and ability to make informed decisions regarding this asset class.

Which platform is the best for trading?

Many traders find it difficult to choose the right trading platform. There are so many platforms available, it can be difficult to decide which one is best for you.

The best trading platform should offer the features you need, like advanced chart analysis tools, real-time market data, and sophisticated order execution capabilities. The interface should be intuitive and user-friendly.

It should offer multiple account types and low fees. You also need reliable customer service and educational materials. Try out demo accounts or free trials to see if you like the idea of using virtual money.

Think about what kind of trader you are, whether you're active or passive, how frequently you intend to trade, and what asset class you want. Understanding these factors will help narrow down your search for the best trading platform for your needs.

After you have found the right platform for you, you should look at additional features like stock screening tools and backtesting capabilities. Alert systems are also available. Additionally, ensure your chosen platform provides appropriate security protocols in place to protect your data from breaches or theft.

Some of the most popular trading platforms include MetaTrader 4/5 (MT4/MT5), cTrader, eToro TradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade FXCM ThinkOrSwim App Store just to name a few!

Are forex traders able to make a living?

Yes, forex traders can make money. While it is possible to achieve success in the short-term, long-term profits typically come from dedication and a willingness to learn. More traders who are able to understand the market and can analyze technical issues will be successful than those who rely on luck or guesswork.

It's not easy to trade forex, but it is possible with the right knowledge strategies to produce consistent profits over time. It is important to find an educated mentor and develop a working knowledge of risk management before risking real capital.

A lack of a strategy or plan can lead to many traders failing. However, if one is disciplined they can maximize their chances at making money in foreign exchange (forex).

Experienced forex traders make trading plans that they stick with when trading. This helps them reduce their risk exposure, while still finding profitable opportunities. Risk management is key; many new traders can become too aggressive by chasing quick gains instead of having a consistent long-term strategy.

Forex traders can make more money by keeping track of their trades and learning about past payments and trading platforms.

Forex trading is a disciplined business. Setting rules for how much money you're willing and able to lose per trade can reduce losses and help ensure success. Furthermore, strategies such as leverage entry signals can help increase profits that are not possible without the guidance of an experienced mentor.

Ultimately though, being persistent and learning from successful day traders other methods--such as risk management techniques--are necessary for profitability as a trader in forex markets regardless if you're investing your own capital or managing funds for someone else.

Statistics

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

What precautions should I take to avoid online investment scams?

Protection starts with you. By brushing up on how to spot scams and understanding how fraudsters' tricks work, you can protect yourself from getting duped.

Pay attention to offers that look too good for you, such as high-pressure sales tactics and guarantees of returns. Do not respond to unsolicited emails or phone calls. Fraudsters often use fake names, so never trust someone just based on their name alone. You should thoroughly investigate investment opportunities and do your research on the person offering them.

Never invest money immediately, in cash, by wire transfer, or on the spot. Any offer to pay using these payment methods must be rejected. Lastly, always remember "Scammers will try anything to get your personal information". You can prevent identity theft by being aware of various online phishing schemes as well as suspicious links that are sent via email and online ads.

It is also important that you use secure online investment platforms. You should look for sites that have good reputations and are regulated by Financial Conduct Authority (FCA). Secure Socket Layer (SSL) encryption technology is recommended to protect your data over the internet. Before investing, you should read all the terms and condition of any site or app. You also need to understand any fees or other charges.