A16z, a venture capital firm, is located in Menlo Park. Its portfolio includes investments in early stages of mobile communications, ecommerce, gaming and enterprise IT. The firm is also a significant shareholder in Facebook, Twitter, Airbnb.

A16z Venture Capital is one of the most recognizable venture capital firms in the globe. Marc Andreessen founded the company in 2009 with Ben Horowitz. It has been a success story with many of the biggest and most profitable investments in the past few years, including Skype and GitHub.

A16z led the $57 million Series B round for Optimizely in 2014, which is a cloud-based enterprise SaaS. A16z led a $21million Series B round in Figma (a web3 platform for team collaboration) and a $50million Series D round in Roblox (a virtual reality gaming developer). Other notable investments include a seed round of $450 million for Yuga Labs (a cloud CAD software company) and $80 million into Onshape (a company that provides cloud computing infrastructure.

A16z has invested in various companies that are working on developing crypto/blockchain technology. Some of its most recent investments include a16z Crypto Investments, which invests in early stage companies, as well as new layer 1 and layer 2 infrastructure. Some of its portfolio companies include CryptoKitties. Dfinity. and PeerStreet.

OpenCoin, a San Francisco-based cryptocurrency company, was one of the first to get venture capital. OpenCoin has become one of the most prominent players in crypto. A16z made an investment into the company in April 2013.

A16z also made other investments in crypto, as did many other venture capital companies. BuzzFeed and Onshape are just a few of the notable companies that a16z invested in. A16z made investments in companies such as uBiome, Stack Exchange, Honor, Inc., Okta.

A16z is also a major investor in blockchain-related businesses. Paradigm Venture Capital (a firm that invests exclusively in encryption technologies) is also their co-founder. Their most recent investments include a $300 million crypto fund and Entropy, a new decentralized cryptocurrency custodian.

Polychain Capital is another of the companies on a16z’s investment list. This fund is the first to manage a $1 billion in assets. It is supported by Sequoia Capital, Tiger Global Management and Union Square Ventures.

A16z has been involved in investments in several other crypto/blockchain firms, including Dfinity and Imply. A fourth crypto fund has been announced by the company, valued at $4.5 Billion. The seed investments will make up the majority of the funds, with the rest going to infrastructure and layer 1 and 2.

Andreessen, Horowitz (or "a16z") is one of the biggest investors in the crypto and blockchain industry. A16z also invests in crypto startups, such as Netflix and Airbnb. Apart from investing in the startup scene a16z also invests in fintech and consumer companies such as Coinbase and Uber.

FAQ

Do forex traders make money?

Yes, forex traders are able to make money. It is possible to succeed in the short-term but long-term success usually comes from hard work and willingness to learn. Traders who understand market fundamentals and technical analysis are more likely to be successful than those who rely solely on luck or guessing.

Forex trading isn't easy but with the right knowledge and strategies, it's possible to generate consistent profits over time. It is important to find an educated mentor and develop a working knowledge of risk management before risking real capital.

Many traders fail because of lack of a systematic plan or approach. However with discipline, one can increase their chances of making profit in the foreign currency (forex) markets.

Experienced forex traders make trading plans that they stick with when trading. This helps them reduce their risk exposure, while still finding profitable opportunities. Risk management is key; many new traders can become too aggressive by chasing quick gains instead of having a consistent long-term strategy.

Forex traders can make more money by keeping track of their trades and learning about past payments and trading platforms.

Forex trading is all about discipline. Developing rules, such as what you are willing to lose on each trade, helps reduce losses and ensure success. Strategies like leveraging entry signals can help increase profits beyond those that could be achieved without the guidance of an experienced mentor.

Be persistent, learn from successful day trader and be persistent. Profitability in the forex market trading markets is dependent on whether you're managing funds for yourself or someone else.

Which trading platform is best?

Choosing the best trading platform can be a daunting task for many traders. With so many different platforms to choose from, it can be hard to know which one is right for you.

The best trading platform must offer all of the features that you need such as chart analysis tools and real-time market data. It should also have sophisticated order execution capabilities. The interface should be intuitive and user-friendly.

It should also provide a variety of account types and competitive fees as well as reliable customer service and educational resources. For those who want to try virtual money before you invest your real money, look out for free demo accounts.

You should consider your type of investor or trader when looking for a trading platform. For example, are you active or passive? How often do you plan to trade? What asset class mix would you like? These factors will help you narrow down the search for the right platform.

Once you have identified the platform that suits you best, it is time to explore additional features such backtesting capabilities and stock screening tools. Additionally, ensure your chosen platform provides appropriate security protocols in place to protect your data from breaches or theft.

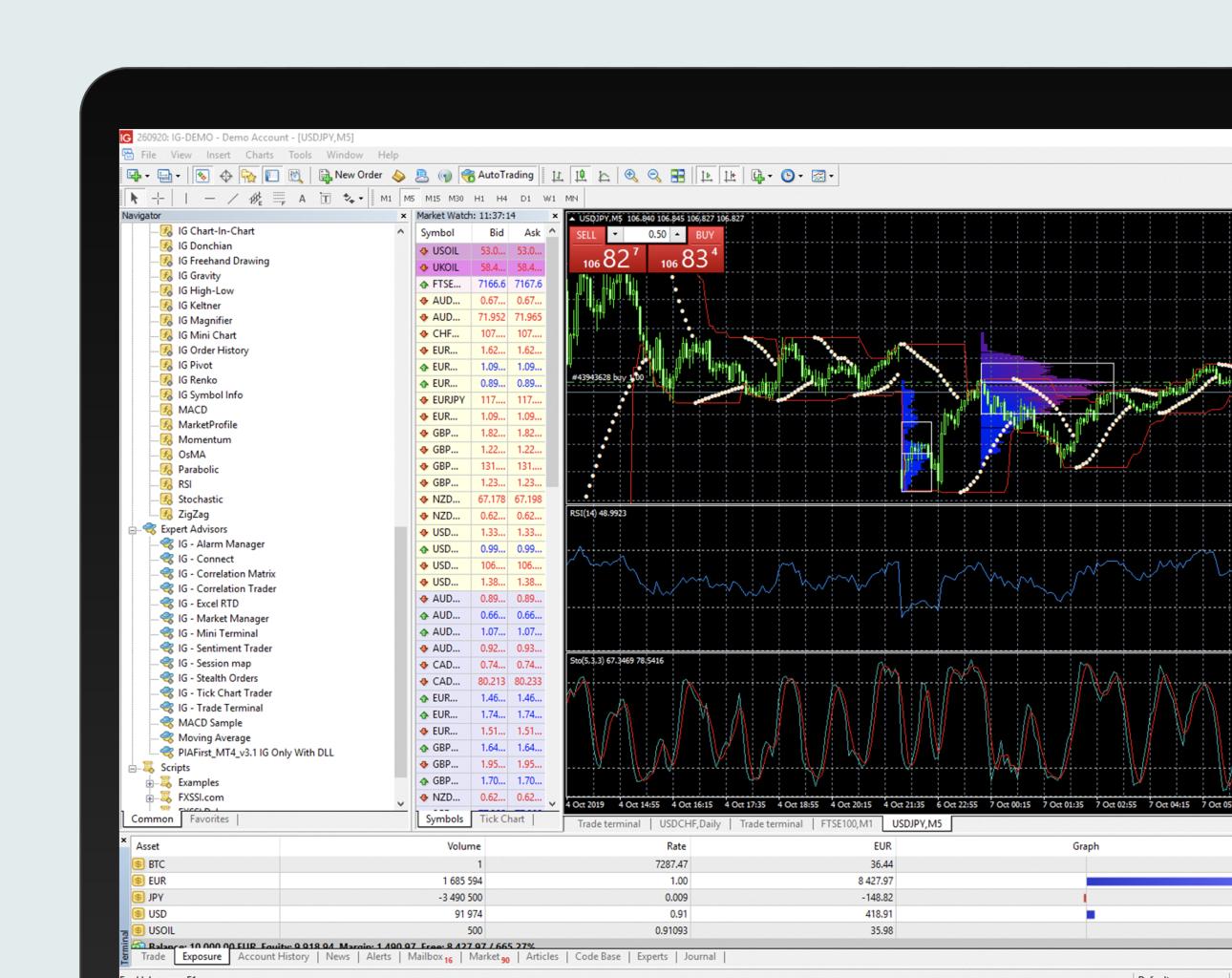

Some of the most popular trading platforms include MetaTrader 4/5 (MT4/MT5), cTrader, eToro TradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade FXCM ThinkOrSwim App Store just to name a few!

Which is best forex trading or crypto trading?

Forex and crypto trading both have their opportunities for profits, but which one is best for you really depends on your investment goals.

Forex trading allows you to invest in different currencies. It is a great option for beginners. Forex trading requires less capital upfront and the forex markets are open 24 hours a day.

But crypto trading is a great alternative because it offers almost instant returns as prices can fluctuate quickly due volatility. Crypto trades are also highly liquid, so cashing out your tokens quickly is possible.

In both instances, it is crucial to do your research prior to making any investments. With any type or trading, it is important to manage your risk with proper diversification.

Understanding the various trading strategies for different types of trading is important. To maximize their profits, crypto traders can use arbitrage or margin trades to maximize their gains. Forex traders may use either technical analysis or fundamental analysis to assist them in making decisions. To help manage their investments, traders may use automated trading systems or bots. It is important to understand the risks and rewards associated with each strategy before investing.

What are the advantages and disadvantages of online investing?

Online investing offers convenience as its main benefit. With online investing, you can manage your investments from anywhere in the world with an internet connection. Online trading is a great way to get real-time market data. Online brokerages typically charge less than traditional brokerages. This makes investing easier, especially if you have a smaller amount of money.

Online investing has its limitations. Online investing is not without its challenges. For instance, you may find it difficult to obtain personalized advice or guidance online as there are no financial advisors or brokers to help you make your decisions. Additionally, online trading platforms may not offer the same level of security as traditional brokerages, so investors need to be aware of the risks involved. Online trading can be more complicated that traditional investing. Therefore, it is essential to fully understand the markets before developing a strategy.

It is also important for online investors to be aware of all the investment options. Stocks, bonds, mutual funds, and cash equivalents are all options for investors. Each investment type has its own risks, rewards, and it is important to fully research each option before making a decision. There might be restrictions or a minimum deposit required for certain investments.

Which trading site is best suited for beginners?

All depends on your comfort level with online trades. If you're totally new to the process, then going through an established broker with expert advisors would be a great place to start.

These brokers take the guesswork out of choosing companies and give solid recommendations that can help you build a portfolio steadily over time. Many brokers offer interactive tools that allow you to see how trades work, without having to risk any real money.

On the other hand, if you want more control over your investments and have a bit of knowledge already, there are plenty of sites that allow you to trade independently. These sites offer customizable trading platforms, live data feeds, research resources, and real-time analytics for well-informed decisions.

You can find customer reviews on any route, no matter what. These will give insight into the experience and level of service at each site before you commit.

Most Frequently Asked Questions

What are the 4 types of investing?

Investing is a way to grow your finances while potentially earning money over the long term. There are four major types of investment: stocks, bonds mutual funds, cash equivalents, and stock.

There are two types of stock: preferred stock and common stock. A common stock gives an individual ownership right of a company, including voting rights at shareholders' meetings and the potential to earn dividends. Preferred stock also gives ownership rights but with no voting privileges, as well as fixed dividend payments that offer investors a reliable income stream.

Bonds can be loans made by investors to governments or companies for interest payments. While bonds offer more stability and lower risk than stocks, the returns are usually lower than those of stocks.

Mutual funds are a way to pool investor money in order spread risk and diversify investments across many types of securities, including stocks, bonds and commodities. Professional managers manage mutual fund investments. They use their knowledge to choose profitable investments that meet pre-set criteria.

There are many cash alternatives, including Treasury bills, money markets deposits, certificates-of-deposit (CDs) and commercial papers. These products often mature in one year, so they have very little risk of being defaulted on or losing value. This type of investing is mostly suitable for conservative investors who don't want to take high risks but still seek a little bit more return than depositing money at traditionally low-interest bank accounts.

Statistics

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

External Links

How To

How can you verify the legitimacy or an online investment opportunity?

Research is critical when investing online. You should research the company that is offering the opportunity. Make sure they are registered with financial authorities. Also, be aware of any restrictions or industry regulations that may apply to your investments.

Review past performance data, if possible. Find customer reviews online to find out how people have felt about the investment opportunity. Do you believe it is too good to true? Be wary of claims that promise future success or substantial returns.

Learn about the investment's risk profile and review the terms and condition. Before opening an account, confirm the exact fees and commissions on which you might be taxed. Do your due diligence and make sure you get what you pay for. You can also make sure that you have an exit strategy for any investment that doesn't go according the plan. This will help reduce long-term losses.