Zerodha is a discount broker which offers a wide range of brokerage services. These services include equity delivery trading, margins, derivatives and currency options. The company was established in India and was founded in 2010. It is regulated and a listed company on the Bombay Stock Exchange and National Stock Exchange. In addition, Zerodha provides several other features to its customers.

Zerodha is a leading discount broker in India. In recent years, the company has seen a significant increase in users. Access to more than 5 000 stocks and futures for traders who use the services of the company is provided by them. The platforms of the company are easy to use and provide high-quality research tools.

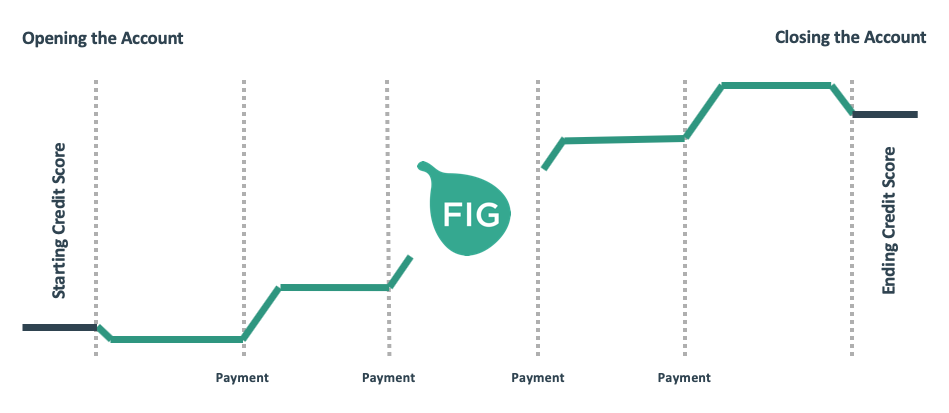

Zerodha provides two types accounts, one online and one offline. Online accounts permit traders to deposit and withdraw money using their bank accounts. However, the company does not support credit card payments. The company requires that a Digilocker connection be established, Aadhar details are provided, and that an email address is used to confirm the account. For a digital account to be opened, the customer must show proof of income (e.g. salary slips) or Form 16. The same applies to an offline account. To open a digital account, the customer must complete an application form with their name and contact details.

Zerodha also offers a variety of educational resources and trading tools. Kite is their mobile app. With the help this app, traders are able to make equity and derivatives trades right from their smartphones. Additionally, traders can request withdrawals or download contract notes.

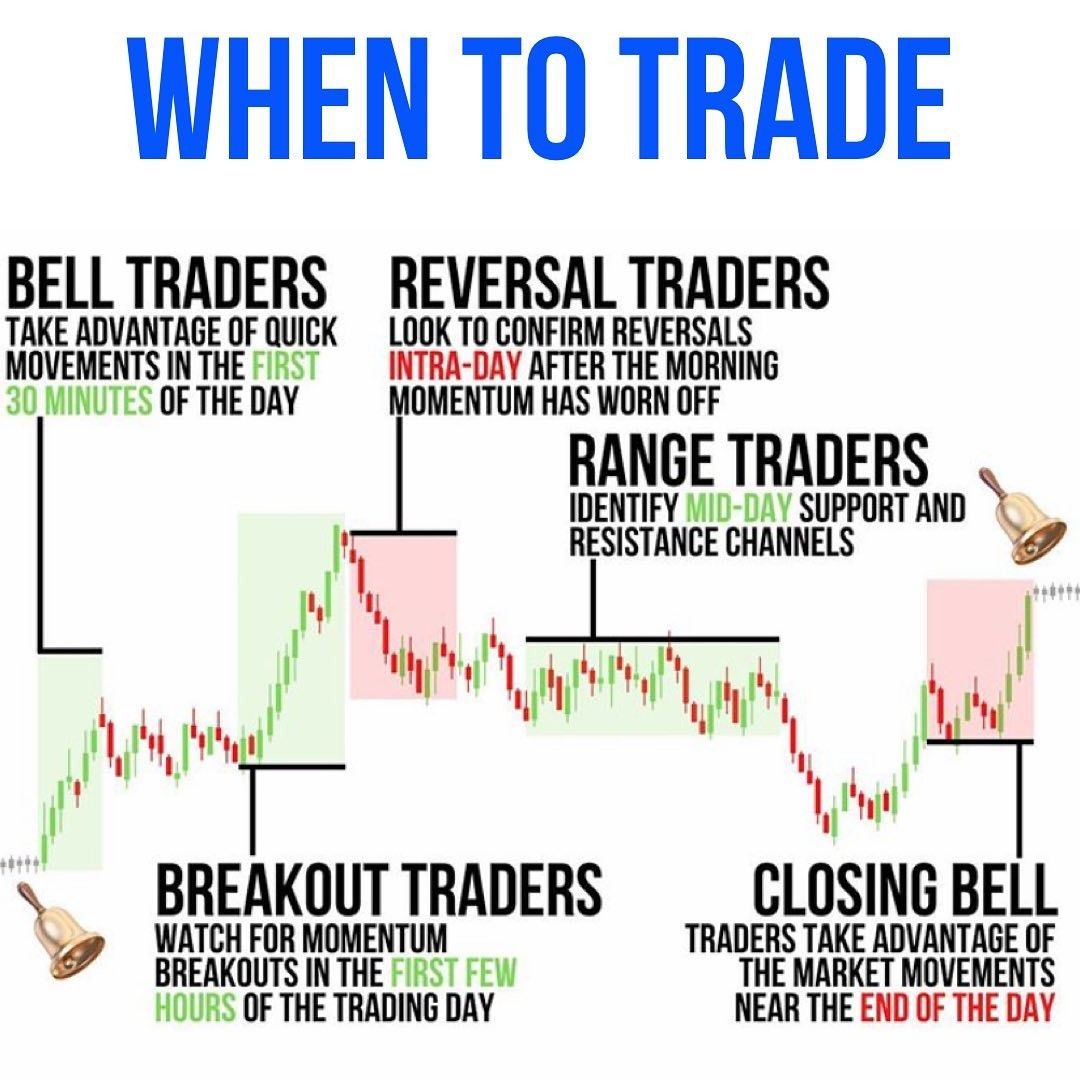

Zerodha is a lightning-fast trading platform. Using this platform, traders can make intraday trades and receive notifications when a underlying reaches a certain price. To set up price alerts, traders can also use Zerodha Sentinel. They can also conduct a detailed technical inspection on their investments.

Zerodha also offers an educational tool called "Zerodha Varsity". This educational resource consists of a collection lesson from the company's head of research. Besides, there are several modules on different trading concepts. A variety of trading strategies are also offered by the company to assist users in making the best trading decisions.

Zerodha offers support for traders 24/7. The customer service department is available by phone and e-mail. Traders may also visit the Charges page. The company will send an OTP to the customer's email or phone number if a transaction takes place.

Zerodha also offers customer referral programs. This program allows people to refer their friends and families to Zerodha, and they will receive 10% of the brokerage fees. The company offers traders a forum to communicate, share trading tips and ask questions.

To open a Zerodha account, the company requires a valid PAN, Aadhar details, and e-mail address. In addition, a payment for account opening should be made. Once the account is set up, the customer has access to Zerodha's console. There are many options for visualizations, analysis, and reports.

FAQ

What are the pros and cons of investing online?

Online investing offers convenience as its main benefit. Online investing makes it easy to manage your investments from anywhere on the planet with an internet connection. Access real-time market data, and make trades online without leaving your office or home. Additionally, many online brokerages offer lower fees than traditional brokerages, making it easier for investors to get started with smaller amounts of money.

Online investing comes with its own set of disadvantages. Online investing is not without its challenges. For instance, you may find it difficult to obtain personalized advice or guidance online as there are no financial advisors or brokers to help you make your decisions. Online trading platforms might not provide the same level security as traditional brokerages. Investors need to be aware about the potential risks. Online trading can be more complex and difficult than conventional investing. Before you begin, make sure to thoroughly understand the markets.

You should also be aware of the different investment options available to you when investing online. Investors have many options. There are stocks, bonds mutual funds, cash equivalents and stock options. Each investment has its risks and rewards. Before you decide which type of investment is best for you, it is important that your research is thorough. Some investments may also require a minimum investment or other restrictions.

How Can I Invest in Bitcoin?

Investing in Bitcoin can seem complicated, but it's not as hard as you think! To get started, you only need to have the right knowledge and tools.

First, you need to know that there are many ways to invest. You have the option to buy Bitcoin direct, trade on an exchange, or gain exposure using a financial instrument called a derivatives contract.

You must also decide where you will store Bitcoin. There is a wide range of options available, including exchanges, custodians, cold storage, wallets and exchanges. Depending on your risk appetite, goals, and other factors, certain options might be more appropriate than others.

Next, gather any additional information to help you feel confident about your investment decision. Before you start investing in cryptocurrencies, it is important to learn the basics and understand how they work. To stay on top of crypto trends, keep an eye out for market developments and news.

Finally, you should create a plan to invest Bitcoin based in your level of expertise and set reasonable expectations about returns. This will ensure that you have a greater chance of long-term success.

Which trading platform is the best for beginners?

It all depends on your level of comfort with online trading. It is a great idea to start with an established broker that has experienced advisors, if you are new to online trading.

These brokers remove the guesswork from choosing companies and offer solid recommendations to help you build your portfolio. Many brokers provide interactive tools to show you how trades function without risking any money.

You can also trade independently if your knowledge is good enough. You can create your own trading platform, access live data feeds and use research tools like real-time analysis to make informed decisions.

You can find customer reviews on any route, no matter what. These will give insight into the experience and level of service at each site before you commit.

Which forex or crypto trading strategy is best?

Forex and crypto trading both have their opportunities for profits, but which one is best for you really depends on your investment goals.

Forex trading involves investing in foreign currencies. This is an easy option for beginners. This requires a smaller initial capital, and forex markets can be accessed 24/7 around the world.

The upside is that crypto trading provides a quick return, as prices can change very rapidly due to volatility. You can cash out your tokens quickly because crypto trades are highly liquid.

In both instances, it is crucial to do your research prior to making any investments. With any type or trading, it is important to manage your risk with proper diversification.

It is important that you understand the different trading strategies available for each type. For example, forex traders could use technical analysis or foundation analysis to help make decisions. Crypto traders may choose arbitrage or margin trading to maximise their profits. Automated trading systems and bots may also be used by some traders to help them manage investments. Before investing, it's important to understand both the risks and the benefits.

Where can you invest and make daily income?

Although investing can be a great investment, it's important that you know your options. There are many options.

One option is investing in real estate. Property investments can yield steady returns, long-term appreciation, and tax benefits. Consider diversifying your portfolio by investing in bonds, ETFs or mutual funds. You might also want to consider specialty fields such as cryptocurrency.

You could also look into investing in dividend-paying stocks or peer-to-peer lending sites that allow you to lend money and receive interest payments from borrowers. Trading online with day trading strategies is also possible, if you are comfortable with taking on the risks.

Whatever your investment goals may, it's important that you research all types of investments before investing. Every asset has its own risks. Make sure you closely monitor any investments and recognize when to buy and sell accordingly so you can maximize your earnings and work towards achieving your financial goals!

What is the best trading platform for you?

Choosing the best trading platform can be a daunting task for many traders. There are many trading platforms out there, so it can be difficult for traders to choose one that is right for them.

The best trading platform should offer the features you need, like advanced chart analysis tools, real-time market data, and sophisticated order execution capabilities. It should also have an easy-to-use interface that's intuitive and user-friendly.

It should also provide a variety of account types and competitive fees as well as reliable customer service and educational resources. Try out demo accounts or free trials to see if you like the idea of using virtual money.

You should consider your type of investor or trader when looking for a trading platform. For example, are you active or passive? How often do you plan to trade? What asset class mix would you like? These factors will help you narrow down your search to find the right trading platform.

After you have found the right platform for you, you should look at additional features like stock screening tools and backtesting capabilities. Alert systems are also available. Additionally, ensure your chosen platform provides appropriate security protocols in place to protect your data from breaches or theft.

MetaTrader 4/5, cTrader, eToro, ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader InteractiveBrokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM ThinkOrSwim, to name a few.

Statistics

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

External Links

How To

How can I verify the legitimacy of an online investment opportunity?

When you invest online, it is crucial to do your homework. Check out the company behind the opportunity and make sure they are registered with the appropriate financial authorities. Additionally, look out for any industry regulations or restrictions that could apply to your investments.

Review past performance data, if possible. Look for current customer reviews online to get a sense of how customers have experienced the investment opportunity. Do you believe it is too good to true? Be wary of claims that promise future success or substantial returns.

Learn about the investment's risk profile and review the terms and condition. Before opening an account, confirm the exact fees and commissions on which you might be taxed. Due diligence checks are necessary to ensure you are receiving the services and terms you agreed to. In the event that your investment does not go according to plan, make sure you have an exit strategy. This could reduce losses over time.