There are many ways to buy crypto. Some may be more complicated than others. It is important to research any cryptocurrency before buying it.

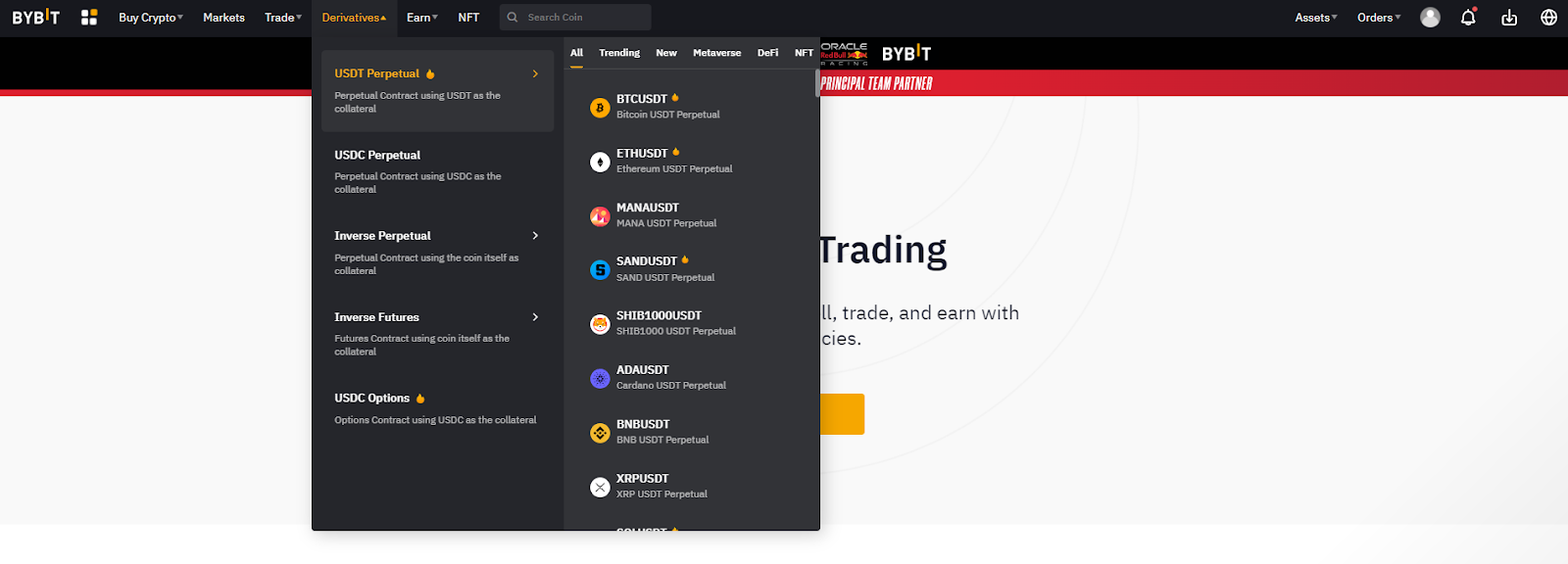

A crypto exchange is a dedicated platform where you can purchase crypto. While there are several types of exchanges, most allow you to link your bank account to make purchases and sell. This simplifies the process.

Good security measures should be in place at the exchange you choose. A reputable customer support department should be available. If you have a question about how to purchase a specific coin, you should get a clear answer.

An exchange should offer a good selection of cryptocurrencies. It should be possible to choose between Bitcoin and lesser-known altcoins. The transaction and administration fees for cryptocurrency exchanges are usually high. Before you open an account with a cryptocurrency exchange, it is advisable to verify your bank. Although they are an option, credit cards are not usually the best method to buy coins.

You should choose an exchange with intuitive user interfaces. If you're a beginner, it can be helpful to find a platform that is easy to navigate. A wide variety of payment options should be available. These payment methods include bank transfer and credit card. You may be able to purchase and sell crypto using your bank's debit cards.

Customer service is the most important aspect of any exchange. The exchange should be able answer your questions regarding the purchasing process and general policy. It should also have private insurance. If the exchange isn't insured, you could face significant damages in case of a security breach.

There are a variety of other things to consider. There are many other things to consider. For example, the best time for you to buy cryptocurrency may differ from one region to another. Your capital could be at stake as a cryptocurrency is not backed by any type of bank. Similar to the above, there are tax rules when buying and trading cryptocurrency.

The purchase of a cryptocurrency, such as Bitcoin, is a significant decision. Therefore it's important to research the best way to go about it. You'll be pleasantly surprised at the number of options you have whether you want to buy your first bitcoin, to invest or just diversify your portfolio.

However, it is possible to do things the old-fashioned fashion. Many banks and brokerages offer a variety of options for buying and selling cryptocurrencies. You should check to see if your bank has a deposit or withdrawal option for the coins you are looking at. There might be a fee, depending on how your bank handles it.

Other platforms that are popular include payment apps, which have built-in crypto buying capabilities. Celsius is one of these apps. You'll want to look at the features and fees of your chosen app before making your final decision. These apps are easy to use and provide current information about the best places for crypto purchases.

FAQ

Where can i invest and earn daily?

Although investing can be a great investment, it's important that you know your options. You don't have to put your entire savings into the stock market - there are plenty of other options.

You can also invest in real estate. You can earn steady returns while also enjoying long-term appreciation and tax advantages by investing in real estate. Diversifying your portfolio might be a good idea.

You could also look into investing in dividend-paying stocks or peer-to-peer lending sites that allow you to lend money and receive interest payments from borrowers. Online trading is possible if you're comfortable with the risks.

Whatever your investment goals may be, it's important to do research about each type of investment before diving in head first as every asset carries its own set of risks associated with it. You should closely monitor your investments and know when to sell and buy accordingly. This will help you maximize your earnings and reach your financial goals.

Is it possible to make a lot of money trading forex and cryptocurrencies?

It is possible to get rich trading forex or crypto. However, you need to use a strategic approach. You need to be aware of the market trends so you can make the most of them.

Additionally, you'll need to learn how to recognize patterns in prices. These patterns will assist you in determining where the market is headed. Trading with money you can afford is a good way to reduce your risk.

For long-term success, you will need to combine experience, knowledge, risk management skills, and discipline.

The volatility of cryptocurrency prices is a problem. It is important to ensure that your entry position matches your risk appetite and exit strategy. This means that you should take profit or limit losses if you have the opportunity.

The cryptocurrency market is largely unregulated and presents substantial risks. Before you sign up for any type of wallet or platform, make sure to research the coins and exchanges.

Additionally, since forex trading involves predicting fluctuations in currency exchange rates through technical analysis/fundamental analysis of global economic data this type of trading needs specialized knowledge acquired over time. Understanding the different currency conditions is crucial.

At the end of the day though, it's all about taking calculated risks, being willing to learn continually, and mastering an effective strategy that works best for you. With enough dedication, knowledge, and proper education, trading forex or cryptocurrency can be very lucrative.

What are the pros and cons of investing online?

Online investing has the main advantage of being convenient. You can access your investments online from any location with an internet connection. Access real-time market data, and make trades online without leaving your office or home. Additionally, many online brokerages offer lower fees than traditional brokerages, making it easier for investors to get started with smaller amounts of money.

Online investing comes with its own set of disadvantages. It can be difficult to get personal advice and guidance online, because you don’t have a broker or financial advisor to guide you. Online trading platforms might not provide the same level security as traditional brokerages. Investors need to be aware about the potential risks. Online trading can be more complicated than traditional investing. It is important to learn the markets and create a solid strategy before you start.

Online investing is a complicated process. It is important to be familiar with the various types of investments that are available. Investors have many options. There are stocks, bonds mutual funds, cash equivalents and stock options. Each investment comes with its own risks. You should research all options before you decide on the right one. Some investments may also require a minimum investment or other restrictions.

Which is harder, forex or crypto.

Different levels of difficulty and complexity exist for forex and crypto. Because crypto is new and closely related to blockchain technology, it may prove more difficult for beginners. Forex, on the other hand has a proven trading infrastructure and has been around for many years.

Trading cryptocurrency is more risky than forex. It's because the crypto markets can change in an unpredictable way over short time periods. You can gain an advantage over your competitors by researching historical trends in the markets in which it trades.

Forex traders need a good understanding of the dynamics between foreign currencies pairs. For instance, they must be able to see how prices respond to news. This also requires an in-depth understanding of technical indicators which can indicate sell or buy signals. The leverage factor is another important consideration. Forex traders who trade currency pairs with high volatility are at risk of losing their capital and may have to borrow additional funds.

Forex and crypto both require keen research skills and attention to ensure successful trades.

How can I invest in Bitcoin?

It can be difficult to invest in Bitcoin. But it isn't as hard as you think. All you need is the right knowledge and tools to get started.

The first thing to understand is that there are different ways of investing. To gain exposure, you can either buy Bitcoin directly or trade it on an exchange.

You'll also need to decide where you will store your Bitcoin - there are many options available such as wallets, exchanges, custodians, and cold storage. Depending on your risk appetite, goals, and other factors, certain options might be more appropriate than others.

Next, research any additional information you may need to feel confident about your investment decisions. It is essential to understand the basics of cryptocurrency and their workings before you dive in. To stay on top of crypto trends, keep an eye out for market developments and news.

Finally, you should create a plan to invest Bitcoin based in your level of expertise and set reasonable expectations about returns. This will ensure that you have a greater chance of long-term success.

Cryptocurrency: Is it a good investment?

It's complicated. It is complicated. One thing is certain: the cryptocurrency market can be unpredictable and volatile so investing in it will always come with risk.

You can also make a profit if your risk is taken and you do your research.

The potential for portfolio diversification is also possible through cryptocurrency investments, as these assets can move independently from traditional stock exchanges.

It all comes down ultimately to an individual's risk tolerance and knowledge of the crypto market. If you're able to make informed decisions and are open to taking risks, then investing is definitely something worth considering.

Statistics

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How can you verify the legitimacy or an online investment opportunity?

When you invest online, it is crucial to do your homework. You should research the company that is offering the opportunity. Make sure they are registered with financial authorities. Also, make sure to check for any industry regulations that could affect your investments.

Review past performance data, if possible. Find customer reviews online to find out how people have felt about the investment opportunity. It's possible to make a good investment, but be skeptical of claims that guarantee future results.

Learn about the investment's risk profile and review the terms and condition. Verify exactly what fees and commissions you may be taxed on before signing up for an account. Do your due diligence and make sure you get what you pay for. In the event that your investment does not go according to plan, make sure you have an exit strategy. This could reduce losses over time.