The Commodity Futures Trading Commission, (CFTC), is a federal agency responsible for regulating derivatives markets like options and futures. The CFTC has been overseeing derivative markets in the United States since 1974. Its mission, to protect the rights of investors in financial instruments by enforcing the rules that govern regulated markets, is to ensure their protection. There are thirteen operating divisions of the CFTC. Each division focuses only on one industry or market. Currently, the CFTC plans to appoint four women members of its commission.

Stability of the markets is a key aspect of the CFTC’s mission. This includes the development and implementation of rules that reflect current developments in the various industries. Commissioners serve on committees focusing on different areas such as derivatives and trade. These groups meet frequently to discuss technology and market structure. They have issued reports on issues related to algorithmic and high frequency trading, as well as market access, and pre-trade functionality.

During financial crisis, the CFTC grew its responsibilities. Machine learning and distributed ledgers are two new technologies that could impact the CFTC regulations. In preparation for these changes, the agency established a new office to assist in rule-making and data-driven policymaking.

One of the biggest issues facing the CFTC is the emergence of cryptoassets. The Securities and Exchange Commission, (SEC), and the agency are both working together to regulate markets. Russ Behnam (CFTC Commissioner) recently spoke to the Georgetown McDonough School of Business about the history of CFTC, and its role within the financial sector. He also spoke about the Dodd-Frank Act and outlined the CFTC's new structure.

Another issue facing the CFTC are how to best apply its statutory authority on digital assets. The agency had in the past limited resources to investigate and enforce its regulations. Recent changes in funding and personnel have allowed the agency to improve its ability to tackle the problem. This is why it is likely to be extremely vigilant about transactions of this nature. During a February hearing, Senator Perianne Boing, chairwoman of Senate Agriculture Committee, demanded more clarity from the CFTC regarding its position on digital assets.

The CFTC plays a key role in regulating financial markets. The agency has been working together with foreign regulators on how the cross-border application CFTC swaps regulations would impact global markets. A CFTC commissioner has advocated for the establishment of an Office of Data and Technology. It would draw on the knowledge of technology experts within the agency to better help it implement its regulations.

Commissioner O'Malia has been a leader for advancing technology to aid the CFTC's missions. He is also responsible for reestablishing the Technology Advisory Committee at the CFTC. The TAC met many times under his leadership to discuss technology trends and their impact on markets. Recent efforts of the committee include reports on algorithmic high frequency trading and pre-trade digital asset functionality.

FAQ

Which is more difficult forex or crypto currency?

Crypto and forex have their own unique levels of difficulty and complexity. Crypto may require a greater level of understanding due to its newness and connection with blockchain technology. Forex is a well-established currency with a stable trading infrastructure.

In terms of cryptocurrency trading, there are more risks when compared to forex, due to the fact that crypto markets tend to move in unpredictable ways within short periods of time. If you want to succeed in crypto trading, researching the historical trends in the markets where it trades can give you an edge over your competition.

Forex traders need to understand the dynamics between foreign exchange pairs, such as how prices move based on news and macroeconomic events. It also requires an acute understanding of technical indicators that can indicate buy or sell signals. Leverage is also an important factor to be considered, since traders can risk their capital as well as additional borrowed funds when trading currency pairs of high volatility.

For both crypto and forex, it is important to be alert, do your research well, and have a strategy for making consistent trades.

Frequently Asked Question

What are the 4 types of investing?

Investing allows you to increase your financial resources and potentially earn money in the long-term. There are four major categories of investing - stocks, bonds, mutual funds, and cash equivalents.

Stocks can be divided into preferred and common stock. Common stock grants an individual the right to own a company. It also gives voting rights at shareholder meetings and the possibility of earning dividends. A preferred stock, however, gives an individual ownership right but without voting privileges. It also offers fixed dividend payments which provide investors with a steady income stream.

Bonds are loans by investors that are made to governments or businesses in exchange for interest payments. While bonds have a greater stability and less risk than stocks stocks, their returns are often lower than stocks.

Mutual funds involve pooling investor money together in order to spread investment risk and diversify investments over many different types of securities including stocks, bonds, and commodities. Professional managers manage mutual funds. They use their experience to choose profitable investments based on pre-determined criteria, such as risk level or expected return rate.

There are many cash alternatives, including Treasury bills, money markets deposits, certificates-of-deposit (CDs) and commercial papers. These products often mature in one year, so they have very little risk of being defaulted on or losing value. This type of investing is mostly suitable for conservative investors who don't want to take high risks but still seek a little bit more return than depositing money at traditionally low-interest bank accounts.

Trading forex or Cryptocurrencies can make you rich.

You can make a fortune trading forex and crypto if you take a strategic approach. You need to be aware of the market trends so you can make the most of them.

Knowing how to spot price patterns can help you predict where the market will go. Also, you should only trade with money that is within your means.

It also requires a combination of experience, knowledge, risk-management skills, and discipline in order to be able to develop a profitable strategy for long-term success.

The volatility of cryptocurrency prices is a problem. It is important to ensure that your entry position matches your risk appetite and exit strategy. This means that you should take profit or limit losses if you have the opportunity.

Researching potential cryptocurrency exchanges and coins before signing up is vital, as they are not well-regulated and can pose significant risks.

Because forex trading involves the prediction of fluctuations in currency rates via technical analysis/fundamental economic analysis, this type of trading requires special knowledge that has been acquired over time. It is therefore essential to have a solid understanding of the factors that affect different currencies.

It's about taking calculated risks and being open to learning. The most important thing is to find the best strategy for you. With enough dedication combined with this knowledge - you could potentially get very rich trading cryptos or forex if done correctly with proper education & research behind it!

Which trading platform is best?

For many traders, choosing the best platform to trade on can be difficult. It can be overwhelming to pick the right platform for you when there are so many options.

The best trading platform should include the features you are looking for, including advanced chart analysis tools as well as real-time data from the markets and sophisticated order execution capabilities. It should also feature an intuitive, user-friendly interface.

It should offer multiple account types and low fees. You also need reliable customer service and educational materials. Try out demo accounts or free trials to see if you like the idea of using virtual money.

When looking for a trading platform, consider what type of trader or investor you are - whether you're passive or active, how often you plan to trade, and your desired asset class mix. These factors will help you narrow down your search to find the right trading platform.

After you have found the right platform for you, you should look at additional features like stock screening tools and backtesting capabilities. Alert systems are also available. Make sure you have the appropriate security protocols in place for your data to prevent theft or breaches.

MetaTrader 4/5 (MT4/MT5) is one of the most widely used trading platforms. cTrader, eToro tradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM thinkOrSwim app Store are all others.

Which forex or crypto trading strategy is best?

Both crypto and forex trading can make you money, but it really comes down to your investment goals.

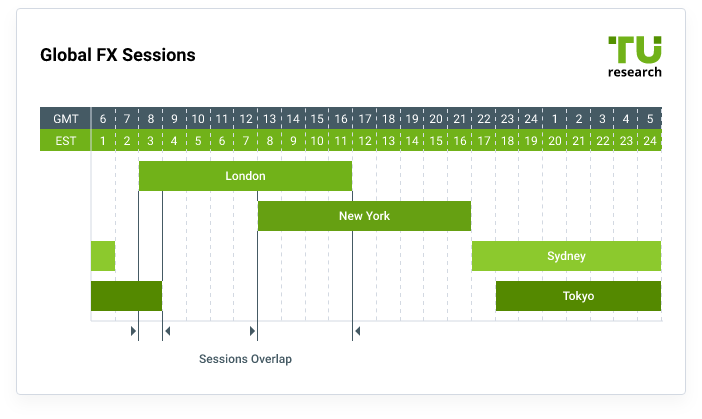

Forex trading involves investing in foreign currencies. This is an easy option for beginners. Forex trading requires less capital upfront and the forex markets are open 24 hours a day.

However, crypto trading can offer a very immediate return due to the volatility of prices. The liquidity of crypto trading means that you can quickly cash out your tokens.

Both cases require that you do extensive research before investing. With any type or trading, it is important to manage your risk with proper diversification.

It is also important to understand the different types of trading strategies available for each type of trading. For instance, forex traders may use technical or fundamental analysis to make their decisions. Crypto traders might use arbitrage, margin trading, or both to maximize profits. Automated trading platforms or bots are also available to assist traders in managing their investments. It is important to understand the risks and rewards associated with each strategy before investing.

Is Cryptocurrency a Good Investment?

It's complicated. The popularity of cryptocurrency has increased over the years. However, whether or not it is a good investment depends on many factors. On one hand, the cryptocurrency market is highly volatile and unpredictable so there's always a risk involved when investing in them.

You can also make a profit if your risk is taken and you do your research.

Because cryptocurrency assets are not subject to traditional stock market movements, they can be used as a portfolio diversification tool.

It really boils down to each individual's tolerance for risk and knowledge about the crypto market. If you're able to make informed decisions and are open to taking risks, then investing is definitely something worth considering.

Statistics

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

External Links

How To

How can I verify the legitimacy of an online investment opportunity?

It is important to do your research before investing online. Look into the company behind the opportunity. Ensure that they have been registered with the proper financial authorities. Additionally, look out for any industry regulations or restrictions that could apply to your investments.

Review past performance data, if possible. To get an idea of the customer experience with the investment opportunity, look online for reviews. Do you believe it is too good to true? Be wary of claims that promise future success or substantial returns.

Make sure you understand the risks involved in the investment. Also, be familiar with the terms. Verify exactly what fees and commissions you may be taxed on before signing up for an account. Due diligence checks are necessary to ensure you are receiving the services and terms you agreed to. Finally, ensure you have a clear exit strategy in case your investment doesn't go according to plan - this could help reduce losses in the long run!