A prop trader, on the other hand, is a trader who acts for a firm. Proprietary trader often uses leverage and other strategies to maximize their profits. They are also superior to average investors because they have access to sophisticated software and data. It is essential to know all the benefits and disadvantages of working in proprietary trading. This will help you decide if it's right.

Proprietary Trading requires that you have a proven track history and a trading system. Prop trading requires that you are familiar with the risk management rules. You will need to adhere to certain guidelines.

Many companies will only hire trader that has demonstrated a high level of paper trading performance. You will receive a simulator account from the company that you can use to explore the trading platform. It is important that you ask questions like whether you will be paid per hour or on a commission basis. A fixed salary or profit-sharing agreement are also options for traders. Some companies will even offer higher share profit percentages.

Proprietary trade is a lucrative career for those who can work hard and will stay with the firm. However, you will have to face some challenges in the initial stages. Remember that you will work with many people and that the best way for you to improve your skills is to network with other traders.

As you gain experience, you can move into a different group at a firm, or to a hedge fund or other company. You can also look for investors that will invest in your project.

A prop trading company will offer mentorship opportunities and training to new traders. They will also allow you to gain exposure to a variety of markets. A fee for the use of the trading platform, software, and desk fees may be required.

Proprietary trading is more lucrative than traditional option or stock trading. There are many kinds of trading markets. Each one has its own rules. To get started, it's important to study the various markets and then create a strategy. You will eventually become an expert on each market. Once you are established you can use leverage and other strategies for increasing your profits.

Proprietary trades are very competitive, but they have their advantages. Proprietary trader are more proficient with complex modeling software than the average investor. You cannot just quit your job and trade options or stock stocks. Proprietary traders can provide a steady income. Plus, it provides you with access to a large pool of funds, which means you have more potential for growth.

You will start receiving more money from the fund as you become more skilled. Before you start trading, you must first apply for a funded trading program. You will be required to give background information and industry experience depending on the fund.

FAQ

Can one get rich trading Cryptocurrencies or forex?

You can make a fortune trading forex and crypto if you take a strategic approach. It is essential to be able to spot trends and determine the best time for you to buy and/or sell.

Additionally, you'll need to learn how to recognize patterns in prices. These patterns will assist you in determining where the market is headed. Additionally, it's important to keep your risk as low as possible by trading only with money that you can afford to lose.

It also requires a combination of experience, knowledge, risk-management skills, and discipline in order to be able to develop a profitable strategy for long-term success.

Because cryptocurrency prices can fluctuate, it is important that you make sure your entry position and exit plan are compatible. If there is an opportunity to take profits or limit losses, then go for it.

Since cryptocurrency markets are largely unregulated and present substantial risks, researching potential exchanges and coins is essential before signing up for any wallet or platform.

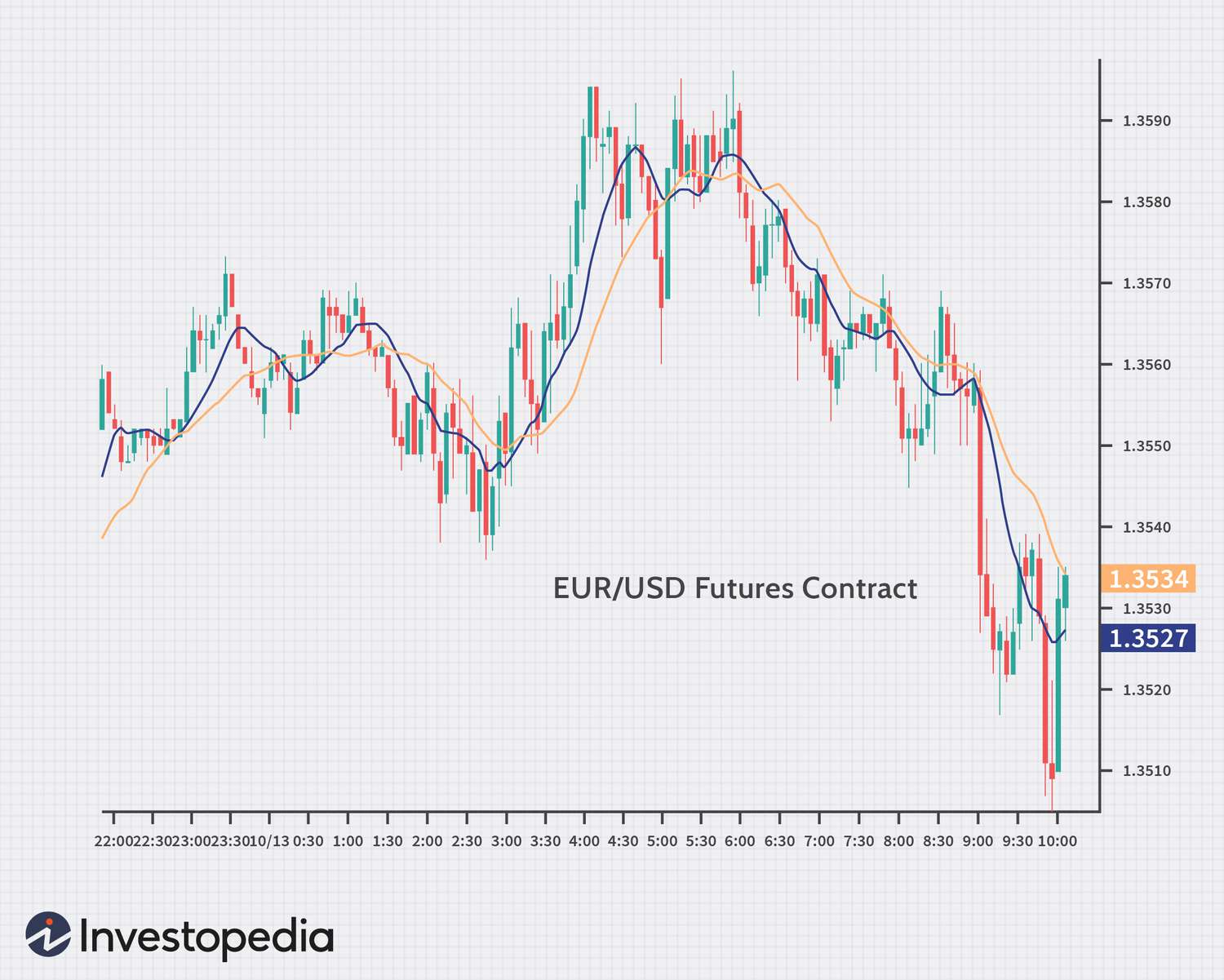

Because forex trading involves the prediction of fluctuations in currency rates via technical analysis/fundamental economic analysis, this type of trading requires special knowledge that has been acquired over time. Understanding the different currency conditions is crucial.

It all comes down to taking calculated risks, learning continuously, and finding the most effective strategy for you. With enough dedication combined with this knowledge - you could potentially get very rich trading cryptos or forex if done correctly with proper education & research behind it!

Which trading platform is the best?

Many traders may find it challenging to choose the best trading platform. With so many different platforms to choose from, it can be hard to know which one is right for you.

A trading platform that is the best should have all the features you require, such as advanced chart analysis tools, market data and order execution capabilities. It should also offer an intuitive and user-friendly interface.

You should have access to a range of account types, competitive fees, reliable customer service, and educational resources. For those who want to try virtual money before you invest your real money, look out for free demo accounts.

Consider your trading style when searching for a platform. This includes whether you are active or passive, how often you trade and what asset classes you prefer. These factors will help you narrow down your search to find the right trading platform.

Once you have identified the platform that suits you best, it is time to explore additional features such backtesting capabilities and stock screening tools. Make sure your platform has the right security protocols to protect your data against theft or breaches.

Some of the most popular trading platforms include MetaTrader 4/5 (MT4/MT5), cTrader, eToro TradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade FXCM ThinkOrSwim App Store just to name a few!

Cryptocurrency: Is it a good investment?

It's complicated. It's complicated. Although cryptocurrency has gained popularity over the last few years, it depends on many factors as to whether it will prove to be a profitable investment. One, the cryptocurrency market can be volatile and unpredictable. This means that there is always risk when investing in them.

You can also make a profit if your risk is taken and you do your research.

The advantages of cryptocurrency investments for portfolio diversification are also available, since they tend to be independent from traditional stock markets.

The final decision comes down to individual risk tolerance and knowledge regarding the cryptocurrency market. If you're able to make informed decisions and are open to taking risks, then investing is definitely something worth considering.

What are the advantages and drawbacks to online investing?

Online investing has one major advantage: convenience. Online investing allows you to manage your investments anywhere with an internet connection. Online investing allows you to have access to real-time market information and place trades without ever leaving your home. Online brokerages typically charge less than traditional brokerages. This makes investing easier, especially if you have a smaller amount of money.

Online investing comes with its own set of disadvantages. For example, it can be difficult to get personalized advice and guidance when trading online, as you don't have a physical broker or financial advisor to help you make decisions. Additionally, online trading platforms may not offer the same level of security as traditional brokerages, so investors need to be aware of the risks involved. Online trading can be more complicated than traditional investing. It is important to learn the markets and create a solid strategy before you start.

It is also important to understand the different types of investments available when considering online investing. Stocks, bonds, mutual funds, and cash equivalents are all options for investors. Each type of investment carries its own risks and rewards, so it is important to research each option before deciding which one is right for you. There may be restrictions on investments such as minimum deposits or other requirements.

Which is more safe, crypto or forex

Forex trading and cryptocurrency are two highly risky investments. The rewards and the risks can be very different.

Crypto, shorthand for cryptocurrency is a digital currency made from code using blockchain technology. It can be traded as any other type of money on exchanges, and has been the subject for speculative investments because of its dramatic price swings.

Forex, also known as foreign exchange currency trade, is high-leveraged investment that involves participants speculating on the value and relative strength of one currency. Forex, which can be unstable and cause large losses if not managed well, is an investment that should not be taken lightly.

While both Forex (Cryptocurrency) and Forex (Forex) have their pros and cons, Cryptocurrency tends be more volatile than Forex. Prices for cryptocurrencies are unpredictable because of the limited availability of units as well as existing regulations. On the other hand, forex markets tends to move more steadily and investors have more control. Therefore when determining which between Crypto and Forex is safer it would depend on one's own risk appetite as well as their experience with each investment option before making a final decision.

Where can I earn daily and invest my money?

Although investing can be a great investment, it's important that you know your options. There are many other investment options available.

One option is investing in real estate. You can earn steady returns while also enjoying long-term appreciation and tax advantages by investing in real estate. Diversifying your portfolio might be a good idea.

If you are looking for daily income and short-term profits, then you should consider investing in stocks that pay dividends. If you're comfortable taking the risks, you can also trade online with day trading strategies.

Whatever your investment goals may, it's important that you research all types of investments before investing. Every asset has its own risks. Make sure you closely monitor any investments and recognize when to buy and sell accordingly so you can maximize your earnings and work towards achieving your financial goals!

Statistics

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

Are my investments safe online? Or should I look into other options?

It is easy to lose your money, but it can also be difficult to decide where to keep it. Your valuable assets require a strong security system and you have a few options.

You can easily access your investment assets online from any device. It also makes it easy to keep track of them quickly and easily. There are some risks associated with using a digital option as electronic breaches could occur.

Alternatively, keeping your money in physical forms like cash or gold is more secure, but it's also harder to keep track of and requires a higher level of maintenance for storage and protection.

Other options include keeping your investments in traditional banking or investing accounts as well as self-storage facilities that allow you to safely store gold, silver, or other valuables outside of your home.

You might also consider looking into specialist investment firms that provide secure custody services, specifically tailored to protect large asset portfolios.

The final decision is up to you. What works for you? What provides the safety and security necessary to protect your investment assets?