Webtrader is an online trading platform that offers traders the ability to trade from any device. This platform doesn't require traders to install any software, making it a great option for those who wish to trade without taking up too much space.

MT4 Websitetrader

MetaTrader4 is a very popular online trading platform. The platform has many easy-to-use features. Its user interface is one of the most important features of MT4. It's easy to use and navigate. You will also find a variety of indicators and tools to assist traders in better understanding the market and making informed decisions.

MT5 Webtrader

MetaTrader 5 - Another popular online trading platform can be used on both desktops as well as mobile devices. It provides all the same features of MT4 in an online format. This makes it an excellent option for people who use multiple devices and want to trade from anywhere.

Plus500 Webtrader

Plus500, an online broker for forex and CFDs, offers a great trading experience for both novice and experienced traders. The demo account allows you to try out trading strategies and learn about the platform before you commit any real cash. Even $40,000 of fictitious cash can be traded.

Plus500 provides a free demo account and a variety of features to help you improve your trading strategies and increase profits. They allow you to choose between a 'Close At Profit' or loss rate for your trades, which can help you maximize your profits or minimize losses.

You also have a range of other tools that can help you manage risk and prevent you from losing too much. You can set your pending orders so that they close when prices reach a certain level. Additionally, you can monitor the status of your position by analysing it in real-time.

Interactive Brokers Webtrader

Interactive Brokers provides a variety of platforms for investors to trade stocks, forex and CFDs anywhere in the world. WebTrader is most popular. It has an intuitive user interface that makes accessing your account easy.

IG Webtrader

The IG webtrader, an online trading platform, is accessible on all browsers. It has an intuitive interface. The platform also includes a variety of technical indicators that can prove very helpful for traders. These indicators will help you to analyze trends and provide you with an indication of the direction of the market.

IG also has a number of add-ons that can be used to customize the platform and enhance your trading experience. These addons include stealth or mini terminals that can be customized to suit your trading style.

IB Webtrader

Forex investing is risky. You should choose a trusted and safe broker to help you make your investment. Do your research on the broker and go to their website.

FAQ

Which trading platform is best?

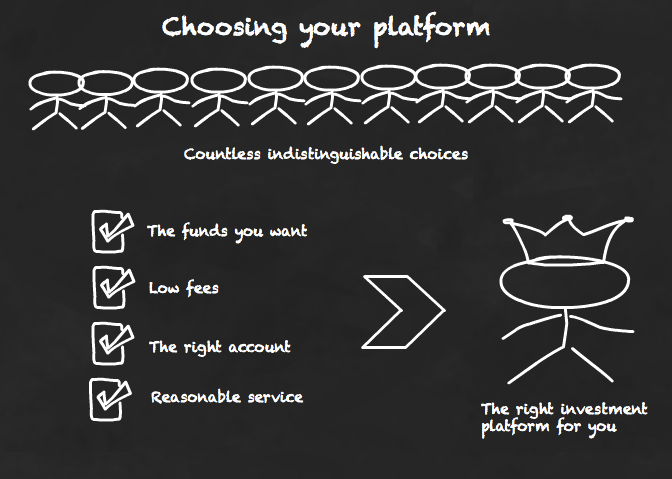

Many traders can find choosing the best trading platform difficult. With so many different platforms to choose from, it can be hard to know which one is right for you.

A trading platform that is the best should have all the features you require, such as advanced chart analysis tools, market data and order execution capabilities. It must also be easy to use and intuitive.

You will need to have access to multiple account types, low fees, reliable customer support, and educational resources. Demo accounts and free trials are a great way to test virtual money before investing any real money.

Consider your trading style when searching for a platform. This includes whether you are active or passive, how often you trade and what asset classes you prefer. This will help you narrow your search for the right trading platform.

Once you have identified the platform that suits you best, it is time to explore additional features such backtesting capabilities and stock screening tools. Also, make sure that the platform you choose has appropriate security protocols in order to protect your data from theft and breaches.

Some of the most popular trading platforms include MetaTrader 4/5 (MT4/MT5), cTrader, eToro TradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade FXCM ThinkOrSwim App Store just to name a few!

Where can you invest and make daily income?

However, investing can be an excellent way to make money. It's important to know all of your options. There are many options.

One option is investing in real estate. Investing in property can provide steady returns with long-term appreciation and tax benefits. You may also consider diversifying your portfolio with bonds, ETFs, mutual funds, or specialty fields like cryptocurrency.

If you are looking to make short-term gains or generate daily income, consider investing in dividend paying stocks. Or you can look into peer lending platforms, where you loan money and get interest payments direct from the borrowers. If you're comfortable taking the risks, you can also trade online with day trading strategies.

No matter your investment goals, it is important that you do thorough research on each type and investment before making any major decisions. Every asset comes with its own risks. Make sure you closely monitor any investments and recognize when to buy and sell accordingly so you can maximize your earnings and work towards achieving your financial goals!

How do I invest in Bitcoin

Although investing in Bitcoin may seem complex, it's actually not as difficult as you think. You just need the right knowledge, tools, and resources to get started.

There are many options for investing. You can purchase Bitcoin directly, use an exchange to trade, or use a financial instrument known as a derivatives contract to gain exposure.

It is also important to choose where your bitcoin will be stored. There are many options, including wallets, exchanges and custodians. There are many options available, but some might be more appropriate than others, depending on what your goals and risk appetite are.

The next step is to research additional information you might need in order to be confident about your investment decisions. It is crucial to know the basics about cryptocurrencies and how they work before investing. To stay on top of crypto trends, keep an eye out for market developments and news.

Finally, create a plan for investing in Bitcoin based on your level of experience and set reasonable expectations for returns - this will give you a better chance at success long-term too!

Is Cryptocurrency a Good Investment?

It's complicated. The popularity of cryptocurrency has increased over the years. However, whether or not it is a good investment depends on many factors. On one hand, the cryptocurrency market is highly volatile and unpredictable so there's always a risk involved when investing in them.

On the other hand, if you're willing to take that risk and do your research, there are potential gains to be made based on events like Initial Coin Offerings (ICOs) and shifts in the marketplace.

Because cryptocurrency assets are not subject to traditional stock market movements, they can be used as a portfolio diversification tool.

It comes down to each person's individual tolerance for risk and knowledge in relation to the crypto markets. If you're able to make informed decisions and are open to taking risks, then investing is definitely something worth considering.

What are the advantages and disadvantages of online investing?

Online investing offers convenience as its main benefit. You can manage your investments online, from anywhere you have an internet connection. Online trading allows you to access market data in real time and trades from anywhere. Online brokerages often offer lower fees than traditional brokerages. This makes it easier for investors start with smaller amounts of capital.

However, there are some drawbacks to online investing. Online investing is not without its challenges. For instance, you may find it difficult to obtain personalized advice or guidance online as there are no financial advisors or brokers to help you make your decisions. Online trading platforms may not offer the same level or security as traditional brokerages. Investors must be aware that there are risks. Online trading can be more complex and difficult than conventional investing. Before you begin, make sure to thoroughly understand the markets.

When considering investing online, it is also important that you understand the types of investments available. Investors have many options. There are stocks, bonds mutual funds, cash equivalents and stock options. Each investment comes with its own risks. You should research all options before you decide on the right one. There may be restrictions on investments such as minimum deposits or other requirements.

Can forex traders make any money?

Forex traders can make a lot of money. Although it is possible to make money in the short term, you will need to be patient and willing to learn. Traders who understand market fundamentals and technical analysis are more likely to be successful than those who rely solely on luck or guessing.

Forex trading isn't easy but with the right knowledge and strategies, it's possible to generate consistent profits over time. Before you risk real capital, it is important to find a mentor who is knowledgeable about risk management.

Many traders fail because of lack of a systematic plan or approach. However with discipline, one can increase their chances of making profit in the foreign currency (forex) markets.

Experienced forex traders create trading strategies that they follow when trading to minimize their risk exposure and still find profitable opportunities. The key to risk management is being able to see the big picture. New traders often chase short-term gains and lose sight of a long-term strategy.

Forex traders can increase their chance of generating long-term profits by maintaining good records, learning past trades and paying attention to other aspects of trading.

Forex trading is a disciplined business. Setting rules for how much money you're willing and able to lose per trade can reduce losses and help ensure success. Furthermore, strategies such as leverage entry signals can help increase profits that are not possible without the guidance of an experienced mentor.

However, regardless of whether you are investing your own capital or managing funds on behalf of someone else, persistence and learning from successful day traders are essential to being a profitable trader in forex markets.

Statistics

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How can my online account be secured?

Online investment accounts must be secure. It is crucial to safeguard your data and assets against unwelcome intrusions.

First, you want to make sure the platform you're using is secure. Make sure to look out for encryption technology and two-factor authentication. These security measures will give you maximum protection from hackers and malicious actors. Also, a policy should be created that describes how the sharing of personal information with them will go.

Second, make sure you choose strong passwords to access your account and limit the number of sessions you log in on public networks. Avoid clicking on suspicious links and downloading unknown software. These can result in malicious downloads that could compromise your funds. You should also regularly review your account activity to ensure you are aware of any suspicious links or downloading unfamiliar software. This will allow you to quickly detect possible threats and take appropriate action.

Thirdly, make sure you understand your investment platform's terms and conditions. You need to be aware of all fees associated with investing as well as restrictions and limitations regarding how you can use the account.

Fourth, be sure to research the company where you plan on investing. Check out user reviews and ratings to get an idea of how the platform works and what other users have experienced. Make sure to understand the tax implications of investing online.

By following these steps, you can ensure that your online investment account is secure and protected from any potential threats.